New Energy Vehicles Dip Below Market "Middle Line": Is a Fuel Vehicle Comeback Imminent?

![]() 03/14 2025

03/14 2025

![]() 475

475

Introduction | Lead

After peaking in August 2024, the domestic penetration rate of new energy vehicles (NEVs) has since declined. In the first two months of 2025, the penetration rate has yet to recover to last year's high. The next chapter could see NEVs losing momentum while fuel vehicles catch up, creating a competitive landscape; alternatively, NEVs might merely be taking a brief respite before accelerating further and fully displacing fuel vehicles. At present, considerable uncertainty prevails.

Produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Full text: 2578 words

Reading time: 4 minutes

Since the beginning of this year, the NEV penetration rate has remained below 50%.

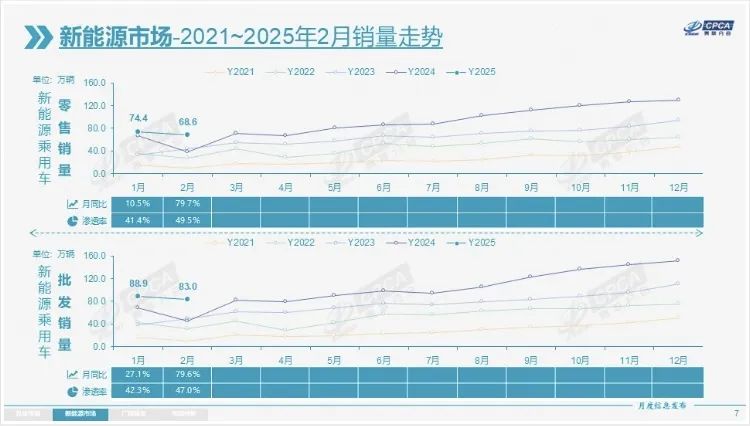

According to the latest data from the China Passenger Car Association, in February, retail sales of new energy passenger vehicles in China amounted to 686,000 units, marking a 79.7% year-on-year increase but a 7.8% month-on-month decrease, with a penetration rate of 49.5%. Compared to January's 41.5%, the domestic NEV penetration rate exhibited a notable monthly increase. However, compared to mid-2024's penetration rate exceeding 50%, the decline is still significant. Further analysis reveals that domestic NEV sales are primarily driven by independent brands. Both luxury and mainstream joint venture brands contribute relatively low proportions of NEV sales.

△According to the China Passenger Car Association, the NEV penetration rate has hovered below 50% in the first two months of this year.

NEVs Under Pressure to Advance

In fact, signs of a decline in NEV market share in the domestic automotive market have already emerged.

In July 2024, the domestic NEV penetration rate surpassed 50% for the first time, peaking at 53.7% in August. However, this figure subsequently plummeted, with the monthly penetration rate declining for four consecutive months and falling below the 50% threshold in December.

NEVs, particularly pure electric vehicles (EVs), have yet to gain full acceptance among some consumers.

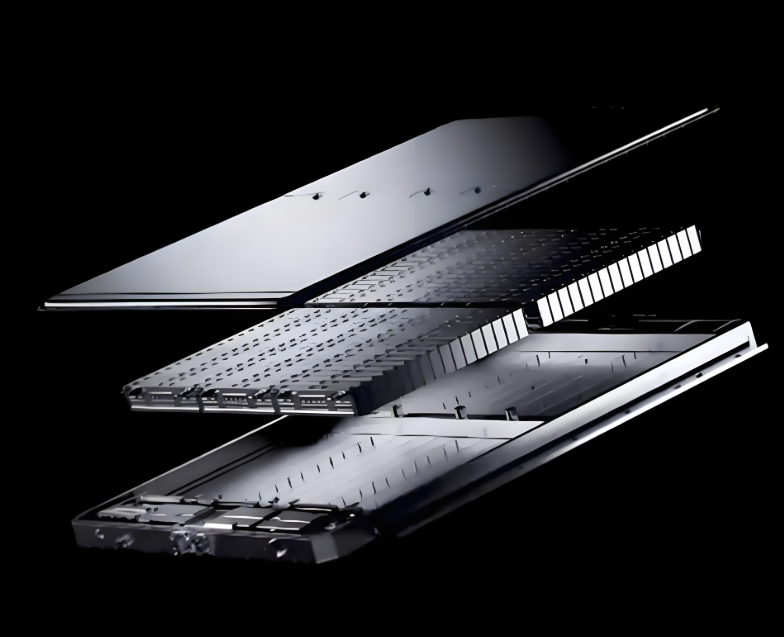

On one hand, constraints on user driving habits imposed by the physicochemical properties of EV batteries persist. Whether in winter or on highways, EVs cannot fully replace traditional fuel vehicles. For instance, EV Didi drivers in Shanghai are reluctant to turn on the air conditioning in winter, leading to conflicts between passengers and drivers. On the other hand, issues such as EV depreciation rates, battery maintenance and replacement costs, and even safety concerns continue to make many consumers hesitant when purchasing vehicles.

△Electric vehicles are constrained by the performance of lithium batteries.

Therefore, without robust policy support, it remains challenging for EVs and the entire NEV industry to fully replace fuel vehicles. From a policy-maker's perspective, both China and the global community have shifted their focus away from heavily favoring EVs. In the European market, major EV-consuming countries like Germany and Sweden have reduced or even eliminated EV subsidies. After the Trump administration came to power, the United States aimed to completely eliminate all EV subsidy policies from the Biden era. And after years of vigorously encouraging NEVs, China has also begun to prioritize "equal rights for fuel and electric vehicles" as a policy concern.

△"Equal rights for fuel and electric vehicles" needs to be prioritized.

Fuel vehicles not only retain a significant fan base but also support a massive industrial chain and a considerable workforce, serving as an economic and financial pillar in some regions. Unequal treatment of fuel vehicles is essentially unfair to these automakers. Moreover, most new-force automakers or EV projects currently sell cars at a loss, with many well-known new-force automakers already collapsing, causing extremely negative public opinion and social impact. In this context, seeking balanced and equal development of EVs, fuel vehicles, and hybrid vehicles has become a consensus among all parties.

Will Fuel Vehicles Make a Comeback?

In the domestic automotive market, fuel vehicles still enjoy a solid foundation. However, in terms of promotion and marketing strategies, internet-backed new-force automakers significantly outperform traditional automakers. Under intense promotion, EVs often appear as cutting-edge technology, while fuel vehicles are portrayed as outdated products. In reality, fuel vehicles are far from obsolete and will continue to occupy a place in domestic and global markets for a long time.

△Lei Jun's marketing prowess surpasses that of traditional automakers.

For traditional automakers, particularly joint ventures, the key lies in abandoning external influences and focusing on developing next-generation products. How can fuel vehicles match new-force automaker models in terms of intelligent cockpits and autonomous driving? How can overall fuel economy be continuously optimized, reducing fuel consumption per hundred kilometers and offsetting EVs' travel cost advantages? These are issues traditional automakers must address. Judging from the new generation of products from traditional automakers like GM, Volkswagen, Toyota, and Geely, traditional fuel vehicles are already capable of competing with NEVs on an equal footing in terms of intelligence. Through several generations of product iterations, it will be difficult for the situation where fuel vehicles lag behind NEVs in intelligence to recur.

△Enhancing fuel vehicle intelligence can lure back some consumers.

Regarding domestic joint venture automakers, although they have encountered certain difficulties, this does not imply they will lose their place in the domestic market. As long as major multinational automakers like Toyota, Volkswagen, GM, and Ford have not decided to withdraw from the Chinese market, even if domestic joint ventures continue to incur losses, their global profits are sufficient to subsidize the Chinese market. In contrast, new-force automakers are still a minority that have achieved profitability, with most still incurring losses. This may lead foreign automakers to believe that over time, more competitors will falter. Since the second half of last year, most mainstream domestic joint venture automakers have begun following new-force automakers' example by introducing a "one-price" strategy. Traditional joint ventures, cornered into a tight spot, have regained consumers' attention and witnessed a sales recovery through significant terminal discounts, which has also lowered the NEV penetration rate to a certain extent. In 2025, traditional automakers will be more determined to implement their fuel vehicle price reduction strategies. For the NEV penetration rate to climb to new heights again, besides policy support, it will also depend on technological breakthroughs.

△Many joint venture automakers have introduced a "one-price" sales strategy.

Fuel Cells Remain Unpopular

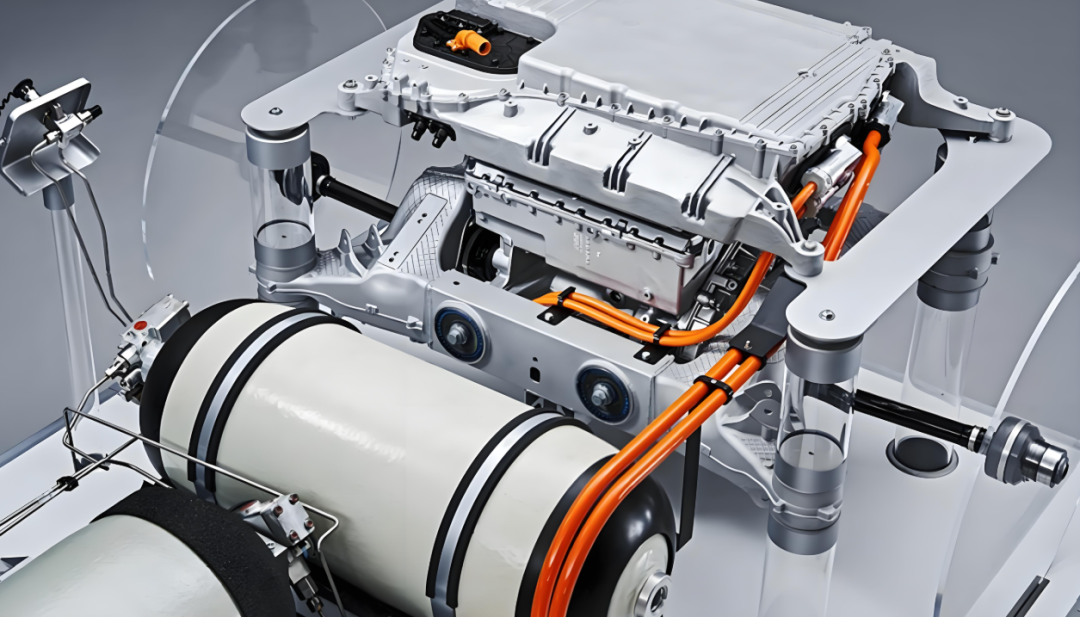

As a relatively unpopular vehicle type in China but occasionally gaining attention due to various news, fuel cell vehicles performed poorly in 2024, and it is estimated that fuel cells will remain benched for an extended period.

△Fuel cell vehicle sales experienced their first year-on-year decline in many years in 2024.

In 2024, nationwide fuel cell vehicle production and sales data amounted to 5,548 and 5,405 units, respectively, representing year-on-year decreases of 10.4% and 12.6%. This broke the trend of continuous year-on-year growth in domestic fuel cell vehicle production and sales data since 2021. Compared to EVs and other NEVs, fuel cell vehicles face more restrictions and constraints, including the cost of the fuel cell system itself, the construction of hydrogen refueling stations, and hydrogen storage and transportation. In the short term, fuel cell technology faces numerous challenges in its promotion in China and even globally.

According to data released by South Korean research institution SNE Research, the total global sales of registered hydrogen fuel cell vehicles in 2024 were 12,866 units, also representing a year-on-year decrease of 21.6%. For the foreseeable future, unless there is a significant leap in fuel cell system technology and an explosive growth in hydrogen refueling station construction, fuel cells will primarily be used for demonstration operations. Domestic automakers need to be cautious about their investments in this field. After all, the commercial vehicle sector, once considered the "home court" of fuel cells, is gradually being eroded by lithium battery models.

△The sales prospects for fuel cell vehicles in China remain grim.

Commentary

Since the second half of last year, many domestic joint venture automakers have simply introduced a "one-price" strategy, significantly boosting fuel vehicle sales, which are their strength. While fuel vehicle market share has increased, NEV growth momentum has also begun to slow down. Moreover, from a policy guidance perspective, the state has also gradually emphasized "equal rights for fuel and electric vehicles." Ultimately, if NEVs aim to fully replace fuel vehicles, it hinges on technological breakthroughs. Otherwise, no matter how intense the advertising, seasoned drivers will still find it challenging to "go electric."

(This article is original content of "Heyan Yueche" and may not be republished without authorization)