Volkswagen Group Q1 2025 Financial Report: Luxury Brands Buck Trend with Profit Growth, Battery and Software Segments Widen Losses

![]() 05/29 2025

05/29 2025

![]() 647

647

In the first quarter of 2025, the Volkswagen Group reported an operating revenue of €77.558 billion, marking a 2.8% increase year-on-year. However, operating profit declined by 36.9% to €2.873 billion, resulting in an operating profit margin that fell from 6.0% in the same period last year to 3.7%.

Importantly, these financial figures exclude two Chinese joint ventures (SAIC Volkswagen and FAW-Volkswagen), as the Group's stake in these ventures does not exceed 50%. Nonetheless, Volkswagen noted in its financial statement footnotes that its share of operating profit from these Chinese joint ventures amounted to €272 million, down from €429 million in the same period last year.

Figure 1: Sales and Revenue of Volkswagen Group and Subgroups

Figure 2: Operating Profit of Volkswagen Group and Subgroups

Notes:

1. Porsche's revenue and operating profit include those of Porsche Financial Services.

2. The "sales," "revenue," and "operating profit" of the Core Brand Group and the Luxury Brand Group exclude contributions from Chinese joint ventures.

3. The negative sales figure in "Others" reflects adjustments to avoid double-counting. For instance, the Audi Q4 e-tron, produced under the Volkswagen brand, is initially counted as part of Volkswagen's sales (an internal transfer) and subsequently as part of Audi's sales (an external sale). To prevent double-counting at the Group level, relevant data is consolidated and offset in the "Others" category.

Subgroup Performance:

Core Brand Group (comprising Volkswagen, Škoda, SEAT/CUPRA, and Volkswagen Light Commercial Vehicles): Revenue surged 7.8% year-on-year to €35.340 billion, but operating profit fell 46.3% to €1.118 billion, leading to a drop in the operating profit margin from 6.4% to 3.2%.

Luxury Brand Group (including Audi, Bentley, and Lamborghini): Revenue grew 12.4% year-on-year to €15.431 billion, with operating profit increasing 15.2% to €537 million. Consequently, the operating profit margin improved from 3.4% to 3.5%.

Sports Luxury Brand (Porsche): Despite a 4.0% year-on-year decline in revenue to €7.819 billion, Porsche's operating profit fell more sharply, by 43.8%, to €678 million. This resulted in a drop in the operating profit margin from 14.8% to 8.7%.

CARIAD (software company): Revenue increased 32.4% year-on-year to €237 million, but the operating loss widened from €552 million in the same period last year to €755 million.

Battery Business: Revenue was approximately €2 million, while the operating loss widened from €79 million in the same period last year to €213 million.

TRATON Group (encompassing MAN, Volkswagen Commercial Vehicles, Scania, and International): Revenue declined 10.0% year-on-year to €10.326 billion, with operating profit falling 38.3% to €640 million. This led to a drop in the operating profit margin from 9.0% to 6.2%.

Volkswagen Group Mobility (involved in leasing, financial services, and mobility services): Revenue increased 7.9% year-on-year to €14.866 billion, while operating profit rose 20.6% to €948 million. This improvement resulted in an increase in the operating profit margin from 5.7% to 6.4%.

Attachment:

For detailed information on Volkswagen Group's global deliveries and factory distribution in Q1 2025, please refer to:

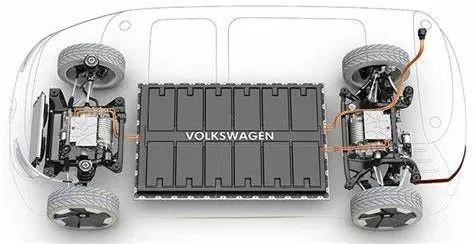

Volkswagen Group Delivers 2.13 Million Vehicles in Q1, Pure Electric Vehicles Surge 59% (Attachment: Volkswagen's Global Vehicle Base Layout)

Note: "Deliveries" refer to the number of vehicles delivered to end customers, distinct from the "sales" figures presented in Figure 1 of this article. "Sales" represent the number of vehicles sold by the Volkswagen Group.

Source: Apsoto Auto / Apsoto Auto Community