Guangzhou Automobile Group's "Ice and Fire": Navigating Turbulent Waters

![]() 03/31 2025

03/31 2025

![]() 563

563

When will Guangzhou Automobile Group emerge from its darkest hour?

Author | Hao Wen

On the evening of March 28, Guangzhou Automobile Group (601238.SH) officially unveiled its 2024 financial performance.

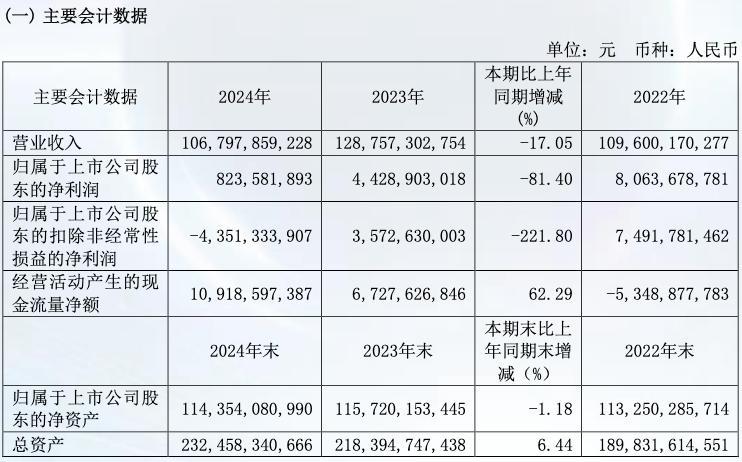

The financial report revealed that in 2024, Guangzhou Automobile Group's operating revenue amounted to 106.798 billion yuan, a year-on-year decrease of 17.05%. Net profit attributable to shareholders stood at 824 million yuan, a drop of 81.40% compared to the previous year. Non-deductible net profit recorded a loss of 4.351 billion yuan, contrasting sharply with a profit of 3.573 billion yuan in the same period last year. Meanwhile, net cash flow from operating activities increased by 62.29% to 10.919 billion yuan.

Image source: Financial report screenshot

Although Guangzhou Automobile Group had previously announced its 2024 annual performance forecast in January, the actual release of these results still came as a surprise to the outside world.

In terms of share price performance, Guangzhou Automobile Group has struggled in recent years. As of March 29, its A-shares closed at 8.49 yuan per share, with a price-to-book ratio of just 0.66 times. The share price has plummeted by 54.38% from its peak of 20.36 yuan in September 2021, effectively halving. The latest total market value stands at 86.6 billion yuan, a reduction of over 40% from its previous peak.

A few years ago, Guangzhou Automobile Group made rapid strides in the automotive market with its two joint venture brands, GAC Toyota and GAC Honda. However, with the release of this annual financial report, marking the largest decline in nearly a decade, Guangzhou Automobile Group's "joint venture moat" appears to be rapidly eroding. As the automotive industry reaches a pivotal moment of transformation and elimination, the question arises: is Guangzhou Automobile Group truly prepared?

01. Joint Ventures Falter, Independent Brands Struggle

This is the second consecutive year that Guangzhou Automobile Group's net profit has seen a significant decline.

For such dismal results, the company attributes the main reasons to "factors such as price competition within the automotive industry and drastic changes in the competitive landscape." In other words, Guangzhou Automobile Group has been impacted by the "price war" in the domestic automotive market, leading to a decline in car sales and subsequent profit losses.

According to the financial report, in 2024, Guangzhou Automobile Group achieved total vehicle sales of 2.0031 million units, a year-on-year decrease of 20.04%. Among these, the Group's independent brands sold 789,500 units, a drop of 10.95% year-on-year.

Image source: Financial report screenshot

As the two pillar joint venture brands of Guangzhou Automobile Group, GAC Honda and GAC Toyota have traditionally been the Group's most important "profit engines" and the ballast for its performance growth. However, in 2024, sales of GAC Honda and GAC Toyota declined by 26.52% and 22.32% year-on-year, respectively, with sales revenue decreasing by 27.03% and 28.34% year-on-year, respectively.

It's worth mentioning that, in addition to "Honda and Toyota," other joint venture brands of Guangzhou Automobile Group are also facing severe challenges. GAC Mitsubishi has withdrawn from the Chinese market due to persistently low sales, while GAC Acura quietly exited the market due to poor sales performance.

Under the pressures of sluggish new energy transformation, declining product appeal, and falling terminal prices, the "cost-effectiveness" allure of Japanese joint venture cars like GAC Honda and GAC Toyota is no longer effective. Meanwhile, independent brands and new players are making continuous technological breakthroughs and enhancing smart experiences, making joint venture brands increasingly "marginalized" in the minds of young consumers.

It's worth noting that "GAC AION," the standout brand for Guangzhou Automobile Group in recent years, also encountered a sales "Waterloo" in 2024, with annual sales of 375,000 units, a year-on-year decline of nearly 22%.

GAC AION, an independent brand of Guangzhou Automobile Group, was once seen as a key player in the Group's new energy ambitions. Due to its continuous high-speed growth in 2022 and 2023, the former general manager of GAC AION, Gu Huinan, set a goal of striving for GAC AION to exceed "one million sales" by 2025.

Image source: Stock image library

However, amidst the saturation of the ride-hailing market and continuous pressure from price wars, GAC AION failed to maintain its growth momentum. Instead, the deceleration in GAC AION's sales exposed that Guangzhou Automobile Group is facing significant transformation challenges in its "oil-to-electricity" strategy.

Wang Ke, a senior analyst at Analysys, pointed out that the decline in AION sales is also linked to brand positioning. "AION has always been a representative of ride-hailing vehicles. The current ride-hailing market is essentially saturated, and AION struggles to exert influence in this area. Coupled with long-term brand perception and a relatively low-end brand image, few household vehicle buyers consider AION."

Currently, the only brand under Guangzhou Automobile Group that has achieved sales growth is the traditional independent brand "GAC Trumpchi." In 2024, GAC Trumpchi's annual sales volume was 415,000 units, an increase of about 1.99% year-on-year. However, this growth rate is limited and struggles to offset the overall downward pressure on the Group.

In summary, across the entire Guangzhou Automobile system, both the joint venture sector and the new energy business have fallen into varying degrees of "lagging behind": joint venture brands are accelerating their decline due to outdated technology paths and aging products, while the independent new energy sector is experiencing slower growth due to intensifying competition and weak profitability. Even though GAC Trumpchi has shown slight growth, it cannot conceal the fact that the entire Group's growth engine has stalled.

02. Can Collaborating with Huawei Help Break the Deadlock?

The continuous decline in revenue, profit, and market sales is also accelerating Guangzhou Automobile Group's comprehensive transformation and its search for a way out of the deadlock.

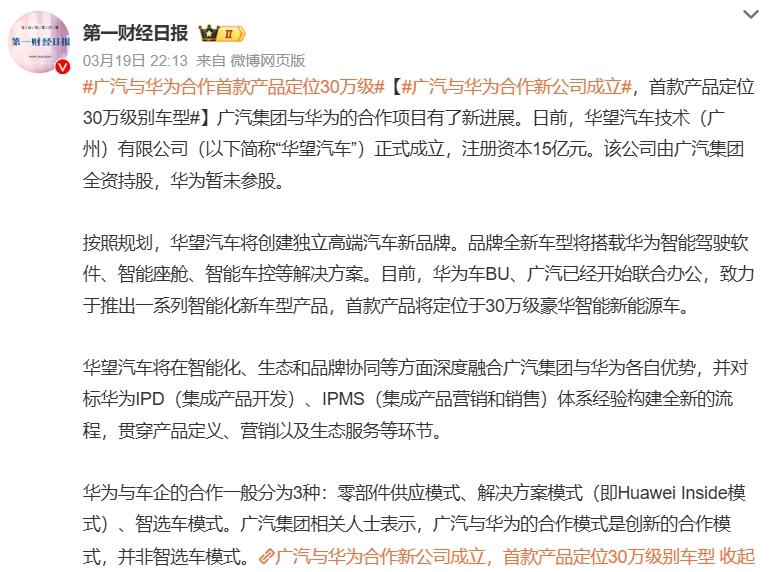

On March 19, there was new progress in the collaboration project between Guangzhou Automobile Group and Huawei. Guangzhou Automobile Group announced the official establishment of Huawang Automotive Technology (Guangzhou) Co., Ltd. (hereinafter referred to as "Huawang Automotive"), a new company with an investment of 1.5 billion yuan. A new high-end smart car brand will also be announced soon. The company is wholly owned by Guangzhou Automobile Group, and Huawei has not yet taken a stake.

Image source: Weibo screenshot

Guangzhou Automobile Group stated that this is a further step in the Group's layout of the smart car ecosystem and high-end brands, as well as the latest progress in the GH project. According to the plan, Huawang Automotive will create an independent high-end automotive brand, with new models equipped with Huawei's intelligent driving software, intelligent cockpit, intelligent vehicle control, and other solutions.

According to media reports, the cooperation mode between Guangzhou Automobile Group and Huawei is an innovative one, not a smart selection vehicle mode. Currently, Huawei's automotive BU and Guangzhou Automobile Group have started joint office work, committed to launching a series of new intelligent vehicle models, with the first product positioned as a 300,000-yuan luxury smart new energy vehicle.

From this perspective, Guangzhou Automobile Group is attempting to leverage "external forces" to create a breakthrough in its own intelligence and high-end positioning. Faced with challenges such as insufficient brand strength, high technical barriers, and incomplete user perceptions among independent brands, choosing to deeply cooperate with technology giants like Huawei is a strategic approach akin to "borrowing a boat to sail out to sea."

Therefore, Huawang Automotive not only bears the mission of Guangzhou Automobile Group to compete in the high-end new energy market but may also carry the Group's expectations of turning the tide in the "second half of the smart car era."

Image source: Weibo

At the Guangzhou Automobile Group investor performance briefing on March 29, regarding the Huawang project collaboration with Huawei, Feng Xingya, chairman of Guangzhou Automobile Group, stated: "Huawang Automotive primarily targets high-end customers in the 300,000 yuan range, with detailed product definitions and positioning mainly led by Huawei. Meanwhile, Guangzhou Automobile Group provides support and maintains decision-making authority for the Huawang team, ensuring their rights and responsibilities in product development and definition."

In fact, if we consider Huawang Automotive as a key step in Guangzhou Automobile Group's transformation, then it is crucial for the first step to be taken solidly and implemented smoothly. Especially in the context of increasingly intense competition in the smart car market and fierce competition among high-end brands, there is very limited room for new brands to "trial and error."

It's worth noting that in September 2022, Guangzhou Automobile Group launched the luxury pure electric brand "AION" and simultaneously unveiled its first electric supercar, the Hyper SSR, priced at over one million yuan. This was followed by the launch of two mass-produced models, the AION GT and AION HT. However, according to "Interesting Business Insights," in 2024, the cumulative wholesale volume of AION was 19,700 units, and the retail volume was over 17,300 units. Overall, the market response to AION has been mediocre, and brand recognition and user stickiness have failed to break through.

Image source: Stock image library

Therefore, the "Huawang" created with a new company, new team, and new system can be seen as Guangzhou Automobile Group's relaunch after abandoning the path of "putting new wine in old bottles" and truly "resetting itself."

Fortunately, despite sluggish domestic sales, Guangzhou Automobile Group's overseas performance in 2024 was decent. According to financial report data, the company's overseas sales increased by 67.6% in 2024, with a gross margin in overseas markets reaching 14.72%. The export volume of independent brands exceeded 100,000 units for the first time, with a growth rate of 92.3%, and its products have covered 74 countries and regions.

This series of data may bring a breath of relief to Guangzhou Automobile Group and also showcase its potential and resilience in the global market. Amidst highly competitive domestic markets, going overseas may be becoming another "lifeline" for the sustainable growth of Guangzhou Automobile Group's independent brands. Especially in emerging markets such as the Middle East, Latin America, and Southeast Asia, the advantages of Chinese brands in new energy and intelligence are gradually being realized. If Guangzhou Automobile Group can seize the initiative to layout and stabilize its basic market, it will lay the foundation for subsequent global breakthroughs.

03. Can the Change in Leadership Lead to a New Path?

As business challenges deepen, the "power center" of Guangzhou Automobile Group is also undergoing changes.

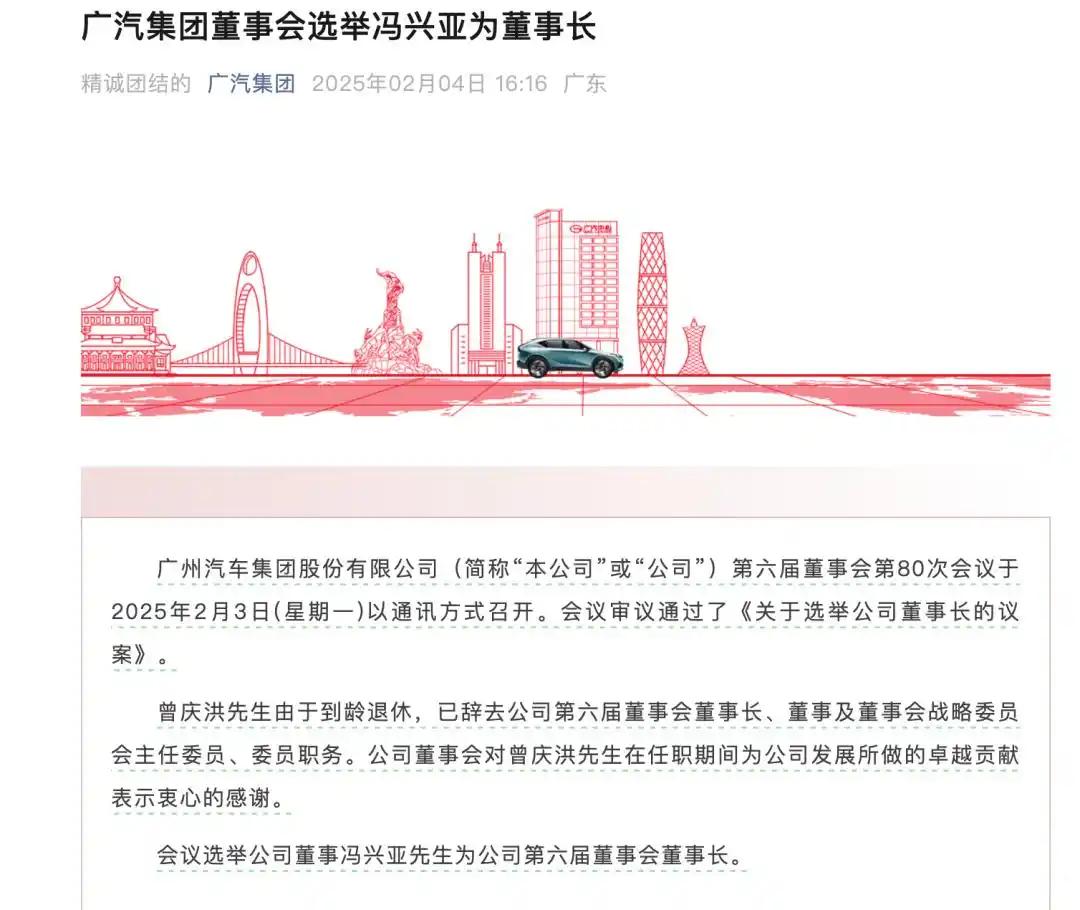

On February 4, Guangzhou Automobile Group announced that Zeng Qinghong had resigned from his positions as chairman of the sixth board of directors, director, and chairman of the board's strategy committee due to reaching retirement age. Feng Xingya was announced as the new chairman, marking the beginning of the "Feng Xingya era" at Guangzhou Automobile Group.

Image source: WeChat official account screenshot

According to "Interesting Business Insights," Feng Xingya, born in 1969, has been serving at Guangzhou Automobile Group since December 2004, for over 20 years. After taking office as the chairman of Guangzhou Automobile Group, Feng Xingya also concurrently holds positions as chairman of GAC Trumpchi Automobile Co., Ltd., chairman of GAC AION New Energy Automobile Co., Ltd., and chairman of GAC International Automobile Sales and Service Co., Ltd.

Zeng Qinghong, who is eight years older than Feng Xingya, served as the party secretary and executive deputy general manager of GAC Honda from 1999 and began serving as chairman of Guangzhou Automobile Group in 2016, officially taking charge of the Group.

During his nine-year tenure as chairman, Zeng Qinghong always presented himself as "low-key and pragmatic" and rarely spoke to the outside world. However, in his last year in office, Zeng Qinghong raised his voice for Guangzhou Automobile Group and the automotive industry, stating directly: "Guangzhou Automobile Group does not oppose price wars and is not afraid of price wars, but they must be rational and have bottom lines, not excessive." "Profit concessions are fine, but concessions that harm the foundation are unsustainable." At the same time, he suggested that relevant government departments could study the "equal rights for oil and electric vehicles" policy in a timely manner.

At that time, Zeng Qinghong faced numerous accusations of speaking out in frustration due to the declining sales and profits of "Honda and Toyota." However, as price wars intensified in the second half of 2024, leading multiple automakers to adopt contraction strategies, and the industry witnessing numerous broken capital chains and significant layoffs, Zeng's remarks retrospectively exhibited early warning significance.

Image source: Weibo screenshot

As the new chairman, Feng Xingya unveiled the "Panyu Action" plan at the November 2024 Guangzhou Auto Show, clearly stating that by 2027, Guangzhou Automobile Group's independent brands would account for over 60% of total sales, aiming to challenge an annual sales volume of 2 million units.

To achieve this ambitious goal, Feng Xingya proposed four reform initiatives and five safeguard measures, with "enhancing product success rates" being one of the key safeguards. In his view, product development is pivotal to Guangzhou Automobile Group's successful transformation. He emphasized the need to shift from "occasional success" to "consistent success," emphasizing the importance of scientific and systematic processes to ensure the success of each new product.

However, Feng Xingya's challenge extends beyond translating the concept of "product success rates" into execution; he must also restore confidence and order within a system that is experiencing comprehensive deceleration.

Currently, Guangzhou Automobile Group faces a multifaceted challenge: "lagging joint ventures, unestablished independent brands, pressure on new energy initiatives, and an aging organization." Amidst this dual pressure from both internal and external sources, even with a clear strategic direction and firm goals, if synergistic pathways for key areas such as research and development, supply chains, markets, and brands cannot be swiftly established, "consistent success" may remain merely an aspiration.

More practically, Feng Xingya is not merely inheriting a Guangzhou Automobile Group undergoing transformation; he is also tasked with a "restructuring project" that must yield results within a short timeframe. The reform window will not remain open indefinitely, and the market will not patiently await Guangzhou Automobile Group's gradual transformation, particularly in the highly competitive automotive landscape. Every product misstep and every sluggish pace will be directly exacerbated into a survival crisis by competitors.

Furthermore, on January 15, 2025, building upon the reform of professional managers, GAC Group announced its intention to further promote competitive recruitment among group management cadres and fully implement a tenure and contract management system, with performance indicators serving as the basis for evaluation.

Feng Xingya undoubtedly shoulders a heavy burden, but it is precisely this challenge that will determine whether GAC Group can transition from its "darkest moment" to "recovery." Ultimately, the success of this transformation hinges on whether this new leader can instigate a profound change that reaches the core of the system.