Volkswagen Group Reports Global Profit of €150.6 Billion in 2024, Yet China Earnings Dip to €13.4 Billion; Plans Counteroffensive for 2025

![]() 03/12 2025

03/12 2025

![]() 587

587

On March 11, Volkswagen Group unveiled its 2024 financial performance. The Group sold 9.037 million vehicles in 2024, marking a 3.5% year-on-year decline, while sales revenue reached €324.7 billion, up 0.7% from the previous year. This translated into an operating profit of €19.1 billion, down 15.4% from the previous year. The return on sales stood at 5.9% in 2024, a decrease of 15.4% from the 7.0% achieved in 2023.

"2024 was a challenging year filled with numerous obstacles," said Oliver Blume, CEO of Volkswagen Group. "We are systematically optimizing our cost structure and further enhancing our financial robustness."

By segment, Volkswagen's passenger car division reported an operating profit of €11.4 billion, with a return on sales of 5.3%. In the Traton segment, operating profit amounted to €4.2 billion, reflecting a return on sales of 9.1%. Financial Services generated an operating profit of €3.1 billion, down 18% year-on-year. The software segment, CARIAD, saw sales grow by 23% to €1.3 billion, primarily due to the launch of the 1.2 software platform.

Within the core passenger car segment, Volkswagen categorizes its brands into three portfolios: core brands (including Volkswagen, Škoda, SEAT/CUPRA, etc.), aspirational brands (Audi, Lamborghini, Bentley, Ducati), and luxury sports brands (primarily Porsche).

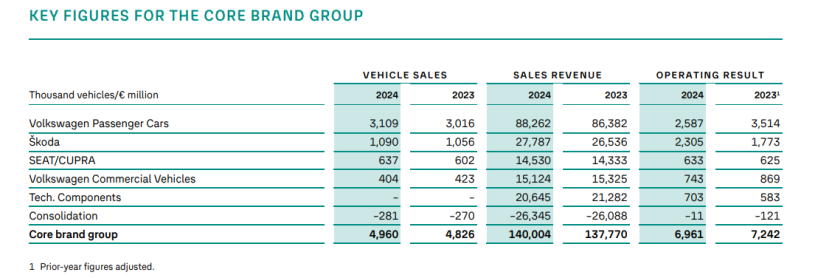

Sales of the core brand portfolio increased by 2% to €140 billion in the passenger car division, with an operating profit of €6.961 billion, down 4% from the previous year. The profit margin for this portfolio was 5%. Volkswagen, the key brand in this group, sold 3.109 million vehicles in 2024, generating operating revenue of €88.262 billion and an operating profit of €2.587 billion, for a profit margin of 2.9%, underscoring the urgency of restructuring. Škoda was commended for achieving a profit of €2.305 billion, almost matching Volkswagen's profit with just one-third of its sales volume, resulting in an operating profit margin of 8.3%.

The aspirational brand portfolio is led by the Audi Group, which sold 1.123 million vehicles globally, a decrease from 1.282 million in 2023. Ducati sold 57,400 motorcycles in the reporting year. Sales revenue stood at €64.5 billion, down 8% from €69.9 billion in the same period last year. Operating profit declined by 38% to €3.9 billion from €6.3 billion in the previous year, with a profit margin of 6.0%. The decline in profit margin was due to negative impacts totaling €2 billion from residual value effects and expenses related to the Brussels plant. Excluding these factors, the profit margin would have exceeded 9%, indicating robust performance.

The luxury sports brand (Porsche AG) sold 313,000 vehicles globally in fiscal year 2024, compared to 334,000 in the same period of 2023. Porsche's sales revenue dipped slightly from €37.3 billion in 2023 to €36.4 billion, with operating profit contracting to €5.3 billion. In terms of operating profit margin, it reached 14.5% in 2024, a decrease of 4.1 percentage points from the previous year.

Volkswagen Group maintains a cautiously optimistic outlook for 2025. The company expects sales revenue to grow by up to 5%, with an operating sales return on investment projected to be between 5.5% and 6.5%. Starting from 2025, Volkswagen believes it will enter a "year of acceleration." "2025 will be a year showcasing the new strength of the Volkswagen Group," said Oliver Blume.

01 Chinese Market

The Chinese market is a recurring topic for Volkswagen Group. In 2024, the Group sold 2.742 million vehicles in China, down 10% year-on-year, with market share decreasing by 2 percentage points, in line with Volkswagen Group's initial expectations for the year. "We felt the impact of intense price competition in China," said Oliver Blume. He noted that the decline in sales, increased costs associated with the launch of numerous models, and delivery bottlenecks adversely affected Volkswagen's operating results.

In 2024, Volkswagen's share of operating profit from its joint venture activities in China declined to €1.7 billion, down €920 million from the previous year's €2.621 billion. This is the lowest profit Volkswagen has made in China in the past decade. However, the Group still recognized this performance. "In a highly competitive market environment, we have found a healthy balance between profitability and sales," said Arno Antlitz, CFO of Volkswagen Group.

Over the next two years, Volkswagen Group will focus on developing and launching new locally produced models, expected to be highly competitive in terms of design, technology, and cost. Given this context, Volkswagen Group anticipates profitability in China to decline to between €500 million and €1 billion in fiscal year 2025, then stabilize from the end of 2025 onwards, with a noticeable upward trend in the coming years. This profit forecast also accounts for Volkswagen Group's reserves to address price wars.

"Volkswagen Group expects the Chinese market to remain challenging in 2025. In this fiercely competitive market, we anticipate price discounts to increase further. But we are prepared," said Oliver Blume.

Oliver Blume stated that Volkswagen Group is already prepared for the Chinese market through its new strategy. In the future, the Group will offer products with reliable performance, equipped with highly automated driving systems, state-of-the-art infotainment systems, enhanced comfort through connectivity and personalization, and continuous OTA capabilities. In the Chinese market, Volkswagen will take three measures to boost its competitiveness: 1) Collaborate with strong regional technology partners; 2) Implement systematic cost control; 3) Revise product strategy to fully cater to Chinese customers.

Oliver Blume emphasized that the Chinese market has unparalleled vitality, and the Volkswagen Group is keeping pace with the "Chinese speed." In the Chinese market, Volkswagen's new energy products will be rapidly launched in 2026, including extended-range electric vehicles. Volkswagen Group will unveil its first extended-range model planned for launch in 2026 at the Shanghai Auto Show. Oliver Blume noted that Volkswagen's model offensive will commence in 2026. Additionally, in 2025, Volkswagen has some iconic products, such as the first model, Audi E, from the collaboration between the Audi brand and SAIC Motor, as well as the second Audi model based on the PPE platform.

From 2025 to 2027, Volkswagen Group will introduce approximately 40 new models in China, more than half of which will be electrified products. By 2030, Volkswagen Group aims to bring over 30 pure electric vehicle models to Chinese customers.

02 Adjusting Software Strategy

For Volkswagen, to succeed in future competitions, two key technologies are of significant interest to the outside world: software technology and battery technology. In terms of software, it was once a weakness for Volkswagen Group, delaying the launch of a new generation of Volkswagen products and significantly impacting the group's competitiveness. To address software deficiencies, Volkswagen has adjusted its software development approach and strengthened its capabilities through new partnerships.

At the financial report conference, Oliver Blume announced that Volkswagen Group is collaborating with XPeng in China and Rivian in the United States in other regions. Regarding software strategy, the previous concept of a unified platform has been revised. Oliver Blume stated that CARIAD, Volkswagen Group's in-house software company, will focus on key cross-domain technologies: autonomous driving, infotainment systems, cloud services, data processing, and backend solutions. However, it will cede control of existing software to the brands, thereby bringing them closer to customers. For instance, in the Chinese market, Volkswagen has established an innovation center in Hefei, currently employing 3,000 Chinese staff.

"We are maintaining the competitiveness of internal combustion engine vehicles while investing in our core businesses of transitioning to electric mobility and software," said Arno Antlitz. Volkswagen Group also announced its future investment plans: over the five-year period from 2025 to 2029, Volkswagen Group intends to invest €165 billion. Key investment areas include electric mobility, software, battery operations, and the US market.

In addition to software, battery development is a crucial aspect of Volkswagen Group's technology strategy. According to previous announcements by Volkswagen Group, the company began adopting standard cell technology in 2023, aiming to cover 80% of electric vehicle models under Volkswagen Group by 2030. The cost of standard cells in mass-produced models will be reduced by 30%, and in entry-level models, it will be halved. Oliver Blume noted that Volkswagen's first-generation unified battery represents a significant advancement in performance, flexibility, and cost efficiency. Through unified batteries, Volkswagen has created a global, cross-brand technology platform, reducing complexity and achieving scalability.

Volkswagen Group has also expanded its battery raw material sourcing. In 2024, Volkswagen acquired a stake in a North American mining company as a further step to secure raw material supply. Oliver Blume stated that this is essential for reducing battery costs, thereby providing customers with more affordable products.

Currently, Volkswagen is developing the next generation of batteries: solid-state batteries. These batteries do not require any liquid materials and offer greater range and faster charging speeds. The batteries are produced by PowerCo, a subsidiary of Volkswagen Group, utilizing QuantumScape technology. Currently, the batteries have passed more than 1,000 charging cycles, with a battery capacity retention rate of over 95%. This means that after completing 500,000 kilometers of driving, there is virtually no performance degradation.