Can 'Fixed Pricing' Revive Lincoln's Fortunes?

![]() 03/17 2025

03/17 2025

![]() 494

494

As the 'price war' intensifies, more participants are joining the fray. Amid this trend, even automakers that prioritize brand tone are beginning to enter the battlefield. After a prolonged period of hesitation, manufacturers are setting aside 'prestige' in favor of 'substance'. In this shift, Lincoln has emerged as the latest entrant.

Recently, Lincoln officially introduced a 'fixed pricing' policy for the Lincoln Z sedan and compact SUV Corsair. The starting prices for both models have been adjusted to RMB 188,800, marking a reduction of nearly RMB 50,000 from the original guided starting price of RMB 235,800.

This is not the first time Lincoln has resorted to price cuts. As early as December 2023, the terminal price of the 2.0T four-wheel drive version of the high-volume Lincoln Navigator offered a discount of almost RMB 60,000. In May last year, a media exposé revealed in-store quotes from a Lincoln dealer, showing discounts exceeding RMB 100,000 for the Aviator, which was in the clearance phase. The Corsair and Lincoln Z were priced at just RMB 199,800. Furthermore, in July 2024, a third-party platform reported the bare car price of the Lincoln Z at an astonishing RMB 169,800.

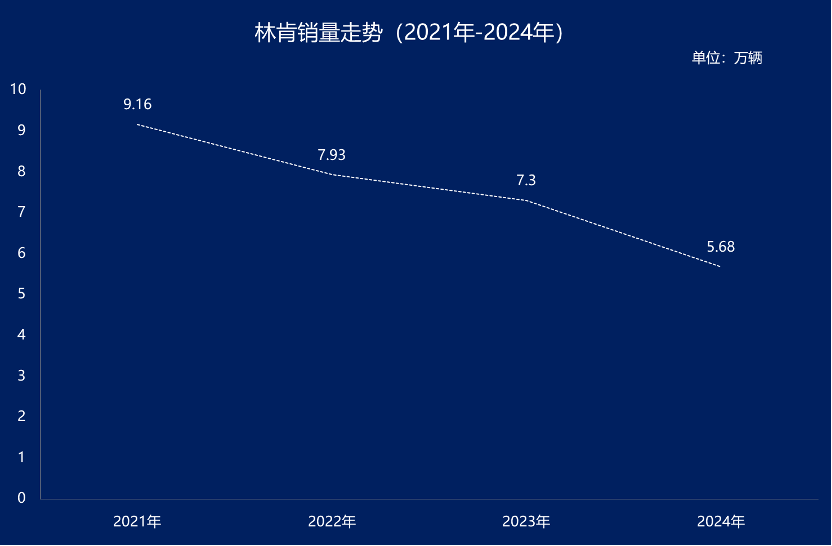

Notably, when the Lincoln Z and Corsair were launched, Zhu Meijun emphasized that price wars were not the path for Lincoln, a luxury brand. Instead, he advocated adhering to the brand's unique rhythm and route, exploring the genuine needs of customers. However, Lincoln's terminals have deviated from this ideal path, compelled to compromise for survival. Public data indicates that in 2024, Lincoln sold a cumulative total of 56,800 vehicles in China, a year-on-year decrease of 20.67%. In the first four months of 2024, sales further dipped to 18,517 vehicles.

From 2022 to 2024, Lincoln experienced a 'three-year decline' in China, with sales plummeting from 91,600 vehicles to 56,800, a decrease of 38%. During this retreat, China's automotive market underwent significant changes. The rise of electrification and intelligence continuously eroded the market share of traditional fuel vehicles. While brands like BYD impacted Nissan and Honda, emerging players such as NIO, Li Auto, and AITO posed significant challenges to traditional luxury brands.

To maintain market share, many luxury brands intensified price cuts. Consumers now face options like the Mercedes-Benz A-Class and Audi A3 priced below RMB 130,000, the BMW i3 priced below RMB 170,000, the Volvo S60 at RMB 180,000, the Audi Q5 at RMB 300,000, and the Mercedes-Benz EQE priced above RMB 270,000. However, Lincoln, emphasizing brand tone, refrained from significant discounts. Zhu Meijun candidly stated, 'A brand leads to sales, but sales do not necessarily lead to a brand. As a luxury brand, Lincoln focuses on 'customer value' to build its brand, adheres to 'value marketing', and refuses to sacrifice price for volume.' At that time, relevant institutions calculated that in the second half of 2023, Lincoln's discount rate was only 11.5%, significantly lower than the approximately 20% discount rate of other luxury brands.

With declining sales, Zhu Meijun stepped down as president of Lincoln China, replaced by Jia Mingdi. Upon taking office, Jia Mingdi reiterated that 'Lincoln always pursues high-quality sales and does not measure success by sales figures alone.' Nevertheless, by the end of last year, Lincoln's discount rate had risen to 18.8%. The introduction of this 'fixed pricing' strategy can be seen as Lincoln further adapting to the Chinese market, aligning with competitors' tactics. However, it remains uncertain whether this price reduction will prove effective.

An undeniable fact is that the growing popularity of new energy vehicles and the collective favor of emerging automakers indicate a shift in China's automotive consumption environment and concepts. The evolving electrification and intelligence technologies offer consumers a novel car ownership experience, increasingly favored over traditional automakers' mechanical prowess, sophisticated manufacturing, and storied brands. In the eyes of the outside world, Chinese new energy companies have seized the automotive industry's discourse from luxury brands, redefining the essence of a luxury car. Recent market performance underscores that the era of easy profits for traditional luxury brands is over. Within the luxury sector, Lincoln has always been a second-tier brand, with a market position and brand appeal slightly inferior to BBA.

Admittedly, Lincoln is adapting to the market dynamics. However, the entire luxury car market is experiencing substantial price reductions. Against this backdrop, Lincoln's discounted pricing may not necessarily establish a price advantage. Facts demonstrate that even with price cuts introduced last year, Lincoln failed to reverse its decline. Some public opinions suggest that Lincoln needs breakthroughs in technological reserves, product iterations, user experience, and other dimensions. Currently, BBA is rapidly expanding its latest generation of electrified products in the Chinese market, collaborating with Chinese partners to develop electronic and electrical architectures and enhance software standards. Lincoln too must accelerate its pace. (Images sourced from the internet, please remove if infringement occurs)