HiPhi Motors Resurgence? Lebanese Investment Shows Promise, Yet Capital Alone Won't Drive Automotive Success

![]() 05/30 2025

05/30 2025

![]() 631

631

Manufacturing cars necessitates a "pure heart" – a dedication beyond financial means.

After a prolonged stagnation of one year and three months, HiPhi Motors has finally welcomed a potential "savior."

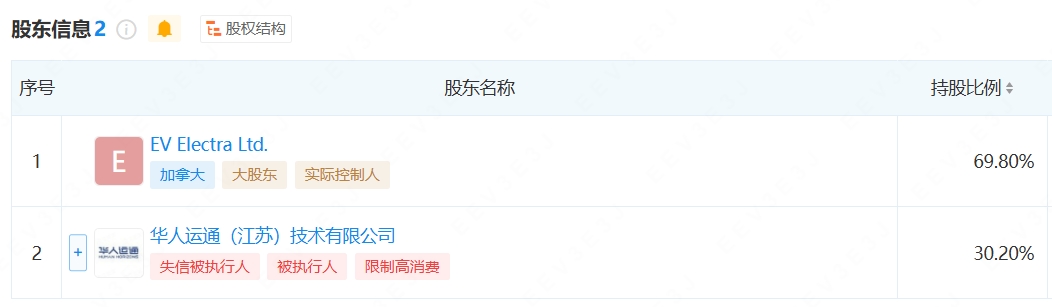

According to Qichacha, "Jiangsu HiPhi Motors Co., Ltd." was established on May 22, 2025, with a registered capital of approximately US$143 million. Human Horizons (HiPhi Motors' former parent company) holds a 30.2% stake, while the remaining 69.8% is owned by Lebanese automaker EV Electra Ltd. The legal representative has shifted from Ding Lei to the Lebanese company's CEO, Jihad Mohammad.

Screenshot: Qichacha official website

Recall that in June 2023, the Saudi Investment Ministry signed a memorandum of understanding worth roughly US$5.6 billion with Human Horizons. However, given that it announced a production halt and applied for pre-reorganization bankruptcy in 2024, it is likely that Human Horizons did not receive the US$5.6 billion investment.

When domestic market competition becomes too fierce, emerging automakers often seek assistance from overseas markets, as exemplified by Aiways, NIO, WM Motor, among others. Nevertheless, many of these emerging players have vanished, with very few actually receiving foreign support. HiPhi Motors is considered fortunate to have barely survived.

Yet, HiPhi Motors has already failed in the world's largest new energy vehicle market. Why is this Lebanese company still willing to invest in HiPhi Motors? What does the future hold for HiPhi Motors?

Who is this Lebanese "savior"?

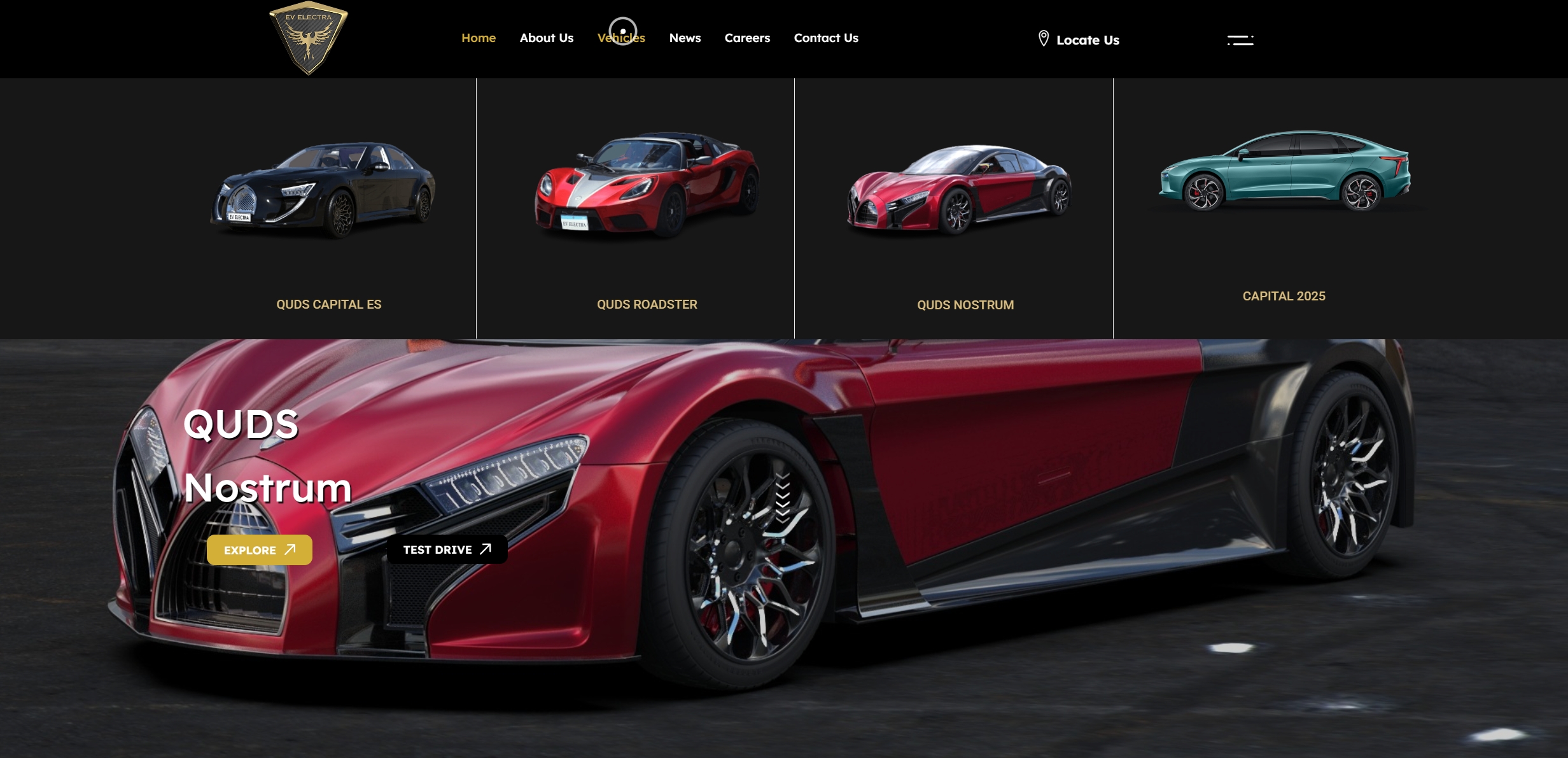

Like HiPhi Motors, EV Electra was also founded in 2017 and didn't launch its first pure electric vehicle until 2021. It proudly proclaims itself as "the first electric vehicle manufacturer in Lebanon and the Arab world" with an annual production capacity target of 10,000 vehicles.

Upon visiting the EV Electra official website, it becomes evident that among the five models showcased, the middle three are HiPhi Motors products, while the others are EV Electra models that have yet to enter mass production. Delving into the product introduction page, it's discovered that EV Electra has a total of four high-performance supercars in different positions, none of which have announced pricing.

In other words, EV Electra currently doesn't have a single truly mass-produced vehicle.

Screenshot: EV Electra official website

If judged by the standards of domestic emerging automakers, EV Electra would undoubtedly be classified as a "PPT carmaker." Furthermore, its ultra-high-end product positioning limits its market audience, making it difficult for the brand to recoup funds in a short period.

Despite being a relatively young car company with less than a decade of history, EV Electra has already adopted Geely Holding Group's "buy, buy, buy" strategy.

In 2021, EV Electra acquired a majority stake in Detroit Electric, an electric vehicle company based in Detroit, with an investment of up to US$500 million.

In December 2023, Jihad Mohammad purchased the ownership of the NEVS Emily GT and PONS Robotaxi projects.

In April 2024, EV Electra acquired an automotive factory in Italy.

Apart from acquisitions, on April 30 this year, investment company Silver Rock Group announced the signing of a US$450 million equity credit line with EV Electra. The funds will primarily be utilized for technology research and development in batteries/autonomous driving, expanding manufacturing bases, and enhancing the sales network system in global markets.

With insufficient market experience, EV Electra needs significant investment to bridge the gap with globally renowned automotive brands. Although specific sales data has not been disclosed, EV Electra currently has the financial means.

To establish a strong presence in the global new energy vehicle market, EV Electra must not only expand its influence but also further enrich its product line. The most cost-effective approach is naturally to "leverage existing resources."

Prior to investing in HiPhi, Jihad Mohammad conducted a poll on "which Chinese electric vehicle company is worth saving and has great potential." HiPhi Motors emerged victorious with an absolute number of votes, surpassing NIO and Evergrande Auto.

Screenshot: linkedin @Jihad M.Mohammad

Upon reflection, this makes sense. Compared to NIO and Evergrande Auto, which have entered the mainstream market, HiPhi Motors' product positioning aligns well with EV Electra, making it a preferred choice.

However, I must temper enthusiasm: Even if EV Electra pulls HiPhi Motors back from the brink, it doesn't guarantee a comeback in the domestic market. The best-case scenario would be becoming a "domestic brand deeply rooted in the overseas market."

The domestic market has become fiercely competitive, but overseas is not a sanctuary either.

HiPhi Motors' inability to compete in the domestic market isn't due to issues with its products but rather changes in the automotive market's competitive landscape.

When it first entered the market, HiPhi Motors, with its bold and innovative design, did attract wealthy individuals. However, as the penetration of new energy vehicles increases, more automakers are launching high-end new energy vehicles, such as Xiaomi, Lotus, and Denza. HiPhi, which relied on differentiated advantages, now finds itself in a more challenging position.

Even after launching the HiPhi Y, priced at the 300,000 yuan level and no longer confined to the high-end market, HiPhi Motors' brand aura has significantly weakened.

Image source: HiPhi Motors official website

According to April's new energy vehicle sales data, monthly sales of automakers like BYD, Zero Running, Xpeng, Li Auto, Wenjie, Xiaomi, and Deep Blue exceeded 20,000 units. Their main sales products target various market segments, with BYD, Zero Running, Xpeng, and Deep Blue focusing on cost-effectiveness, Li Auto and Wenjie targeting the high-end home SUV market, and Xiaomi rooted in the performance pure electric vehicle market.

These brands essentially cover most of China's mainstream markets, not to mention others like Avatar and Lunar.

Compared to the past, when the new energy market was dominated by "three new forces" of NIO, Xpeng, and Li Auto, the current market has evolved into a "one superpower and many strong players" pattern. BYD leads the pack, followed closely by new energy brands like Zero Running, Xpeng, Li Auto, and Xiaomi, which are continuously expanding their competitive advantages in the mainstream market.

Even if HiPhi Motors changes its strategy, it will be difficult to compete with so many new energy automakers. Seizing market growth opportunities is extremely challenging, and predicting the next market opportunity is even more so.

Therefore, developing the overseas market is HiPhi Motors' only chance for survival.

Of course, the overseas automotive market is far from a sanctuary. Neighboring automakers that have announced overseas expansion, such as Aiways and WM Motor, have already vanished from the news. NIO officially announced 1,219 orders during the Thai auto show in mid-April but hasn't announced any new orders in nearly two months. Recently, there have even been negative reports about the "headquarters LOGO being dismantled overnight."

Image source: Electric Vehicle News photography

Moreover, domestic brands like BYD, Chery, and Xpeng have intensified their globalization strategies, with their popularity in overseas markets steadily increasing. If HiPhi Motors can carve out a niche under such circumstances, it would indeed be impressive. However, frankly, Electric Vehicle News isn't very optimistic about HiPhi Motors' future.

Making cars requires more than just money; it also requires a "pure heart."

For HiPhi Motors, EV Electra is undoubtedly a "savior." However, Electric Vehicle News still points out that EV Electra is a pure electric automaker that hasn't yet mass-produced a single vehicle. Furthermore, there's no financial report data, sales data, or other key information available. The only advantage left is "money."

Having resources can indeed solve many problems, but in the domestic market, two companies with similar financial resources have entered the automotive field with vastly different outcomes.

One is Xiaomi Motors. In spring 2021, Lei Jun used the phrase "we have money" to instill confidence in investors about Xiaomi Motors' future. After three years of car making, Xiaomi SU7, with its superior capabilities compared to the Tesla Model 3 and Xiaomi's accumulated market reputation in the technology field, officially entered the Chinese automotive market, ultimately "dethroning" the Tesla Model 3.

Image source: Xiaomi Motors official website

The other is Evergrande Auto. Before the launch of its first model, Xu Jiayin revealed that Evergrande had invested up to RMB 47.4 billion in the automotive industry and unveiled nine new models at the Shanghai Auto Show that same year. During the launch event of its first model, the Hengchi 5, the then-president of Evergrande Auto, Liu Yongzhuo, boldly stated that "the Hengchi 5 will definitely sell well." However, according to official financial reports, the cumulative sales of the Hengchi 5 in 2023 were only 1,389 units.

Ultimately, before launching its first model, Evergrande Auto made bold claims such as "the best pure electric SUV under RMB 300,000," "simultaneous production of 15 models," and "achieving an annual production capacity of 5 million vehicles," which didn't leave a good impression on consumers. In contrast, Xiaomi Motors has truly made consumers feel its awe and sincerity in entering the automotive market.

Therefore, the outcomes of these two automakers are vastly different.

EV Electra, also wealthy, is currently in a stage of heavy investment. However, in the automotive industry, money alone cannot drive market sales. Consumers need to feel the sincerity behind the product to give it more market opportunities.

(Cover image source: HiPhi Motors official website)

Source: Lei Technology