Asian Auto Market | Japan March 2025: Toyota Maintains Leadership

![]() 04/08 2025

04/08 2025

![]() 613

613

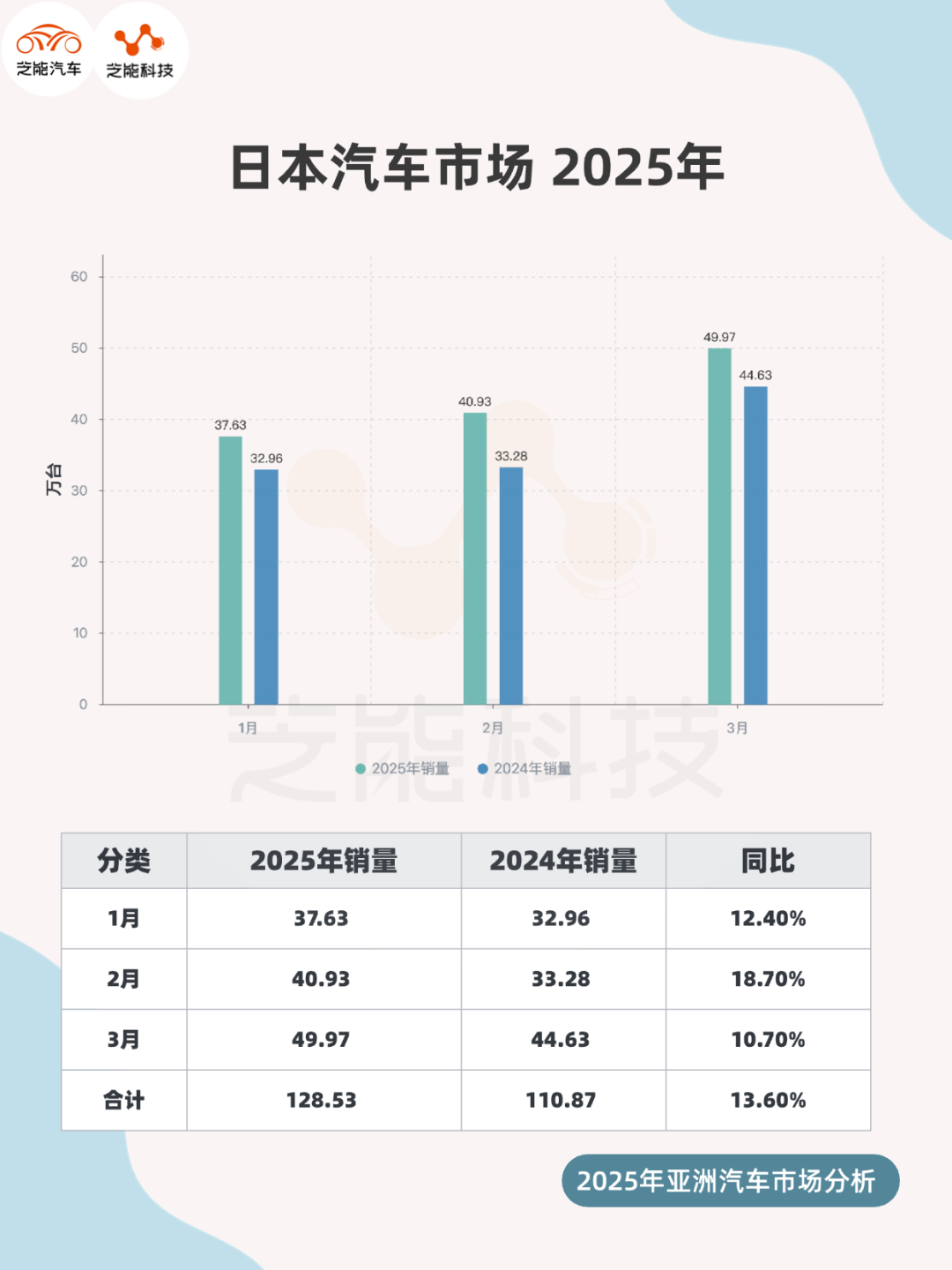

In March 2025, Japan's new car sales surged 10.7% year-on-year to 499,745 units, with cumulative sales for the first quarter rising 13.6% to 1,285,351 units, partly due to a low base effect from the previous year.

● Toyota retained its top spot with a 29.1% market share, while Daihatsu witnessed a remarkable 240.3% growth fueled by production recovery. Chinese brand BYD entered the market but only sold 331 units.

● Toyota Yaris/Cross and Corolla/Cross continued to lead in model sales, while Honda N-BOX dominated the kei car segment.

This article by Zhineng Technology delves into the current state and trends of the Japanese auto market, examining sales overview, brand performance, and model competition.

01

Sales Overview in Japan for March 2025:

Brand and Powertrain Performance

● March 2025 saw Japanese new car sales reach 499,745 units, a 10.7% year-on-year increase, ending a downturn caused by production disruptions. This growth was bolstered by the low base effect of a 21.1% sales decline in March 2024.

As a pivotal month at the fiscal year's end, March traditionally marks a peak for Japan's auto market, with manufacturers registering vehicles to meet annual targets.

● First-quarter cumulative sales stood at 1,285,351 units, up 13.6% year-on-year, indicating a general market recovery. However, compared to historical peaks, March's performance was subdued, with supply chain pressures and consumer confidence still recovering.

Japan's market remains dominated by traditional internal combustion engines (ICE) and hybrid electric vehicles (HEV), with a relatively low presence of battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV).

● Popular Models

◎ Hybrid models such as Toyota Yaris/Cross, Corolla/Cross, and Aqua excelled, highlighting HEVs' continued dominance.

◎ Kei cars like Daihatsu Tanto and Honda N-BOX are predominantly small ICE models, reflecting ICE's stronghold in this segment.

◎ BYD sold 331 units, possibly including BEVs and PHEVs, but the specific powertrain distribution remains unclear. It is speculated that its electrified products' penetration in Japan is still minimal.

● Brand Rankings

◎ Toyota led with 145,406 units (+16.2%), holding a 29.1% market share, though slightly lower than the 30.6% in Q1.

◎ Honda followed in second with 76,326 units (+4.1%).

◎ Suzuki (72,185 units, -13.0%) and Nissan (52,423 units, -11.5%) placed third and fourth, respectively.

◎ Daihatsu surged to fifth place with 50,285 units (+240.3%), overtaking Nissan due to production recovery.

◎ Mazda (19,837 units, +23.1%), Subaru (13,282 units, +22.9%), and Isuzu (9,250 units, +37.6%) performed well in the top ten.

◎ Among foreign brands, Mercedes (5,939 units, +1.0%) ranked eleventh, ahead of BMW (4,518 units, +5.6%) and Volkswagen (4,430 units, +56.8%).

● Chinese brands are still nascent in the Japanese market:

◎ BYD sold 331 units, a 9.8% year-on-year decrease.

◎ MG sold only 2 units, ranking 47th.

Japanese domestic brands occupy over 90% of the market share.

02

Model Sales and Competitive Landscape Analysis

● Popular Model Rankings

Regular Models:

◎ Toyota Yaris/Cross: 16,483 units (-6.8%), maintaining its lead.

◎ Toyota Corolla/Cross: 16,353 units (-13.2%), closely trailing.

◎ Toyota Sienta: 12,644 units (+39.2%), jumping to third place.

◎ Honda Freed: 11,107 units (+16.5%), ranking fourth.

◎ Nissan Note: 10,011 units (-21.4%), ranking fifth.

Kei Cars:

◎ Honda N-BOX: 23,627 units (+16.0%), firmly in first place.

◎ Suzuki Spacia: 16,463 units (-7.9%), second place.

◎ Daihatsu Tanto: 12,012 units (+1123.2%), third place.

◎ Daihatsu Move: 9,579 units (+1329.7%), fourth place.

◎ Suzuki Hustler: 8,379 units (-21.1%), fifth place.

Foreign Models (Q1 Cumulative):

◎ Mini Series: 4,764 units (+15.5%), first place.

◎ Volkswagen Golf: 3,740 units (+29.0%), second place.

◎ Volkswagen T-Cross: 2,750 units (+159.9%), third place.

● Competitive Landscape

◎ Toyota dominates with Yaris/Cross, Corolla/Cross, and Sienta, leveraging hybrid technology as its core competitive advantage.

◎ Honda Freed and Nissan Note exhibited stable but unremarkable growth.

◎ Daihatsu Roomy (+1052.1%) and Raize (+294.8%) witnessed explosive growth, reflecting the market's replenishment post-production recovery.

◎ Nissan Fairlady Z (+600.4%) emerged as a surprise in the sports car segment.

◎ Honda N-BOX remains the kei car leader, accounting for roughly 40% of sales, reflecting Japanese consumers' preference for economical and compact vehicles.

◎ Daihatsu Tanto and Move's exceptional growth, fueled by production recovery, challenged Suzuki Spacia and Hustler's market positions.

◎ Kei cars, with their low fuel consumption and taxes, will maintain strong demand in the short term.

◎ The Mini Series and Volkswagen Golf/T-Cross's strong performances indicate growing consumer acceptance of European small premium cars.

◎ Mercedes GLC and G-Class dominate the luxury SUV market.

◎ Models like BYD Atto 3 failed to make the sales rankings.

Japan's low acceptance of electric vehicles (BEVs account for less than 5%), coupled with the hybrid prowess of local brands like Toyota and Honda, restricts the expansion opportunities for Chinese new energy vehicles.