Wei Jianjun Compares Automotive Industry to Evergrande: Is it a Warning or Confusion?

![]() 05/30 2025

05/30 2025

![]() 659

659

Source: SourceAuto

The ripple effects of Wei Jianjun's remarks continue to unfold.

Starting from the first trading day after the "automotive Evergrande" theory was proposed on May 26, the CSI Automobile Index and SSE Automobile Index declined for three consecutive days. Focusing on passenger vehicle companies, according to incomplete statistics from SourceAuto, the combined market value of listed Chinese auto companies on the A-share market shrunk by over RMB 100 billion within three days, dealing a significant blow to Chinese auto stocks, which had been steadily rising recently.

The alarm over Evergrande stems from its profit-driven descent into a destructive path, dragging down the entire industrial chain and affecting a wide array of industries. In contrast, the automotive industry has seen Chinese auto companies gain global recognition through rapid advancements in intelligent and electric vehicle technology. In China, they have also captured market share previously held by joint venture and foreign auto companies, with more and more new-energy vehicle companies nearing profitability.

Amidst the claims by Great Wall and Wei Jianjun that an "automotive Evergrande" has emerged, some have hailed him as an industry whistleblower, while others question the exaggeration, given the fundamental differences between the automotive and real estate sectors.

01

The Reality Behind Chinese Auto Companies' High Debt

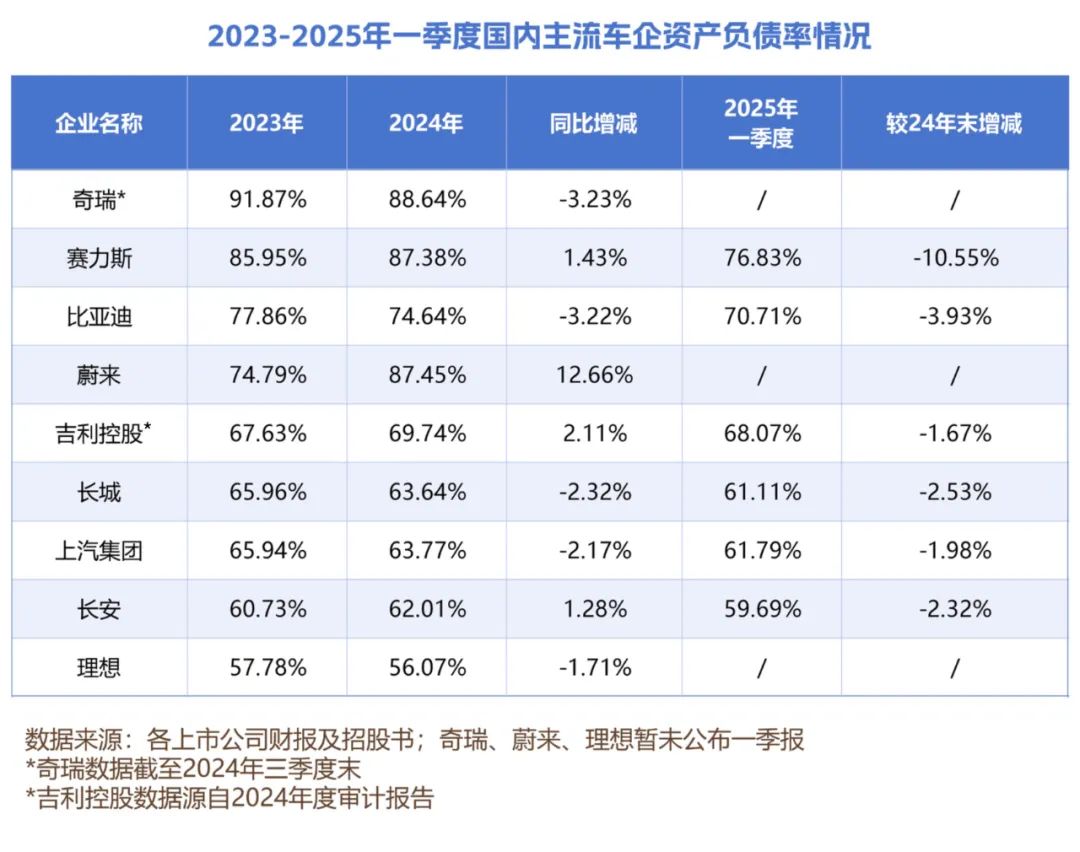

When Evergrande collapsed, its alarming debt ratio was a key concern. Hence, one perspective among proponents of the "automotive Evergrande" theory is that Chinese auto companies often have debt ratios of 70% or even exceeding 80%. However, despite the high debt ratios of Chinese auto companies, from the perspectives of industry average debt and debt structure, the two are not directly comparable.

Firstly, as a capital-intensive industry, high debt ratios are common among auto companies.

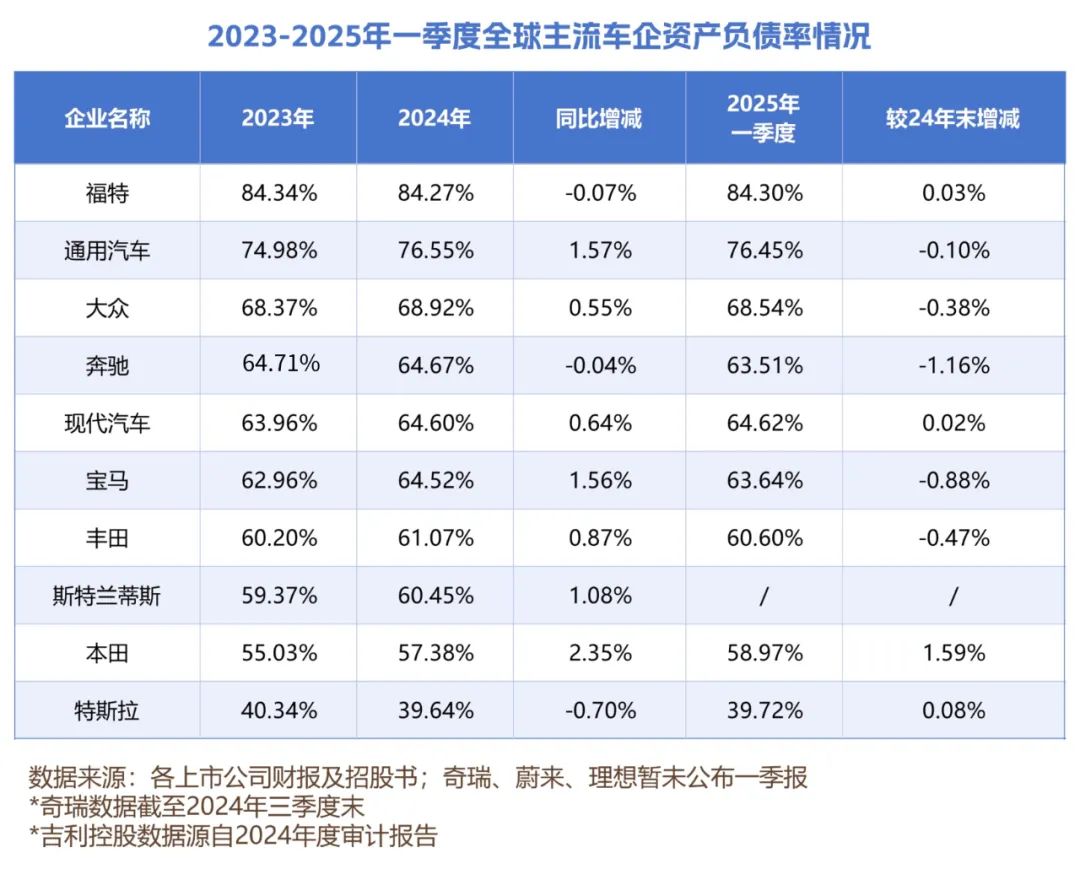

The first-quarter financial reports for 2025 reveal that the debt ratios of Toyota, Volkswagen, and Hyundai Motor, three leading global auto companies, range between 60% and 70%, similar to the debt ratios of domestic mainstream auto companies like BYD, Geely Holding, and SAIC Motor during the same period.

Even Thalys, which has a relatively high debt ratio among domestic auto companies, reported a debt ratio of 76.83% at the end of the first quarter of 2025, significantly lower than Ford, which has one of the highest debt ratios among overseas auto companies at 84.3% during the same period. Moreover, the debt ratios of mainstream Chinese auto companies such as BYD, Great Wall, SAIC Motor, and Changan have shown an accelerated downward trend in recent years.

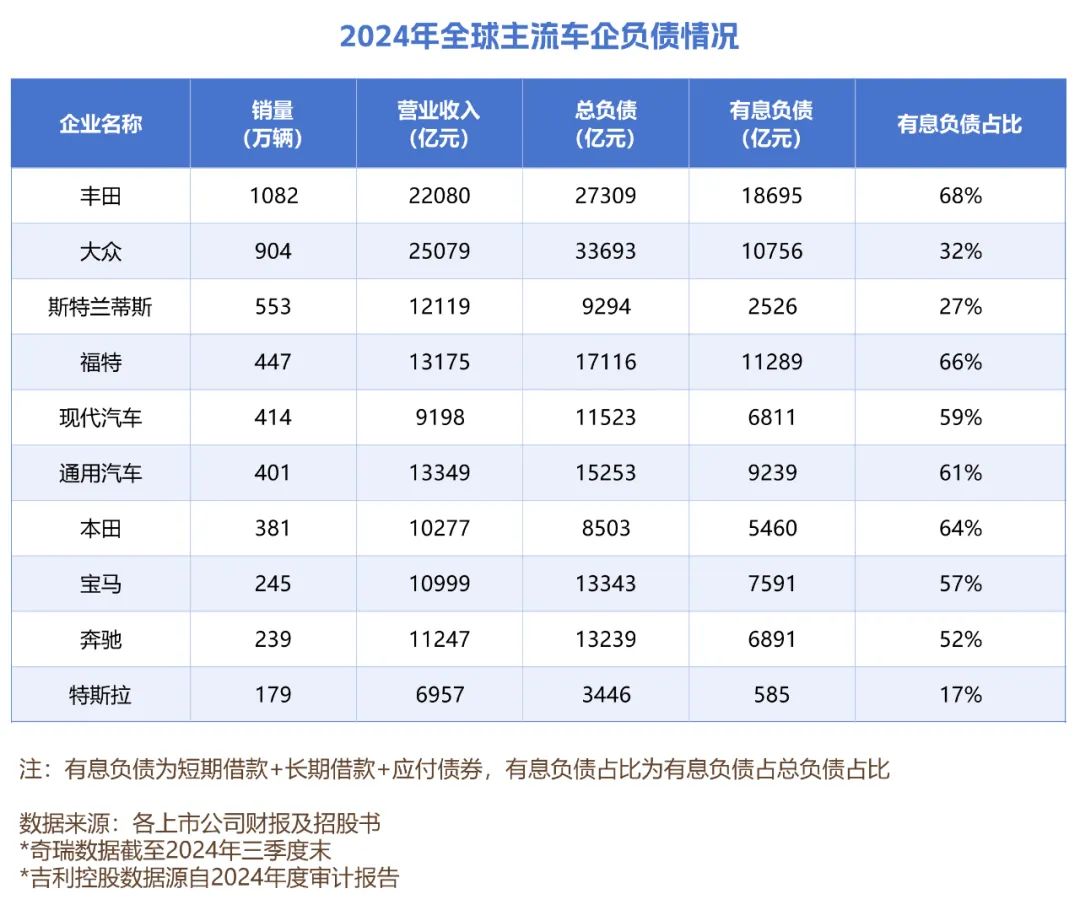

Secondly, to accurately assess a company's financial health, in addition to the debt ratio, it is crucial to consider the debt structure, particularly interest-bearing debt.

According to 2024 financial report data, among domestic mainstream auto companies, Thalys, which has a relatively high debt ratio, has an interest-bearing debt ratio of only 0.8%, while BYD's ratio is 5%, and the interest-bearing debt ratios of Lixiang, Great Wall, SAIC Motor, and NIO range between 9% and 22%. In contrast, overseas auto companies like Toyota, renowned for its stability, have an interest-bearing debt ratio of 68%, and other mainstream auto companies including Hyundai Motor, Honda, BMW, and Mercedes-Benz have interest-bearing debt ratios exceeding 50%.

In terms of financial discipline, Chinese auto companies clearly exhibit greater caution.

Furthermore, for an auto company aiming for stable operations, it is essential not only to control the scale of interest-bearing debt but also to maintain a reasonable level of non-interest-bearing debt.

It is worth noting that an excessively high proportion of non-interest-bearing debt and prolonged payment terms can easily strain supplier relationships, particularly for auto companies with a history of delayed payments to suppliers. Based on 2024 financial report data, BYD excels in these two aspects, with the lowest proportion of accounts receivable to revenue among listed domestic auto companies at 31% and the shortest average payment cycle to upstream suppliers at 127 days.

It is noteworthy that Great Wall Motors, which highlighted the excessively long payment cycles of some auto companies to upstream suppliers, has an accounts payable ratio of 39% and a payment term of 163 days.

02

Industry Whistleblowing or Self-Promotion?

Returning to the controversial remarks made by Great Wall and Wei Jianjun, according to a recent statement by Zhu Huarong, Chairman of Changan Automobile, perhaps the head of Great Wall Motors intended to remind the industry to focus more on risk control. However, this is not the first time that Great Wall and Wei Jianjun have shocked the industry and market with their statements.

In August and October of last year, coinciding with the release of Great Wall's financial reports, Wei Jianjun made remarks such as "Chinese auto companies are a bit too arrogant now" and "fake price wars." Additionally, at a recent launch event for a new Wey brand vehicle, Great Wall displayed a slogan stating, "We'd rather die than make extended-range vehicles."

It seems to have become a pattern for Great Wall Motors to make bold statements. Whether the intention is to sound an alarm for the industry or to champion consumer interests, in reality, these remarks have often created market divisions.

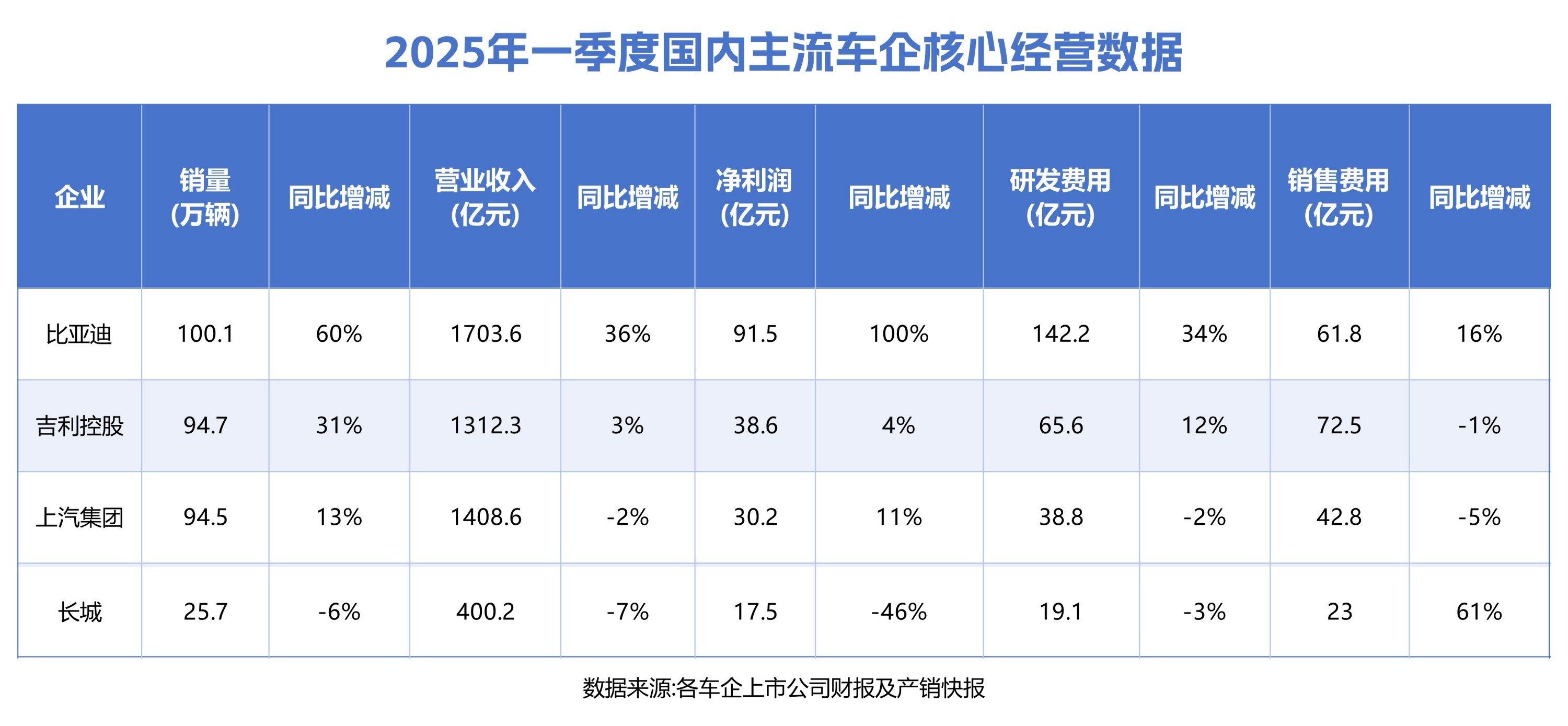

Currently, the domestic auto market has entered the final sprint of the elimination round. Some auto companies are advancing vigorously, while others are losing momentum. Even Great Wall, which reported impressive financial results at the end of last year, has encountered setbacks since entering 2025, with significant year-on-year declines in sales, revenue, and net profit in the first quarter.

To boost sales, Great Wall Motors has gone all in, even pricing its iconic four-wheel-drive SUVs at "two-wheel-drive prices." For instance, the starting price of the second-generation Haval Xiaolong MAX, at RMB 116,800, is more than 26% lower than that of the first-generation model launched in 2023. Additionally, Wei, targeting the RMB 300,000 market segment, has set a price for its all-new HAVAL H9 that is below market expectations.

With its sales volume falling to just over a quarter of that of mainstream private auto companies like BYD and Geely Holding, Great Wall cannot afford to be complacent. The sales target it set for 2025 is now out of reach. While sounding the alarm for the industry, Great Wall should also introspect and address its own challenges.

Some images are sourced from the internet. Please inform us if there is any infringement for removal.