Who Will Continue to Wage Price Wars Amidst State Crackdowns?

![]() 06/04 2025

06/04 2025

![]() 431

431

Introduction

Despite the state's rigorous crackdown, some entities remain entrenched in the mirage of price wars, while the market has already rendered a harsh verdict.

Recently, the Ministry of Industry and Information Technology (MIIT) voiced opposition to the "price war" in the auto industry, emphasizing that it will prioritize rectifying payment terms for auto manufacturers' suppliers. This announcement underscores the government's unwavering commitment to curbing price wars in the sector.

As early as March, the government work report sounded the alarm on disorderly competition in the auto industry. Subsequently, on May 20, the National Development and Reform Commission reiterated the need to address inward-turning competition during a press conference. During this period, several auto industry leaders, including Yin Tongyue, chairman of Chery Holding, and Wei Jianjun, chairman of Great Wall Motors, expressed their aversion to engaging in price wars.

However, before relevant departments could reiterate their warnings, an even more intense price war swept through the entire auto industry.

In late May, several mainstream independent brands and joint ventures successively announced price reductions, sparking a chain reaction of follow-ups from multiple brands. Some models witnessed price cuts of up to nearly RMB 100,000 compared to their older versions. Consequently, pessimism spread, and auto stocks swiftly experienced a broad decline, revealing the capital market's disapproval.

Faced with relentless price wars, which have led to slim profit margins in the auto industry and a wait-and-see attitude among consumers, both detrimental to the sector's development, the state has resolved to intensify efforts to rectify the situation.

According to industry insiders' predictions, in addition to strengthening penalties for violations of laws and regulations and further implementing measures to comprehensively manage inward-turning competition, the focus will also be on inspecting payment term issues of related enterprises that owe money to parts enterprises, and ensuring compliance with the government's requirements for shortening payment terms within a specified timeframe.

01 Price Wars Raise Red Flags for Industry Health

At the beginning of 2023, Tesla spearheaded a price war, with its Model 3 and Model Y models experiencing price reductions of RMB 20,000 to 48,000. BYD swiftly followed suit with a "same price for oil and electric vehicles" strategy, and the price of its mainstream sedan, the Qin PLUS, fell below RMB 100,000, evoking a strong market response. Subsequently, over 40 auto companies and hundreds of models were drawn into the fray.

Since then, the price war in China's auto market has spiraled out of control. Data from the China Passenger Car Association (CPCA) shows that in 2024, a total of over 220 models in the domestic auto market participated in price reductions, significantly exceeding the approximately 150 models in 2023. By 2025, this trend showed no signs of abating, even amidst continuous official advice.

During this period, with the industry's advancement, automotive technology became increasingly mature, and the driving experience continuously optimized, yet selling prices continued to decline. Data indicates that in 2024, the average price of pure electric vehicles fell by RMB 18,000, a decrease of 9.2%; the average price of plug-in hybrids decreased by RMB 13,000, a drop of 6.8%. Roland Berger's "Foresight 2025" report noted: "Fierce competition has intensified the survival pressure on traditional auto companies."

Amid the chain reaction triggered by the wave of price reductions, dealers bore the brunt. A report by the China Automobile Dealers Association revealed that nearly 85% of dealers experienced price inversions, with about 60% of dealers facing price inversions of more than 15%.

"Over the past few months, I've test-driven over a dozen new cars," a consumer told "Auto Commune". "Buying the same car a few months later can save you tens of thousands of yuan." This wait-and-see mentality further dampened consumer enthusiasm and disrupted the integrity of the auto usage chain.

Simultaneously, a deeper crisis is also emerging at the supply chain end.

Last year, an email from an auto company requesting suppliers to reduce prices by 10% starting from 2025 sent shockwaves through the industry. Concurrently, the payment terms of auto companies have been continuously extended, averaging 182 days, double that of international auto companies. Among them, Haima Automobile's payment terms are as long as 298 days, meaning suppliers must wait nearly 10 months after delivery to receive payment. A supplier of interior decorations once helplessly told "Auto Commune": "Under vicious competition, we are forced to slow down product innovation."

Under these ripple effects, while China's auto market once again stood at the 30 million unit production and sales threshold, unlocking the achievement of being the world's largest for 16 consecutive years, industry profits have plummeted.

Data shows that the industry-wide profit margin was only 4.3% in 2024. In the same year, the total profit of China's 18 listed auto companies was only RMB 48.8 billion, whereas Toyota's net profit alone reached RMB 125.3 billion. By the first quarter of 2025, the industry profit margin had further declined to 3.9%, far below the average level of the manufacturing industry.

In addition to insufficient profitability, China's auto industry has endured a period of intense pain due to price wars, supply-demand imbalances, and the impact of industrial transformation. In the first eight months of 2024, the industry suffered retail losses of RMB 138 billion, dealers faced the dilemma of an average of 10 closures per day, and the supply chain was squeezed below the cost line, reflecting deep-seated structural contradictions within the industry.

Behind these figures lie health indicators that have already raised red flags for the auto industry.

Despite the state's rigorous crackdown, some entities remain entrenched in the mirage of price wars, but the market has already rendered a harsh verdict - while Toyota is setting a 91-year high profit of nearly JPY 5 trillion in the US market, Chinese auto companies are still grappling with profits of just a few thousand yuan per vehicle. Therefore, it is evident that the state's measures to rectify price wars and regulate market competition are accelerating.

02 When Will We Return to the Right Track?

Some refer to May 2004 as the "black May" for China's auto market.

At that time, Shanghai GM took the lead in launching a price reduction campaign codenamed "Breakthrough 2005" on May 17, 2004, with price adjustments for its Buick Regal series and Buick GL8 business vehicles, with the maximum reduction reaching RMB 40,000. Among them, Buick Excelle launched two new models, effectively adjusting prices. This adjustment encompassed Shanghai GM's entire lineup, with an average price reduction of 8%.

Subsequently, Volkswagen, Dongfeng Peugeot, Beijing Hyundai, and others followed suit, triggering the first round of large-scale price wars. For the next six years, price wars persisted, with auto companies competing for market share through strategies such as "high opening and low closing" and "price reductions and configuration cuts", leading consumers to form the expectation of "buying only when there's a price reduction".

This scenario bears an uncanny resemblance to the current price wars.

Thus, we find that if we extend the timeline, price wars in China's auto market are not isolated incidents but exhibit periodic outbreak characteristics.

So, why do price wars continue to emerge? What are the core reasons and underlying logic? Through comparisons of the auto market background and industry analysis, we have uncovered numerous clues.

One of the most core reasons is the structural imbalance between supply and demand.

From 2017 to 2022, domestic auto demand stagnated below 30 million units for an extended period, but new energy capacity expanded rapidly during this time, further highlighting the issue of overcapacity. In the process of eliminating excess capacity, direct collisions between auto companies intensified, especially in 2024 when the supply-demand contradiction escalated, with the new energy penetration rate exceeding 50% and fuel vehicle sales declining by 12% year-on-year, pushing previously behind-the-scenes competition further into the spotlight. This explains the prevalence of verbal spats between auto executives in recent years.

Weak demand has compelled many auto companies to use the "poison" of price wars to stimulate market growth.

Sales in 2024 increased by only 3% year-on-year, significantly lower than the 12% increase in 2023. This change is reflected in the increasingly unhealthy dealer inventory index. Under the pressure of inventory and sales, dealers naturally welcome official price reductions and related subsidy measures, as official propaganda can stimulate indecisive customers to make decisions, accelerate sales, and alleviate high inventory pressure.

In addition to the imbalance in supply and demand, technological change driving industry reshuffling demonstrates the positive side of price wars.

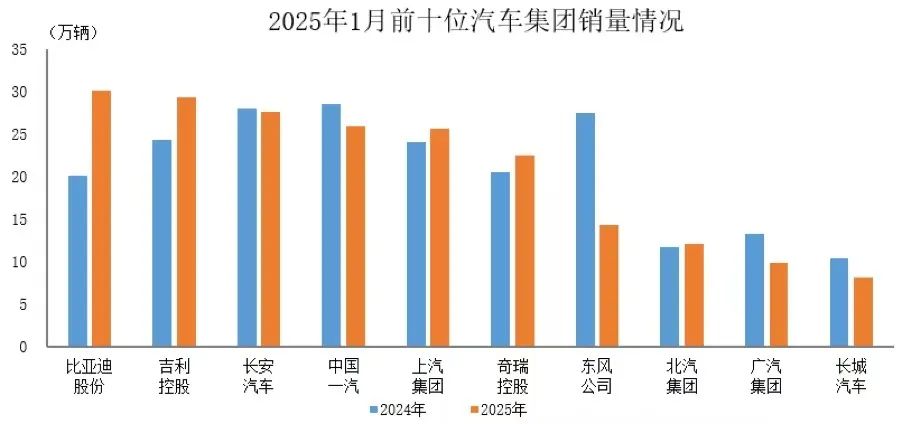

Due to the electrification transition, the lifecycle cost advantages of new energy vehicles have become prominent, forcing fuel vehicles to reduce prices to survive. For example, BYD reduces battery costs through scale, gaining more room for price reductions. Driven by technology, the Matthew Effect in the auto market has intensified, with the top ten sales companies long occupying more than 80% of the market share. Leading companies are accelerating the elimination of weaker brands through price reductions.

In this process, cost transmission and supply chain pressure have compelled auto companies to demand price reductions from suppliers; otherwise, they will struggle to turn a profit.

Dealers are then forced to bear the brunt - in 2024, over 4,000 4S stores withdrew from the network, Guanghui's market value fell by 90%, and the OEM's "inventory pressure" model became unsustainable.

Overall, the essence of price wars is a survival strategy under the dual pressures of overcapacity and technological change. In the short term, it accelerates industry reshuffling, with leading companies eliminating weaker brands due to cost advantages; in the long term, price wars are unsustainable, and the collapse of industry profits will inevitably force companies to return to rational competition, with the state's intervention accelerating this return to the right track.

Of course, to effectively prevent inward-turning price wars in the auto industry, in addition to the state's guiding, supervisory, and regulatory roles, auto companies themselves must also transform their development concepts and competitive strategies to form an internal and external synergy - including firmly moving towards the era of intelligence, actively expanding overseas markets, reconstructing industrial values, and reshaping supply chain relationships, among others.

As for what needs to be done now, it is to awaken from the mirage of price wars as soon as possible.

Editor-in-chief: Cao Jiadong, Editor: He Zengrong