Li Auto: Navigating Through Cyclical Challenges to Initiate Sustained Growth Momentum

![]() 06/04 2025

06/04 2025

![]() 506

506

When Li Auto demonstrates its resilience, it signifies that this burgeoning player is poised for even greater heights.

Body

Recently, Li Auto unveiled its Q1 financial report, a document that truly stands out in every respect.

However, a deeper dive into the report reveals Li Auto's profound and far-reaching vision for the future.

I. Financial Fortitude of Li Auto

Let's delve into the numbers.

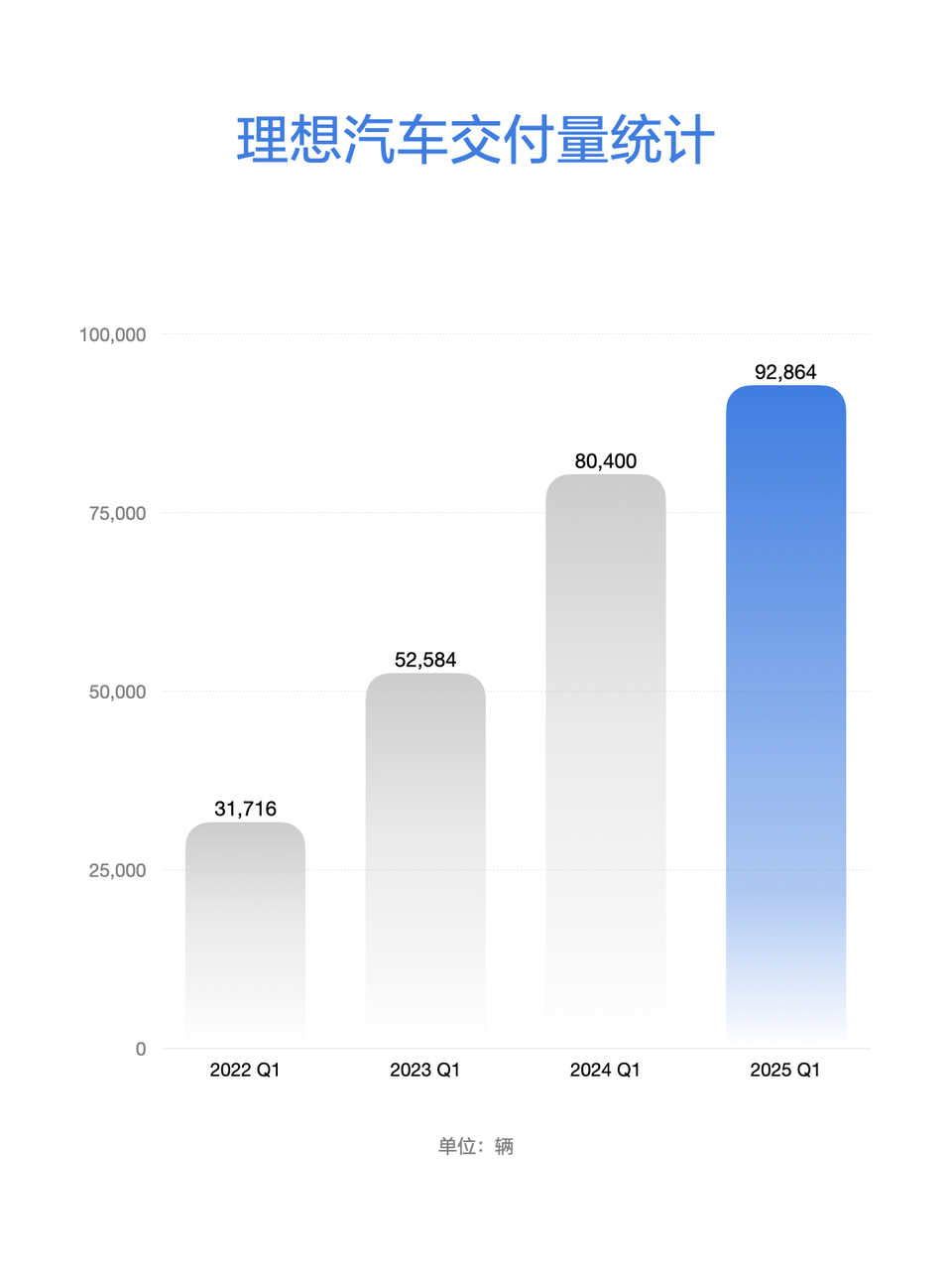

Despite the first quarter traditionally being a slow period for auto sales, Li Auto has shown remarkable resilience. It delivered 93,000 vehicles, maintaining its top spot among Chinese automobile brands priced above RMB 200,000. Sales increased by 15.5% year-on-year, double the growth rate of the overall new energy vehicle market in the same segment.

Within its model lineup, the Li L6 led sales of mid-to-large SUVs priced between RMB 200,000 and RMB 300,000. The cumulative sales of the Li L7 and Li L8 models topped the sales of mid-to-large SUVs priced between RMB 300,000 and RMB 400,000. The Li L9 emerged as the sales champion among large SUVs priced between RMB 400,000 and RMB 500,000.

Notably, the cumulative delivery volume of the Li L series officially surpassed 1 million units, making it the first extended-range product series to reach this milestone globally.

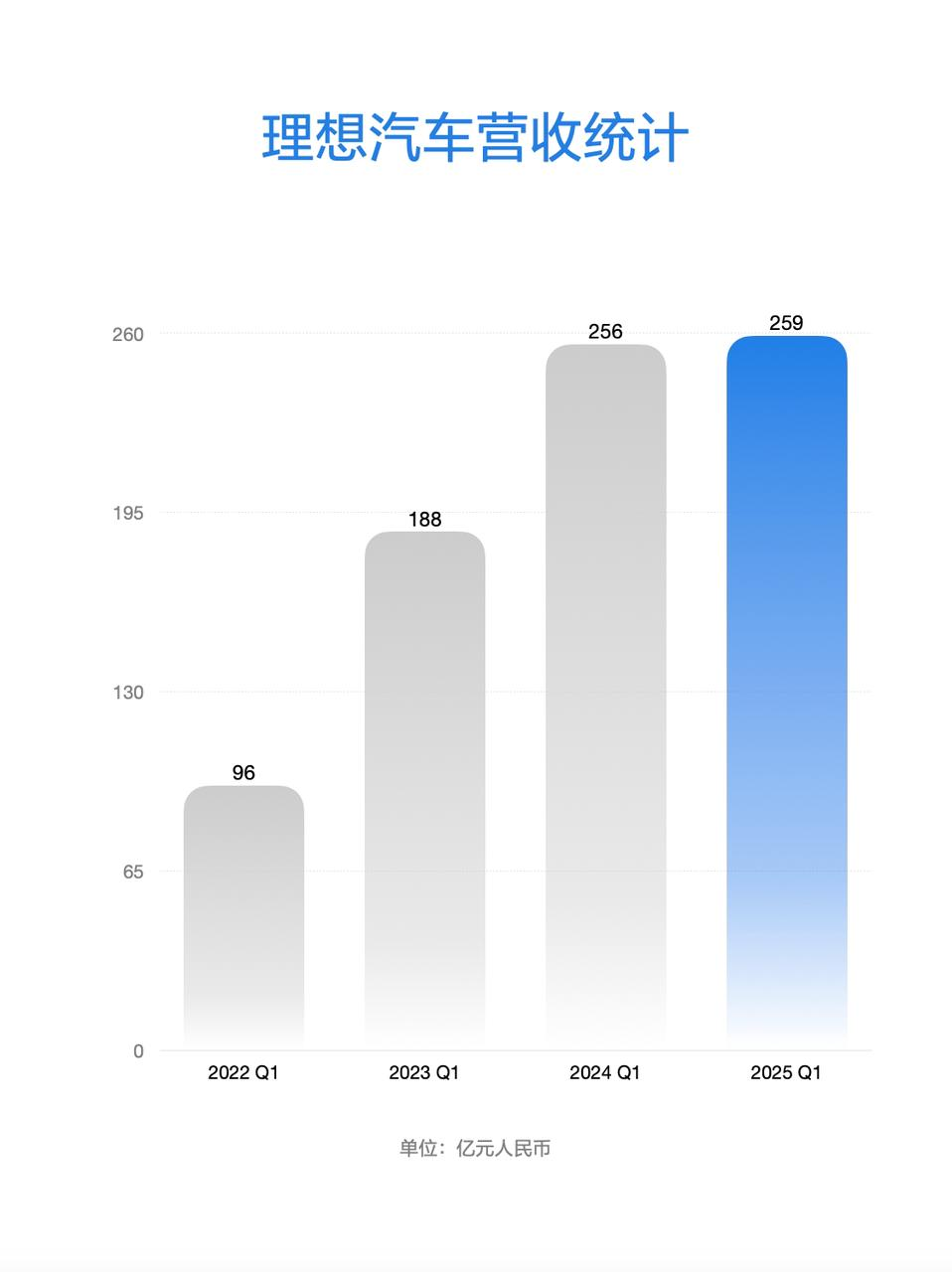

This impressive delivery performance naturally translated into robust revenue. Li Auto generated revenue of RMB 25.9 billion in Q1. Coupled with rigorous cost management and expanded scale effects, the quarterly net profit reached RMB 647 million, an increase of 9.4% year-on-year. Notably, while most emerging players grapple with widening losses, Li Auto has been profitable for ten consecutive quarters.

Even more impressive, Li Auto projects that the next quarter's delivery volume will range from 123,000 to 128,000 units, an increase of 13.3% to 17.9% year-on-year; quarterly revenue is expected to reach between RMB 32.5 billion and RMB 33.8 billion, an increase of 2.5% to 6.7% year-on-year.

It seems evident that Li Auto has transformed into a seasoned and stable automaker.

In terms of sustainability, Li Auto also showcases exceptional R&D capabilities and cash reserves. R&D expenses in Q1 amounted to RMB 2.5 billion, marking accelerated progress towards the evolution of the next-generation intelligent agent.

A case in point: by the end of May, Li Auto's in-car system had achieved the ability to autonomously plan and execute complex instructions. For instance, with a simple statement of user needs, the in-car system can autonomously handle tasks like ordering tea and fast food, tracking packages, and more.

While pre-research into next-generation technologies will lead to a sequential decrease in cash reserves, with RMB 110.7 billion in cash reserves, it's not an exaggeration to call Li Auto the "cash king" among emerging players.

Having covered the financial highlights, the underlying issues are the core focus of this report.

II. Navigating Product Transition Challenges and Strategic Transformation

In reality, Li Auto is experiencing some pain points.

Let's dissect the data.

On a sequential basis, auto sales decreased by more than 40%; the average selling price per vehicle also dropped from over RMB 300,000 in the same period last year to approximately RMB 270,000; sales of the MEGA fell short of expectations due to pricing and design controversies...

Of course, these poor data can partly be attributed to the Spring Festival holiday, the transition of the L series, and the initial ramp-up of the MEGA. However, there are also issues that Li Auto needs to address head-on.

Firstly, how to navigate the pure electric vehicle (EV) sector. Amidst intensifying competition in the extended-range sector, Li Auto must not only defend its market position but also explore new opportunities in the EV field.

Secondly, with the market heating up and price wars intensifying, Li Auto needs to determine where to find new growth avenues after securing a foothold in the high-end market.

These questions are precisely what Li Auto must contemplate as it transitions into a mature automaker.

However, the financial report provides insights into Li Auto's strategies.

On one hand, Li Auto is shifting from "configuration competition" to "technology premium" to avoid the pitfalls of a price war. On the other hand, Li Auto has planned a new EV series to avoid being one-dimensional.

III. Three-Pronged Strategy: EV + Intelligent Driving + Market Expansion

We are exceedingly optimistic about Li Auto's future.

Because Li Auto has charted a robust path for future growth.

Firstly, the accelerated implementation of the EV strategy.

At the 2025 Shanghai Auto Show, Li Auto launched the MEGA Ultra intelligent refresh version and the MEGA Home special edition MPV. The MEGA Home began deliveries in late May.

The MEGA Home version accounts for over 90% of MEGA orders, and production capacity for zero-gravity rotating seats is being accelerated, with a July production target of 2,500-3,000 units.

According to official news, Li Auto's MEGA is expected to achieve a stable monthly delivery volume of 2,500 to 3,000 units, marking a 150% to 200% increase compared to the stable monthly delivery volume of the 2024 model.

Furthermore, the EV SUV Li i8 will be launched in July. Boasting leading product capabilities such as ultra-long range, ultra-low energy consumption, ample space, and low wind resistance, the Li i8 has already undergone over 9.5 million kilometers of testing.

For Li Auto, this opens up an entirely new EV market with sales potential of 2.1 million units.

Secondly, deepening the technological moat.

Li Auto's self-developed next-generation advanced driver assistance system, VLA (Vision-Language-Action Model), integrates spatial, linguistic, and behavioral intelligence, possessing strong 3D spatial understanding, logical reasoning, and behavior generation capabilities. The VLA driver model addresses safety and model black box issues, providing users with a safe, efficient, and more human-like driving experience, accelerating the evolution from L2 combined driving assistance to higher-level autonomous driving. According to the plan, Li Auto's VLA driver model will be released simultaneously with the Li i8, the company's first EV SUV product.

Additionally, Li Auto's self-developed automotive operating system, "Li Xinghuan OS," has been fully open-sourced, empowering the industry with self-developed technology. Li Xinghuan OS is an automotive operating system designed for the era of artificial intelligence. Leveraging its advantages of flexible adaptation, rich hardware support, powerful performance, and high security, Li Auto has significantly shortened chip adaptation and verification time and supports domestic chip architectures, fostering an open-source ecosystem and promoting coordinated industry development.

Finally, rational expansion that is both strategic and precise.

Currently, Li Auto is not lacking in customers, yet it continues to expand its product portfolio. The proportion of central stores and auto city stores has been steadily increasing, and coverage in fourth- and fifth-tier cities has been continuously optimized and upgraded. This expansion is a strategic move, further enhancing Li Auto's brand presence in lower-tier markets.

Li Auto's "Hundred Cities and Numerous Stars Plan" aims to achieve a market share of 25%-28% in pilot stores in fourth- and fifth-tier cities by 2026, with a target incremental sales volume of over 100,000 units.

Meanwhile, Li Auto is also making steady progress in building its supercharging network.

As of the end of the first quarter of this year, the supercharging network covers over 50,000 kilometers of highways, with a coverage rate of over 70% of national high-speed mainlines. To date, Li Auto has opened 2,350 Li Supercharging Stations equipped with over 12,700 supercharging piles. It is expected that by the time the Li i8 is launched in July, Li Auto will have established over 2,500 supercharging stations.

In terms of data, Li Auto's self-built network scale in both urban and high-speed areas ranks first among domestic automakers.

It is precisely based on these factors that we believe Li Auto will embark on a robust growth trajectory in the coming quarter.

Coincidentally, Li Xiang, the founder of Li Auto, also publicly stated a few days ago that Li Auto aims to achieve an ambitious annual revenue of RMB 300 billion through extended-range SUVs, EV SUVs, and the upcoming comprehensive delivery of the Li MAGE series.

We eagerly anticipate the outcome.