The New Energy Vehicle Market Sales Champion Struggles to Defend Its Title: Who Will Be the Next Zero Run?

![]() 04/08 2025

04/08 2025

![]() 595

595

The elimination rounds are in full swing, and no competitor dares to falter.

As March drew to a close, marking the end of the first quarter of 2025, despite the impact of the Spring Festival holiday, automakers remained relentless in their pursuit of sales targets. Even as the holiday approached, sales posters were promptly released, showcasing their latest achievements.

Particularly noteworthy is the resurgence of monthly sales rankings after the relevant departments halted weekly sales reports. These rankings have once again become the fiercest battleground, with unqualified sales figures revealing an even harsher competition.

Most importantly, the March sales data also underscored a crucial fact: it is indeed challenging for a new force sales champion to maintain its position. Whether it be Li Auto, which has long dominated the rankings, or XPeng, which has risen from the ashes, both have struggled to hold onto the throne for an extended period.

'Small Li Auto' Surpasses Li Auto

The competition for the top three sales spots among new forces in March was intense, sweeping away the sales slump of February. With 30,000 vehicles becoming the entry ticket to this elite circle, Xiaomi deviated from its usual sales poster convention and attempted to integrate into this elite group with sales data of 29,000 vehicles.

As a pursuer, Zero Run ascended to the top of the monthly sales rankings among new forces for the first time. This was both a stroke of luck and an inevitable result of market development.

Since its listing, Zero Run has focused on the price range of 100,000-200,000 yuan, which is pivotal in terms of sales share. Both Zero Run and BYD, the leader in new energy vehicles, have firmly established their presence in this market segment.

According to data from the China Passenger Car Association, in 2024, passenger vehicles priced between 100,000 and 200,000 yuan accounted for over 50% of sales. Products priced between 100,000 and 150,000 yuan accounted for a whopping 33.5%, making them the absolute sales leaders. More importantly, the penetration rate of new energy vehicles in this segment is still at 50%, indicating enormous market potential.

XPeng's successful breakthrough was also closely tied to pricing, with the M03 and P7+ both targeting this price range. Relying on these two new models, XPeng's sales soared, proving that this market still holds considerable growth potential.

Returning to Zero Run, its product positioning may not be as eye-catching as other competitors in one or a few aspects, but it also lacks obvious shortcomings. Despite being ridiculed as 'Small Li Auto' by some, beyond a similar spirit, it's hard to say they resemble each other in form.

From another perspective, it was inevitable that Zero Run would surpass Li Auto in sales. On one hand, Zero Run is launching new vehicles with both extended-range and pure electric power modes, while Li Auto has always adhered to the extended-range path. On the other hand, Zero Run pursues the mainstream market and has a clear advantage in sales ceilings. As long as there are no product issues, it's only a matter of time before sales surpass Li Auto.

With the launch of Zero Run's new B10 model this month, its sales will continue to rise. In the mainstream market, once there is momentum for takeoff, sales will follow suit, as consumers subconsciously seek a safe choice.

Li Auto faces more challenges than other brands, the most pressing of which is the lack of new models. After completing the L6 in 2024, Li Auto's product lineup was nearly complete. A year has passed, and Li Auto has not made any significant changes, which is unusual for a new force capable of releasing three models a year, especially given that Tesla only has one model.

For Li Auto, competing with current new models using products from one or two years ago puts it at a disadvantage. However, even in this seemingly unfair competition, Li Auto was still able to sell 36,000 vehicles a month, demonstrating the competitiveness of its products.

Limited by production qualifications, Li Auto struggles to expand into the sedan market, leaving it with only the pure electric SUV market. This is also the focus of Li Auto's products this year, with the debut of the Li Auto i8 becoming a new growth point for the company.

However, following the failure of the MEGA, Li Auto is being cautious with the release schedule of this new model, prioritizing stability.

In contrast, XPeng is gradually accelerating the release of new models. After the success of two new models, revised models are quickly following up, aiming to rapidly popularize new intelligent driving solutions and achieve cost reduction and efficiency enhancement.

In addition to the already exposed new G7 model, rumors abound about the first extended-range model codenamed G01 and a sedan codenamed E29, which is said to be a performance model akin to the Xiaomi SU7 Ultra.

This shows that after finding a successful path, XPeng is entering a sea of models, aiming to swiftly capture the market. The current slowdown in sales growth is only temporary. The only concern is whether XPeng's production capacity can keep pace with the rapid release of new models.

Market Discontinuity

Among the new forces following Zero Run, Li Auto, and XPeng, only Xiaomi and Deep Blue have sales exceeding 20,000 vehicles. The remaining brands are concentrated at 15,000 vehicles and below, revealing a clear discontinuity in sales.

From Xiaomi's sales poster, it's evident that the company does not want to be lumped in with subsequent brands. With sales above 29,000 vehicles, Xiaomi is telling the market that it's just a tiny step away from monthly sales of 30,000 vehicles, positioning itself as a quasi-30,000-vehicle contender.

Of course, no one doubts that Xiaomi can achieve monthly sales of 30,000 vehicles. Almost everyone knows that the only limit to Xiaomi's sales is production capacity, and Xiaomi's capacity is continuously increasing. Monthly sales of 30,000 vehicles are only a matter of time for Xiaomi.

However, starting in April, Xiaomi found itself embroiled in its biggest crisis since its inception, with an accident resulting in the loss of three lives, making Xiaomi the target of widespread criticism.

Facing this unprecedented public relations crisis, Lei Jun chose silence, as any explanation would appear feeble before the official conclusion of the incident investigation.

As a phenomenal product in the new energy vehicle market, the Xiaomi SU7 has its own traction, which is a double-edged sword. On one hand, it can increase exposure and boost sales, but on the other hand, it can also amplify minor incidents into hot topics.

Close behind Xiaomi in sales is Deep Blue. After fully integrating into the Huawei ecosystem, sales have grown significantly, making Deep Blue a viable replacement option for the HarmonyOS Intelligent Driving ecosystem.

Simultaneously, backed by a large state-owned automaker like Changan, Deep Blue has advantages over other new forces in product development and cost control, especially in cost control, which has become the new password for Deep Blue's sales growth.

According to statistics, Deep Blue's best-selling model in March was the S05, an SUV with a starting price of 114,900 yuan, which is nearly a top-tier product in this price range with no shortcomings. The only regret may be that it does not carry the HarmonyOS ecosystem and the Kunlun ADS3.0 SE intelligent driving system; otherwise, sales could have increased even further.

But this also means that it's still difficult to control the cost of decentralizing the Huawei ecosystem. It remains to be seen whether SAIC's cooperation with Huawei, Shangjie, can break through this price limit.

Zeekr and NIO, which rank after Deep Blue, can be said to have their own troubles.

After merging with Link&Co, Zeekr's sales are still counted separately, but they have hovered around 15,000 vehicles this year, proving that Zeekr's current products have entered a bottleneck period and lack a sales leader. It can only rely on new models to continuously increase sales.

Zeekr's next model is the already unveiled 007GT, but it remains to be seen whether it can replicate the success of the 001 or even squeeze out the current 001 market.

Additionally, there's also a large SUV model, the Zeekr 9X, known as the 'Hangzhou Bay Cullinan.' Judging from its positioning and the starting price of the Link&Co 900, the 9X is expected to be priced at least above 400,000 yuan.

Currently, there are not many pure electric models in this price range that can support sales, except for phenomenal models like the AITO M9. Almost all other competitors struggle with sales.

NIO can be said to have considerable experience in this regard. Despite multiple attempts to push its products to higher prices, sales of the NIO brand alone have not changed much. Even after the launch of Letao, sales have declined, as 5,000 of the current 15,000 monthly sales come from Letao.

However, NIO has its own path to follow. The launch of the ET9 indicates that NIO will continue to compete in the luxury car market, determined to carve out a niche.

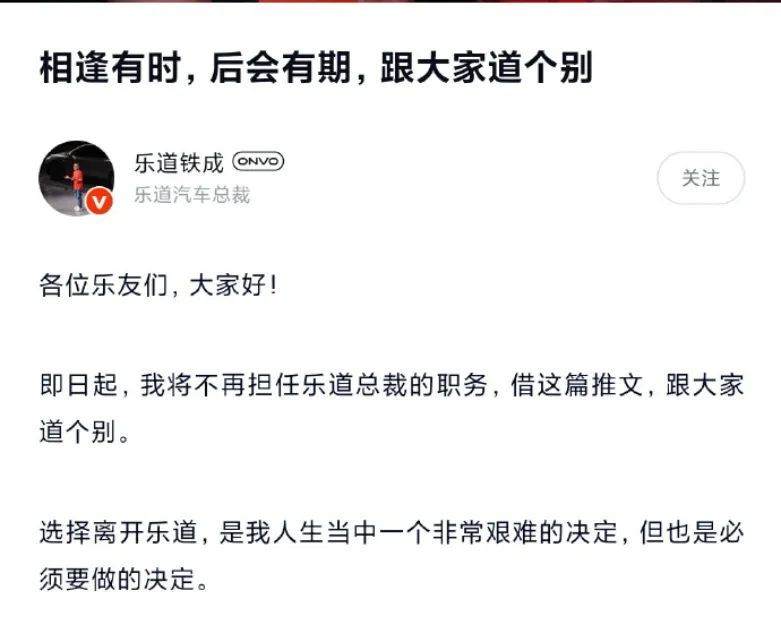

After Letao failed to meet sales targets, President Ai Tiecheng announced his resignation on April 2, becoming the first senior executive to leave NIO after this year's internal reforms. This also proves that Li Bin has indeed changed, and that failure leads to dismissal, demonstrating that business does indeed require a certain degree of ruthlessness.

However, after Ai Tiecheng's departure, the biggest challenge facing NIO is how to boost Letao's sales. In particular, the fact that Shen Fei, the head of energy business, took over Letao also proves that NIO lacks core management personnel and can only cannibalize resources from other areas.

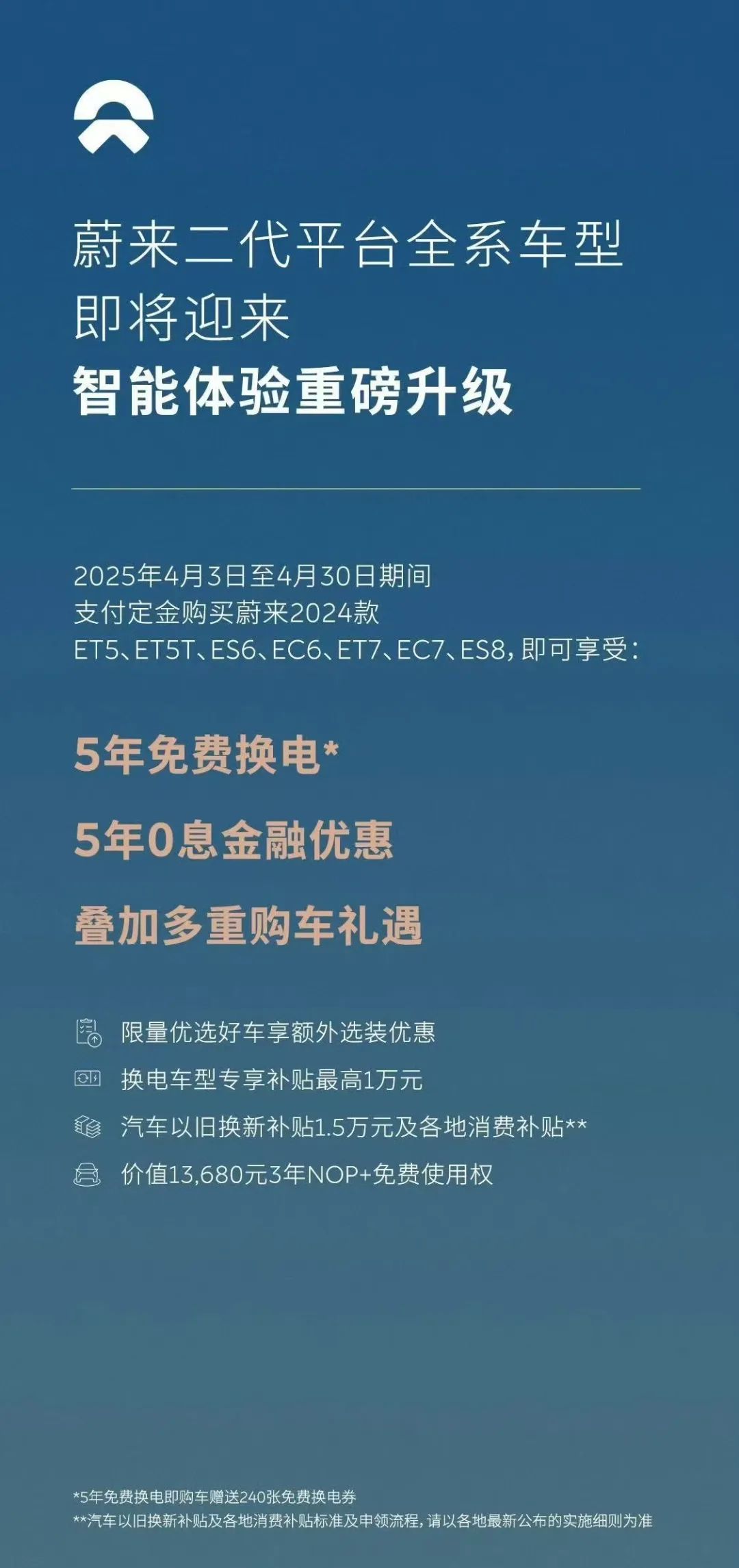

Of course, facing the sales dilemma, NIO has also come up with a response strategy. On April 3, NIO announced that users who purchase current models will enjoy free battery swaps for five years and a zero-interest car purchase policy for five years, which can be seen as a price reduction for current models without impacting the price system.

It can only be said that there are still many challenges ahead for NIO.

As for the last three brands, ARCFOX, AITO, and Voyah, although they rank lower in sales statistics, they are all brands with sales exceeding 10,000 vehicles, and their sales are steadily increasing, with significant growth both year-on-year and month-on-month, proving the huge potential of these brands.

More importantly, unlike other new forces, these three brands are supported by traditional automakers and belong to wealthy second-generation companies that do not have to worry too much about funding. They can focus solely on car manufacturing.

Of course, it's also possible that the next dark horse will emerge from among them. After all, no one would have expected Zero Run to become the monthly sales champion among new forces a year ago. It can only be said that in the vast domestic market, there is no shortage of brands capable of creating miracles.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.