Honor's Desperate Bid for Revival

![]() 07/10 2025

07/10 2025

![]() 591

591

Source | Bohu Finance (bohuFN)

Recently, the sales rankings of China's mobile phone market based on activations for the second quarter of this year were released, placing Honor among the 'Others'. Including the first quarter, Honor has failed to reclaim a top 5 position for six months.

While other companies have also faced the dilemma of slipping into the 'Others' category, Honor is currently under greater pressure:

On one hand, Honor stands at a critical juncture for its IPO: The China Securities Regulatory Commission website revealed that Honor obtained listing counseling registration on June 26, with CITIC Securities as the counseling institution. More than ever, Honor needs to demonstrate its value.

On the other hand, differentiation in the domestic smartphone market continues to deepen. After Huawei's return, the long-standing landscape of Honor, Xiaomi, OPPO, and vivo has shifted – Huawei quickly surged into the top five domestically, relying on brand and marketing momentum, while Xiaomi leveraged its foray into the automotive industry to boost mobile phone sales.

In contrast, following an unexpected leadership transition earlier this year, Honor must address team issues and redefine its identity. With Huawei's return, Honor urgently needs to articulate its differences from Huawei.

The domestic mobile phone market has limited growth potential, now primarily driven by replacement demand. Canalys previously predicted that smartphone market growth will plateau starting in 2025, with the compound annual growth rate from 2024 to 2028 further reducing to 1%. This means every additional phone sold takes market share from competitors.

After a series of personnel changes, Honor's new CEO Li Jian is betting on AI. Honor's new positioning is as an "AI Terminal Ecosystem Company," and he has pledged to invest over ten billion dollars in the next five years to support ecosystem construction.

However, with Xiaomi's offline expansion and Huawei's return to the mobile phone business, Honor has a limited window to regain market share. Compared to the new AI terminal ecosystem positioning, the new management's statement of "returning to the top three in the market in the second half of the year" may be more reassuring to investors.

01 The Mobile Phone Business: A Tough Nut to Crack

It is well-known that the mobile phone business is highly competitive and saturated. But for Honor, the difficulty has increased significantly since separating from Huawei.

In 2020, Honor's biggest challenge was rebuilding its development platform and operating system. Then-CEO Zhao Ming mentioned that imaging capabilities, energy management, and operating systems all relied on Huawei's stable platform. When this platform changed, the entire system had to be reconstructed. "When the market and products are overhauled, it's not a fluctuation, but a reset."

Despite the mobile phone industry's downturn, Huawei's exit left room for Honor in the mid-range market. Leveraging Huawei's previous sub-brand market image and inherited channel resources, Honor captured this market share more easily than other brands.

While Honor tirelessly explains its business independence from Huawei in promotional materials, at the product level, it remains close. Launched products are often criticized as copies of Huawei phones. For example, the Honor Digital series resembles Huawei's P series, while the flagship Magic series mirrors Huawei's Mate series.

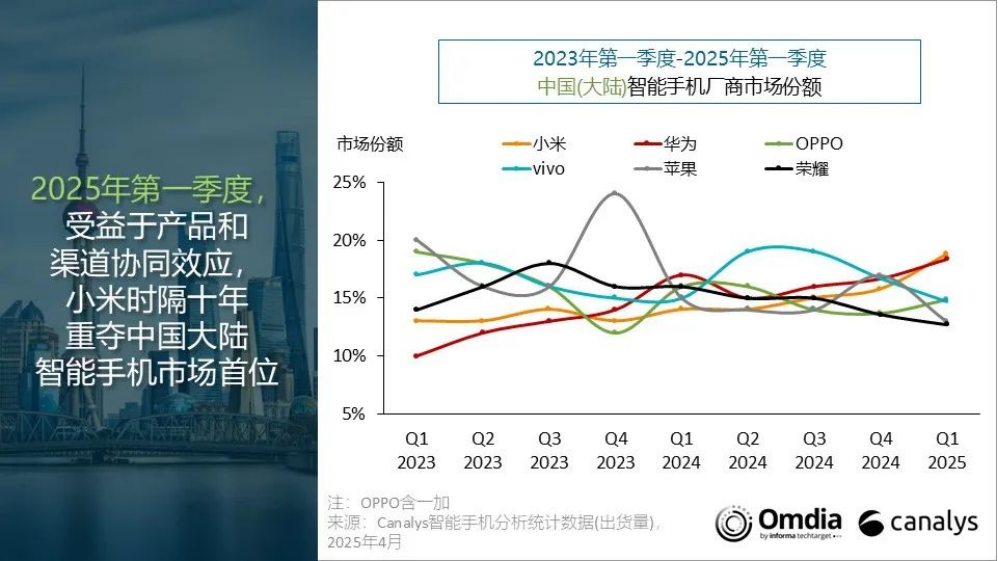

In the first quarter of 2023, Honor secured the top three positions in the domestic market, peaking in the third quarter.

The turning point came with Huawei's return. In late August 2023, Huawei suddenly launched its new flagship, the HUAWEI Mate 60 Pro. By the end of the year, Huawei also introduced models like the Enjoy 70 and nova 12 series, targeting the high-end market above 5,000 yuan and the more affordable mid-range market, respectively. Huawei maintained a normal update rhythm thereafter.

Post-Huawei's return, Honor's brand and channels, previously relied upon, took a significant hit. According to Canalys data, Honor could still maintain its position as the second largest domestic player in the fourth quarter of 2023, but this was followed by an uncontrollable decline, with its market share falling to sixth. In contrast, Huawei gradually regained lost ground in the domestic market, occupying the first position in the first quarter of 2024 and largely maintaining a top-two position.

What also concerns Honor is that its peers are still evolving.

In the second quarter of this year, Xiaomi regained the top spot in the Chinese market based on activations. In the first quarter, Xiaomi led in shipments with 13.3 million units, a year-on-year increase of 40%.

Xiaomi's success can be attributed to its product definition. The small-screen flagship Digital series stabilized Xiaomi's sales volume in mid-to-high-end models, while the Ultra series focused on imaging, holding onto the high-end imaging segment.

Furthermore, Xiaomi's investments over the past few years have borne fruit. Xiaomi's automotive business and new retail represented by "Xiaomi Home" have significantly boosted its mobile phone business recently. Due to low channel profits, Xiaomi struggled with offline expansion in the past. However, after Xiaomi's automotive business became a hit, the qualification to open stores became a scarce resource, naturally driving Xiaomi's new retail expansion. According to Lei Feng Wang, after the Xiaomi SU7 became a hit, some malls were even willing to reduce rent to one-tenth of the original price to attract customers.

Xiaomi's high customer unit price and popularity have helped its mobile phones attract more attention while enhancing its image in users' minds. After completing the "people, cars, homes" ecosystem, Xiaomi's unique interconnected system has also increased user stickiness to its mobile phones.

The current trend shows Xiaomi's momentum growing stronger. In the future, differentiation in the domestic mobile phone market may widen further, with the top two or three players increasing their market share.

As mentioned, for every additional phone sold by competitors, Honor sells one less. Competition is intensifying, leaving little time for Honor to adjust.

02 Can "The First AI Terminal Ecosystem Stock" Succeed?

We discussed in "From 'Benchmarking Xiaomi' to 'Leading the Pack,' Honor Accelerates IPO" that Honor has two main strategic points: one is to use "AI and foldable screens" to compete in the high-end market; the other is to find a path of differentiation and focus on overseas markets.

In March of this year, at the Mobile World Congress, new CEO Li Jian officially announced that Honor would transform from a smartphone manufacturer to an AI terminal ecosystem company, stating that Honor would invest 10 billion dollars in AI terminal technology, ecosystems, and partnerships over the next five years.

Honor is not just talking; it is also acting. In the first half of this year, Honor made numerous layouts from R&D investment to talent team building.

Honor has established a first-level R&D department called the "AI & Software Business Department," as well as a New Business Model Expansion Department and a New Industry Incubation Department. The AI & Software Business Department has five major laboratories to accelerate technological innovation and industry incubation through interdisciplinary cooperation. The New Industry Incubation Department focuses on promoting the deep integration of AI capabilities with product lines and system platforms to accelerate product intelligent reconstruction.

At the launch of the Honor 400, Honor also released a self-developed robot, claiming it could achieve an industry-record running speed of 4 meters per second.

Focusing on the AI terminal ecosystem is undoubtedly a sound strategy, as a pure mobile phone business lacking integrated hardware and software capabilities cannot support an imaginative valuation. Currently, the only domestically listed mobile phone companies are Xiaomi and Transsion. The latter focuses on overseas markets and currently has a market value of 88.2 billion yuan. Xiaomi's market value has soared to 1.49 trillion Hong Kong dollars, but this is built on the foundation of its automotive manufacturing business. Before automotive manufacturing officially bore fruit, Xiaomi's share price hovered at a low level. Based on the market value in March 2024, the valuation corresponding to the mobile phone business is approximately 204.9 billion yuan.

For any mobile phone manufacturer, grasping both AI and ecosystems is always the right choice.

The issue is that AI terminals are not likely to contribute to short-term performance. Even the current promotional focus – edge AI capabilities – is not a key competitive point in mobile phones. AI mobile phones are still in the exploratory stage technically, with no killer application at the application level yet.

What keeps Honor afloat is still selling mobile phones. In China, Honor has launched the Honor 400 series, targeting the mid-range market with sincerity: large battery, strong imaging, flagship chip, and even Xiao Zhan as the spokesperson. Market feedback has been positive, with the first sale of the Honor 400 series increasing by 195% year-on-year, achieving over a million activations within a month, making it Honor's fastest-growing product in the past three years.

Li Jian believes that "the Honor 400 series may be a turning point in the company's mobile phone sales," indicating that the new sales curve is expected to rise in June and July.

We believe the successful first sale of the Honor 400 can only be considered a crucial step for Honor to stabilize. The mid-to-low end is not Huawei's focus, consumer loyalty is lower, and profits are thinner. Whether developing foldable screen products or using R&D results to further shape the brand image, Honor needs to produce more convincing results to support its future vision of the AI ecosystem.

The cover image and accompanying images are the property of their respective copyright owners. If the copyright owner believes that their work is not suitable for public browsing or should not be used free of charge, please contact us promptly, and this platform will immediately make corrections.