Wavelength Optoelectronics Achieves 32% Gross Margin: Breaking ASML's Moat in Domestic Optical Devices

![]() 08/11 2025

08/11 2025

![]() 623

623

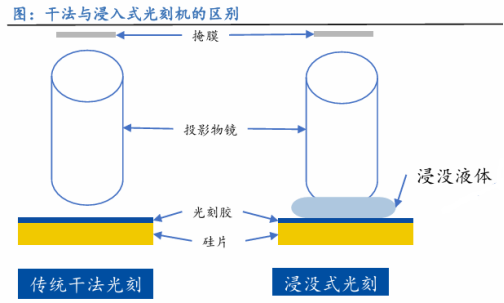

As global semiconductor giants invest $50 billion in expanding production for advanced processes below 7nm, and immersion lithography machines become the cornerstone of the chip arms race, a Chinese optical enterprise is quietly reshaping the landscape of lithography equipment.

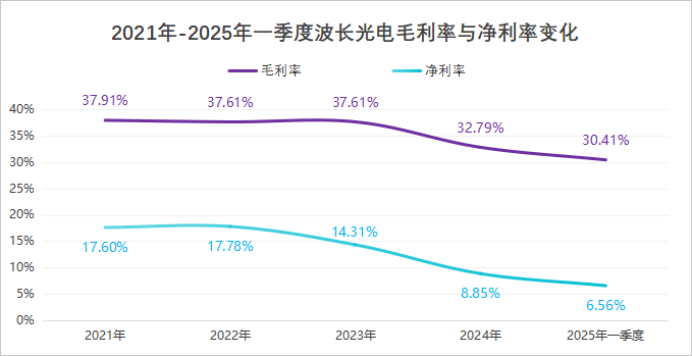

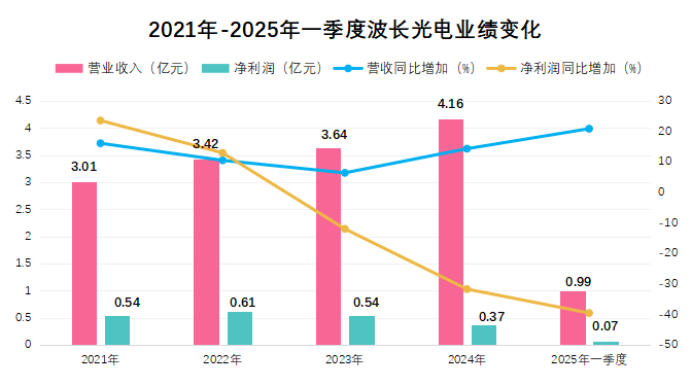

In 2024, Wavelength Optoelectronics leveraged semiconductor lithography revenue of 17.7 million yuan to generate total revenue of 416 million yuan. Behind the 32.79% gross margin lies a battle of technological breakthroughs centered on the 'optical heart' of domestic lithography machines.

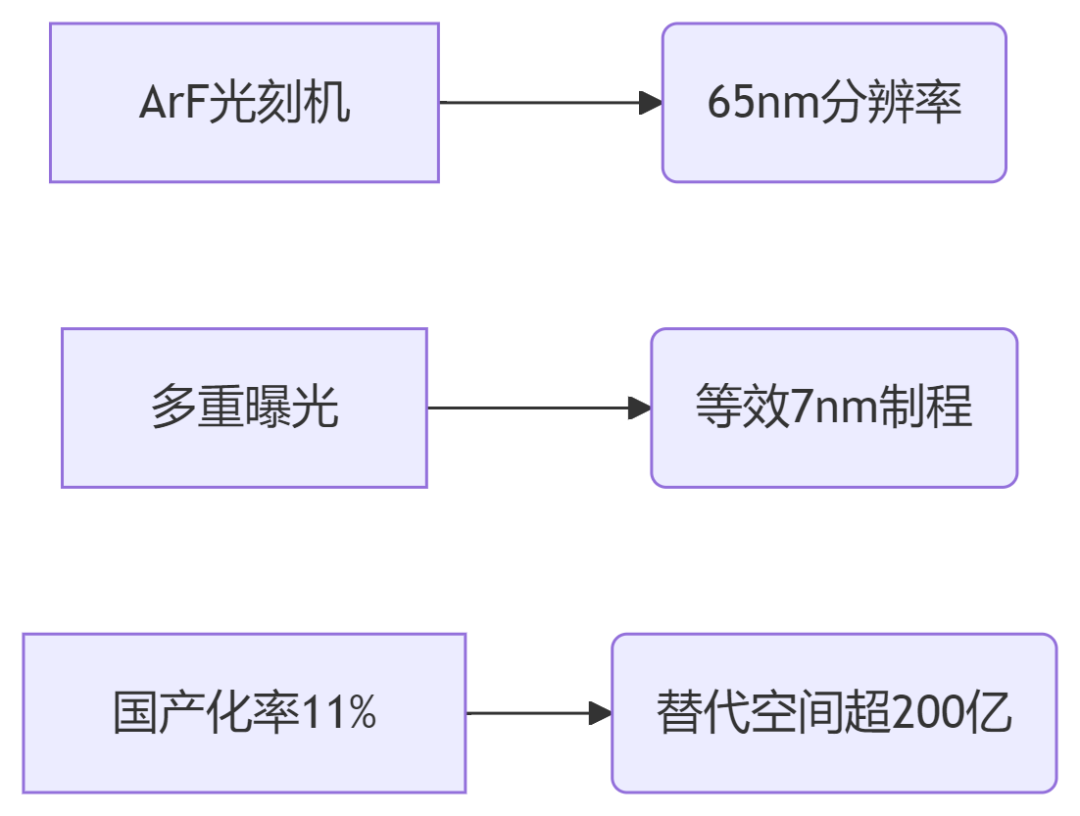

The domestic optical journey towards the 65nm breakthrough has been a long and arduous one.

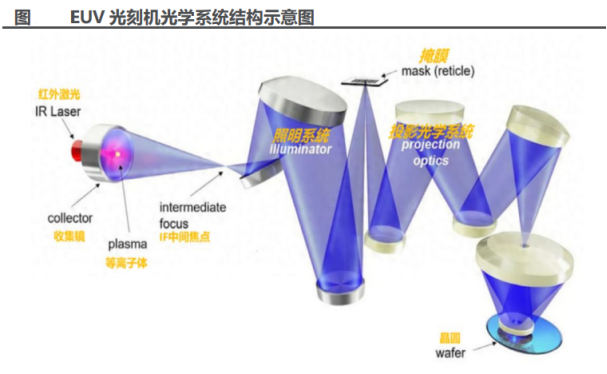

Under the shadow of ASML's monopoly on EUV lithography machines, domestic semiconductor equipment companies have embarked on a circuitous path to self-sufficiency.

Wavelength Optoelectronics' three-step leap to break the deadlock:

1. Precision optical base: Leveraging 20 years of laser lens technology to create lithography objectives.

2. Ultra-precision processing: Employing magnetorheological finishing and ion beam shaping with an accuracy of 0.1nm.

3. Optical system integration: Achieving an NA value exceeding 1.35 (a critical point for immersion lithography).

In October 2024, domestic ArF lithography machines achieved a 65nm resolution breakthrough, with key optical components provided by Wavelength Optoelectronics accounting for 27% of the cost structure. Chairman Huang Shengdi stated at the technology conference, "The resolution race for lithography machines is essentially a millimeter-level war of optical precision."

A "Optical+" strategy with three-dimensional penetration.

From industrial lasers to semiconductor lithography, Wavelength Optoelectronics has established a rare full-scene optical coverage.

Revenue structure analysis for 2024:

Breakthrough in the deep waters of semiconductor layout:

Lithography systems: Providing illumination module homogenizers (uniformity > 98%), objective system lens groups (distortion control < 1nm), and overlay accuracy calibration optical components.

Metrology equipment: Laser collimation systems (collimation accuracy 0.001°) and defect detection beam splitters (transmittance 99.8%). In Q1 2025, the revenue share of the semiconductor business rose to 7%, becoming the fastest-growing business line.

How does chalcogenide glass solve the 32% dilemma?

As the price of metallic germanium surged by 60%, eroding profits, Wavelength Optoelectronics swiftly initiated a material cost restructuring.

Independently developed infrared chalcogenide glass achieved triple breakthroughs: a continuously adjustable refractive index from 2.0 to 3.0, a transmission wavelength range covering 1-14μm, and automotive-grade certification obtained in 2024.

With the mass production of the new production line in Nanjing, the penetration rate of chalcogenide glass will reach 40% in 2025, driving the gross margin back up to over 35%.

Technological synergy across three major scenarios:

Wavelength Optoelectronics' "Optical+" strategy is demonstrating remarkable synergy.

1. Industrial lasers: A cash cow of high-end manufacturing. 60,000-watt cutting heads account for 37% market share. Welding heads with positioning accuracy of 0.003mm. Partnerships with giants such as Han's Laser and HG Tech.

2. Consumer optics: The invisible driver of the XR wave.

3. Semiconductor equipment: The core fulcrum of domestic substitution. Immersion lithography lenses certified by Shanghai Micro Electronics Equipment (Group) Co., Ltd. Metrology optical modules supplied to Zhongkefeice. Semiconductor revenue is expected to exceed 80 million yuan in 2025. Continuous increase in R&D investment (up 40% to 37 million yuan in 2024) is accelerating the cross-scenario migration of technology.

A dawn signal at the bottom of 37 million yuan in net profit. Despite a 32% decline in net profit in 2024, multiple signs indicate a turnaround in performance. The order reservoir continues to expand.

Comprehensive start of growth engines: Semiconductor immersion lithography lens capacity increased by 300%, monthly shipments of consumer electronics AR optical components exceeded 500,000 units, and orders for industrial laser new energy welding heads surged by 200%.

With the increase in chalcogenide glass substitution rates and the mass production of high-end products, net profit is expected to recover to 65 million yuan in 2025.

The 'Chinese lens' of the optical revolution.

In Wavelength Optoelectronics' ultra-clean workshop, ion beam polishers are fine-tuning lithography objectives with atomic-level precision.

These glasses, with diameters of less than 8 centimeters, are about to be installed in domestic lithography machines, embedded in AR glasses, and integrated into lithium battery laser welding machines. They are becoming optical blades piercing through the 'iron curtain of technology'.

From the red ocean competition of industrial lasers to the cutting-edge challenges of semiconductor lithography, Wavelength Optoelectronics' path of advancement embodies the transformation logic of Chinese manufacturing: In bottleneck areas, only by mastering technological control at the atomic level can the monopoly of international giants be broken.

When Huang Shengdi announced, "We want to be the TSMC of the optical industry," the ambition of this enterprise transcended devices, aiming to become the optical nerve center of high-end manufacturing.

With the mass production of chalcogenide glass breaking the shackles of raw materials and the introduction of lithography optical components into domestic equipment chains, Wavelength Optoelectronics' "Optical+" strategy is ushering in a moment of qualitative change.

In this grand narrative of $50 billion invested in semiconductor equipment and 1.4 billion XR terminals, this hidden champion is stepping from behind the scenes to the forefront, reflecting the brilliant spectrum of China's hard technology through precise lenses.

Note: (Disclaimer: The article content and data are for reference only and do not constitute investment advice. Investors act at their own risk based on this information.)

- End - Hope to resonate with you!