European Auto Market | France May 2025: Private Purchases of Electric Vehicles Plunge

![]() 06/05 2025

06/05 2025

![]() 666

666

In May 2025, the French automotive market underwent significant turbulence, with overall sales dropping 12.3% year-on-year. Notably, private sales of electric vehicles plummeted by 58%, serving as a prominent indicator of market distress.

While local stalwarts like Renault, Peugeot, and Citroen struggled, Chinese brands defied the trend, with MG performing exceptionally well.

01

Sales Decline and Power Structure Reconfiguration:

Mainstream Brands Reel Amid Market Turbulence

In May 2025, new car sales in France hit 124,000 units, marking a 12.3% year-on-year decline and the worst May performance since the COVID-19 pandemic peak in 2020.

Year-to-date sales fell by 8.3%, and annual sales are projected to fall below 1.5 million units, reverting to levels last seen in the 1970s.

● On the demand side, private car purchases and corporate fleets declined in tandem, both by over 18%. The only segment propping up the market was short-term leasing and manufacturer self-purchases, which were tactical and unsustainable.

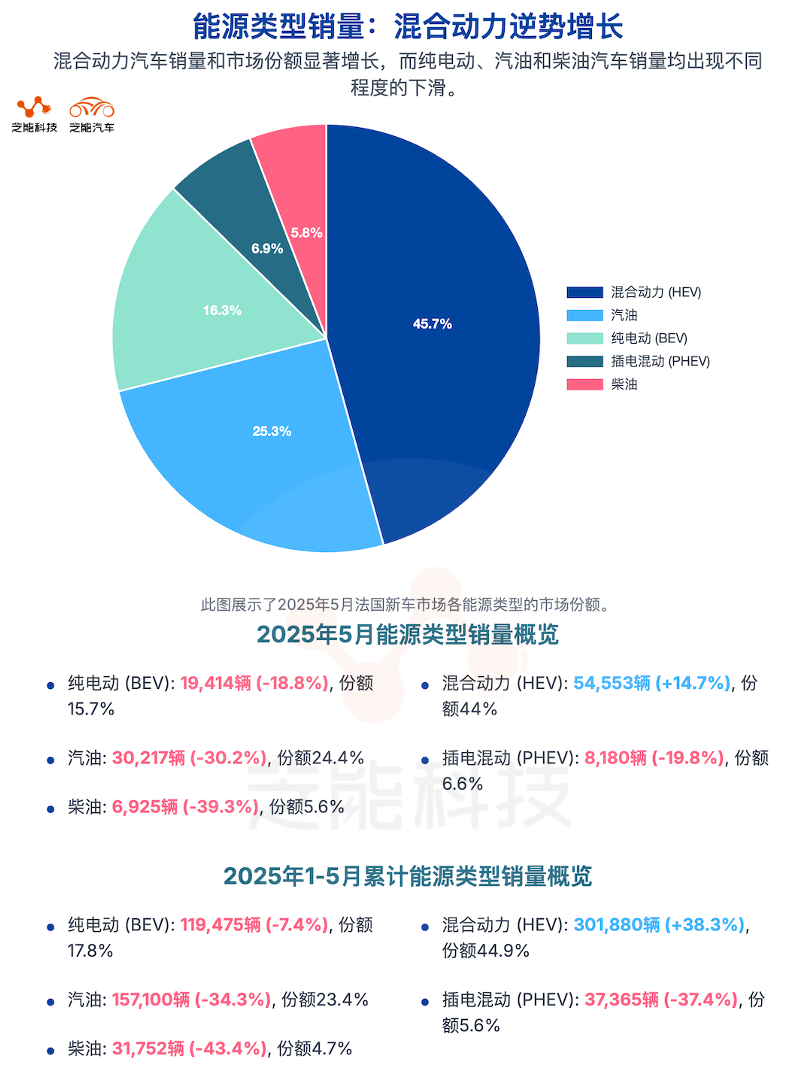

● In the powertrain landscape:

◎ Both plug-in hybrid and pure gasoline models witnessed significant declines, with overall electric vehicle (BEV) sales down 18.8%. Private BEV purchases plummeted 58% year-on-year, reducing their market share from 16.9% in the same period last year to 14%. ◎ Relatively, hybrid (HEV) emerged as the sole growth technology, with sales surging 14.7% year-on-year and market share rising from 33.7% to 44%, nearly becoming the default choice for French consumers. This reflects a crisis of confidence in electric vehicles amid subsidy cuts, charging inconveniences, and rapid depreciation of used electric cars.

● In terms of brands:

◎ Renault maintained its top spot but fell 15.2% year-on-year; ◎ Peugeot dipped slightly by 5.2%, with its market share stable; ◎ Citroen saw a marginal 2.7% year-on-year increase, but its total volume was overtaken by Dacia, which grew 12.4% to capture a 9.6% market share, its highest in nearly a year.

German brands faced overall pressure, with Volkswagen, BMW, Mercedes-Benz, and Audi all recording double-digit declines. BMW's decline reached 22.2%, and Toyota suffered a steep contraction of 26.5%. Against this backdrop, Skoda shone as the only bright spot among European traditional brands, growing 13.3% and entering the top eight for the first time.

● In the model rankings:

◎ Renault Clio reclaimed the top spot with nearly 10,000 units sold in a single month, a 23.4% year-on-year increase, marking its best performance since the COVID-19 pandemic in 2020. ◎ Peugeot 208, Dacia Sandero, and Peugeot 2008 ranked 2nd to 4th but all reported negative growth. ◎ Notably, the new generation Citroen C3 jumped to fifth place, while the initially underwhelming Dacia Duster and the new Peugeot 3008 achieved triple-digit growth.

02

Chinese Brands Expand Against the Trend:

Electric Vehicles as a Spearhead, Chinese Manufacturing Accelerates Penetration

Amid the double trough of sales and confidence in May 2025, the French market presented an optimal window for Chinese brands to make breakthroughs.

MG stood out, with sales surging 190.4% year-on-year to 2,500 units, propelling it to 14th place in the brand rankings.

Among specific models, MG 3 and MG ZS ranked in the top 30 with 1,059 and 1,022 units sold, respectively. MG ZS achieved a monthly year-on-year growth rate exceeding 700%, while MG 3's was as high as 566%. These two models collectively formed the backbone of MG's presence in the French market.

Chinese brands primarily entered the French market through electric vehicles, leveraging the "cost-effectiveness + intelligent configuration" combination.

Despite the overall decline in pure electric vehicle sales in France, Chinese brands managed to grow against the trend, indicating that their product mix resonates with specific market segments and that traditional brands still have gaps in the 100,000-300,000 RMB price range for BEV products.

In contrast, Tesla's sales fell by 67.2%.

Summary

The French auto market is undergoing multiple transformations in supply, demand, and technology paths, with overall sales under pressure, fluctuating confidence in electric vehicles, and declining mainstream brand power. Amidst this uncertainty, Chinese brands have found avenues for growth, gradually establishing a new order rooted in product differentiation, spanning from electric compact cars to intelligent SUVs.