Profit and Revenue Soar! Yongxin Optics Reports 233 Million Yuan in Revenue for Q3 2025

![]() 10/30 2025

10/30 2025

![]() 595

595

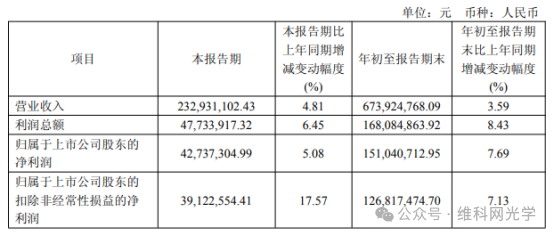

On October 29th, Yongxin Optics unveiled its financial results for the third quarter. According to the financial report, during the first three quarters of 2025, the company achieved a revenue of 674 million yuan, marking a year-on-year growth of 3.59%. The net profit attributable to shareholders climbed to 151 million yuan, up 7.69% from the same period last year. Meanwhile, the net profit excluding non-recurring gains and losses stood at 127 million yuan, a 7.13% increase year-on-year.

In the third quarter of 2025 alone, Yongxin Optics reported a revenue of 233 million yuan, representing a 4.81% year-on-year rise. The net profit attributable to shareholders reached 42.7373 million yuan, a 5.08% increase over the previous year. The net profit excluding non-recurring gains and losses surged to 39.1226 million yuan, up 17.57% year-on-year.

Yongxin Optics is dedicated to the research and development, production, and sales of optical products, boasting a diverse shareholder base. As of October 29th, 2025, a total of 15 institutional investors have disclosed their holdings of A-share shares in Yongxin Optics. Collectively, they hold 77.9147 million shares, accounting for 70.23% of the company's total share capital.

The report reveals that the top ten institutional investors include Yongxin Optoelectronics Industry Co., Ltd., Gongqingcheng Botong Investment Partnership (Limited Partnership), Ningxing (Ningbo) Asset Management Co., Ltd., Ningbo Electronic Information Group Co., Ltd., Angao International Resources Co., Ltd., Ningbo Xinhao Enterprise Management Consulting Partnership (Limited Partnership), Ruishou Life Insurance Co., Ltd. - Own Funds, Industrial and Commercial Bank of China Limited - Nuoan Pioneer Hybrid Securities Investment Fund, Hong Kong Central Clearing Limited, and Huaxia CSI Dividend Quality ETF. The combined shareholding ratio of these top ten investors reached 70.15%. Compared to the previous quarter, their combined shareholding ratio increased by 0.43 percentage points.

Notably, Industrial and Commercial Bank of China Limited - Nuoan Pioneer Hybrid Securities Investment Fund emerged as a new circulating shareholder.