A 728 Billion-Yuan Market Awaits! Giants Are Pouring Capital into Autonomous Vehicles

![]() 09/26 2025

09/26 2025

![]() 599

599

Original Source: Shenmu Finance (chutou0325)

Recently, China Post unveiled a tender notice, announcing plans to lease and purchase a total of 7,000 autonomous vehicles. This includes 718 small vehicles, 4,524 medium-sized vehicles, and 1,758 large vehicles, setting a new benchmark for industry procurement.

Simultaneously, the autonomous driving logistics sector has witnessed a flurry of financing activities. Mainline Technology has secured hundreds of millions of yuan in strategic funding, with investors including the Beijing Shunyi High-End Industry Fund, SDIC Innovation, and other notable institutions. Neolix has successfully completed a 1 billion yuan Series C+ funding round, marking the largest single financing event in the logistics autonomous vehicle sector this year.

On one front, China's express delivery industry is witnessing a surge in autonomous vehicle procurement. On the other, the capital market is providing robust support to the autonomous vehicle logistics sector. China Merchants Securities estimates that the market potential for autonomous delivery vehicles could soar to as high as 728 billion yuan. Driven by policies, technological advancements, and market demand, this logistics revolution is propelling the shift of autonomous logistics vehicles from 'technical trials' to 'large-scale commercialization'.

01

Express Industry Leaders Vie for Autonomous Vehicle Purchases

Recent data indicates that industry leaders such as J&T Express, SF Holding, ZTO Express, China Post, YTO Express, Yunda Holding, and STO Express are all making substantial investments in autonomous delivery vehicles. Currently, the number of autonomous vehicles in the express logistics industry has surpassed 7,000, marking an accelerated phase of intelligent transformation in the sector.

J&T Express explicitly stated in its first-half 2025 financial report that, as of the end of June, it had deployed 600 autonomous vehicles across its network. SF Holding's financial report for the same period revealed a cumulative total of 1,800 autonomous vehicles in operation in the autonomous transportation sector.

ZTO Express disclosed at the 2025 Express Logistics New Quality Productivity Development Forum that its fleet of autonomous vehicles had exceeded 2,000 units. Among these, over 1,300 were supplied by Jiushi, with the remaining 900+ sourced from Neolix and other companies.

YTO Express boasts over 170 franchisees utilizing more than 500 autonomous vehicles across its network, with 67% sourced from Jiushi and 33% from Neolix.

Yunda Holding's first-half 2025 financial report also disclosed that the company had deployed over 500 autonomous vehicles in the first half of the year, expanding their use in end-mile delivery scenarios to high-value-added areas such as medical supplies and fresh food cold chain logistics. Among its autonomous vehicles, 83% were sourced from Jiushi, and 17% from Neolix.

STO Express also announced in July that it would deploy 2,000 autonomous vehicles by the end of the year, primarily sourced from Jiushi, Neolix, and Cainiao.

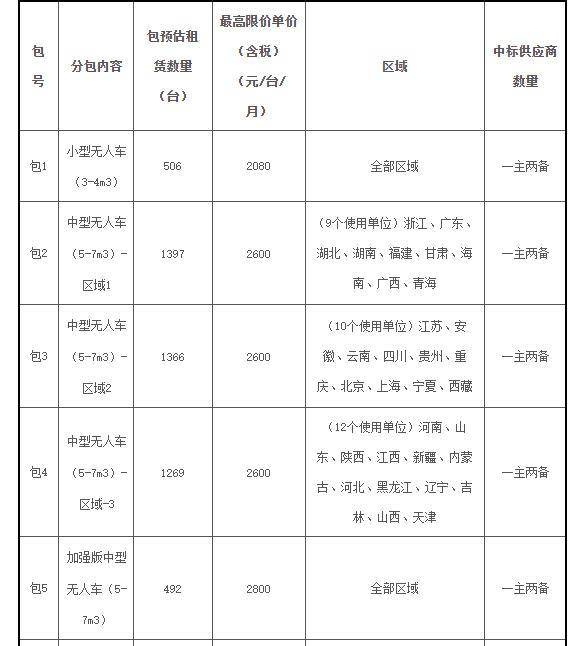

The latest entrant in the procurement wave is China Post. According to its tender notice released in early September, China Post has launched its 2025 autonomous vehicle leasing and procurement project, planning to purchase a total of 7,000 vehicles. This includes 718 small autonomous vehicles (3-4m³), 4,524 medium autonomous vehicles (5-7m³), and 1,758 large autonomous vehicles (8-12m³), setting an industry record with a total volume of 7,000 units.

The tender information specifically mandates that in 13 provinces with severe cold regions, such as Shaanxi and Xinjiang, the procured autonomous vehicles must be equipped with battery heating functions and provide services for snow tire/anti-slip chain replacement and storage to ensure normal operation at temperatures below -20°C.

02

Autonomous Vehicle Logistics Emerges as an Investment Hotspot

Recent financing news in the autonomous vehicle logistics sector has been continuous, with many companies securing substantial funding and accelerating their commercialization efforts.

White Rhino completed a nearly 500 million yuan Series B+ funding round, with existing investors SF Holding and Linear Capital continuing to participate, while new investors such as Jun Capital, 360 Fund, and Huatai Zijin joined the fray.

In February, Neolix completed a 1 billion yuan Series C+ funding round, marking the largest single financing event in the logistics autonomous vehicle sector this year.

In April, Jiushi Intelligence completed a nearly 300 million USD Series B funding round, with investors including Meituan and Shenzhen Innovation Investment Group.

In May, Carl Force completed a nearly 300 million yuan Series A+ funding round, with investors including Ordos SDIC and Shenzhen Innovation Investment Group.

In early September, Mainline Technology, an autonomous trucking company, announced it had secured hundreds of millions of yuan in strategic financing, jointly invested by multiple institutions, including the Beijing Shunyi High-End Industry Fund.

Tian Lihui, a finance professor at Nankai University, believes that the influx of capital is not accidental but rather the result of the synergy between policies, technological advancements, and market demand. The State Post Bureau has explicitly proposed accelerating the large-scale application of drones, autonomous vehicles, and intelligent cloud warehouses in the industry.

Cost reduction and performance improvement are key driving factors. The hardware cost of autonomous vehicles has significantly dropped from the early million-yuan level to around 20,000 yuan for some base models. Meanwhile, the cost advantages of autonomous vehicle delivery have become evident.

A Neolix autonomous urban delivery vehicle can reduce traditional transportation costs from 0.15 yuan per parcel to 0.06 yuan per parcel. The average monthly operating cost of a Jiushi autonomous urban delivery vehicle is roughly between 2,000 and 3,000 yuan.

According to industry estimates, for a distribution center handling 8,000 parcels daily, using autonomous vehicles can reduce the average cost per parcel by 70%. A single vehicle can deliver up to a thousand parcels daily, with delivery efficiency improving by 20% to 30%.

03

Technical Challenges and Regulatory Gaps Persist

Autonomous delivery initially focused on solving last-mile delivery problems. Today, autonomous delivery vehicles are gradually moving from small-scale pilot programs in industrial parks to full-domain delivery.

In China Post's procurement, medium and large vehicles with a capacity of 5m³ or more account for approximately 90%, primarily meeting transportation needs for the 'last 3-5 kilometers.' Pan Yuchang, co-founder of Jiushi Intelligence, stated, 'The discovered demand for autonomous logistics vehicles is just the tip of the iceberg.'

The express delivery industry is not the only application scenario for logistics autonomous vehicles. Bulk cargo transportation, cold chain logistics, and other sectors also represent untapped markets. Autonomous vehicles are also being utilized in pharmaceuticals, fresh food supermarkets, mechanical parts, and other fields.

Despite rapid development, large-scale commercialization of autonomous vehicle logistics still faces significant challenges. Multiple corporate leaders have admitted that autonomous delivery technology is not yet fully mature, with issues such as low positioning accuracy and insufficient obstacle avoidance capabilities.

In complex and changing environments, the perception, decision-making, and execution capabilities of autonomous vehicles need improvement. Relevant laws, regulations, and industry standards for the autonomous delivery sector are not yet complete or unified.

The market is highly competitive, with some companies lowering vehicle prices or even selling at a loss to secure orders, often operating at a strategic loss. How to build differentiated competitive advantages and achieve profitability remains a critical issue for companies.

04

Conclusion

According to China Merchants Securities estimates, based on the number of express logistics outlets nationwide, the market potential for autonomous delivery vehicles is approximately 468 billion yuan. Based on the number of residential communities nationwide, the market potential ranges from 546 billion yuan to 728 billion yuan.

Autonomous vehicles are evolving from auxiliary tools for logistics delivery to becoming essential infrastructure for smart cities. With the opening of road rights and the release of policy dividends across regions, 2025 may become a pivotal year for the development of smart logistics.

*Image sourced from the internet. Please contact for removal if infringement occurs.