Lixiang One's Q1 Deliveries Expected to Rise, Yet Weak Revenue Guidance Puts Pressure on ASP and Auto Gross Margin

![]() 03/17 2025

03/17 2025

![]() 727

727

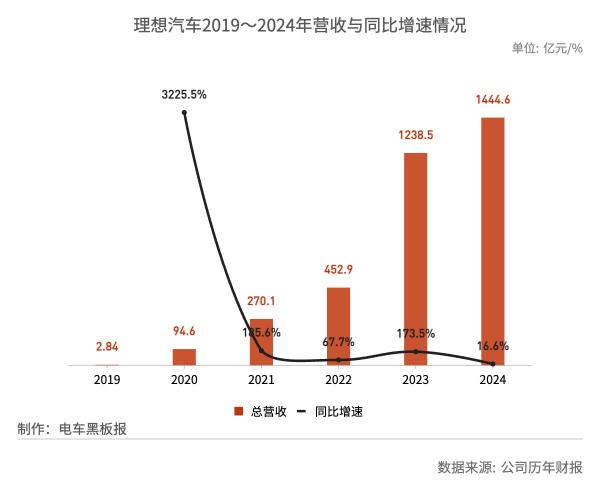

Among the "NIO, Xpeng, and Lixiang One," Lixiang One was the first to unveil its Q4 and full-year 2024 financial report, which presented a mixed bag of results.

On a positive note, the company's revenue has surpassed the 100 billion yuan mark for two consecutive years, with quarterly revenue continuing to set new highs. Furthermore, quarterly R&D expenses were better controlled than market expectations.

However, on a less optimistic front, quarterly net profit fell nearly 40% year-on-year, and both the average selling price (ASP) and auto gross margin declined year-on-year and quarter-on-quarter, with the potential for further decline.

According to the delivery guidance provided in the financial report, deliveries in Q1 2025 are expected to maintain a year-on-year growth rate of 9.5% to 15.7%, reaching 88,000 to 93,000 vehicles. Nonetheless, revenue guidance decreased by 8.7% to 3.5% year-on-year, ranging from 23.4 billion to 24.7 billion yuan, significantly below market expectations.

Moreover, due to price reductions of 10,000 to 16,000 yuan for Lixiang One's L series models in March, coupled with the ongoing implementation of financial interest subsidies, the company's ASP in Q1 is likely to continue declining.

The weak revenue guidance potentially weighed on Lixiang One's U.S. stocks, which fell more than 7% in pre-market trading on Friday and closed down 4.39%.

During the financial report conference call, Li Tie, CFO of Lixiang One, noted that due to the impact of the Spring Festival holiday and promotional activities, the company expects its Q1 auto gross margin to be approximately 19%. This represents a decline of 0.7 percentage points from Q4 2024 and 0.3 percentage points year-on-year.

1. Gross Margin Approaches the "Minimum Healthy Standard"

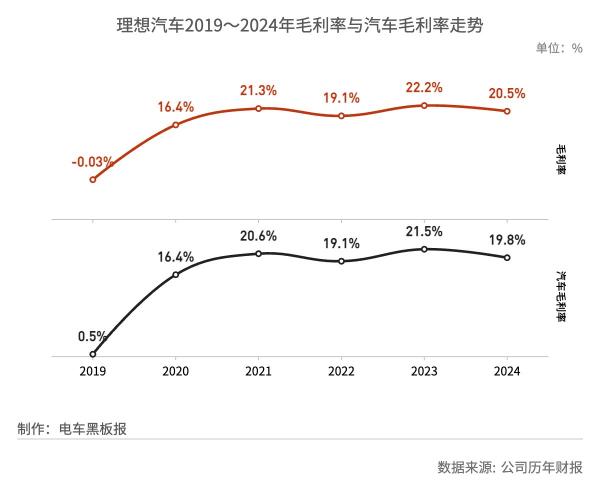

Gross margin is a crucial metric for measuring automakers' profitability. During the reporting period, Lixiang One witnessed declines in both annual and quarterly dimensions.

According to the financial report, the company's gross margin decreased by 1.7 percentage points year-on-year to 20.5% in 2024. This indicator also declined both year-on-year and quarter-on-quarter in Q4, falling by 3.2 percentage points to 20.3% year-on-year and by 1.2 percentage points quarter-on-quarter.

Li Xiang, CEO of Lixiang One, has publicly stated that a 20% gross margin is the minimum healthy standard for automakers adopting a direct sales model.

In this financial report, Lixiang attributed the decline in both annual and quarterly gross margins to the decrease in auto gross margin during the same period, primarily influenced by changes in the company's product mix and pricing strategy.

Specifically, the auto gross margin in 2024 fell by 1.7 percentage points year-on-year to 19.8%, while the auto gross margin in Q4 declined by 3 percentage points year-on-year to 19.7% and by 1.2 percentage points quarter-on-quarter, falling short of market expectations of 20.6%.

The quarter-on-quarter decline in Q4 auto gross margin was due to a decrease in ASP caused by purchase commitment losses and financial interest subsidies provided to customers, according to the financial report.

Lixiang did not disclose the specific amount of purchase commitment losses in the financial report. Financial interest subsidies, offered for a limited-time period of one month at the end of November last year to boost year-end sales, provided a three-year interest-free scheme for the entire range of models. Depending on the selling price, customers could save up to 15,700 to 27,700 yuan in interest.

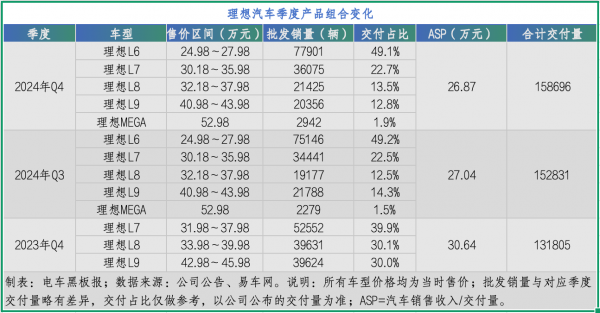

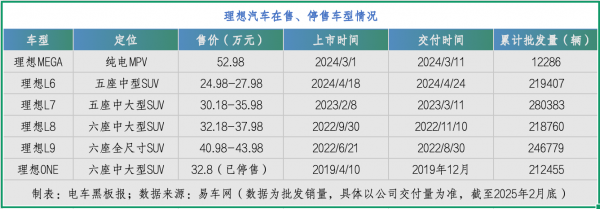

Comparing the company's quarterly product mix over comparable periods, there were five models on sale in Q3 and Q4 of 2024, including Lixiang One L6, L7, L8, L9, and MEGA, while only L7, L8, and L9 were available in Q4 of 2023.

The year-on-year decline in Q4 auto gross margin was mainly attributed to changes in the product mix. In terms of wholesale sales, the launch of Lixiang One L6 significantly increased the company's overall deliveries but also lowered the ASP. The ASP in Q4 fell by 37,700 yuan year-on-year to 268,700 yuan and by 1,700 yuan quarter-on-quarter.

Since its launch and delivery in April 2024, L6 has ranked first in sales among the company's models for three consecutive quarters, accounting for half of the total deliveries in Q3 and Q4. Priced between 249,800 and 279,800 yuan, it is the lowest-priced model in Lixiang One's lineup.

Additionally, Lixiang immediately adopted a new pricing system for its entire range of models after the launch of L6, with price reductions ranging from 18,000 to 30,000 yuan for L7, L8, L9, and MEGA, which also affected the company's gross margin to a certain extent.

2. Q1 Delivery Growth Comes at a Cost, and the Overseas Market May Become a Full-Year Increment

Based on the company's Q1 delivery guidance provided in the financial report and combined with the delivered data already published for the first two months of 2025, deliveries in March are expected to range from 32,000 to 37,000 vehicles, an increase of 21.1% to 40.2% quarter-on-quarter. This indicates a significant increase in order volume since the price reduction in March.

During the financial report conference call, Li Xiang revealed that two new pure electric SUVs will be launched this year, with the first model, Lixiang i8, set to be released in July, followed by i6 in the second half of the year. This release schedule is similar to that of L9 and L8 in 2022, which will help the company achieve better sales in the second half of the year and store more orders for Q1 of the next year.

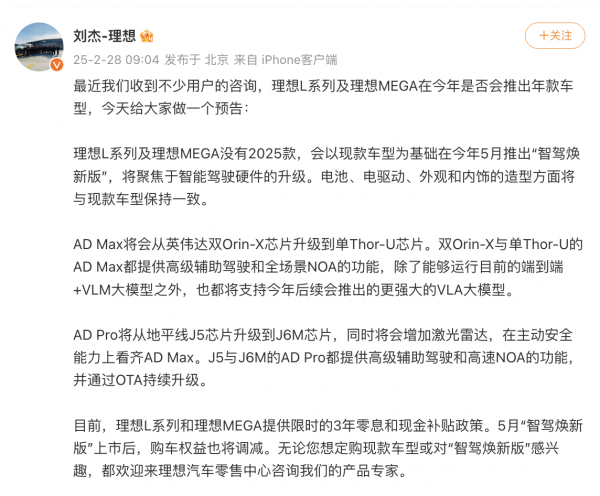

Previously, Liu Jie, Vice President of Lixiang One, posted on Weibo that there will be no 2025 models for the L series and MEGA. Instead, a "Smart Driving Renewal Edition" will be launched in May based on the current models, focusing on upgrades to intelligent driving hardware. The battery, electric drive, exterior, and interior design will remain consistent with the current models.

This means that Lixiang One will have no new car launches for a full year since the launch of L6. The pure electric SUV originally planned for launch in the second half of last year has been delayed to the second half of this year due to the poor performance of MEGA in its first month on the market. Additionally, the number of pure electric SUVs has been reduced from three to two.

It is understandable why Lixiang One introduced price reductions for four models in the L series on top of financial interest subsidies at the end of February. On one hand, it aims to continue ensuring the company's sales growth in the absence of new car launches and model refreshes. On the other hand, it is also preparing for the upcoming "Smart Driving Renewal Edition." Liu Jie stated that vehicle purchase benefits will also be adjusted downward after the launch of the "Smart Driving Renewal Edition" in May.

During the financial report conference call, the company's management did not mention Lixiang One's sales target for 2025, and the market's general expectation remains at 700,000 vehicles. In 2024, Lixiang One's deliveries increased by 33.1% year-on-year to 500,508 vehicles. Based on this calculation, the company's sales growth rate in 2025 will be close to 40%.

Zou Liangjun, Senior Vice President of Lixiang One, stated during the financial report conference call that the company will achieve breakthroughs in sales growth in 2025 through product upgrades, expanding the sales network, strengthening marketing, and accelerating overseas market expansion.

Zou Liangjun believes that "the new pure electric SUV models will provide the company with greater market space. Additionally, after upgrading the intelligent driving system to the V13 version trained on 10 million clips, the intelligent driving capabilities will be greatly improved, laying a solid foundation for the company's sales growth this year."

The overseas market is expected to become a significant increment for the company's full-year sales growth. Zou Liangjun noted that 2025 is the first year for Lixiang One's official entry into the overseas market. "The company has made significant progress in markets such as Central Asia and the Asia-Pacific region and will continue to increase investment in markets like Latin America, the Middle East, and Europe."