European Auto Market | Norway April 2025: Chinese Brands Dig for Gold Amid Pure Electric Dominance

![]() 05/07 2025

05/07 2025

![]() 662

662

In April 2025, Norway's new car market set a new benchmark in the electrification journey, with new energy vehicles constituting a whopping 97% of new car registrations, marking an all-time high.

With plug-in hybrid models phased out due to tax reforms, the market is virtually dominated by pure electric vehicles. Amidst this profound electrification trend, Chinese brands have proactively positioned themselves, capturing a notable 12% market share, with standout performers like the Xpeng G6.

Let's delve deeper into the electrification trajectory in Norway, the competitive dynamics among brands, and the aggressive strategies of Chinese automakers!

01

Electrification Nears the "Finish Line":

Understanding the Structural Shift Behind 97% Pure Electric Penetration

In April 2025, Norway registered 11,286 new cars, of which 10,942 were pure electric models, accounting for 97% of the total registrations. This represents an increase of approximately 900 vehicles year-on-year, sustaining a robust growth trajectory. Compared to March's 84.1% pure electric penetration rate, April's leap was particularly significant, partly due to the market's "clearance effect" following adjustments to the hybrid tax system.

● From a powertrain perspective, non-pure electric models have been significantly marginalized: In April, only 56 plug-in hybrid vehicles, 98 HEVs, 25 gasoline vehicles, and 165 diesel vehicles were registered.

The combined market share of traditional internal combustion engines (gasoline + diesel) stands at a mere 1.7%. This signifies that the Norwegian market is on the cusp of achieving the "100% pure electric" milestone.

As of the first four months of 2025, Norway has registered 42,882 new cars, marking a 28% year-on-year increase. This growth is entirely fueled by pure electric models, with March's "hybrid peak" serving as a fleeting resurgence prior to the tax reform.

● At the brand level,

◎ Tesla maintains its unassailable lead in the Norwegian market, with 3,656 registrations of the Model Y in the first four months of 2025, a year-on-year decrease of 31.4%, yet still ranking first in sales.

◎ Toyota bZ4X (2,984 units) and Volkswagen ID.4 (2,617 units) closely trail behind in the rankings.

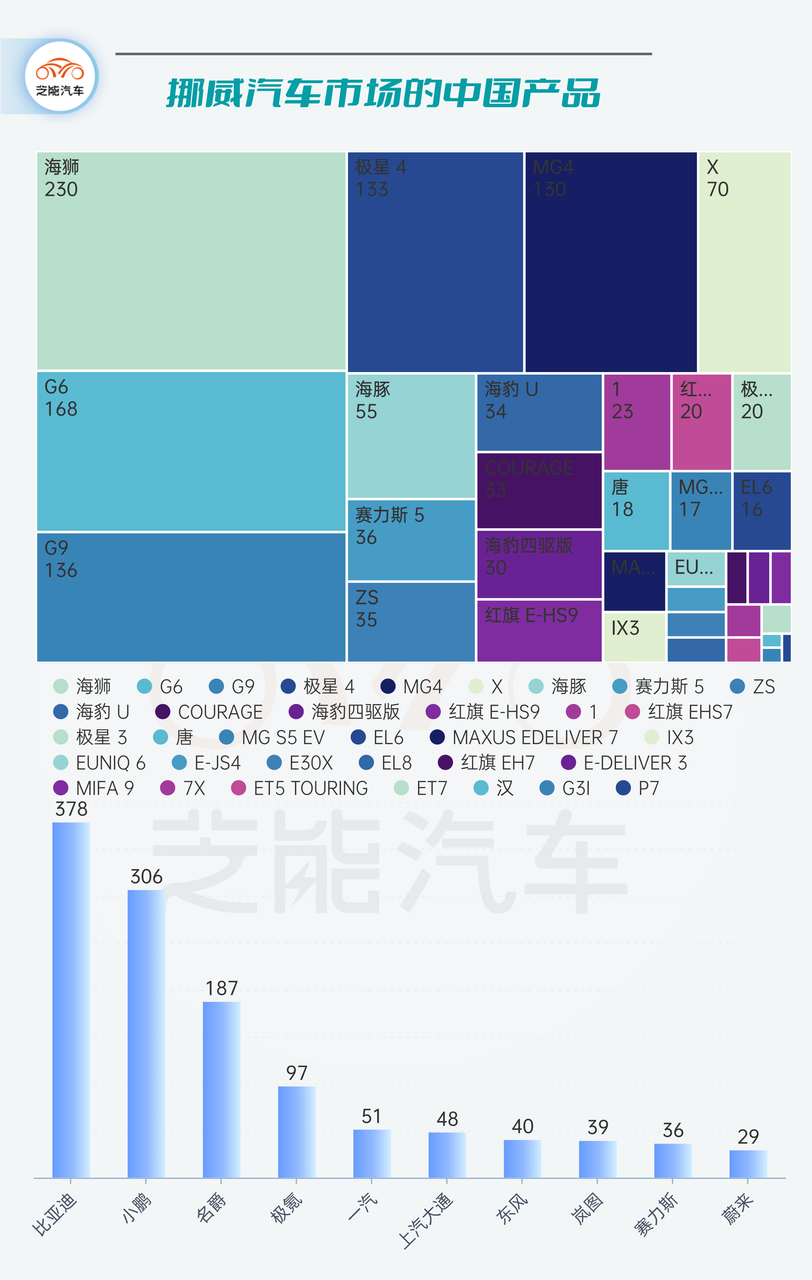

Notably, Chinese brands are gaining momentum. According to OFV statistics, Chinese manufacturers have secured approximately 12% market share, a substantial increase from the previous year. In April, Xpeng G6 emerged as the top-selling Chinese brand model in Norway with 185 registrations, successfully entering the mid-to-high sales bracket.

While their overall figures have yet to rival traditional European and American brands, capturing a double-digit share in a highly mature electric vehicle market is a testament to their strength. Chinese brands' European adaptation strategy, which integrates "cost-effectiveness, technology, and design," is gradually bearing fruit, particularly in the compact and mid-size SUV markets where domestic brands can compete head-to-head with European rivals like the ID.4 and bZ4X.

02

Intense Model Sales Competition:

Chinese Brands Initiate the "Positioning War"

● In terms of specific model registrations in April, pure electric models monopolized the top 30 spots, a first in Norwegian auto sales history, with non-electric models barely making an appearance until the 39th position on the list.

This phenomenon underscores a complete shift in consumer preferences and reflects drastic changes in the product supply structure under policy regulation.

● Among the top 10 pure electric models,

◎ Tesla Model Y continued to lead with 869 registrations, accounting for 7.7% market share.

◎ Volkswagen ID.4 (724 units), Toyota bZ4X (697 units), Volkswagen ID.7 (696 units), and Volkswagen ID.3 (620 units) follow closely. Volkswagen occupies three spots in the top five, underscoring its manufacturing prowess and supply chain efficiency in Europe.

◎ Among subsequent Japanese and Nordic brands, Nissan Ariya (423 units), Skoda Enyaq (356 units), Volvo EX30 (343 units), BMW iX1 (293 units), and Ford Explorer (291 units) are primarily mid-size to compact SUVs, further highlighting that the current mainstream demand in the Norwegian market revolves around electric SUV products.

For Chinese brands, this market structure presents both challenges and opportunities. Taking Xpeng G6 as an example, its positioning overlaps with many of the aforementioned main models, and its sales volume of 185 units in April already demonstrates the penetration trend of Chinese brands in the "second tier." If they can maintain a steady supply rhythm and continuously refine the localized user experience, it is plausible to aspire to monthly sales levels of 300+ or even 500+.

● In terms of overall brand strategy, Chinese automakers face two options:

◎ One is to persist with "high cost-effectiveness + smart cockpit" to break through and carve out a niche between Volkswagen ID.3/ID.4 and MG ZS EV;

◎ The other is to pursue a premium brand positioning and compete with models like the Model Y and Volvo EX30 in the price segment above RMB 300,000, which necessitates robust channel construction, OTA capabilities, and after-sales support systems.

As models like Enyaq are currently in a replacement cycle, some traditionally strong brands have experienced short-term sales weakness, potentially creating opportunities for Chinese brands to temporarily "position" themselves.

Summary

Norway is hurtling towards a "pure electric society" at an unprecedented pace, fueled by tax policies, industrial support, and heightened consumer awareness. In this highly electrified environment, Chinese brands stand at a pivotal starting point. Xpeng G6's market performance marks just the beginning. As brands like NIO and BYD further expand their strategic footprints in Norway and the Nordic regions, Chinese brands are poised to gain a firm foothold in segmented markets in the future. Behind this endeavor lies not just a competition of product prowess but also a race of overseas system construction and long-term brand building. For Chinese brands aiming to secure a prominent place in the European electric vehicle market, Norway is indeed a formidable challenge that must be overcome.