Cars as Durable Icons: Beyond Small Deposits in Strength Assessment

![]() 05/07 2025

05/07 2025

![]() 601

601

Introduction

Amidst the digital frenzy, pre-orders have subtly emerged as a pivotal factor in redefining the evaluation of product strength.

In "The Little Prince," how does one gauge the quality of a house?

“If you tell adults, ‘I saw a beautiful house made of rosy brick, with geraniums in the windows and doves on the roof…’ they won't envision it. You must say, ‘I saw a house worth a hundred thousand francs.’ Then they'll exclaim, ‘What a charming house that must be!’”

Applying the same logic, one might also say:

If you tell users, “My car uses a four-layer ultra-high-strength steel frame, has logged 8 million kilometers of test mileage, and has a four-year research and development cycle…” they won't comprehend its excellence. You must tell them, “This car has surpassed 100,000 small deposits.” Then they'll exclaim, “What an outstanding car!”

If the price and limited-time purchase incentives announced in the final minutes of a product launch become the yardstick for judging a new car's survival, then the data on small deposits within 24 hours, three days, and one week of launch are undoubtedly the weather vanes indicating whether a brand's sales momentum can firmly establish itself in the market, potentially achieving blockbuster sales.

As pre-sale data becomes a market stimulant, the automotive industry is undergoing an unprecedented cognitive deconstruction. Behind the digital frenzy, pre-orders have quietly become a key factor in reversing the assessment of product strength.

01 “50,000 Small Deposits is Acceptable”

What is the paramount indicator for gauging the strength of a new energy vehicle that hasn't been officially released? Is it the disclosed parameters, the brand it relies on, or its impact and disruption on niche markets and even the entire automotive market?

Perhaps none of these. With the advent of concepts like blind reservations, small deposits, and large deposits, and new energy vehicles trending towards "large household appliances" replaced every few years, pre-order sales seem to be the ultimate benchmark for measuring their strength.

“Nowadays, when a new car is launched, if it doesn't announce orders exceeding 20,000 vehicles within 2 hours/24 hours/72 hours, one feels embarrassed greeting others outside.”

A few years ago, Zhang Yong, then CEO of Nezha Auto, joked about this on WeChat Moments. Although these remarks were seen as Zhang Yong's sarcasm towards exaggerated orders for newly launched cars, if they were made today, probably not many people would remember this slightly "humblebrag" remark.

As a senior industry insider puts it, in today's market, breaking 10,000 small deposits is already basic operation: “It's embarrassing to announce if small deposits don't exceed 10,000 within 24 hours; 50,000 is acceptable.”

Not only has breaking 10,000 small deposits within 24 hours become another benchmark, but the timing units for breaking 10,000 small and large deposits are also constantly being refreshed.

Dongfeng Nissan's N7, which sparked a media frenzy, as a mid-to-large sedan with an axle distance exceeding 2900mm, equipped with five industry-leading technologies including AI zero-pressure cloud blanket seats, all-domain intelligent anti-motion sickness technology, and one-stop end-to-end combined driving assistance, garnered 10,138 small deposit orders within one hour at a price range of 119,900 to 149,900 yuan.

The bulky Lingke 900, which began pre-sales in early April, also performed exceptionally well: with a pre-sale price of 330,000 to 435,000 yuan, pre-sale orders exceeded 14,600 within 24 hours. After officially launching at the end of April with a limited-time launch price of 289,900 yuan, Lingke 900 achieved the feat of breaking 10,000 large deposits within one hour.

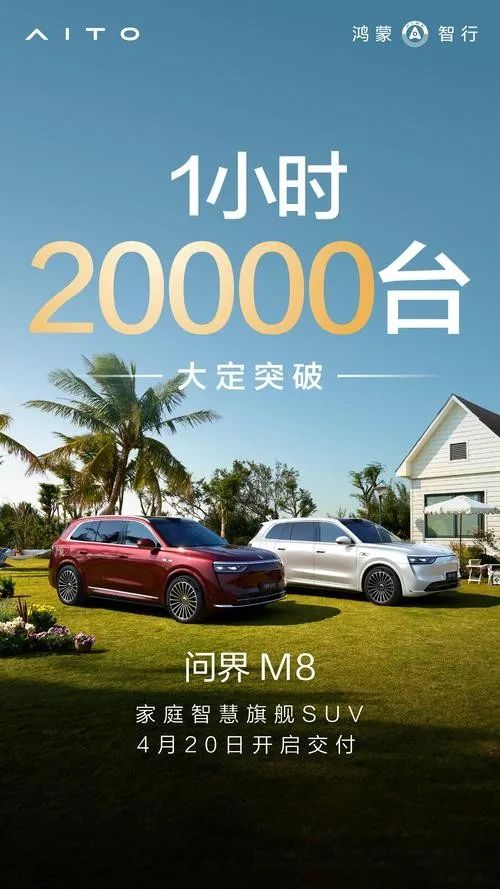

When it comes to recent small deposit kings, AITO M8 undoubtedly deserves the title. Since its launch on March 6, with a pre-sale price of 368,000 yuan, the number of small deposits for AITO M8 has been on the rise, exceeding 21,000 within 6 hours and reaching 36,000 within 36 hours. Since then, it has reached 47,000, 100,000, 120,000… Before its launch, cumulative small deposit orders exceeded 150,000.

The fact that a new car priced at over 350,000 yuan can accumulate 150,000 small deposits speaks volumes about its remarkable popularity.

While the market was setting the hour as the timing unit for breaking 10,000 small deposits, AITO M8 redefined the timing unit for large deposits: it secured 8,000 large deposits within 8 minutes of its official launch, exceeded 32,000 within 24 hours, 44,000 within 72 hours, and 50,000 within four days of its launch.

As advanced driver assistance systems and battery capacity become the keys to overtaking in the new energy vehicle sector, they are both crucial for unlocking the fuel blockade and the shackles of self-imprisonment. Only by accelerating updates and iterations can one avoid being swept away by the tides of time. Therefore, as new energy vehicles increasingly converge towards the positioning of "large household appliances," pre-orders have also become an important means for brands to seize users.

However, besides small deposits, large deposits, and pre-orders becoming another promotional point for automakers, as industry observers, we must also raise the overlooked question: Is it really right to achieve immediate sales upon launch?

02 Who Benefits from Immediate Sales upon Launch?

“Delivery upon launch, and sales upon delivery” – these powerful 10 words have become a proud promotional point for brands in the propaganda of numerous new energy automakers.

The surge in sales upon the launch of new energy vehicles forms a stark contrast with the gradual climb in sales during the fuel era.

Before concepts like blind reservations, small deposits, large deposits, and pre-orders became popular alongside the emergence of new energy vehicles, even if a new fuel vehicle had a pre-sale period, it wouldn't receive too many orders, and the brand wouldn't consider it a promotional point. The climb in sales not only requires market acceptance but also the accumulation and release of consumer word-of-mouth, taking at least half a year, or up to a year, for new car sales to steadily climb to a peak and remain stable.

Taking Mercedes-Benz's classic previous C-Class (V204) as an example, it was launched in August 2014, and it wasn't until more than half a year of market running-in that sales gradually picked up, reaching a peak monthly sales of 15,000 vehicles in 2017.

In the new energy era, everything is different.

During previous field interviews, a terminal sales representative stated that nearly one-third of the annual sales of a new car model would explode and be released within an extremely short period of time after its launch.

Without market testing or accumulation of user word-of-mouth, the surge in car sales relies solely on brand endorsement and promotional selling points. As a result, the marketing rhetoric of automaker launches has become increasingly captivating, and telling a good story has become a necessary prerequisite and even the only prerequisite for selling a good car.

“A knife can kill its wielder.” The attractive pre-order data brought about by pre-sale strategies undoubtedly become another promotional gimmick worth touting for automakers, giving themselves a golden sheen. However, once product strength is insufficient or competitors undercut the market with lower prices, a plethora of new cars that were highly anticipated will inevitably suffer backlash, with sales plummeting rapidly.

For consumers, pre-ordering is more like a hastily joined gamble driven by various anxious emotions such as early bird discounts, limited-time specials, and complimentary options. The audience's stakes are the deposits and principal coveted by the dealer, while the gambling chips are the new cars and exaggerated pre-order benefits that they have only heard about but never seen.

Going deeper, the obsession with immediate sales upon launch not only invisibly accelerates internal competition within the new energy vehicle sector but also weakens the long-term positioning of the automotive industry at a deeper level.

During the first six months of a new car's launch, considered the golden period, if it fails to achieve sales growth, it basically means it will fade into obscurity. Therefore, technological “innovation,” fully loaded configurations, “one-step” pricing, and rapid sales growth have become necessary means for new cars to break through. Behind this lies a great test of R&D speed and supply chain responsiveness.

Moreover, whether it's from the perspective of the China Association of Automobile Manufacturers calling for a halt to weekly rankings or the century-long history of the automotive industry, as a high value-added product, cars require long-term investment and in-depth refinement, while immediate sales upon launch and rapid iterations accelerate the shift of cars towards the more replaceable positioning of "large household appliances."

Fragmented information measured in minutes, hours, and days runs counter to the operating laws of the automotive industry, which has monthly, quarterly, and annual cycles; a more erratic positioning is vastly different from the century-long accumulation of the automotive industry.

But cars will never be fast-moving consumer goods; they carry the weight of humanity's century-long mobile civilization. Just as it takes a watchmaker a hundred years to calibrate the accuracy of time, the glory of the automotive industry may be hidden in those long waits that cannot be quantified by small deposit data – waiting for a breakthrough in materials revolution, waiting for the maturity of a safety technology, waiting for a generation to measure the world with wheels.

These silent accumulations are what truly distinguish cars from "running sofas" and the key to breaking the dilemma of being trapped in reversing the assessment of product strength based on pre-order volumes.

Editor-in-chief: Shi Jie; Editor: He Zengrong