Village's Hope Crushed as Northvolt Files for Bankruptcy

![]() 03/17 2025

03/17 2025

![]() 609

609

Introduction

Introduction

Northvolt's bankruptcy filing has dealt another severe blow to Europe's already beleaguered battery industry.

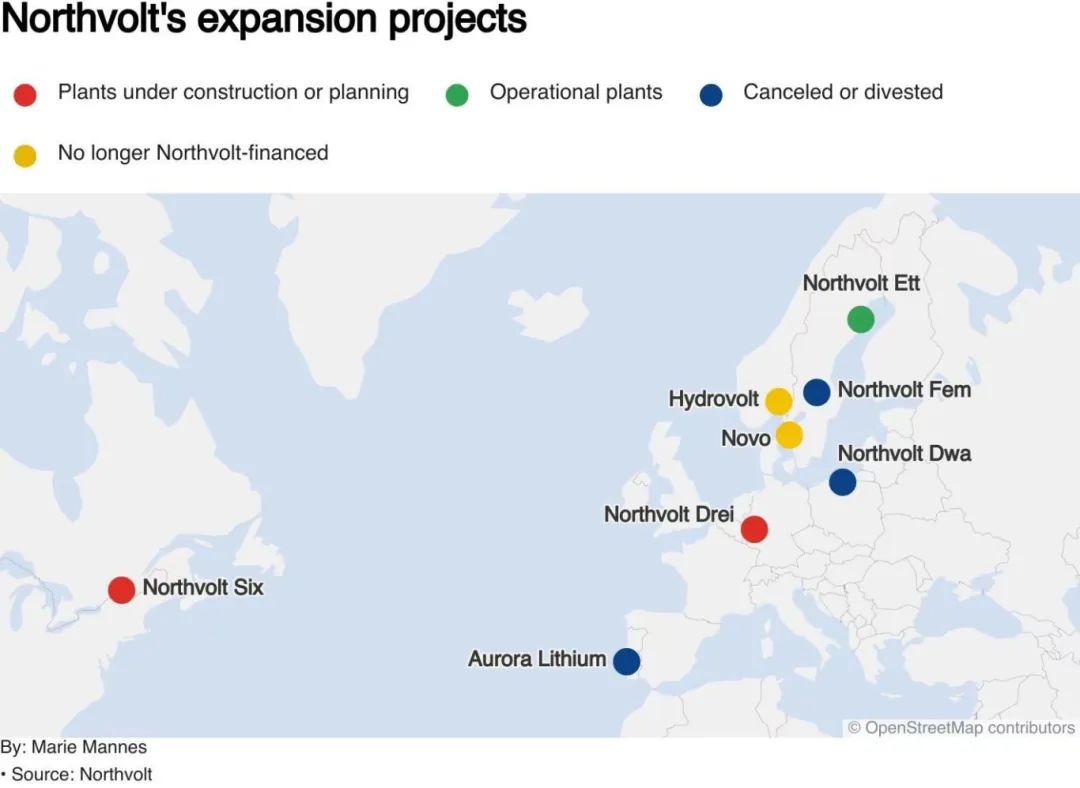

This week, Swedish battery manufacturer Northvolt announced its bankruptcy filing in Sweden, with its business and assets set to be sold under the supervision of a court-appointed trustee.

Last November, Northvolt filed for Chapter 11 bankruptcy protection under the U.S. Bankruptcy Code due to insufficient capital reserves, aiming to raise funds to address manufacturing and capacity challenges. Despite exploring all avenues to avoid bankruptcy, the worst-case scenario could not be averted.

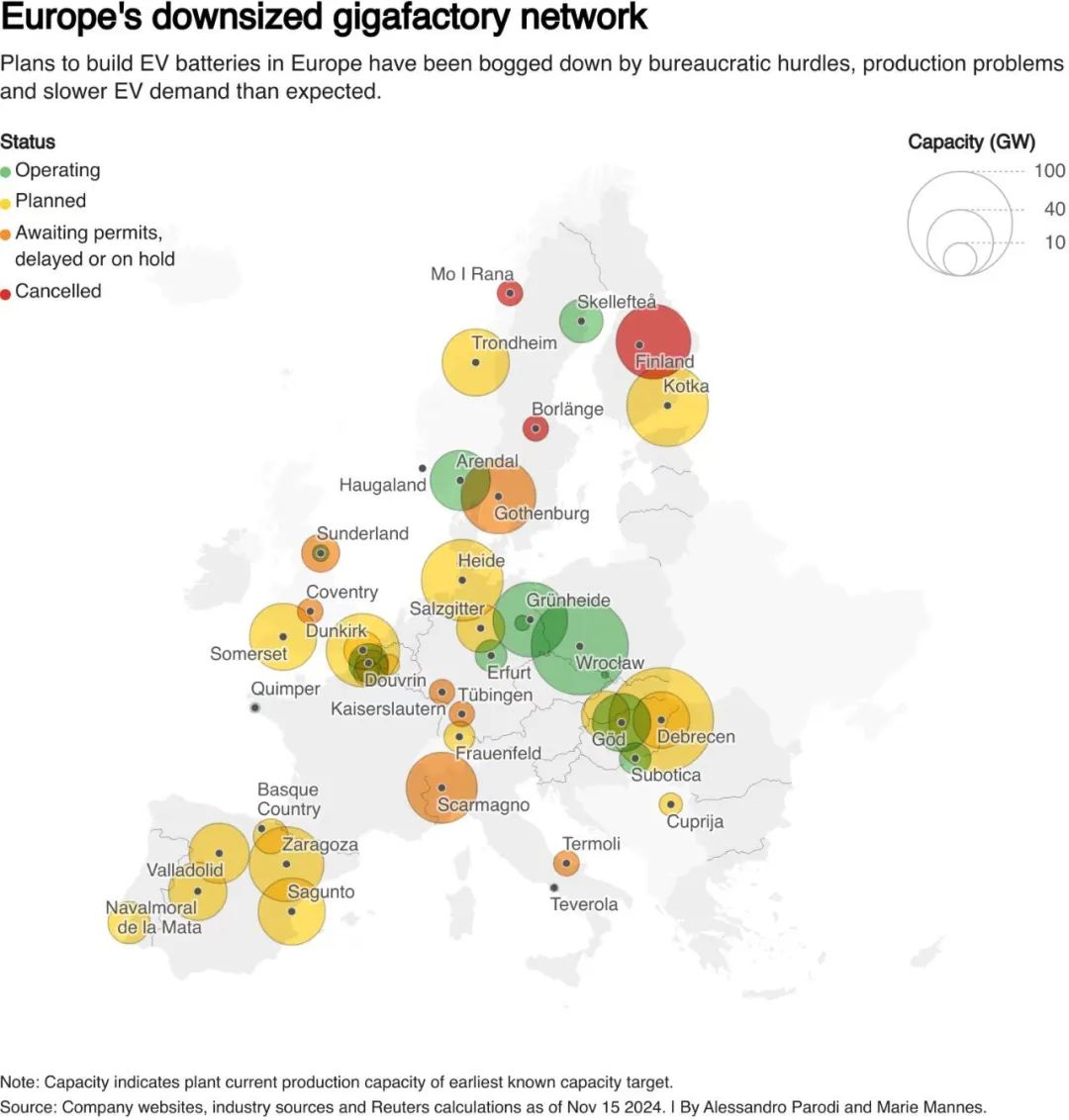

Over the past few years, Europe has been striving to establish a local battery supply chain to break China's dominance in the electric vehicle sector. However, signs indicate that this ambitious plan is nearing failure. With Northvolt's setback, the "village's hope" has been completely dashed, and Europe's grand vision for an electric vehicle battery supply chain has encountered significant hurdles.

Last year, Northvolt received a $5 billion loan from the European Union but struggled with cost pressures, supply chain disruptions, and internal capacity issues. This bankruptcy is one of the largest in Swedish corporate history, putting up to 5,000 jobs at risk of unemployment.

Since its inception in 2016, the Swedish company has raised over $10 billion through equity, debt, and public financing. Its largest shareholders are currently Volkswagen, with a 21% stake, and Goldman Sachs, with a 19% stake.

Northvolt's vision was to enable Europe to compete with Asian manufacturers in the global battery market. However, it has proven challenging to "overtake" the power battery sector, where Chinese manufacturers lead. The company had ambitious plans to build factories in Sweden, Germany, and Canada but struggled to increase production while controlling costs.

The final straw that forced the board to file for bankruptcy was the inability to resolve short-term cash flow issues. Since the second half of last year, several major customers who had signed contracts with Northvolt have sought alternatives, and even European automakers are turning to Asian partners for battery production.

Experience has taught them that there are limits to waiting for European battery suppliers. If it's not suitable, they must withdraw. Moreover, Northvolt faced numerous challenges, including bureaucratic obstacles, capacity and product issues, and tight cash flow, each of which could drag the company into a quagmire and trigger bankruptcy.

Northvolt's bankruptcy filing has dealt another severe blow to Europe's already beleaguered battery industry. Notably, in addition to BMW's $2 billion order, Volkswagen, another major shareholder, has invested up to $14 billion in a ten-year supply contract.

Volkswagen not only fed Northvolt but also contracted to support the company for the next ten years. Unexpectedly, Northvolt overturned its own rice bowl.

However, Volkswagen, the largest shareholder, has also been struggling recently. Just this week, both Porsche and Skoda, two major brands under the Volkswagen Group, as well as software subsidiary Cariad, were reported to be undertaking large-scale layoffs.

Porsche issued a statement this week announcing plans to cut about 3,900 jobs by 2029. Among these, about 1,900 positions will be reduced through natural attrition, hiring restrictions, and voluntary agreements.

Last month, Porsche announced a strategic retrenchment plan to reduce the number of employees at its two German factories in Zuffenhausen and Weissach through voluntary measures such as early retirement and compensatory layoffs, and to adopt restrictive measures for recruiting new employees.

Skoda is also preparing for large-scale layoffs. The company's CEO stated this week that to optimize operational efficiency and expand its electric vehicle product line, it plans to cut 20% of its workforce.

Skoda currently employs 41,000 people, and based on the 20% layoff ratio, about 8,200 employees will be affected.

However, European media reported that Skoda's layoffs will be moderate, achieving the layoff target through natural attrition, mainly through normal retirement of employees and non-renewal of contracts after expiration, gradually reducing the team size.

This week, Volkswagen released its 2024 financial report, revealing that the group sold 9.037 million new vehicles in the past year, a year-on-year decline of 3.5%, with an operating profit of 19.1 billion euros (approximately 150 billion yuan), a year-on-year decline of 15.4%.

It is worth mentioning that China, as Volkswagen's largest single market globally, sold 2.742 million vehicles in 2024, a year-on-year decrease of 10%, with operating profit falling to 1.7 billion euros (approximately 13.4 billion yuan). This is the group's weakest profit performance in the Chinese market in the past decade.

Editor-in-Chief: Cao Jiadong; Editor: Wang Yue