Stock Prices Plunge: Are Auto Industry Price Wars Undermining the Sector's Foundations?

![]() 05/30 2025

05/30 2025

![]() 614

614

Lead

On Monday of this week, the stock prices of domestic auto companies listed on A-shares and Hong Kong stocks plummeted. Is this decline attributable to accidental or inevitable factors? Despite China's rapid progress in the global new energy vehicle market over the past two years, why have auto company stock prices collectively fallen sharply? Will investors remain optimistic about Chinese autos moving forward?

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Total words: 2228

Reading time: 4 minutes

On May 26, auto companies listed on A-shares and Hong Kong stocks experienced a relatively rare comprehensive decline. BYD's A-share fell by nearly 6%, with SAIC, GAC, Thalys, and BAIC also declining; in the Hong Kong stock market, Geely, BYD, Leapmotor, Great Wall, Li Auto, and others all saw significant drops, with almost no exceptions.

△Auto stocks on Hong Kong stocks fell sharply on Monday

A New Round of Price Wars Ignites the Decline

The primary reason for the decline in auto stocks this time is related to the continuous fall in auto prices. BYD initiated this price war. Shortly after BYD's price reduction, it quickly sparked a chain reaction among domestic auto companies, with Geely, Chery, Changan, GAC, and others following suit. With profit margins per vehicle already relatively low, these price reductions further impacted auto company performance, leading to the natural decline in stock prices.

Specifically, BYD announced a promotional activity with fixed prices or limited-time subsidies from May 23 to June 30, covering a total of 22 intelligent driving models under its Dynasty and Ocean networks. The Seal 07 DM-i intelligent driving version saw a reduction of RMB 53,000; the Qin PLUS DM-i intelligent driving version was priced at only RMB 63,800 after subsidies; and the Song PLUS intelligent driving version dropped to RMB 99,800.

△BYD has sparked a new round of price wars this year

BYD's decision to reduce prices is mainly tied to its annual sales target and the market environment in which it operates. Reportedly, BYD has set its sales target for this year at 5.5 million vehicles, but only 1.38 million vehicles were sold from January to April. June to August are traditionally slow sales seasons, so price reductions have become one of the main methods to stimulate terminal sales. The current market environment is also not favorable for BYD. On one hand, the sales of its mid-to-high-end brands, including Yangwang and Fangchengbao, have not achieved significant breakthroughs. This is not only due to the high-end market's relatively small volume but also because luxury brands such as BBA and ultra-luxury brands like Porsche and Ferrari still have a loyal following. On the other hand, BYD's Dynasty and Ocean series are facing comprehensive competition from independent brands. Traditional auto companies like Chery, Geely, Changan, and Great Wall, as well as new force auto companies such as Leapmotor and XPeng, all have multiple models that directly compete with the Dynasty and Ocean series.

△Geely Xingyuan has significantly diverted sales from BYD Dolphin and Seagull

When Will the Price Wars End?

The price wars among auto companies are the result of the combined effects of short-term and long-term factors.

In the short term, the rapid rise in auto company inventories is the key driver of this round of price wars. Data from the China Passenger Car Association shows that at the end of April 2025, the inventory of the national passenger car industry reached 3.5 million vehicles, an increase of 150,000 vehicles from the previous month and 120,000 vehicles compared to April 2024. As the leader of domestic auto companies, BYD's inventory increased by 56,900 vehicles from January to April. To digest this inventory, price reductions are the most direct method.

△As of the end of April, domestic auto company inventories are rising rapidly

In the long run, overcapacity in the domestic auto industry is the sword of Damocles hanging over auto companies. Data shows that as of 2023, China's total passenger car production capacity was approximately 55 million vehicles, while passenger car production and sales in 2024 totaled 27.477 million and 27.563 million vehicles, respectively. Such a vast amount of idle capacity naturally leads auto companies to occasionally use price reductions as a weapon to achieve their annual sales targets.

In fact, the auto industry has already recognized the harm caused by price wars. At this year's Electric Vehicle Hundred People Forum, representatives from the Ministry of Industry and Information Technology and other ministries and commissions successively voiced their concerns, pointing out the serious internal competition within the domestic auto industry and the situation where many auto companies have increased revenue but not profits. Data shows that the profits of the national auto industry in 2024 declined by 8% year-on-year, with a profit margin of only 4.3%. However, if the high inventory cannot be resolved and excess capacity cannot be cleared, price wars will remain inevitable in the future, even with government regulation. In an oversupply situation, auto companies can only find a way out through price wars to survive. In the brutal market competition, a batch of auto companies and corresponding capacities will gradually be eliminated, and then the market and prices may return to rationality.

△How to prevent vicious internal competition among auto companies has become one of the industry's main concerns

How Can Costs Be Further Reduced?

Price reductions are not a sustainable solution. After years of price wars, the cost potential that can be tapped by squeezing suppliers has long been exhausted. Most auto companies need to find new paths to reduce costs:

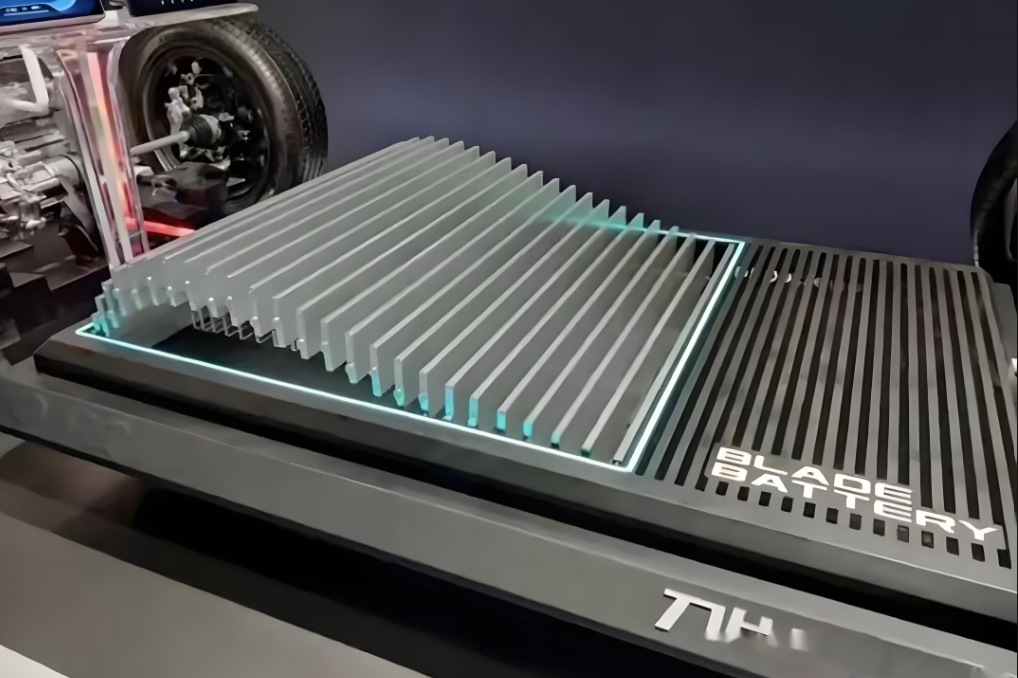

Self-manufacturing of core components. Taking BYD as an example, the main reason it can repeatedly initiate price wars is undoubtedly its large scale and BYD's possession of a vertical supply chain system and strong component manufacturing capabilities. Compared to auto companies that need to purchase all components externally, BYD can maximize the profits of the entire vehicle factory by transferring profits through its component companies. Especially in the upstream power battery field, BYD, with its first-mover advantage in lithium iron phosphate batteries, once built a cost moat that is difficult for other auto companies to surpass.

△Blade batteries give BYD a significant cost advantage

Expanding synergies. Facing an increasingly competitive auto market, auto companies have adjusted their internal strategies. Among them, after Geely Automobile released the "Taizhou Declaration," it carried out vigorous integration internally, making bold adjustments to brands such as Lynk & Co and Zeekr. At the technical level, R&D teams previously scattered under various brands have also been integrated. From previous internal competition to now focusing synergies, this has become Geely's main action to reduce costs. Besides Geely, NIO, which once created three sub-brands—NIO, Letao, and Firefly—has also adjusted its three sub-brands.

△Geely has carried out vigorous internal integration

Expanding into overseas markets. With the domestic market already saturated, expanding into overseas markets with relatively less intense competition is an important measure to increase sales. The automobile industry emphasizes economies of scale. Therefore, the more sales, the more the initial investment can be amortized to the greatest extent, the capacity utilization rate of auto companies can also be effectively improved, and auto companies have more room for maneuver when calculating costs. For example, Chery and SAIC MG have seen significant increases in sales in overseas markets in recent years, accelerating their dual-track approach at home and abroad.

Commentary

In recent years, although domestic price wars have been raging, the status of Chinese auto companies in the global auto industry, especially in the field of new energy, has risen rapidly. This is mainly because domestic auto companies have significantly improved their competitiveness in a fiercely competitive environment. However, years of endless price wars have also affected the healthy and stable development of the auto industry to a certain extent. With overcapacity still existing, price wars among auto companies will not subside, but price wars are not a sustainable solution. How to increase profits through innovation is an urgent problem that auto companies need to solve at present.

(This article is originally produced by "Heyan Yueche" and may not be reproduced without authorization)