Trump's Tariffs Impose Significant Impact on Global Automotive Industry

![]() 04/07 2025

04/07 2025

![]() 619

619

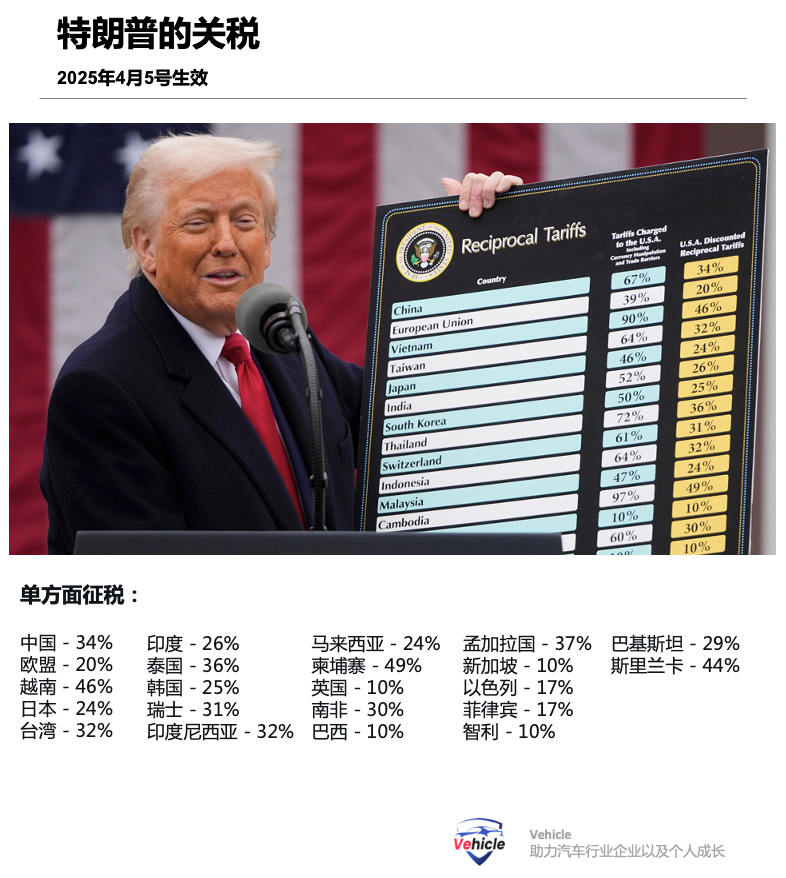

President Trump's actions are notoriously unpredictable. On April 3rd, he announced the implementation of "reciprocal tariffs" on virtually all products from multiple countries. These tariffs range from a base rate of 10% to 49%, effectively hiking taxes on goods imported into the United States. These tariffs are calculated based on the trade deficit between the United States and each country, with 50% of this figure collected as a reciprocal tariff.

The final calculated tariff rates are as follows: China - 34%, EU - 20%, Vietnam - 46%, Japan - 24%, Taiwan - 32%, India - 26%, Thailand - 36%, South Korea - 25%, Switzerland - 31%, Indonesia - 32%, Malaysia - 24%, Cambodia - 49%, UK - 10%. For specific products like automobiles and parts, Trump's tariff is uniformly set at 25%.

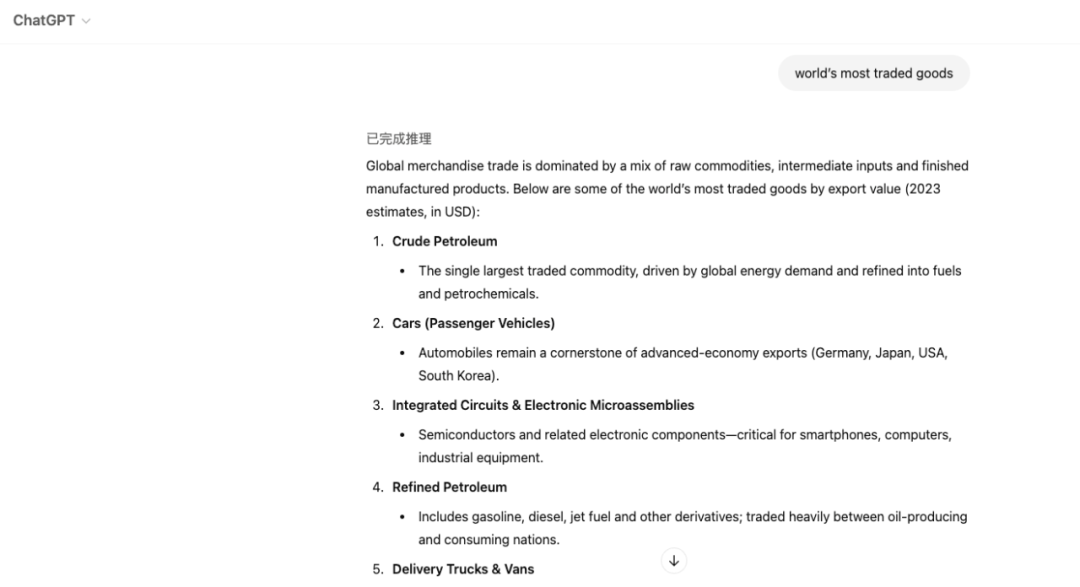

According to ChatGPT's question-and-answer responses, based on import and export volumes, passenger cars and cargo trucks rank second and fifth, respectively, among the top five traded commodities globally.

As a major global trading nation, the Trump administration's imposition of a 25% tariff on most automobile and auto parts exports to the United States will disrupt the global automotive industry. It remains unclear whether retaliation from major US trading partners will lead to a retreat, renegotiation, or isolation of the US automotive industry, as other countries increase trade among themselves to compensate for lost sales in the US. However, it is certain that this move has caused widespread concern worldwide.

In Asia, Japan and South Korea, as allies of the United States, not only face substantial reciprocal tariffs imposed by the US but also a 25% tax on cars exported to the US. The Japan Automobile Manufacturers Association (JAMA) states that Japan exports 1.37 million cars to the US annually, worth 6 trillion yen ($40 billion), accounting for 30% of Japan's total auto exports. JAMA Chairman Masakuni Katayama said in a speech in Tokyo in March that Japan's cumulative investment in the US auto industry has increased to $61.6 billion, producing 3.2 million Japanese-brand cars annually in the US. Japanese automakers directly employ 110,000 people in the US and indirectly support 2.2 million jobs.

Among Japanese manufacturers, Mazda may face the greatest tariff risk, as only 20% of the 420,000 cars it sells annually in the US are manufactured there. The company is now considering increasing production at its Alabama plant, which is jointly operated with Toyota. Hyundai Motor Group, the world's third-largest automotive group, is deeply reliant on the US market. In 2024, Korea shipped 1.014 million finished vehicles to the US, in addition to the approximately 700,000 vehicles produced annually at Hyundai's two US factories. Therefore, exports remain the primary way Korean cars supply the US market.

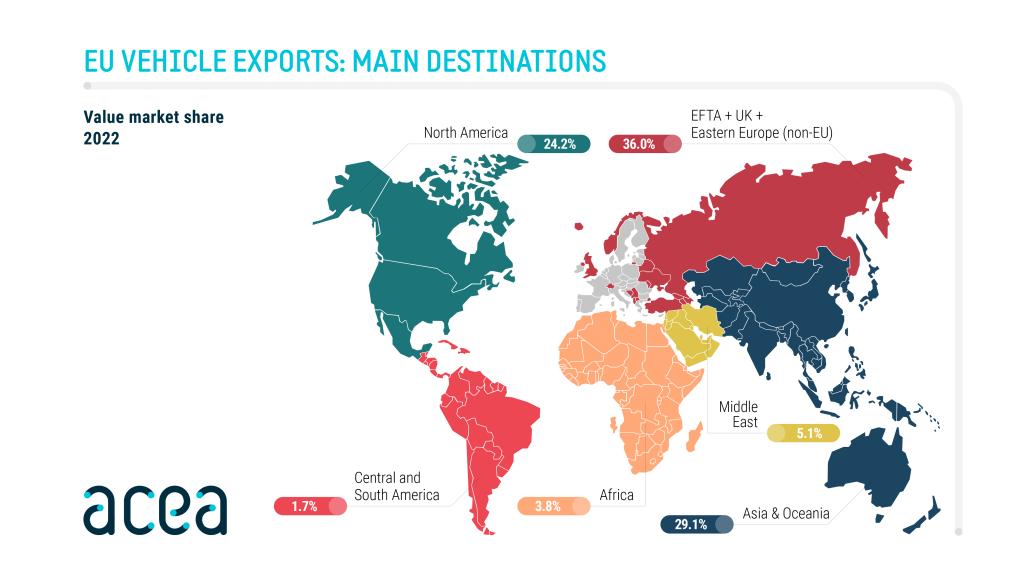

European Concerns: The European Automobile Manufacturers Association (ACEA) highlights the impact on auto OEMs and suppliers, including European companies producing cars and parts in North America. ACEA data shows that in 2024, European automakers exported 757,654 new vehicles to the US, worth 38.9 billion euros ($43.3 billion), far exceeding the 169,152 new vehicles imported from the US by the EU, valued at 7.8 billion euros. However, ACEA notes that international automakers produce nearly 4.9 million vehicles annually in the US, accounting for 48% of total production, with companies headquartered in Europe responsible for about 830,000 vehicles, 50% to 60% of which are exported as US-made cars.

Component manufacturers represented by the European automotive supplier lobby group CLEPA face a double hit from direct auto tariffs and already imposed tariffs on aluminum and steel components. Since the outbreak of the COVID-19 pandemic, China's imports from Europe have doubled. To offset the trade deficit with China, the EU supplier industry has increased trade with the US, making it particularly vulnerable to tariffs. In the past five years, the EU has exported 8.7 billion euros worth of auto parts to the US annually, creating a global trade surplus of 7 billion euros for European suppliers.

Within the EU, the US imposition of a 25% tariff on auto imports could have a strong negative impact on the core manufacturing countries of the EU - Germany, Austria, the Czech Republic, Hungary, Poland, and Slovakia - which are closely linked to the European and global automotive value chain. This is another blow to the EU's struggling automotive industry, in addition to the pressures of the green transition (to electric vehicles) and competition from China. Slovakia, which "heavily relies on the automotive industry," may suffer the greatest losses, with a potential 1.1% decline in total exports, followed by Hungary, Germany, and Sweden, each with a 0.31% decline, Austria with a 0.21% decline, and the EU average with a decline of about 0.14%. Additionally, Mexico is a significant hub for EU suppliers, with investments of 9.5 billion euros in production facilities in Mexico over the past decade. EU suppliers have also invested nearly 8.7 billion euros in the US, creating 35,000 jobs, with a total investment of 18.4 billion euros in North America. This also poses a potential threat.

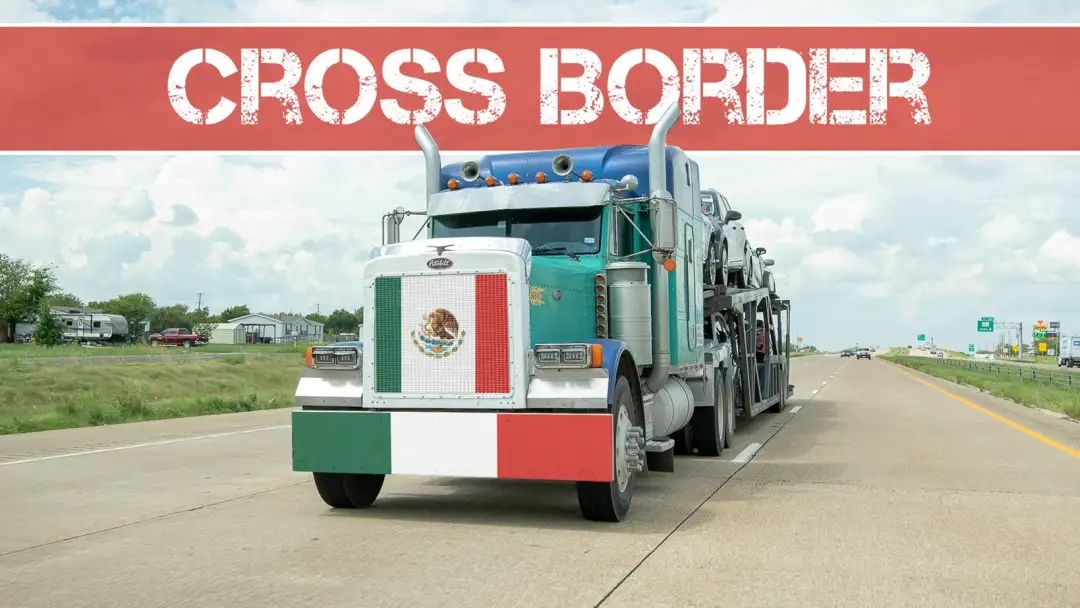

Mexican Stalemate: According to the Mexican Automobile Industry Association (AMIA), Mexico exported 198,600 light vehicles from January to July 2024, 79% of which were sold to the US. Meanwhile, the Mexican National Automotive Parts Industry Association pointed out that Mexican auto parts production reached $113 billion from January to November 2024, accounting for 43.18% of total US imports.

The association states that the industry has grown 140% since 2010, and Mexico is now the "fourth-largest producer of auto parts globally" and an "important source of raw materials such as steel for the US automotive industry." The association also emphasizes its integration with the USMCA. For example, "an automotive seat belt system consists of over 30 components that cross the Mexican, US, and Canadian borders seven to eight times to become a finished product."

Thomas Karig, a Mexican automotive industry consultant and former Volkswagen vice president, believes that "ultimately, the customer is still there," so companies will try to continue selling in the US despite the tariffs, which "are just another tax on consumers and businesses." He says companies will raise prices and absorb additional costs, making cars more expensive and affecting sales, but not destroying the Mexican auto and parts industry. Furthermore, Trump's plan to attract factories to the US may not succeed.

Karig warns that relocating factories "is not easy" and notes that "the first cars may take three years to be ready." He says only companies with idle capacity have the potential to "move models from existing plants here to there." Executives worry that tariffs may be lifted or changed, "and investment decisions in this industry are made with a long-term perspective, so factories can operate for decades." "Replacing existing products from German, Korean, and Japanese companies in the US" will be a challenge, as American companies like General Motors and Ford will struggle because "a significant portion of their cars rely on imports." Mexico could try to utilize the country's 14 free trade agreements (including one with the EU) to sell cars to other markets, but Karig says that even though "Mexico is very competitive in terms of cost and productivity" and has a "geographical location for exporting across two oceans," companies producing cars in Mexico for other regions will experience "reduced production volumes."

Karig still hopes that efforts by the Mexican government to curb tariffs will bear fruit. This could include another option being considered by the Mexican government and industry: renegotiating the USMCA, which is unfavorable to Mexico. The current trade agreement has helped increase Mexican auto parts production by 29% from 2019 to 2024.

Canadian Disappointment: In Canada, automotive industry organizations have a clearer understanding of the widespread damage caused by tariffs. David Adams, President of the Global Automakers of Canada, said, "Tariffs are a tax that harms consumers by increasing costs and driving up inflation, while also unfairly affecting workers on both sides of the border."

"We need a long-term solution to remove these unreasonable tariffs and ensure the stability and competitiveness of all North American businesses." However, as the US currently accounts for 85% of Canadian auto and auto parts production, it will be difficult even if the government utilizes trade agreements such as CETA (Comprehensive Economic and Trade Agreement between Canada and the EU), CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), and the Canada-Korea Free Trade Agreement. Adams' organization recommends not imposing tariffs on cars produced in the US, noting that US-produced electric vehicles will hinder Canada's ability to meet current federal and provincial requirements for selling electric vehicles instead of internal combustion engine vehicles.

He said he hopes the US government will promptly recognize the competitive advantages that Canada brings to US automakers, such as government-funded healthcare, a weak currency that lowers costs, an unparalleled tooling, molding, and die-making industry near Windsor, Ontario, and high-quality education that provides an efficient workforce. Ultimately, without the US market, it will be difficult for the Canadian automotive industry to maintain its current size. Even if it is shielded from US competition and has more non-US exports, such sales and the Canadian market are "not enough to sustain an industry producing 3,000 to 4,000 cars per day."

Final Thoughts: Of course, Trump's unpredictability and volatility mean that nothing is set in stone. It is estimated that recently, governments and companies closely linked to US auto trade have been busy with lobbying and strategic responses.