Asian Auto Market | Thailand February 2025: Car Sales Persistently Slump

![]() 03/31 2025

03/31 2025

![]() 644

644

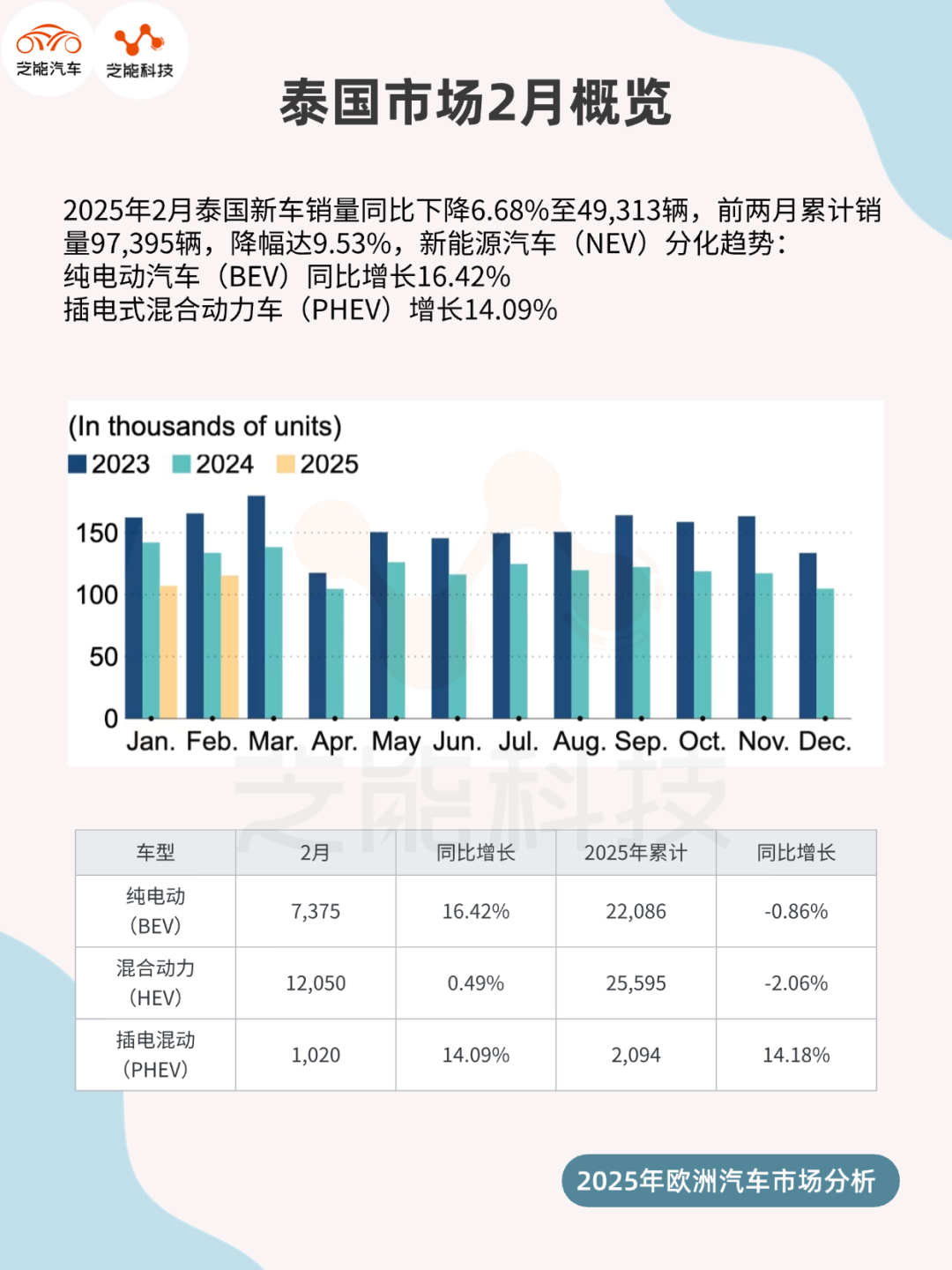

Data from the Federation of Thai Industries (FTI) reveals that new car sales in Thailand dropped 6.68% year-on-year to 49,313 units in February 2025, with cumulative sales for the first two months reaching 97,395 units, a decline of 9.53%.

The market continues to struggle with a downturn seen over the past two years, hampered by stringent pickup truck loan restrictions imposed by financial institutions, a sluggish economic recovery, and competitive pressure from Chinese electric vehicles.

● New Energy Vehicle (NEV) Registrations Show Mixed Trends:

◎ Battery Electric Vehicles (BEV) witnessed a 16.42% increase year-on-year.

◎ Plug-in Hybrid Electric Vehicles (PHEV) experienced a 14.09% rise.

As the largest automobile producer in ASEAN, Thailand's production and exports are also feeling the pinch, with a 13.62% drop in production and an 8.34% decline in exports in February. The upcoming Bangkok International Motor Show is anticipated to spark a sales recovery.

01

Overview of Car Sales in Thailand:

Performance of Different Powertrains and Brands

● In February 2025, new car sales in Thailand totaled 49,313 units, down 6.68% from 52,843 units in February 2024.

● Cumulative sales for the first two months stood at 97,395 units, a 9.53% decrease from 107,657 units in the same period last year.

This marks the 19th consecutive month of declining production in the Thai auto market, primarily due to persistent weak domestic demand and a rejection rate of up to 70% for car loans, as banks and financial institutions tighten credit policies to address rising non-performing loans.

Furthermore, total sales for 2024 amounted to only 572,675 units, a 26% year-on-year decrease, marking the lowest record in 15 years.

The performance of different powertrains in the Thai auto market varies significantly. Conventional gasoline vehicles have been particularly impacted by the decline in pickup truck sales, with an estimated 15% drop to 23,254 units in the first two months of 2025, as small and medium-sized enterprises reduce commercial vehicle purchases due to financing difficulties.

● New Energy Vehicles (NEV) have shown some resilience:

◎ New registrations of Battery Electric Vehicles (BEV) reached 7,375 units, a 16.42% increase year-on-year, but cumulative registrations for the first two months were 22,086 units, a slight 0.86% decrease year-on-year.

◎ Plug-in Hybrid Electric Vehicles (PHEV) performed relatively strongly, with 1,020 units registered in February, up 14.09% year-on-year, and cumulative registrations of 2,094 units, a 14.18% increase.

◎ Hybrid Electric Vehicles (HEV) registered 12,050 units, a 0.49% year-on-year increase, but cumulative registrations of 25,595 units fell 2.06%.

● In terms of brand performance, Japanese brands continue to dominate the market.

◎ Toyota led the pack with 13,918 units sold in February (including Hilux, Yaris ATIV, Yaris Cross, Corolla Cross, and Fortuner), leveraging its strong market presence in pickup trucks and compact cars.

◎ Isuzu ranked second with 6,238 units sold, primarily due to the D-Max and MU-X models.

◎ Honda, with sales of 5,244 units (mainly City and HR-V), placed third but faced significant pressure with a 20.3% year-on-year decline.

◎ Ford performed steadily with 1,124 units sold of Ranger, down 6.5% year-on-year.

◎ Among Chinese brands, BYD continued to expand in the Thai market, with sales in the first two months of 2025 down 23.4% year-on-year to approximately 4,000 units.

02

Model Sales and Competitive Landscape Analysis

● Japanese brands dominated the top 10 models sold in the Thai market in February 2025, with pickup trucks and compact SUVs occupying the mainstream position.

◎ Toyota Hilux topped the list with 6,387 units sold, followed by Isuzu D-Max with 4,955 units, indicating that pickup trucks remain a core demand in the Thai market.

◎ Toyota Yaris ATIV (4,023 units) and Honda City (3,184 units), representing compact sedans, ranked third and fourth, catering to urban commuting needs.

◎ Toyota Yaris Cross (3,096 units) and Honda HR-V (2,060 units) exemplified the popular trend of compact SUVs.

◎ Other models such as Isuzu MU-X (1,283 units), Toyota Corolla Cross (1,266 units), Fortuner (1,212 units), and Ford Ranger (1,124 units) had relatively lower sales but remained competitive in the market.

● The competitive landscape of the Thai auto market is undergoing profound changes.

◎ Japanese brands firmly hold the top sales positions with pickup trucks like Hilux and D-Max, and sedans like the Yaris series and City. However, credit tightening and high debt ratios have weakened consumer purchasing power, especially the decline in demand for pickup trucks from small and medium-sized enterprises, impacting the traditional strengths of Japanese brands.

◎ Meanwhile, Chinese brands such as BYD and Great Wall Motor are entering the market with low-cost electric vehicles, rapidly capturing shares in the BEV and PHEV segments. BYD's low-cost strategy and rich product line give it a first-mover advantage in the new energy sector, while Great Wall Motor further lowers price barriers through localized production.

● In the export market, Thailand, as the largest automobile producer in ASEAN, faces multiple challenges.

Although exports in February increased 30.49% month-on-month to 81,323 units, they fell 8.34% year-on-year, with cumulative exports for the first two months down 18.12%.

Global competition from Chinese brands, the increasing share of low-cost electric vehicles, and stricter emission regulations in European and American markets are putting pressure on Thailand's traditional gasoline vehicle exports. The upcoming implementation of U.S. auto tariffs adds further uncertainty, which may further suppress export demand.

Summary

Thailand's auto market continued its sluggish trend in February 2025, with sales declining primarily due to credit tightening and weak demand for pickup trucks. While Japanese brands maintain their dominance, Chinese brands are still striving to gain market share in the new energy sector.