The Dawn of a New Era: Chinese Automakers Embrace Consolidation

![]() 04/09 2025

04/09 2025

![]() 661

661

Chinese automakers strive to transcend the industrial conundrum of being "large yet not formidable".

The New York Times recently cited two informed sources, revealing that Dongfeng and Changan have engaged in detailed discussions on consolidation plans and have informed their foreign capital partners of these initiatives.

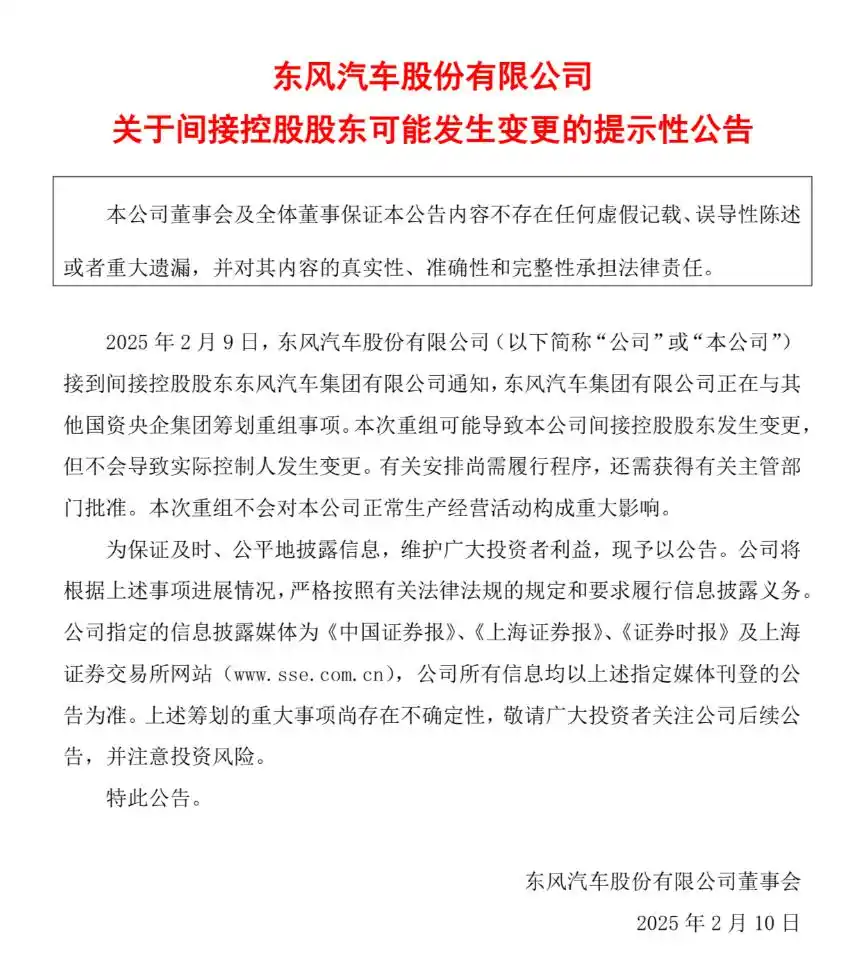

Earlier this year, the Chinese automotive market was stirred by news of a restructuring involving two central state-owned enterprises.

On February 9, Dongfeng Motor Corporation and Changan Automobile simultaneously issued announcements, revealing that their indirect controlling shareholders were planning to restructure with other state-owned central enterprises. The actions of Dongfeng and Changan, two heavyweight automakers, sparked much speculation among outsiders.

As the dual champion of global auto consumption and exports, Chinese automakers aim to overcome the industrial challenge of being "large yet not formidable", accelerate the pace of consolidation within the automotive industry, further strengthen the advantages of the industrial and supply chains, and enhance their standing in the global automotive landscape.

Expanding our perspective to the global context, the automotive industry has evolved over a century, transitioning from early regional market centralization to transnational group competition and cooperation, and now towards ecological reconstruction in the era of intelligence. It has undergone multiple rounds of "vertical mergers".

Should this "Chinese national team" merger of formidable players materialize, it will undoubtedly reshape the competitive landscape of the global automotive industry once again.

Eradicating "dead ends" through mergers

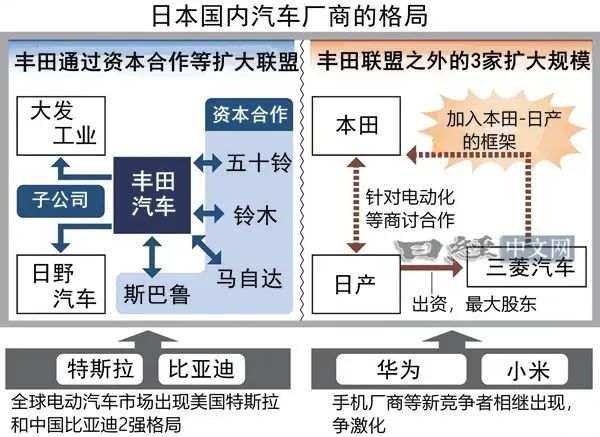

Towards the end of last year, a "cooperation alliance" among Japanese automakers shocked the world.

In December 2024, Honda, Nissan, and Mitsubishi Motors signed a memorandum of understanding, with Honda and Nissan initiating merger negotiations and Mitsubishi Motors exploring participation in the merger. Their ambition was to create a "world-class mobility company with annual sales exceeding 30 trillion yen and annual operating profits exceeding 3 trillion yen".

Had this highly anticipated merger succeeded, it would have been the largest merger and acquisition in the global automotive industry since the merger of Fiat Chrysler and the PSA Group in 2021. The new company's annual sales would have surpassed 8 million vehicles, making it the world's third-largest automaker after Toyota and Volkswagen.

However, the numerous differences that existed ultimately rendered everything a mirage. And because it lasted just over a month from announcement to conclusion, it was dubbed by the industry as the "shortest cooperation alliance in history".

It can be said that the merger between Honda and Nissan was a transformative self-rescue attempt by the "conservative forces" in the global automotive industry, but the hasty conclusion of this cooperation also reflects the collective anxiety of Japanese automakers - finding a way out seemed imminent.

Yet, looking back, the entire wave of global automaker mergers is a history of ambitious endeavors.

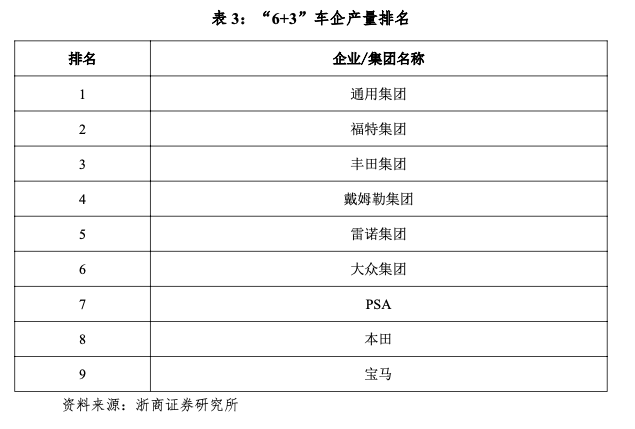

Since 1980, the wave of globalization has given rise to cross-border mergers and acquisitions. General Motors and Ford have respectively acquired multiple brands, and Daimler and Chrysler merged, among other initiatives, creating the "6+3" system in the global automotive market (General Motors, Ford, Toyota, Volkswagen, Daimler, Renault + Honda, BMW, and Peugeot). In 2002, these automakers controlled 90% of global production capacity.

The 2008 financial crisis caused a recession in the automotive industry worldwide almost simultaneously, pushing many automotive giants to the brink of bankruptcy. However, the crisis did not bring only nightmares.

Subsequently, the alliance between Nissan and Renault was formed, and Daimler-Benz acquired Chrysler. At the same time, the explosive growth of the Chinese market drove the development of companies like Geely, and the global automotive market evolved towards a "6+X" structure, with Hyundai-Kia rising to the forefront. All of these were mergers, acquisitions, and reorganizations by companies in distress seeking self-preservation after significant economic turmoil at the time.

The landscape of the entire global automotive industry has also changed accordingly.

In 2020, electrification and intelligence triggered a profound restructuring of the global automotive industry - the overnight merger of Europe's PSA and FCA into the Stellantis Group made it the world's fourth-largest automotive group.

As everyone knows, in the revolution of electrification, no single automaker can afford the cost and effort to develop electric vehicles, hybrid vehicles, and intelligent vehicle platforms alone. Therefore, resource complementarity and platform sharing have become the norm in the industry. On the other hand, the relationship between the FCA Group and the PSA Group does not stop at platform cooperation but reaches a deep integration of symbiotic coexistence.

The industrial boundary of groups like Stellantis is accelerating its migration from machinery manufacturing to software ecology, and scale effects and technological innovation have also become the dual-track survival rules of the automotive industry in recent years.

Currently, judging from the development of countries such as the United States, Europe, and Japan, the "Big Three" of Detroit in the United States (Ford, General Motors, Chrysler) dominate the market through scale effects, while Europe has constructed technological barriers with the five major groups of Volkswagen, Daimler, BMW, Renault, and Stellantis. The Japanese government promotes the integration of Toyota and Nissan with more than 30 enterprises to form an intensive pattern.

If we examine the reorganization history of international automaker giants ranked by sales volume, among the top five, the Hyundai-Kia Group has risen to become an international leading automaker through business integration and share consolidation; in 2021, after the PSA Group and the FCA Group completed share consolidation, Stellantis became the world's fourth-largest automotive group.

What insights do these cases provide for Chinese automakers?

The inevitable path from large to formidable

There is an industry consensus that in the next 3-5 years, China will be left with only three to five automotive groups with international competitiveness.

However, the reality is that there are currently 77 complete vehicle enterprises and 129 brands (more than 90 local brands) in the domestic market, presenting a fragmented landscape. This is in stark contrast to the highly concentrated industrial forms of automotive powerhouses such as the United States (with over 10 brands), Germany (with over 10 brands), and Japan (with about 15 brands).

In other words, China has a significant advantage in the number of enterprises and brands but exposes the chronic issue of being "large yet not formidable". For a long time, China's automotive industry has faced issues of numerous enterprises, small scale, and insufficient industrial concentration, leading to resource dispersion and frequent redundant construction, making it difficult to form scale effects and synergies.

However, mergers led by market logic, such as those between Honda and Toyota, often get bogged down due to interest conflicts and cultural clashes. If it is a strategic reorganization led by national will, aimed at breaking the market involution through administrative forces and concentrating resources to cope with the pressure of new energy transformation, the merger will present a completely different scenario.

Therefore, we have also proposed a "Chinese solution" - strategic reorganization of central state-owned enterprises.

Looking back in recent years, it is not uncommon for central state-owned enterprises to undergo reorganization. "China South Locomotive and Rolling Stock Corporation" and "China North Locomotive and Rolling Stock Corporation" merged into "CRRC Corporation Limited", Baosteel and Wuhan Steel merged into "Baowu Steel Group", Ansteel reorganized Bensteel and Lingang Steel, China Shipbuilding Industry Corporation and China Shipbuilding Heavy Industry Group merged, and China Electronics Technology Group Corporation implemented a reorganization with China Hualu Group... The scope of reorganization and integration has continued to expand.

Most of these reorganization cases have also achieved remarkable results.

The merger of "China South Locomotive and Rolling Stock Corporation" and "China North Locomotive and Rolling Stock Corporation" into "CRRC Corporation Limited" can be considered a classic case of central state-owned enterprise reorganization. Before the merger, there was a certain competitive relationship between the two on the international market. After the merger, CRRC Corporation Limited integrated superior resources and significantly enhanced its competitiveness in the global railway transportation equipment market.

These successful cases demonstrate that the professional integration of central state-owned enterprises is not only an inevitable choice to cope with market competition but also a key move to promote high-quality development of the industry.

Therefore, from the perspective of the "quantity" of the reorganization of Changan and Dongfeng, their market share will increase significantly after integration. In 2024, Changan Automobile and Dongfeng Motor sold approximately 2.68 million and 2.48 million vehicles, respectively, ranking fourth and sixth among domestic automakers. Once merged, their sales volume will exceed 5 million vehicles.

From the perspective of "quality", both will optimize their industrial layout by concentrating resources and eliminating outdated capacity. This can not only avoid duplicate investment in research and development resources, improve research and development efficiency, but also promote the deepening of core technology research and development; at the same time, the integration of production resources optimizes production facility configuration, improves production efficiency, and reduces costs; the integration of sales resources constructs a more comprehensive sales network and enhances market development capabilities.

Particularly importantly, reorganization and integration will also prompt enterprises to focus on tackling key technological challenges such as new energy vehicle battery recycling and autonomous driving safety, promote an overall leap in industrial technology levels, realize industrial structural optimization and upgrading, and enhance the competitiveness of China's automotive industry in the global market.

This turning point for China's automotive industry, transitioning from "wild growth" to "intensive competition", also compels China's automotive industry to undergo strategic reconstruction.

Last September, Geely Holding Group issued the "Taizhou Declaration", clearly announcing that the company would undergo strategic integration. Subsequently, the Geometry brand was merged into the Yinhe brand, and Zeekr and Lynk & Co announced a merger, with the integrated target pointing directly at sales of one million units by 2026.

In November last year, GAC Group announced the launch of the "Panyu Action" three-year plan, clearly positioning its independent brands as the growth pole, with sales targeted at 2 million units by 2027. To date, GAC Group has completed the integrated reform in the marketing field, with Trumpchi, Aion, and Hyperion forming a "trident" matrix.

In addition, in 2024, SAIC Motor completed the merger of its independent brands Feifan and Roewe, forming a dual-track operation system for new energy and traditional fuel vehicles; Changan Automobile constructed the "Changan Gravitation" super brand, integrating the three product lines of Oushang, UNI, and the V logo...

Various indications show that China's automotive industry is currently undergoing structural changes and reshaping of the competitive landscape.

On the one hand, domestic automakers face the dual pressures of "intensifying internal competition + challenges of going overseas", accelerating the survival of the fittest, with financially weak and technologically underprepared enterprises accelerating their clearance.

On the other hand, private enterprises and mixed-ownership enterprises represented by BYD, Geely, and Chery, with their flexible decision-making, agile innovation response, and global layout capabilities, have seized strategic initiative in the transformation towards "electrification, intelligence, networking, and sharing".

The trend of mergers and acquisitions in the industry is significant, with policy support and technological iteration (new energy, intelligence) driving industrial integration. The merger and reorganization of Dongfeng and Changan may become a strategic microcosm of the new energy transformation and global competition of state-owned enterprises. This round of adjustments will accelerate the concentration of resources towards leading enterprises, promote technological breakthroughs and industrial upgrading, and help China's automotive industry move towards high-quality development and global competition.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.