Asian Auto Market | Deep Dive into South Korea's February Car Sales Performance

![]() 03/14 2025

03/14 2025

![]() 502

502

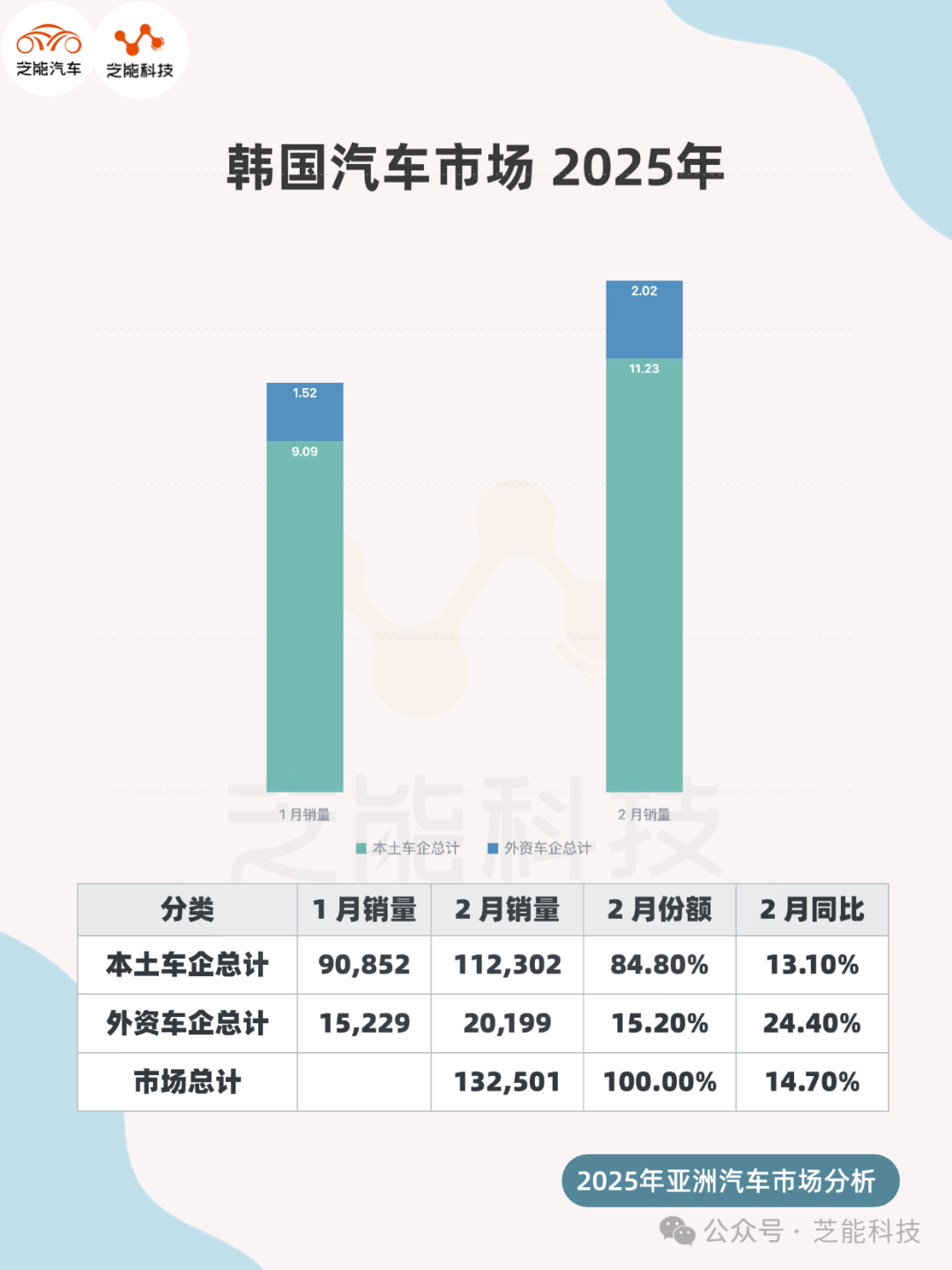

The South Korean automotive market experienced robust growth in February 2025, with new car sales surging to 132,501 units, marking a 14.7% year-over-year increase. This uptick can be attributed to an extended sales period and a resurgence in consumer demand.

Local manufacturers contributed 112,302 units, up 13.1% year-over-year, while foreign manufacturers sold 20,199 units, registering a 24.4% year-over-year jump.

Year-to-date, car sales in South Korea have risen by 3.1% to 238,582 units. Local manufacturers have sold 203,154 units, a slight increase of 0.5%, whereas foreign manufacturers have sold 35,428 units, a notable 20.8% increase.

Hyundai Motor reclaimed the top spot for the sixth time in the past seven months, with a growth rate of 26.8%, while Kia Motors maintained its year-to-date lead with a narrow margin.

01

Overview of Car Sales in the South Korean Market

● In terms of sales, the South Korean automotive market performed impressively in February, with both local and foreign brands experiencing varying degrees of growth.

◎ Hyundai Motor sold 46,993 units in February, up 26.8% year-over-year, capturing a 35.5% market share. Through the launch of new models and product line optimization, it emerged as the sales champion for the sixth time in seven months.

◎ Kia Motors sold 46,047 units, up 4.5% year-over-year, with a market share of 34.8%. Despite moderate growth, it led in sales year-to-date, edging out Hyundai by just 236 units.

◎ Genesis sold 10,223 units, down 3.4% year-over-year, with a market share of 7.7%. Despite increased competition in the luxury segment, it surpassed the 10,000-unit mark for the first time since November 2024.

◎ BMW sold 6,274 units, up 3.0% year-over-year, with a market share of 4.7%, maintaining a stable market position.

◎ Renault Korea sold 4,881 units, a remarkable 170.1% year-over-year increase, with a market share of 3.7%. The success of the new Grand Koleos significantly boosted its sales.

◎ Mercedes-Benz sold 4,663 units, up 29.8% year-over-year, with a market share of 3.5%. Its diverse product range and high-end positioning resonated well with consumers.

◎ KG Mobility sold 2,676 units, down 28.6% year-over-year, with a market share of 2.0%, facing stiff competition in a challenging market.

◎ Tesla sold 2,222 units, a staggering 1177.0% year-over-year increase, with a market share of 1.7%. The popularity of the Model Y underscores the strong demand for electric vehicles in the South Korean market.

◎ GM Korea sold 1,482 units, down 25.4% year-over-year, with a market share of 1.1%. Its sluggish performance may be attributed to slow product updates.

◎ Lexus sold 1,337 units, up 45.5% year-over-year, with a market share of 1.0%. Its steady improvement highlights its potential in the luxury car market.

● Among local brands, Hyundai and Kia together accounted for 70.3% of the market share, reinforcing their dominant position.

● Among foreign brands, BMW, Mercedes-Benz, and Tesla stood out, with Tesla's explosive growth infusing new energy into the market.

02

Competitive Landscape Analysis

● In the competitive landscape, both local and foreign brands shone with notable model sales achievements.

◎ The Kia Sorento sold 9,067 units in February, up 4.6% year-over-year, clinching the sales championship for the sixth consecutive time, underscoring its strong competitiveness in the SUV market.

◎ The Kia Carnival sold 7,734 units, a slight 3.2% year-over-year decline, but still ranking second, demonstrating robust demand in the MPV segment.

◎ The Kia Sportage sold 6,568 units, down 6.1% year-over-year, yet retaining third place, highlighting Kia's deep roots in the SUV market.

◎ The Hyundai Avante sold 6,296 units, a whopping 174.7% year-over-year increase, vaulting to fifth place. Its new design and high cost-effectiveness significantly bolstered its market appeal.

◎ The Hyundai Grandeur sold 5,481 units, up 38.3% year-over-year. As Hyundai's flagship sedan, it benefited from strong demand for high-end sedans among South Korean consumers.

◎ Other noteworthy models include the Hyundai Sonata (+222.2%), Tucson (+54.2%), and Kia Seltos (+20.1%), further consolidating the market position of local brands.

● Regarding foreign model sales:

◎ Tesla's Model Y sold 2,040 units, a phenomenal 2549.4% year-over-year increase, jumping from zero sales in January to the top spot, reflecting the immense potential of the electric vehicle market.

◎ Mercedes-Benz's E-Class sold 1,907 units, up 98.6% year-over-year, performing impressively in the luxury car market.

◎ BMW's 5 Series sold 1,719 units, down 20.4% year-over-year, but still ranking first among foreign models year-to-date.

◎ Mercedes-Benz's GLC sold 726 units, up 170.9% year-over-year, performing well in the luxury SUV market.

◎ Lexus's ES sold 620 units, up 43.5% year-over-year, steadily enhancing its position in the luxury car market.

◎ Additionally, the rise of electric models such as the Volkswagen ID.4 signals an accelerated shift towards electrification.

Summary

The South Korean automotive market exhibited robust growth in February 2025, with both local and foreign manufacturers benefiting from the market recovery.

Hyundai Motor and Kia Motors continued to dominate the market, together accounting for over 70% of the share, while the rapid ascent of brands such as Renault Korea and Tesla injected new competitive dynamics into the market.

With the increasing penetration of electric vehicles and intensifying market competition, the South Korean automotive market will encounter more opportunities and challenges in the future. Cheenergy Tech will continue to monitor market trends and provide readers with professional and in-depth analyses and insights.