The Ambition of the Low-Altitude Economy: Can It "Replicate" the Glorious History of New Energy?

![]() 12/13 2024

12/13 2024

![]() 820

820

Looking back at 2024, the "low-altitude economy" has emerged as a significant technology buzzword, overshadowing car manufacturing, the metaverse, and large models. Since its conceptual inception in relevant plans in February 2021, this sector has garnered considerable attention, and this year, it finally shows signs of a breakthrough.

The capital market's response has been particularly evident. In 2024, share prices of several low-altitude economy-related stocks tripled within a month. This sector has also started attracting entrepreneurs in droves. According to Qichacha data, the number of low-altitude economy-related enterprise registrations in China reached 8,800 in 2023, marking a 36.24% year-on-year increase. As of February this year, there were 69,600 existing low-altitude economy-related enterprises in China.

Investor enthusiasm has also surged. Incomplete statistics reveal that in the first three quarters of 2024, there were 56 financing cases in the low-altitude economy sector, an increase of 9 cases compared to the same period last year, with a total financing amount of 3.9 billion yuan. These signs resemble the developmental trajectory of the new energy vehicle manufacturing industry from years past.

The low-altitude economy already intersects with new energy in some industrial chains, raising questions about their potential convergence.

"Can the low-altitude economy mirror the success of the new energy sector?"

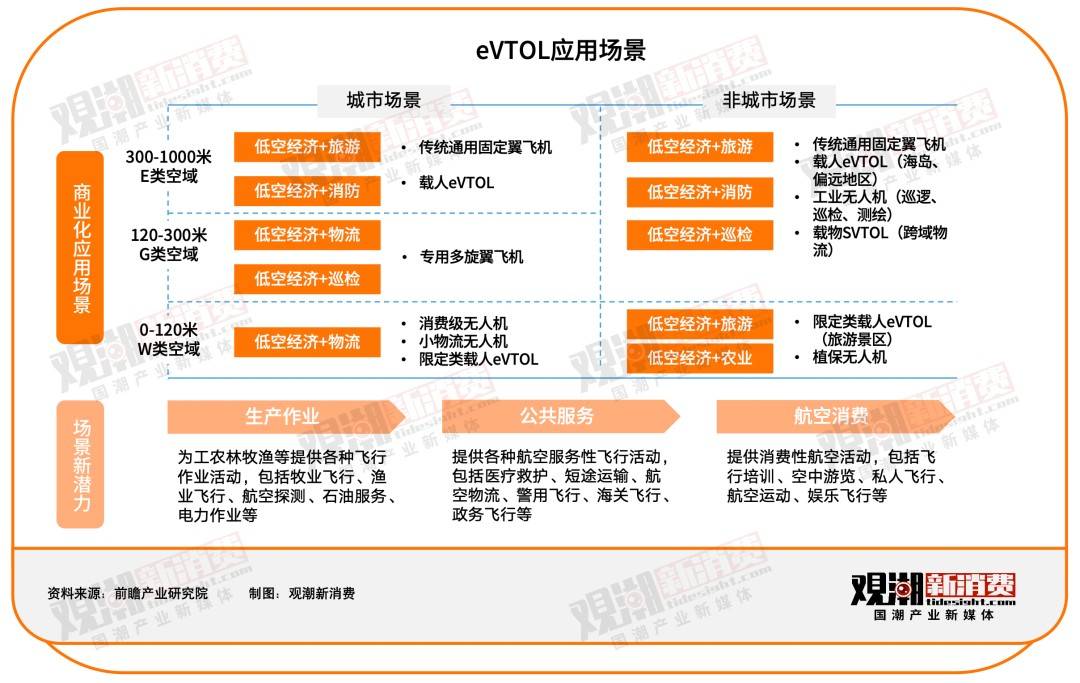

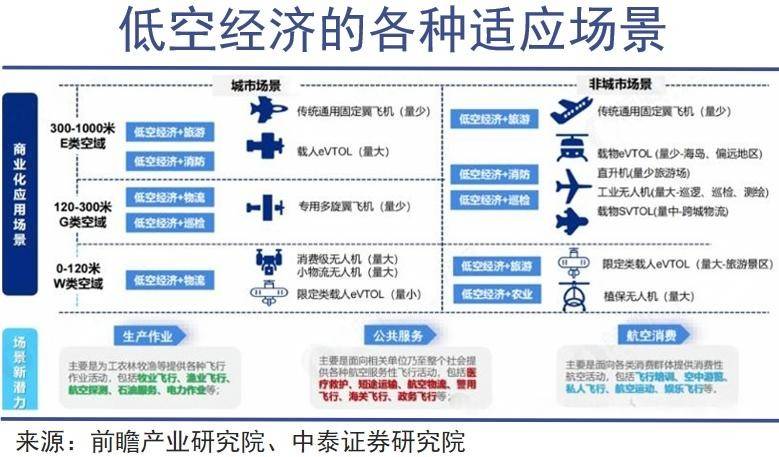

The constant association between the low-altitude economy and new energy stems primarily from their overlapping industrial chains. The dominant part of the low-altitude economy's industrial chain is low-altitude equipment manufacturing, with eVTOL (Electric Vertical Take-Off and Landing aircraft) being a crucial technology. Public information indicates that 70% to 80% of eVTOL supply chain components are shared with the new energy vehicle industry, particularly in motors, electronic controls, and battery systems, which directly benefit from advancements in new energy technology. Some even argue that both new energy and the low-altitude economy share an underlying "electrification" logic.

Currently, many enterprises from the new energy era are involved in the low-altitude economy. Mainstream automakers include XPeng, GAC, Geely, and Toyota; lithium battery enterprises such as CATL, EVE Energy, Guoxuan High-Tech, and Farasis Energy also have a strong presence in this sector.

However, can the low-altitude economy truly follow a similar path to new energy?

In fact, there is a fundamental difference between this sector and the new energy market. Most new energy products ultimately reach the consumer market, where large-scale C-end demand can quickly propel upstream production, enhancing the sector's ecosystem. However, judging from the current development trend of the low-altitude economy, the era of personal consumption is yet to arrive.

This difference alone suggests that the low-altitude economy is unlikely to replicate the explosive growth of new energy in the past. For instance, it took only 2 years and 5 months for China's cumulative production of new energy vehicles to double from 5 million to 10 million, and another 1 year and 5 months to reach 20 million. The current application scenarios of the low-altitude economy may not reach this scale.

Furthermore, the domestic new energy sector's response speed is among the keenest globally. To date, aside from Tesla, almost all major new energy vehicle brands are domestic. However, in the field of the low-altitude economy, domestic actions were slightly delayed. Overseas, leading aviation enterprises such as Boeing and Airbus have already entered the market forcefully. Boeing, for instance, has completed the acquisition of eVTOL leader Wisk Aero.

Additionally, a series of technology enterprises from various countries, including Joby and Archer from the United States, Lilium and Volocopter from Germany, Vertical from the United Kingdom, and Eve from Brazil, have emerged. Data shows that over 430 enterprises worldwide have invested in eVTOL research and development, with over 1,000 concept models released.

The United States has always been the most active investor in the industrial-grade drone market. Germany, Austria, and Switzerland have also extended their manufacturing advantages to the drone sector, evolving piston engine technology into gasoline or heavy fuel aviation engines, achieving common development for flying cars and drones.

While China surged ahead in the new energy sector by leveraging the consumer market and technological potential, the global market for the low-altitude economy is no longer lax, paying as much attention to this industry as domestic markets, indirectly increasing pressure on domestic enterprises.

Nevertheless, the domestic low-altitude sector is not without highlights.

In the drone sector, companies like DJI have a global market share of up to 70% in consumer-grade drones. EHang Intelligence has obtained the world's first type certificate and production license in the global eVTOL industry. Fengfei Technology has also obtained a type certificate for its products. Other enterprises such as Zero-G are actively seeking certifications. Some institutions predict that by the end of 2025, several domestic eVTOL models will obtain TC certificates and be ready for market delivery.

In summary, the low-altitude economy is awaiting its moment, and with the right circumstances, it is not impossible for it to become the next new energy sector.

Has the "Shuffling Period" Arrived Early?

It's noteworthy that amid the vigorous start of the global low-altitude economy, the frenetic capital influx has accelerated the brutal shuffling period. Both domestically and internationally, financing and bankruptcy scenarios in the low-altitude sector are common.

Last month, Lilium, a star flying car manufacturer once valued at $1.97 billion and known as the "Tesla of Flying Cars," announced bankruptcy. Similarly, Volocopter, which focuses on eVTOL aircraft, was reported to be experiencing a funding shortage in April this year. The domestic situation is even more polarized.

Data shows that in the first quarter of 2024, there were 252 low-altitude economy-related listed companies in the A-share market, with a combined operating revenue of 441.547 billion yuan and a net profit attributable to shareholders of listed companies totaling 13.189 billion yuan. Among them, 9 listed companies had operating revenues exceeding 10 billion yuan, and 61 had operating revenues exceeding one billion yuan.

While these figures may seem promising, some established enterprises have been declining over the past two years.

In the first half of 2024, Aerospace Rainbow, one of the drone giants, reported an operating revenue of 1.019 billion yuan, a year-on-year decrease of 10.37%, and a net profit attributable to shareholders of 66.0115 million yuan, a year-on-year decrease of 42.11%. UAV Corporation, a representative enterprise in industrial-grade drones, once saw its stock price surge by over 90% in the secondary market. However, in the first half of 2024, the company reported a total operating revenue of 83.2664 million yuan, a year-on-year decrease of 35.39%, with a net profit attributable to shareholders of -53.0222 million yuan, compared to a net loss of 5.7025 million yuan in the same period last year.

The reasons for these results are not hard to fathom. To date, the global industrial value of the low-altitude economy is still concentrated in the upstream manufacturing sector, and eVTOL and other aircraft manufacturers face unprecedented internal competition despite significant attention.

Take Lilium as an example. Data shows that since its inception, Lilium has accumulated losses of 1.4 billion euros. In the first half of 2024, Lilium's research and development expenses, general and administrative expenses, and sales expenses were 131 million euros, 49 million euros, and 6 million euros, respectively, representing increases of 55%, 22.7%, and 49% compared to the same period last year.

To some extent, Lilium has become a microcosm of the entire low-altitude economy sector. Several domestic drone enterprises have suddenly encountered bottlenecks, largely due to fierce competition. The sudden outbreak of the sector has left some established enterprises struggling to keep up with changing trends.

To stay afloat, they have to make temporary "efforts." A typical example is UAV Corporation. Last year, UAV Corporation's revenue was unsatisfactory due to increased investment in unattended systems, new multi-rotor drone systems, and heavy-lift drone systems, with an 84.27% increase in R&D expenditure.

Additionally, the company increased its sales costs by 33.35% to expand into new markets. Perhaps this accurately depicts the current state of the low-altitude economy sector. The arrival of a trend can impose unbearable burdens on enterprises that take a step forward, but the likelihood of disappearing is even greater if they choose to remain stagnant.

However, this is far from the cruelest aspect; the more ruthless shuffling is yet to come.

Some institutions predict that globally, only 3 to 4 giant enterprises may dominate the aircraft manufacturing sector of the low-altitude economy, and the entire industrial chain exhibits an uneven development trend. All enterprises in this sector will be tested on their R&D capabilities, airworthiness, financing abilities, teams, R&D efficiency, and commercialization abilities.

In short, comprehensive growth is essential for enterprises to survive. A company's commercialization ability is the only confidence for any sector to successfully remain at the forefront of a trend. It is reported that Lilium once received orders for 100 electric aircraft from Saudi Arabia and other places, with a single aircraft price of about $9 million, but no revenue has been generated yet. Consequently, a star enterprise in the low-altitude economy sector collapsed amidst the sector's heat.

How Far is It from "Mass Consumption"?

There is a notable shift: compared to the mysterious nature of previous years, the low-altitude economy has increasingly garnered public attention over the past two years. The mass consumption scenario is undoubtedly the most stable footing for a trending industry. The new energy sector has therefore taken root in the business world, and the low-altitude economy clearly aims to further consolidate its future through the consumer market.

Therefore, just as the new energy market sells cars, the low-altitude economy also sells aircraft. Previously, EHang Intelligence's self-developed unmanned aerial vehicle EH216-S was successfully sold on Taobao Live. Currently, EH216-S is available for purchase on Taobao at a price of 2.39 million yuan.

However, this step will certainly not be as straightforward as selling new energy vehicles. China's general aviation flight operations are still dominated by industrial and agricultural operations, accounting for nearly 80%, while consumer aviation activities such as air tours, aviation sports, business travel, and private flights account for less than 8% in total. Even in the popular cultural tourism market, the penetration rate of the low-altitude economy is far below expectations.

Incomplete statistics show that 13 provinces and cities in China have clearly stated their intention to develop the "low-altitude tourism" new business format. Over 100 popular tourist cities such as Tianjin, Xi'an, Wuhan, Sanya, and Haikou have launched "air tour" projects. During the May Day holiday this year, the low-altitude flight consumption week in Chongqing attracted nearly 510,000 visitors.

Low-altitude transportation, low-altitude sightseeing, entertainment flight experiences, ground static experiences... Although the low-altitude economy in the consumer market is gradually becoming tangible, on the whole, this sector has not yet emerged from its infancy. Data shows that as of the end of 2023, there were 690 traditional general aviation enterprises with general aviation operating licenses, an increase of less than 30 from the 661 at the end of the previous year.

In 2023, there were 449 registered general aviation airports in China, while the number of general aviation airports in the United States exceeded 4,000. Not only do these airport numbers fail to cover the domestic tourism industry, but last year, China's general aviation completed a total of 1.371 million flight hours, of which only 28,000 hours were for passenger carrying, accounting for only 2%.

However, public information shows that low-altitude tourism accounts for up to 50% of global general aviation flights. This discrepancy indirectly reflects the conservative consumption attitude of domestic consumers towards the low-altitude economy, and data also proves this point, with only about 10% of low-altitude tourism projects achieving profitability.

Besides the tourism market, mass consumption areas closely related to the low-altitude economy also include aviation sports and flight training, which are popular among the middle class. As soon as the low-altitude economy exploded, a "pilot license" became a new dream for many young people. It is reported that pilot licenses mainly include three types: sports, private, and commercial.

In recent years, the number of domestic pilot licenses has soared. As of December 31, 2023, the Civil Aviation Administration of China had issued 2,514 sport pilot licenses and 5,317 private pilot licenses. Among them, the number of sport pilot licenses increased by 1,401 compared to 2020, and the number of private pilot licenses increased by 1,298.

Teaching and training aircraft constitute a substantial portion of registered general aviation aircraft in China. According to public data, there are over 30,000 aviation training-related companies operating in the country. Nevertheless, the costs associated with these training programs are generally prohibitive for the average individual, with sports licenses ranging from 68,000 to 108,000 yuan, private licenses costing 168,000 yuan, and commercial licenses exceeding 700,000 yuan.

While new energy vehicles are increasingly accessible, aircraft remain out of reach for many. Similarly, while obtaining a driver's license for a car is relatively straightforward, acquiring a pilot's license is a different story. This fundamental disparity highlights a key difference between the low-altitude economy and the new energy sector. It is our hope that this ambitious vision will one day become a tangible reality.

Dao Zong You Li, formerly known as Wai Dao Dao, is a prominent new media outlet within the internet and technology sphere. This is an original article, and any reproduction without retaining the author's relevant information is strictly prohibited.