Tesla's New Model Y "Price Adjustment" Sparks Sales Concerns Just One Month After Delivery

![]() 04/07 2025

04/07 2025

![]() 594

594

Barely a month after deliveries commenced, Tesla's latest Model Y has undergone a subtle "price adjustment."

On the evening of March 31, amidst the fanfare of new product launches by Lynk & Co, Hongqi, and FANGCHENGBAO, Tesla quietly unveiled April purchase incentives. For the new Model Y, Tesla introduced a limited-time financial purchase plan offering 3 years at 0% interest and 5 years at ultra-low interest for the first time. The down payment for a 3-year 0% interest plan starts at 79,900 yuan, while the down payment for a 5-year ultra-low interest plan begins at 45,900 yuan, with monthly payments as low as approximately 3,809 yuan.

While the vehicle price remains unchanged and interest-free policies are not novel, the news rippled through social media, trending as a "shockwave." Notably, just 13 days prior to this incentive announcement, Tesla had officially raised prices for the new Model Y Long Range version and introduced a 3-year 0% interest + 5-year ultra-low interest policy for the Rear-Wheel Drive version. Such frequent adjustments, coupled with Tesla's sales in China nearly "halving" in February, have fueled widespread speculation. Consequently, online chatter abounds that Tesla's new Model Y is struggling to sell, and its sales mystique has vanished. So, is Tesla truly facing a crisis this time?

Rebounding from the Bottom: It's Premature to Declare Doom

From the perspective of February sales and intensifying competition within the automotive market, Tesla's situation appears concerning. Data from the China Passenger Car Association indicates that in February 2025, Tesla China's wholesale sales amounted to 30,688 units, a year-on-year decrease of 49% and a month-on-month decrease of 51%, marking the worst performance in nearly two and a half years. Meanwhile, competition within China's electric vehicle market continues to intensify.

Firstly, there's the escalating price war. Early this year, Tesla introduced preferential policies such as insurance subsidies and interest-free financing, further lowering vehicle prices. Subsequently, new forces and other independent brands swiftly responded, escalating their efforts. Li Auto's entire L series continues to offer a three-year interest-free policy. NIO has launched a 5-year 0% interest financial plan with a down payment as low as 20%, including 5 years of free NOP+. Xpeng has intensified its efforts with a 5-year 0% interest and 0% down payment financial policy, offering up to 57,000 yuan in interest subsidies. These measures undoubtedly weaken Tesla's competitive edge to a certain extent.

Secondly, independent brands have also encircled and suppressed Tesla in terms of products. From last year's LeDao L60 and Zeekr 7X to this year's newly revised Xpeng G6 and other models, all are targeted at Tesla's Model Y. Superior space, high-voltage platforms, magic carpet air suspensions... Any of these features alone could be a "game-changer." Coupled with more attractive prices and various incentives, there seems to be no compelling reason for the "barebones" Model Y to prevail.

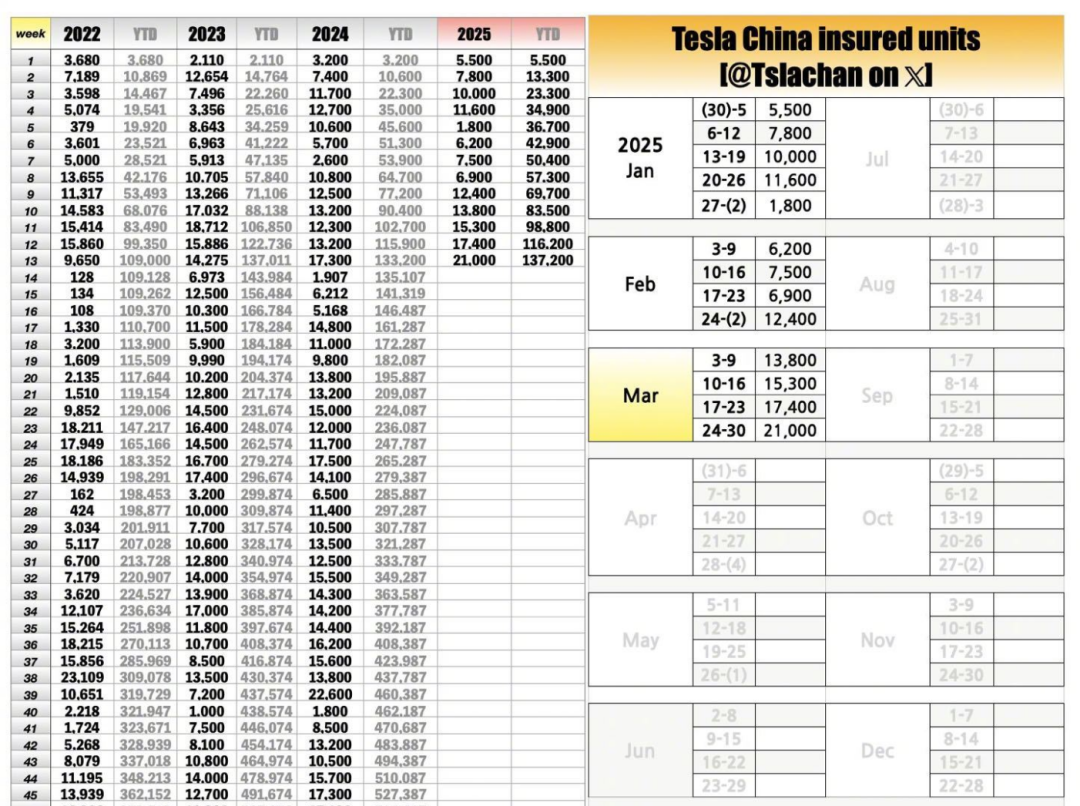

Indeed, independent brands have gained significant momentum in recent years, but it's hasty to conclude that Tesla is struggling to sell. Even though Tesla China's wholesale sales plummeted in February, they still surpassed 30,000 units. Data obtained from relevant channels on vehicle insurance purchases reveals that Tesla China's insurance purchases in February reached 33,000 units. In the electric vehicle market, only a handful of top independent brands can truly attain this volume.

More embarrassingly, the latest March data shows that Tesla China's sales have rebounded strongly. From March 24 to March 31, weekly sales reached 21,000 units, setting a new record for the highest weekly sales in 2025 for the fifth consecutive week. This also implies that Tesla China's sales in the first quarter amounted to 137,200 units, the highest first-quarter sales since 2022. Considering the timing of new Model Y deliveries at the end of February this year, it's evident that the sharp decline in February sales was more due to the impact of the product transition period and does not fully reflect the true market situation.

Challenges Remain

The reasons why Tesla has become a leader and evergreen in China's electric vehicle market are not complex. It's one of the earliest new forces to enter the market, boasts the personal aura of Elon Musk, offers relatively affordable prices, and possesses excellent product capabilities, among other factors. However, I believe the most crucial factor is its technological innovation.

Tesla has always been recognized as a benchmark for electric vehicle technology. Whether it's the electric sports car Roadster, the cyberpunk pickup Cybertruck, or the FSD intelligent driving and driverless taxi Cybercab, Tesla is undoubtedly at the forefront of the times. Its mature and reliable battery, electric drive, and electronic control technologies have also earned Tesla a stellar reputation. Even Lei Jun, the founder of Xiaomi Automobile, has repeatedly expressed his desire to learn from Tesla. However, we must also acknowledge that Tesla's technological advantages are being diluted by the rapidly rising domestic auto manufacturing forces, and its products have become perceived as lacking innovation.

The Model 3 took 7 years to be replaced, and the Model Y's replacement cycle is as long as 5 years. Such a product iteration speed is commonplace in the fuel era but lags in today's market, especially in China's electric vehicle market where manufacturers are eager to innovate rapidly. Mediocre design and the "barebones" interior are secondary issues. When 800V/900V high-voltage architectures and ranges of 800-900 kilometers have almost become standard for independent brands, and when BYD's Super e-Platform's megawatt flash charging can replenish 400 kilometers of range in just 5 minutes, matching gasoline vehicle speeds, the new Model Y still adheres to a 400V, high-current charging strategy. While there's no absolute distinction between good and bad technological routes, from the perspective of most consumers, Tesla may not align with the mindset of "I want it all."

On the other hand, Tesla also faces considerable challenges in the field of intelligent driving. At the beginning of 2025, independent brands collectively turned their attention to the intelligent driving market, proposing the concept of "equal rights in intelligent driving." BYD's Tian Shen Zhi Yan, Geely's Qian Li Hao Han, Chery's Lie Ying Zhi Jia, and others have lowered the threshold for intelligent driving to the 100,000 yuan level or even below, pioneering the era of intelligent driving for all, which is undoubtedly another comprehensive blockade of Tesla from another dimension.

The good news is that Tesla's FSD is close to being implemented in China and has demonstrated strong learning and evolutionary capabilities during its brief one-month rollout, gradually overcoming some issues of "not adapting to local conditions." However, due to factors such as data security compliance, it remains to be seen how far FSD can evolve in China in the future. More importantly, are consumers really willing to pay an additional cost of 64,000 yuan on top of the vehicle price for it?

Final Thoughts

Whether in terms of battery, electric drive, electronic control technologies, intelligent driving, or real user experience, Tesla still ranks among the top tier. It's clearly premature to declare doom for Tesla. However, it's noteworthy that people's perceptions are constantly evolving. A few years ago, Tesla was the go-to choice for electric vehicles for many. But with the rapid development of independent brands, more and more consumers are experiencing the benefits of independent brands and enjoying the fruits of technological progress at a lower cost, and Tesla's aura is gradually fading. Discount promotions can only sustain sales temporarily, not indefinitely. If Tesla cannot swiftly implement cutting-edge technology and introduce new products and technologies that are more sincere and better align with consumer needs, then the day when Tesla loses its pedestal may not be far off.