Observation on State-owned and Central Real Estate Enterprises | 22 Companies Lost 262.5 Billion in a Year, 3 Local State-owned Enterprises Lost Money but Still Distributed Dividends

![]() 05/29 2024

05/29 2024

![]() 759

759

Editor-in-Chief | Su Huai

Market capitalization and dividends are two core keywords that cannot be separated from future state-owned and central enterprises listed on the stock market.

At the beginning of this year, the SASAC meeting proposed to include market capitalization management in the performance evaluation of the heads of central enterprises. In April, the new version of the "Nine National Policies" was released, which explicitly required strengthening the supervision of cash dividends of listed companies and promoting listed companies to enhance their investment value.

After "market capitalization management and cash dividends" were clearly established as evaluation indicators, many state-owned and central enterprises have successively expressed their commitment to enhancing profitability, gradually increasing the dividend ratio in the future, and strengthening communication and exchanges with investors.

Unlike many industries, the current real estate industry is in a downward cycle, and the market capitalization of most listed real estate companies has declined, leading to changes in the throne of market capitalization leaders. Meanwhile, affected by sluggish sales and past high leverage strategies, many real estate companies have been writing off impairments on a large scale in recent years, resulting in negative profits or even significant losses.

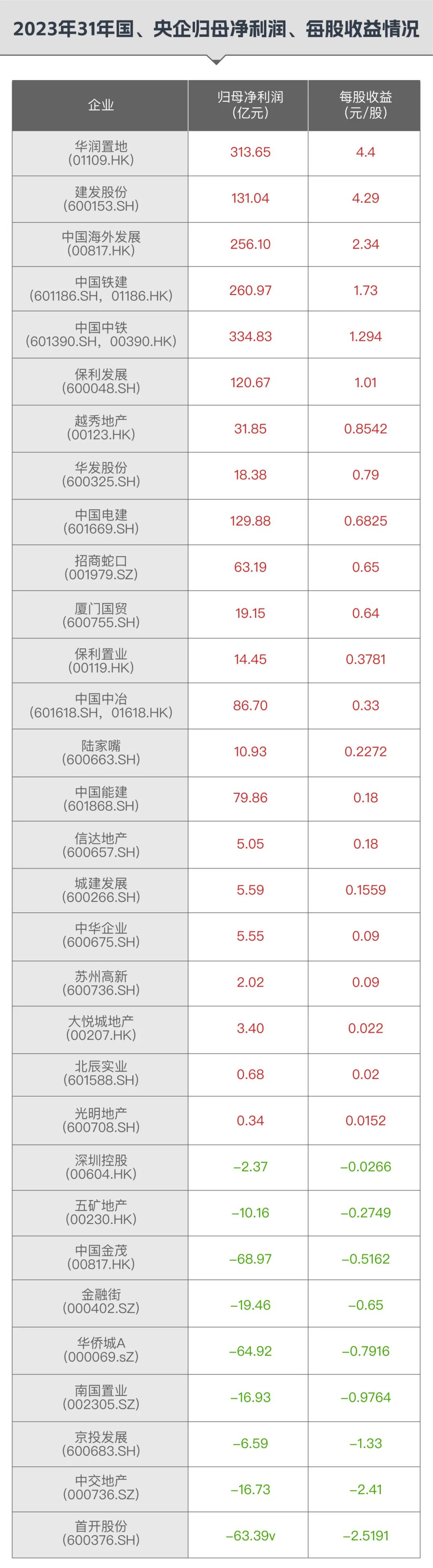

Among the 31 listed state-owned and central real estate enterprises, 8 companies have net losses. Among them, OCT A (000069.SZ) and South China Real Estate (002305.SZ) have recorded losses for two consecutive years. If they fail to improve in 2024, they will face the risk of delisting.

Losses mean that dividends are gone. However, compared to dividend performance, accelerating project sales and increasing cash flow are the focus of most enterprises. To preserve cash on hand, Vanke A (000002.SZ) also broke its 31-year convention and did not distribute dividends for the first time since its listing.

Under such circumstances, state-owned and central listed real estate enterprises face even more challenging tasks than companies in other industries, as they need to avoid sales pressure, achieve greater profits, and increase market capitalization and dividend ratios.

Who can provide the optimal solution to the "dividend paradox"?

01

22 of 31 state-owned and central real estate enterprises fell, and none of their market capitalizations exceeded 200 billion.

If one word were to summarize the real estate industry in 2023, it would be: decline.

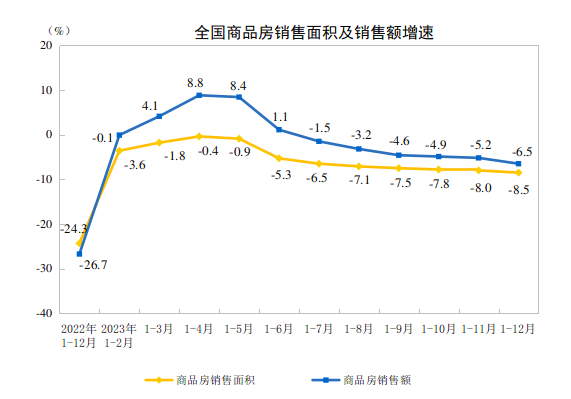

According to data from the National Bureau of Statistics, in 2023, the sales area of commercial housing was 1.117 billion square meters, down 8.5% from the previous year, with the sales area of residential housing down 8.2%; the sales revenue of commercial housing was 11.66 trillion yuan, down 6.5%, and the sales revenue of residential housing down 6%. Meanwhile, the unsold area of commercial housing at the end of the year was 673 million square meters, an increase of 19% over the previous year.

However, the average sales price is still rising, from 9,800 yuan/square meter to 10,400 yuan/square meter.

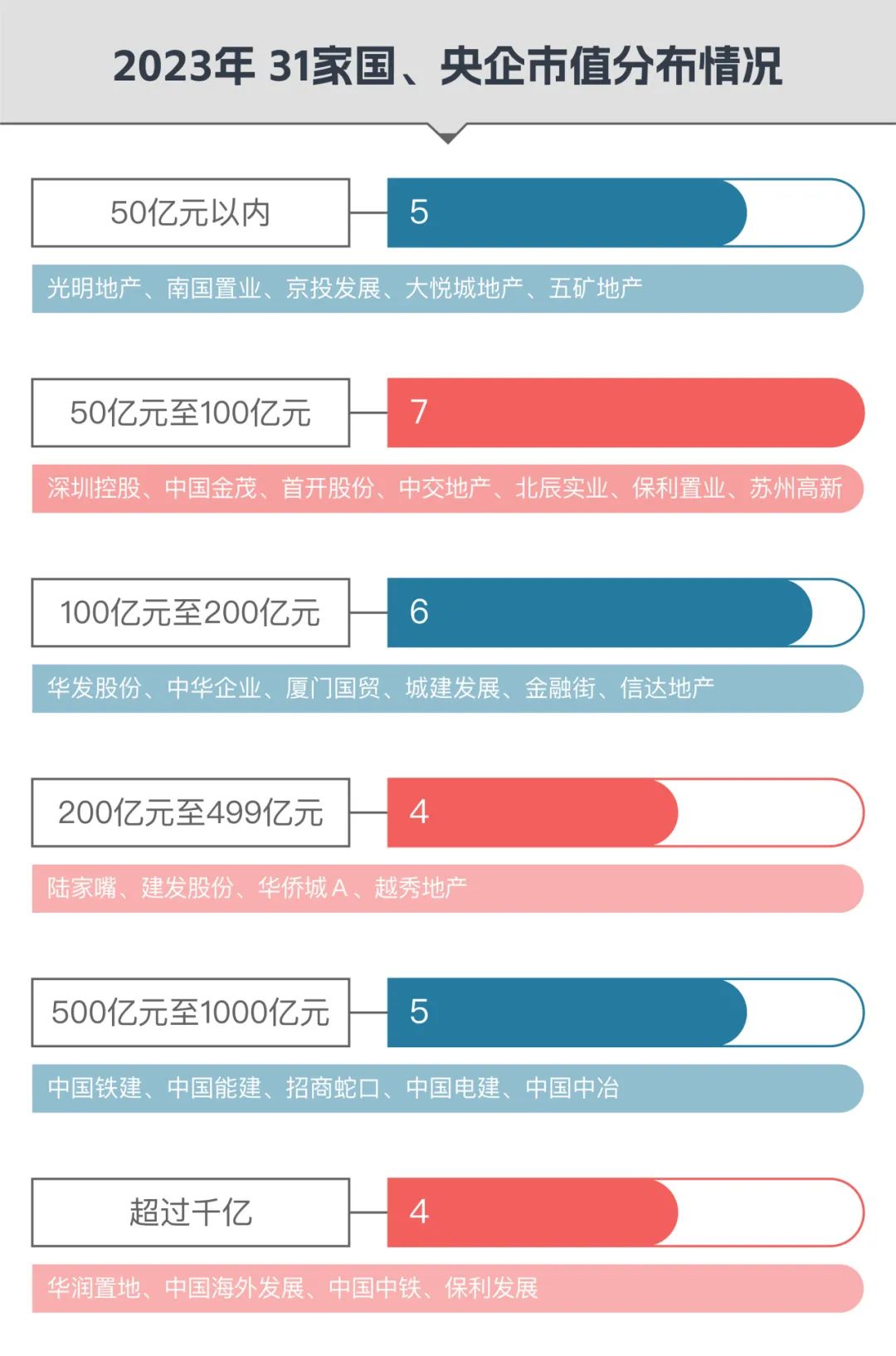

During the industry downturn, the market capitalization of 31 state-owned and central real estate enterprises shrank to a certain extent, with the total market capitalization falling from 1.49916 trillion yuan at the end of 2022 to 1.24893 trillion yuan at the end of 2023, a decline of approximately 16.7%, exceeding 250 billion yuan.

If measured by the market capitalization scale at the end of 2023, over the past year, it was equivalent to losing a China Resources Land (01109.HK) or two Poly Developments and Holdings Group (600048.SH). Meanwhile, among the 31 sample real estate enterprises, none had a market capitalization exceeding 200 billion yuan.

Looking at the entire real estate industry, the market capitalization of companies such as Vanke, Longfor Group (00960.HK), and Sunac China (01918.HK) has also declined to varying degrees. Among them, Vanke's market capitalization shrank by over 80 billion yuan, and Longfor by 59 billion yuan, both exceeding the decline of the 31 state-owned and central real estate enterprises.

Returning to the 31 state-owned and central real estate enterprises, compared to the previous year, 22 enterprises saw a decline in market capitalization, with a total decline of 262.5 billion yuan. Among them, the number of enterprises with market capitalization of over 100 billion yuan and between 10 billion and 20 billion yuan decreased by 1 and 3, respectively, which were PowerChina (601669.SH), China Jinmao Properties (00817.HK), Shoukai Corporation (600376.SH), and China Communications Construction (000736.SZ).

Among them, PowerChina's market capitalization fell by over 35 billion yuan, and China Jinmao Properties fell by over 10 billion yuan.

China Resources Land has remained the leader in the domestic real estate industry in terms of market capitalization for two consecutive years, followed by China Overseas Property (00688.HK) and China Railway Engineering Corporation (601390.SH, 00390.HK). The top three in 2022 were: China Resources Land, Vanke, and China Overseas Property.

China Resources Land and China Overseas Property's ability to remain in the top three of the industry for two consecutive years is largely related to their profitability, which is superior to their peers – both companies' net profit attributable to shareholders exceeded 12% in 2023.

Although Poly Developments and Holdings Group was the only real estate enterprise with sales revenue exceeding 400 billion yuan in 2023, its net profit margin fell to only 3.48%. Obviously, as its profitability declined, the company's share price also fell, breaking through the 10 yuan mark. On the last trading day of 2023, Poly closed at 9.9 yuan per share, down over 30% from the beginning of the year.

As the "scale king" of the industry, Poly Developments and Holdings Group has been the most impacted, with its market capitalization shrinking by 56.74 billion yuan, ranking first among the 31 state-owned and central real estate enterprises, followed by China Overseas Property and China Resources Land.

As usual, from the perspectives of infrastructure central enterprises, real estate central enterprises, and local state-owned real estate enterprises, among the 250.231 billion yuan decline in market capitalization in 2023, the corresponding proportions of the three were 15.14%, 79.11%, and 5.75%.

This shows that purely real estate business listed companies are more affected and less resilient in a downward cycle.

First, looking at the 11 real estate central enterprises, their total market capitalization was 583.595 billion yuan, accounting for 46.73%, down 5.41 percentage points from the previous year, with none showing an increase. Among them, China Resources Land, China Overseas Property, and Poly Developments and Holdings Group rank in the top three, with market capitalizations exceeding 100 billion yuan.

The overall market capitalization of the five infrastructure central enterprises was 455.9 billion yuan, accounting for an increase of over 3 percentage points to 36.5%.

There was a significant divergence in the rise and fall of market capitalization. China Railway Engineering Corporation and China Railway Construction Corporation (601186.SH, 01186.HK) recorded small increases, while PowerChina experienced a sharp decline, closing at 4.89 yuan per share on the last trading day of 2023, down 29.6% from the beginning of the year.

The market capitalization changes of the 15 local state-owned real estate enterprises were nearly "halved" – 7 rose and 8 fell, with an overall market capitalization of 209.438 billion yuan, accounting for an increase of nearly 2 percentage points to 16.77%.

Among them, the top three in terms of increase were Lujiazui (600663.SH), Huafa Properties (600325.SH), and Xiamen International Trade Group (600755.SH). These three companies each have their own characteristics: Lujiazui is a "landlord," with profitability second only to China Resources Land and China Overseas Property; Huafa Properties is a "dark horse" over the past two years, actively acquiring land for development; and Xiamen International Trade Group is exiting the real estate business and focusing on supply chain management.

The top three in terms of decline in market capitalization among local state-owned real estate enterprises were Shoukai Corporation (600376.SH), Jianfa Properties (600153.SH), and Financial Street (000402.SZ). All three companies face the same problem: a significant decline in net profit attributable to shareholders. Among them, Shoukai Corporation and Financial Street both turned from profit to loss, with losses of 6.34 billion yuan and 1.95 billion yuan, respectively; although Jianfa Properties' profits increased slightly, after excluding restructuring gains, its net profit attributable to shareholders decreased by about 34% year-on-year.

Among the 31 state-owned and central real estate enterprises, over 70% of their share prices have declined. How will investors realize profits?

02

China Resources Land is the most generous:

Distributed dividends of over 10 billion yuan for two consecutive years

In mid-April this year, Zijin Chen, known as the "Warren Buffett of China," posted his experience of suffering losses and "cutting losses" in his investment in real estate stocks on an investment exchange community, which once trended on the hot search. According to public information, Zijin Chen invested in real estate stocks such as Vanke A, Vanke Enterprise (02202.HK), and OCT A.

The continuous decline in real estate stock prices has left most investors suffering. Admittedly, investing in real estate stocks during the industry's downward cycle is destined to be more difficult to profit than to lose money. Vanke and OCT's market capitalization shrank by over 80 billion yuan and over 18 billion yuan in 2023, respectively. However, stock prices are a comprehensive reflection of many factors, such as industry prospects, policy directions, the company's potential profitability, and market sentiment.

To know whether a company's stock is more valuable than before, there is a crucial indicator that can be used as a reference: earnings per share.

Among the 31 state-owned and central real estate enterprises, 22 enterprises recorded an increase in earnings per share. Among them, the top three in terms of increase were China Resources Land, Jianfa Properties, and China Overseas Property. The bottom three were Shoukai Corporation, China Communications Construction, and Beijing Capital Development, with Shoukai Corporation's loss per share reaching nearly 2.52 yuan.

A decline in market capitalization and an increase in earnings per share indicate that some real estate stocks may be in a low valuation range. Low valuation only indicates the possibility of an increase, but it is still necessary to consider the industry's downturn. "Smart money" often considers trends and prospects more.

If investors cannot obtain returns through rising stock prices, dividends and dividends become even more important.

According to the dividend plans of the 31 state-owned and central real estate enterprises, 9 enterprises will not distribute dividends at the end of the year, compared to 5 in 2022. The total cash dividend amount was 48.682 billion yuan, a year-on-year decrease of 6.62%. Among them, China Jinmao Properties distributed dividends in the interim but was unable to do so at the end of the year due to losses.

From a year-on-year perspective, the number of enterprises that increased dividends for the full year of 2023 was 10, with the top three in terms of increase being China Resources Enterprise (600675.SH), Poly Property Group (00119.HK), and China Merchants Shekou (001979.SZ).

An interesting point is that China Resources Enterprise suffered a loss in net profit attributable to shareholders in 2022 but still insisted on distributing 120 million yuan in cash dividends; after turning losses into profits in 2023, the dividend amount increased by 1288.76%.

The top three enterprises with the most generous dividends in 2023 were China Resources Land, China Overseas Property, and China Railway Engineering Corporation. Among them, China Resources Land has distributed dividends of over 10 billion yuan for two consecutive years, while China Overseas Property's dividends shrank by over 30% but still amounted to 7.566 billion yuan.

However, the one who is most willing to distribute earned money to investors is someone else. In terms of dividend payout ratio, the top three are Shenzhen Holdings Limited, Urban Construction Development (600266.SH), and Xiamen International Trade Group. Among them, Shenzhen Holdings Limited's net profit in 2023 was 175 million yuan, a steep decline of 92%, and its net profit attributable to shareholders was a loss of 237 million yuan, but it still distributed a generous dividend of 0.07 Hong Kong dollars per share.

Urban Construction Development is the same. With a net profit of only 91 million yuan in 2023, it took out about 208 million yuan to reward investors.

Even more generous than Shenzhen Holdings Limited and Urban Construction Development is Beijing North Star Industrial Group (601588.SH, 00588.HK). In 2023, Beijing North Star Industrial Group had a net loss of 63 million yuan and a net profit attributable to shareholders of 68 million yuan, but it distributed 670 million yuan in dividends, equivalent to distributing all the money it earned to investors.

Although these companies showed "great sincerity," whether they meet the guidance for reasonable dividends under the new