DJI and Insta360 Engage in Crossover Competition, Intensifying Rivalry in the Smart Imaging Sector

![]() 11/13 2025

11/13 2025

![]() 621

621

By Xiangling Shuo

DJI and Insta360 can be considered somewhat unlikely rivals.

The rationale lies in the fact that for nearly a decade, DJI has dominated the consumer drone and action camera markets, encountering few competitors in its supply chain.

Today, DJI's competitive moat remains robust, but with an increasing number of entrants, it can no longer afford complete complacency. Insta360, while possessing strong commercialization capabilities to capture new markets, also faces operational pressures.

Behind this seemingly head-to-head competition lies a pressing need for many leading companies to break through growth ceilings, reflecting the intensifying competition within the smart hardware industry.

Nearly all smart hardware sectors currently face various forms of intense competition. Ultimately, the winners in this competitive landscape will be those manufacturers that achieve long-term development through product strength and user reputation.

Crossover Competition

On the surface, DJI and Insta360 are moving from their respective monopolistic market segments into each other's core businesses, a crossover that is reshaping the smart imaging market landscape to some extent.

To understand their current dynamics, we must revisit the broader context of their 'crossover competition' since 2025. Both companies are actively expanding into each other's territories in search of new growth opportunities, sparking intense competition in the consumer drone and smart imaging markets.

A notable example occurred on July 28th, when Insta360, a leader in panoramic cameras, officially announced its entry into the drone market with the launch of its 'Yingling Antigravity' panoramic drone brand. Meanwhile, DJI Innovation, the reigning champion in drones, released a panoramic camera, entering Insta360's dominant market. DJI's first product, the Osmo 360, achieved a 49% market share in Chinese e-commerce channels and a 43% global market share within three months of its launch, penetrating its competitor's stronghold in less than half a year.

In reality, behind this competitive maneuvering lie the market moats and seemingly impregnable positions that both companies have defended for years.

Especially DJI, which commands over 70% of the global consumer drone market, has long held a dominant position in the industry. The brand perception that 'DJI represents drones, and drones are DJI' is deeply ingrained. DJI wields stronger market dominance in this field than Apple does in smartphones, with some media reporting that DJI's net profit margin approached 40% last year, nearly double that of Apple.

This success stems from DJI's years of cultivation in this sector. Beyond its robust supply chain cost control capabilities, public data indicates that DJI consistently allocates around 15% of its annual revenue to R&D, resulting in approximately 38,000 patented technologies that are reflected in its product strength. For instance, in the flight control system domain, the company's self-developed algorithms achieve centimeter-level positioning accuracy. In imaging technology, the Inspire 3 supports increasing its diagonal descent speed to 10 meters per second, with vertical ascent and descent speeds improving from 6 meters per second and 4 meters per second to 8 meters per second, respectively, and extending battery life to 28 minutes.

The convergence of numerous core product competencies makes it difficult for most companies to keep pace with DJI.

However, Insta360's move into the drone sector has once again disrupted the industry, which had remained relatively static for years. After listing on the Science and Technology Innovation Board in June 2025, founder Liu Jingkang explicitly identified drones as the company's second growth engine, attempting to unlock new growth space through a 'panoramic + flight' combination.

At the 2025 IFA exhibition, Insta360's panoramic drone, the Yingling Antigravity A1, successfully integrated its algorithmic advantages in the panoramic domain into drone products, bringing Liu Jingkang's vision to fruition. Consequently, in October, when DJI reduced its prices, Liu Jingkang, CEO of Insta360, remarked, 'Part of the reason for DJI's significant price reduction may be attributable to us.'

Turning our attention to Insta360, it has also been the global champion in the consumer panoramic camera market for six consecutive years, boasting strong market barriers.

In July 2025, DJI suddenly launched the Osmo 360 panoramic camera, officially entering Insta360's core territory and swiftly exerting pressure on Insta360's panoramic camera business. DJI's market share gains in recent months validate this point.

Behind their crossovers lies the convenience afforded by technological commonalities. Panoramic cameras and drones share significant overlaps in underlying capabilities such as image processing, stabilization algorithms, and sensor technology. This technological synergy substantially lowers the barriers to crossover. DJI leverages its hardware strengths to compensate for software shortcomings, while Insta360 utilizes its software capabilities to penetrate the hardware market. These two distinct breakthrough paths have created a stark contrast in the marketplace.

As the saying goes, 'Business is like a battlefield,' and crossover is an inevitable path to breakthroughs. The crossovers by DJI and Insta360 likely result from a combination of technological spillover effects and market growth demands. After establishing absolute advantages in their respective primary businesses, the growth ceilings in their niche markets have compelled these companies to seek new growth opportunities. Technological commonalities have made these crossovers feasible.

Struggling Siblings

Behind their crossover expansions lie the growth pressures faced by DJI and Insta360. DJI is constrained by the slowing growth of the consumer drone market, while Insta360 encounters operational challenges.

Let's first examine DJI's predicament.

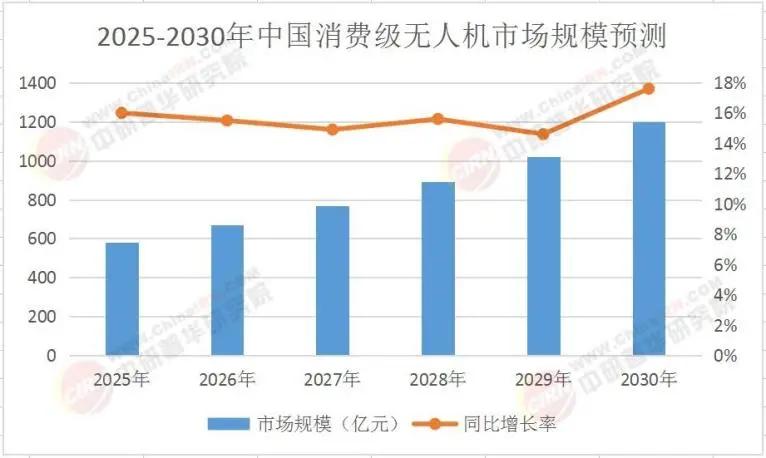

Although DJI maintains an absolute advantage in the drone market, signs of slowing growth have become evident. Data from the Zhongyan Puhua Industry Research Institute shows that the growth rate of China's consumer drone market plummeted from 45% in 2020 to 18% in 2024.

In the external market, the AI imaging capabilities of smart flagship phones continue to evolve, offering simpler and faster shooting and operation in certain scenarios. Besides Insta360, vertical players like Dreame, Autel Robotics, and Fimi, along with other cross-border forces from the smartphone industry, may all potentially enter the action camera and drone markets.

DJI has not been without foresight in this regard. For instance, years ago, DJI founder Frank Wang already believed that the drone market was nearing saturation and that DJI's revenue would peak at 20 billion yuan. Market rumors suggest that DJI's operating revenue exceeded 80 billion yuan last year, representing a 35% increase, with net profits reaching 12.056 billion yuan.

However, this revenue structure encompasses DJI's entire product matrix. To explore new growth avenues, DJI has also ventured into other ecosystem products, including robotic vacuum cleaners.

Shifting our focus back to Insta360, the company faces significant profitability pressures.

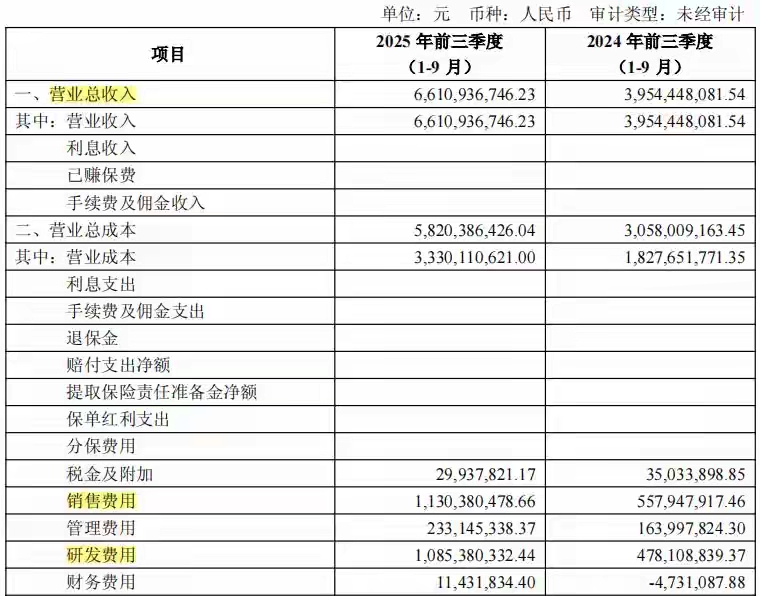

Insta360's third-quarter 2025 financial report reveals that the company achieved revenue of 2.940 billion yuan, a year-on-year increase of 92.64%. However, behind this impressive revenue figure, net profits declined by 15.90% year-on-year, amounting to only 272 million yuan.

Chairman Liu Jingkang explained that the profit decline primarily stemmed from substantial investments in chip customization and strategic projects. Excluding these factors, profit indicators actually improved year-on-year, but this also reflects the strategic investment pressures the company faces in responding to competition.

Facing potential price war impacts from within the industry, Insta360 has maintained its core market share but confronts aggressive offensives from competitors. Data from Jiuqian Consulting shows that Insta360's market share in the global panoramic camera market dropped from 92% in the second quarter to 49% in the third quarter, with DJI capturing 43%.

Another institution's data tells a slightly different story. According to a 'Global Smart Handheld Imaging Equipment Market Development White Paper' released by Frost & Sullivan, Insta360 held an absolute lead with 75% of the global consumer panoramic camera market in the third quarter of 2025, while DJI's market share stood at 17.1%.

The discrepancies may arise from various factors, but one fact remains: Insta360 has retained its core user base through differentiated features such as interchangeable lens designs, panoramic cloud storage, and AI auto-editing. Nevertheless, the company cannot afford complacency in a price-sensitive market.

Furthermore, in the first three quarters of this year, Insta360's R&D expenses reached 1.085 billion yuan, a year-on-year increase of 127%. While this scale may not be considered massive in the broader consumer electronics industry, the future competitiveness of its new technologies remains to be validated by the market.

In reality, behind the rapid growth of many companies in the consumer electronics industry often lie unresolved concerns. The journeys of these two outstanding companies reflect common issues faced by the smart hardware industry as it matures. Even after achieving monopolistic positions in niche markets, leading companies may still encounter growth ceilings. During the process of crossover expansion, they face constraints from shortcomings in their core capabilities and profitability pressures arising from intensified industry competition.

Intensifying Competition in Smart Imaging: Do Users Benefit?

The 'intensifying competition' within the smart hardware industry is inevitable. Whether it manifests as a white-hot price war or product homogenization, where will the competition between these two companies lead?

In reality, the answer may already be relatively clear. DJI will likely maintain its leadership in the consumer drone industry, but new entrants will also capture a larger market share. Similarly, in the panoramic camera sector, Insta360 may no longer enjoy complete dominance.

This represents the obvious outcome. Conversely, the intensifying competition among major players also offers numerous insights.

Price wars are at the forefront.

The current trend of intensifying competition in the smart hardware industry is escalating. For instance, in the smartphone sector, high-end flagship technologies are continuously filtering down to mid-range and low-end models. The robotic vacuum cleaner industry is plagued by frequent price wars, with products originally priced at five to six thousand yuan now selling for three to four thousand yuan. Nearly 70% of new AI earphone products are priced below 500 yuan, with some brands even compressing profits to single-digit percentages.

Although the consumer drone and smart imaging sectors have largely avoided such intense competition in previous years, they have not been spared this year. Insta360 recently pointed out that price competition from competitors may have driven market expansion.

In other words, intensifying competition is not entirely negative. Fierce competition can act as a catalyst for market expansion and technological upgrades. After DJI entered the panoramic camera market, it leveraged its brand influence and price advantages to attract more potential users to try panoramic photography, rapidly expanding the market size.

In the rankings among manufacturers, product strength and user reputation typically form the bedrock of a company's standing. Manufacturers that focus excessively on verbal sparring are unlikely to fare well.

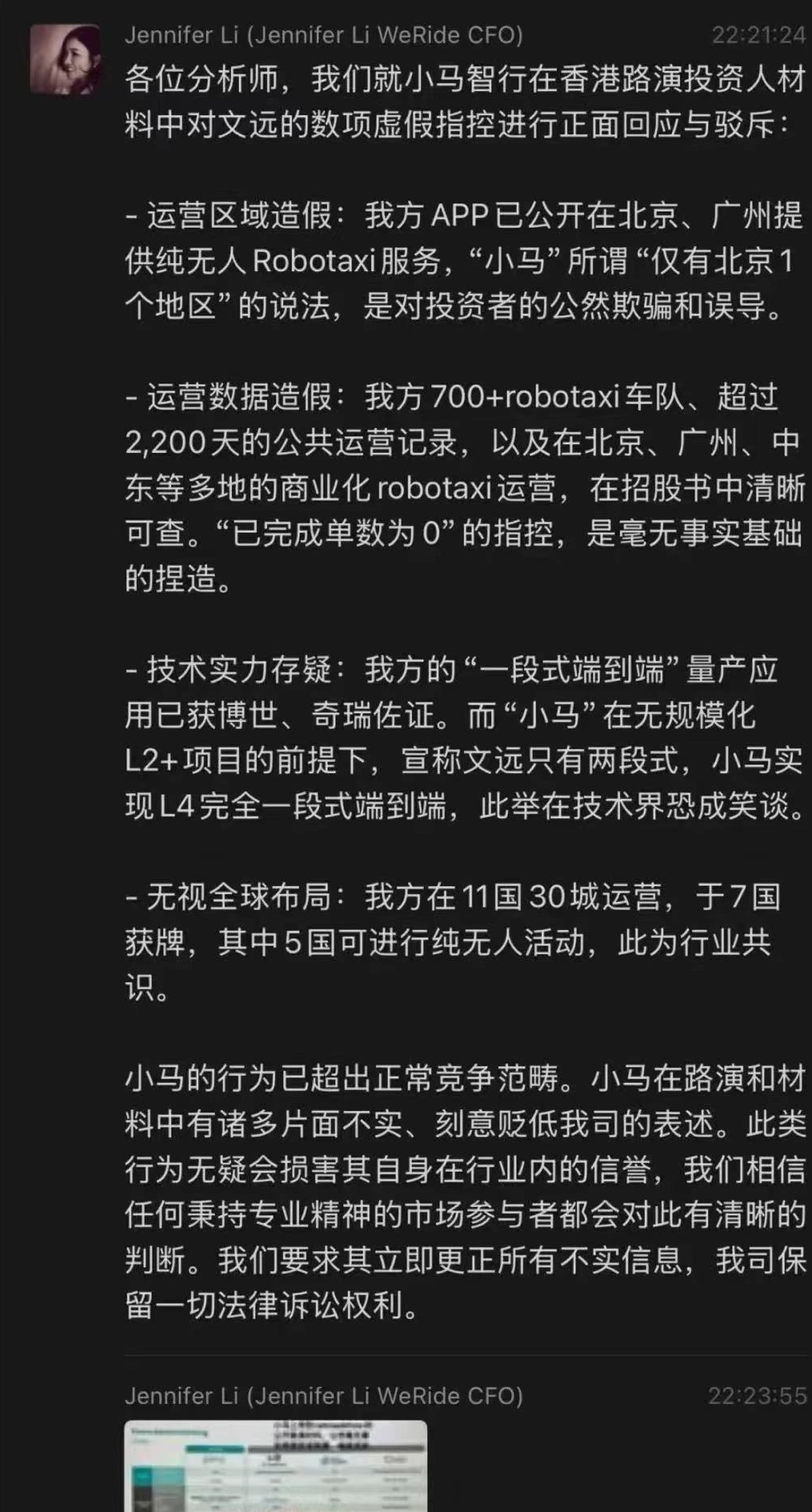

Assuming we apply this perspective to other industries, the rationale remains largely consistent. A typical example is the recent public dispute between Pony.ai and WeRide. On the evening of October 30th, WeRide's CFO, Li Xuan, issued a public statement accusing Pony.ai of 'fabricating data and deliberately disparaging competitors' in its roadshow materials. Both companies operate in the L4 autonomous driving industry, share similar backgrounds, but differ in their business models and matrices. Both are at critical stages of their IPOs, leading many outsiders to view this public clash as an event aimed at capturing capital attention.

The majority within and outside the industry believe that after the dispute, people will not remember the companies that emerged victorious in the public opinion battle. The company that first relaxes its commitment to quality amidst the intensifying competition risks being extrude (edged out) of the market.

Expanding our view, a few months ago, the air conditioning sector also witnessed a public exchange of remarks between Xiaomi and Gree executives, with both sides holding divergent views on certain issues. While this generated brand exposure and traffic, it also caused some misunderstandings. For users, the fundamental criterion for purchasing an air conditioner remains its quality.

The new energy vehicle industry is no exception. After years of competition between traditional and new automakers, involving verbal battles, price wars, and marketing campaigns, the industry's healthy development has been compromised. Today, most automakers are reflecting on their development paths.

It is reasonable to speculate (speculate) that similar public disputes and clashes are likely to recur in the consumer industrial products industry in the future. Those who lack reverence for the market are destined to face disappointment.

*All images in this article are sourced from the internet.