From 'Going Out' to 'Global Roots': Chinese Auto Companies Expand Overseas Factories

![]() 05/29 2025

05/29 2025

![]() 706

706

Produced by Zhineng Technology

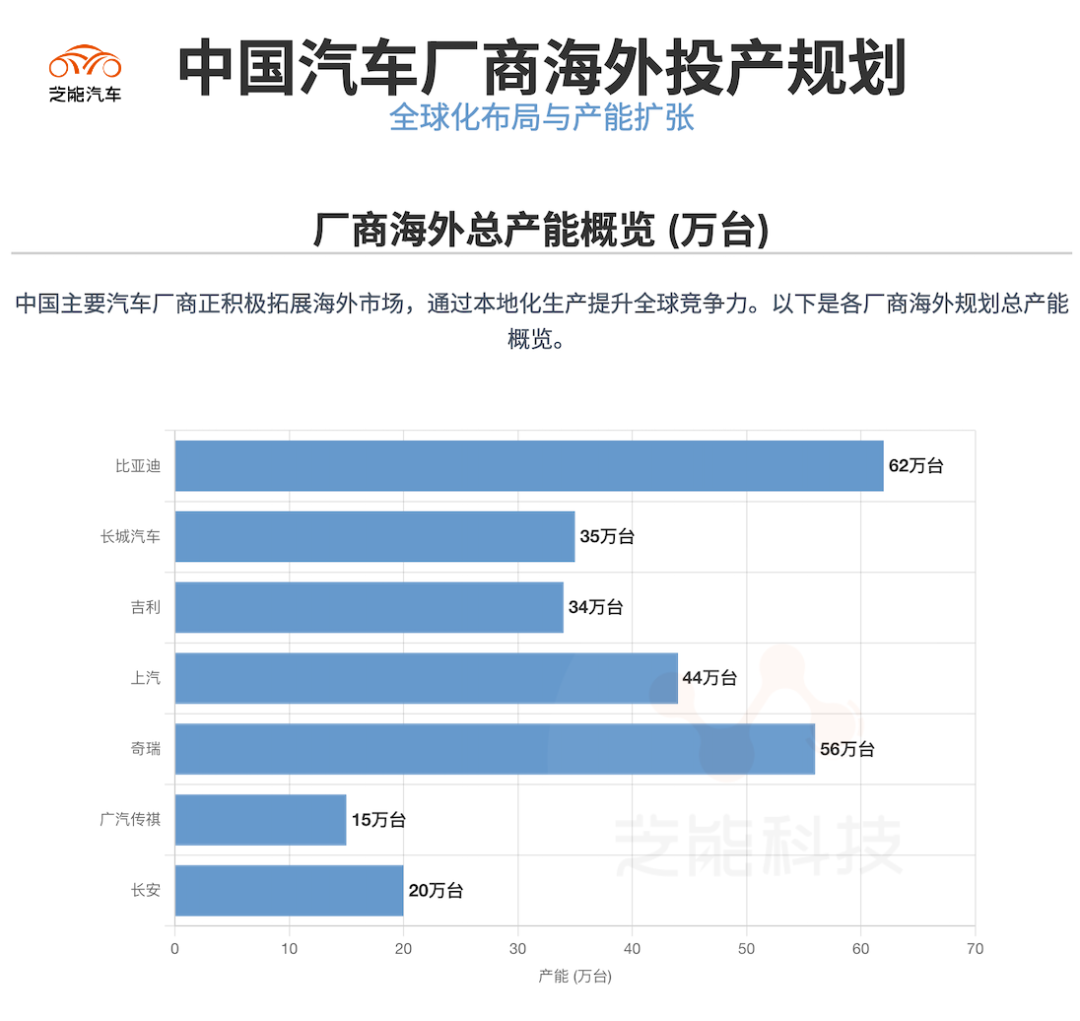

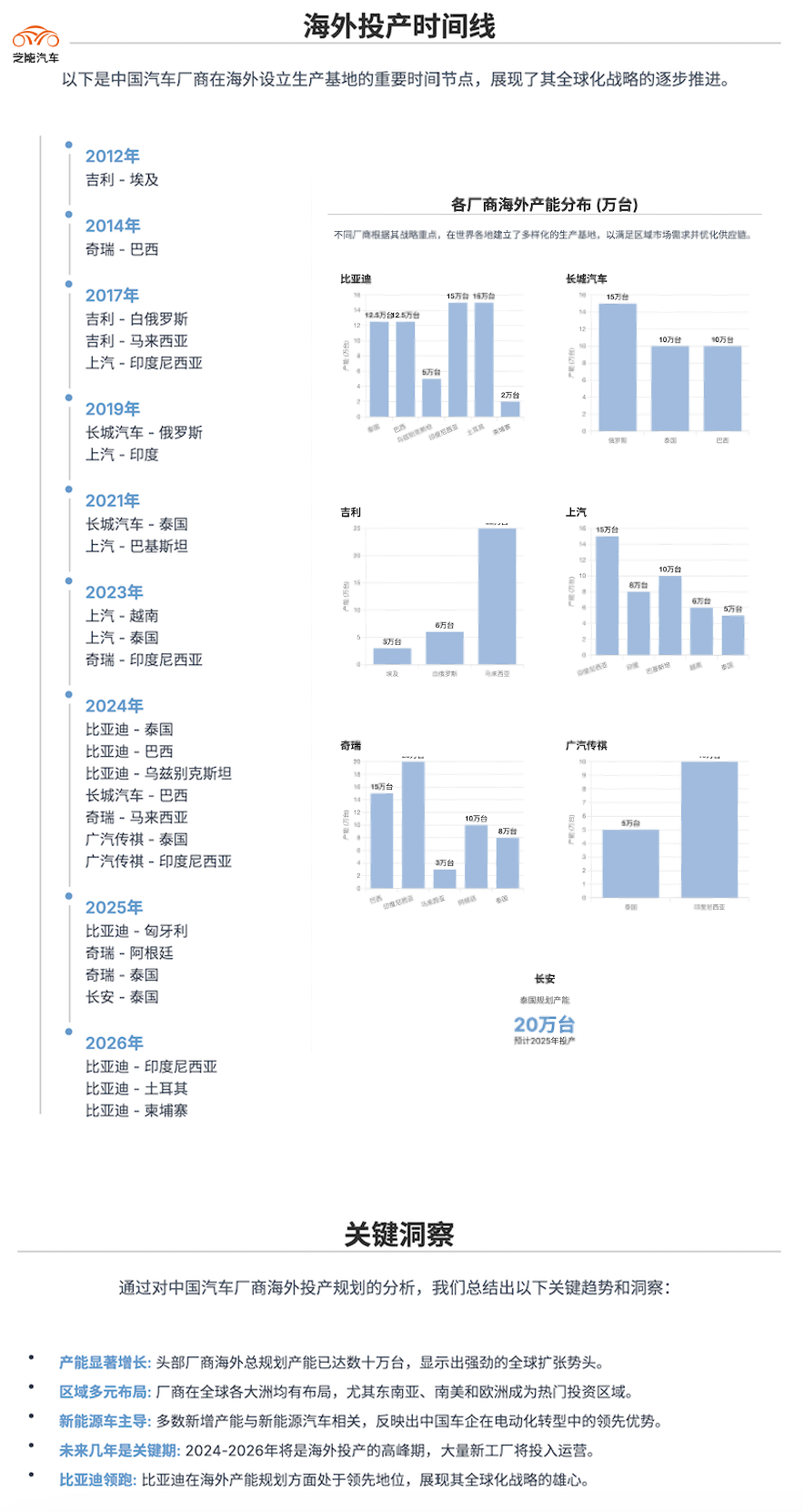

As the global automotive industry shifts towards electrification and intelligence, Chinese auto companies are accelerating their overseas factory establishment, transcending mere export-orientation to achieve true 'global operations' through local production.

From strategic penetration in Southeast Asia to breakthroughs in European markets, and forward-looking layouts in diverse markets such as Latin America and Central Asia, Chinese auto companies are breaking through geographical and policy barriers with deepened 'localization' strategies.

Challenges like technical adaptation, policy compliance, industrial chain integration, and cultural management are inevitable hurdles on the path to globalization.

01

Southeast Asia:

Factories as a Strategic Fulcrum

Tapping Regional Market Potential

In the global landscape, Southeast Asia has emerged as the most dynamic strategic frontier for Chinese auto companies.

This region boasts significant automobile consumption potential and generally favorable policies for new energy vehicles. Importantly, the zero-tariff framework among ASEAN member countries offers an ideal platform for Chinese auto companies to establish their presence.

● Taking Thailand as an example, the establishment of factories by BYD, SAIC MG, and Great Wall Motors aims not just to reduce costs through 'local production' but also to radiate throughout the ASEAN market.

◎ BYD has set up a factory in Rayong Province to produce models like the Dolphin and Seal, centered on Thailand's 'new energy-friendly policies' and geographical centrality.

◎ SAIC MG, with its early layout, has more initiative in product updates and capacity allocation.

◎ Great Wall Motors has gradually gained a foothold in the hybrid market through local production of the Haval H6 HEV.

● The latecomers in Malaysia, Indonesia, and Vietnam should not be underestimated.

◎ Geely has gained a foothold by acquiring a stake in Proton and upgrading the factory to establish a local manufacturing system with a capacity of 250,000 units.

◎ Neta Automobile followed suit, establishing a factory in Negeri Sembilan and regarding Southeast Asia as its next strategic growth pole after China.

◎ Indonesia, with abundant nickel resources and a huge consumer market, has become a key piece in the electric vehicle layout.

BYD and SAIC-GM-Wuling's layouts are not only responses to local resources but also indicate the emerging logic of 'resource-production integration' for Chinese auto companies in the new energy era.

◎ In Vietnam, Chery and Great Wall have quickly established a presence, aiming at local consumption growth and the cost-effectiveness dividend from 'low costs + tariff preferences'.

It is evident that Chinese auto companies' strategy of establishing factories in Southeast Asia is not only market-responsive but also a reshaping of the manufacturing model.

Compared to the asset-light 'export king' model of earlier years, today's overseas factories are becoming more asset-heavy, deeply embedded in local supply chains, and seeking long-term cooperation with local governments and industrial parks. This not only aids localized brand operations but also provides flexibility for fluctuations in local policies.

02

Europe and Beyond:

Breaking Barriers, Generating Overseas Revenue

Unlike the 'quantitative breakthroughs' pursued in the Southeast Asian market, Chinese auto companies' goal in establishing factories in Europe is more symbolic – entering the core of developed markets and transitioning from 'cost advantage' to 'brand premium pricing'.

Spain and Hungary are the fulcrums for Chinese auto companies' European strategy.

◎ Chery took over the Nissan factory and quickly commenced production of the Omoda model. This 'backdoor entry' not only saved time but also demonstrated Chery's accelerated intentions in the European market.

◎ BYD, on the other hand, has made a significant layout in Hungary with an investment of 40 billion yuan and an annual production capacity of 200,000 units, reflecting its ambition to enter the mainstream European market.

BYD's site selection is strategic: Hungary boasts a mature automotive industry base and hosts numerous Chinese and Korean battery enterprises, providing a complete supporting ecosystem for vehicle manufacturing.

BYD's move aims not just to open up the market but to build a replicable closed-loop new energy vehicle industrial chain.

In non-traditional markets, Chinese auto companies' layouts are equally meaningful.

◎ For instance, Turkey, as an EU customs union country, has become a new channel for BYD to 'bypass Europe'.

◎ Uzbekistan, situated at the heart of Central Asia and actively promoting green energy policies, has become a hub for BYD to expand along the Silk Road Economic Belt.

◎ In South America, Chery and BYD have established a foundation through years of cultivation, while Great Wall has made a high-profile entry by acquiring the former Mercedes-Benz factory.

This series of operations clearly demonstrates Chinese auto companies' strategic thinking in globalization, characterized by 'multiple layouts + differentiated operations'.

Summary

These overseas layouts by Chinese auto companies are not isolated events but gradually form a global strategy centered on 'establishing factories overseas, supported by local operations, and taking regional radiation as the path.' The ultimate goal is to generate revenue abroad.