Hong Kong Bids Farewell to the 'Financial Ruins'|Wave

![]() 07/10 2025

07/10 2025

![]() 605

605

Editor|Yang Xuran

In just one year, Hong Kong's stock market transformed from being labeled a 'financial ruin' to becoming a core hub for global capital investment in China.

In 2024, 70% of newly listed Hong Kong stocks broke on their first day of trading, prompting some investors to threaten, 'If you dare to list, I'll break your legs.' A year later, retail investors eagerly anticipated new issues, exclaiming, 'Don't ask if you can get on board; ask if you understand the policy!'

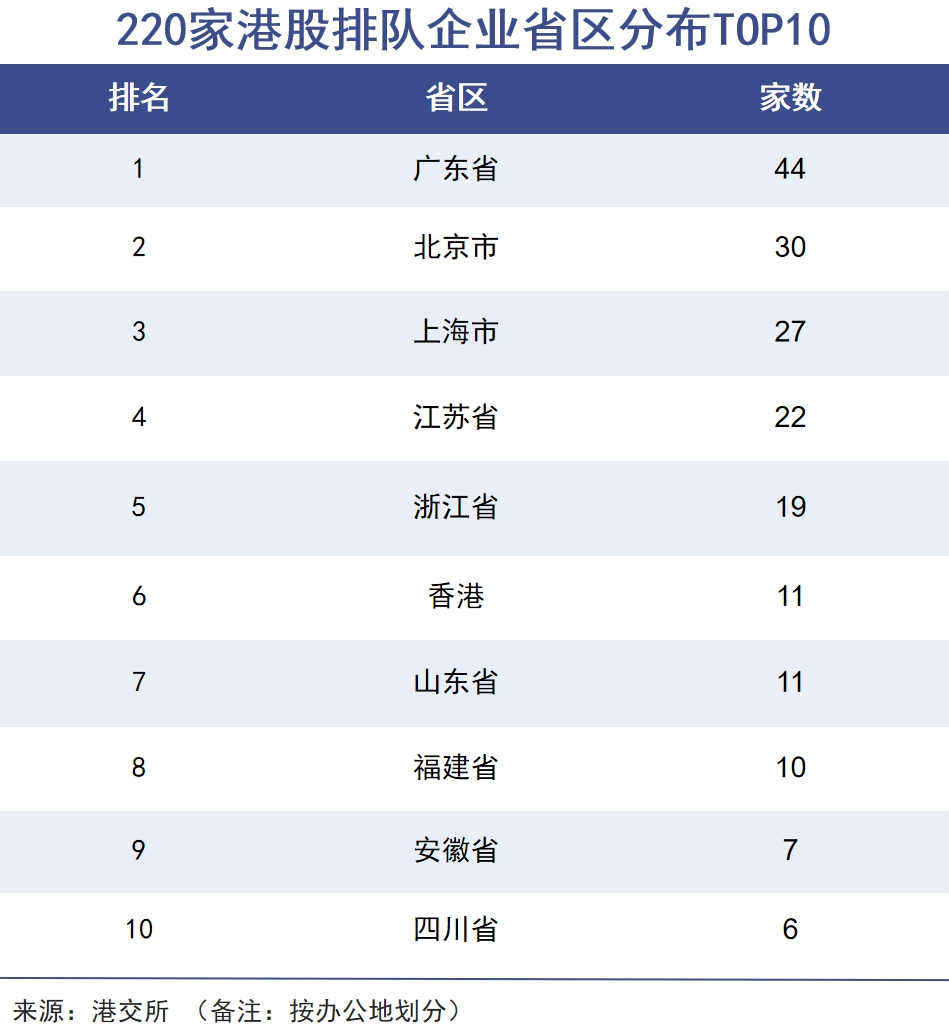

The IPO frenzy in Hong Kong stocks continued in the first half of this year. A-share giants such as CATL, Haitian Flavoring & Health, and Hengrui Medicine flocked to Hong Kong. In just six months, 240 companies rushed to list, with 220 more in the queue (as of June 30).

In just half a year, 43 new stocks debuted on the Hong Kong Stock Exchange, leading some to joke that 'HKEX's golden gong is not enough.' The number increased by 43.3% compared to the same period in 2024; new stock fundraising amounted to HK$106.71 billion, topping the global IPO fundraising list and surpassing Nasdaq on the other side of the ocean (HK$71.3 billion).

Back in 2019, Hong Kong was also the global IPO leader. However, in the following years, the pandemic, turmoil, global economic and trade instability, undervaluation, and liquidity drying up caused this 'one of the world's three major financial centers' to show signs of decline, even being called 'financial ruins.'

Unlike overseas financial cities like Singapore, Hong Kong's true backing is mainland China. From the earliest state-owned red chip stocks to internet companies, the return of Chinese concept stocks, and now more industrial enterprises listing, Hong Kong has actually become a forward base for Chinese enterprises to participate in international competition.

The existence and prosperity of HKEX have strengthened Hong Kong's role as a 'super connector' and 'super value adder.' In the future, the connection between mainland China and Hong Kong will become increasingly close, and the historical status of HKEX will continue to rise.

This is an in-depth value article from the content team at Wave. Welcome to follow us on multiple platforms.

IPO Wave

The current IPO boom in Hong Kong stocks inevitably brings to mind the wave of Chinese concept stock returns that began in 2020 and the steps taken by state-owned enterprises, represented by Tsingtao Brewery in the 1990s, to list in Hong Kong.

History does not repeat itself verbatim, and this time, the significance will be even greater.

As summer flames rage, the gong sounds dense in Hong Kong's financial hall.

On May 20, lithium battery giant CATL listed on the main board of the Hong Kong Stock Exchange. The exchange hall was packed with investment banking elites holding mobile phones for live broadcasts. This time, CATL raised about HK$35.7 billion in Hong Kong, setting a record for the world's largest IPO this year, and its market value in Hong Kong stocks even surpassed that of A-shares by nearly RMB 300 billion.

A month later, 'soy sauce king' Haitian Flavoring & Health listed its H-shares, raising HK$10.1 billion with oversubscription of over 930 times, demonstrating the frenzy surrounding new issues in Hong Kong stocks.

In addition, A-share pharmaceutical leader Hengrui Medicine, beverage giant Mixue Group, and other companies with core businesses in mainland China have also chosen to attract global investors in Hong Kong stocks. Among them, Hengrui Medicine's Hong Kong stock fundraising amount is three times that of A-shares; and with the help of Hong Kong's capital market, Mixue Bingcheng founder Zhang Hongchao's net worth surpassed HK$200 billion, surpassing Qin Yinglin to become the new richest person in Henan. Listed companies including Laopu Gold, Pop Mart, and Weilong Food have sparked a new consumption wave.

With the support of multiple convenience measures, enterprises from mainland China are accelerating their influx into HKEX.

On June 26 and June 30, three companies rang the gong for listing each day. On July 9, an unusual scene of five companies collectively listing on a single day was witnessed.

Statistics show that in the first half of this year, a total of 43 new stocks debuted on Hong Kong, compared to only 30 in the same period last year. The cumulative fundraising for new stock IPOs amounted to HK$106.71 billion, surpassing Nasdaq (HK$71.3 billion) and regaining the top spot globally. Just two years ago, HKEX's fundraising amount rarely fell out of the global top 5.

Data shows that in May alone, more than 40 enterprises submitted applications. As of the end of the first half, a total of 240 enterprises had flooded in, and the number of those in the queue increased to 220, of which 219 were submitted this year.

Deloitte China predicts that this year, up to 80 new stocks will be listed in Hong Kong, raising HK$200 billion, potentially taking the top spot globally. Among them, 25 are expected to be 'A+H' new stocks, demonstrating Hong Kong's capital market's ability to accommodate mainland enterprises.

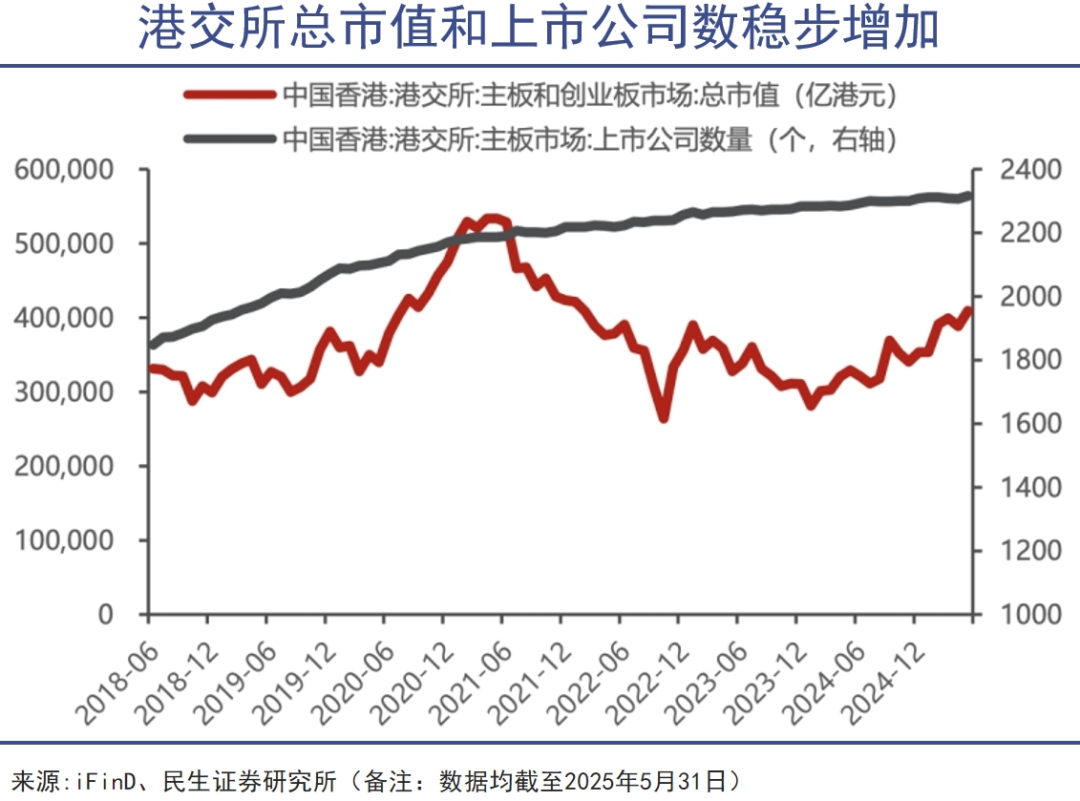

Sweeping away the gloom of the past two years, this round of IPO wave in Hong Kong stocks has solidified Hong Kong's status as an international financial center in terms of the number and scale of listings.

In the early 1990s, the Hong Kong stock market was mainly composed of real estate companies such as CK Hutchison and Sun Hung Kai Properties, as well as local public utility listed companies like Hong Kong Electric and Towngas, with a relatively simple structure.

In 1984, Chinese-funded enterprises acquired Hong Kong listed companies (CITIC Group injected capital into Ka Wah Bank), initiating the 'red chip model,' and Hong Kong stocks began to add a touch of Chinese-funded elements; in 1993, Tsingtao Brewery became the first mainland enterprise to list in Hong Kong, igniting the flame of state-owned enterprises listing in Hong Kong. Since then, the three major operators, large energy enterprises, and large financial companies have followed suit.

Around 2010, the internet economy began to flourish, but as HKEX did not allow companies with 'dual-class shares' to list at that time, Alibaba failed to enter HKEX.

Li Xiaojia, then CEO of HKEX, had a clear understanding of this: 'New technology and the new economy have become new waves driving world economic development... Although we missed one or two big IPOs, we have begun to seriously consider how Hong Kong should keep pace with the times and consolidate its unique advantages as an international financial center.'

Four years later, reform measures were implemented, and Alibaba finally landed on HKEX, with Baidu, JD.com, and NetEase also returning to Hong Kong stocks.

Today, leading enterprises in new consumption, new technology, and innovative drugs are telling new 'China stories' in Hong Kong stocks. Hong Kong's capital market serves as a blood tie connecting mainland enterprises with international capital.

A typical example is that CATL chose to invest 90% of its Hong Kong stock fundraising in its Hungarian factory. It is said that investment bankers were still revising the prospectus at 2 a.m.: 'European customers only recognize the supply chain listed in Hong Kong stocks.' Midea has over RMB 100 billion in cash on its balance sheet and does not lack funds, but it insists on going south due to its covetousness of the global market.

Pricing Power

The boiling IPO in Hong Kong stocks also hides the hidden battle between Chinese finance, Chinese capital, and Wall Street financial capital.

The return of Hong Kong stock financing to its peak is also a reacceleration of the internationalization of Chinese financial institutions. Among the enterprises that have listed this year, CICC has helped 13 enterprises to list and grab the top spot, while CITIC and Huatai tied for second place with 9 each; the 220 enterprises in the queue are almost entirely handled by Chinese-funded sponsor institutions. Capital giants such as Morgan Stanley, Goldman Sachs, UBS, and Citibank pale in comparison.

When Mixue Bingcheng leveraged RMB 4 lemonade to leverage global capital, the ultimate Chinese supply chain + industrial Cthulhu + digital empowerment, coupled with the 'rural surrounding cities' approach, left international capital veterans scratching their heads;

Laopu Gold uses ancient craftsmanship to create modern luxury goods, telling a dual story about culture and precious metals. Nowadays, snatching up Laopu products is like meeting girlfriends for afternoon tea, pushing the stock's PE ratio up to 120 times. Fund managers heavily invested in Laopu Gold believe that the company has pushed the value formula for high-end products, 'Product Value = Functional Value + Emotional Value + Asset Value,' to its extreme, and this valuation system is obviously incompatible with the investment logic adhered to by international investment banks.

When Labubu swept through the wallets of young people around the world, this grinning doll sent Pop Mart's stock price soaring 21 times from its lowest point, leaving global investors adhering to the concept of value investing dumbfounded.

When pricing CATL, traditional international investment banks were still struggling with PE multiples, while the Chinese team presented a 'global lithium battery share + European green electricity subsidy' model, and the issue price was ultimately 23% higher than foreign expectations.

It is said that China Merchants Securities International has assembled a 30-person team to specialize in specialized technology fields, using the 'pipeline valuation method' to evaluate innovative pharmaceutical enterprises and even the 'user asset model' to calculate the value of milk tea shops.

Due to the popularity of issuances, in recent years, there has even been a trend of talent from foreign investment banks flowing to Hong Kong Chinese-funded financial institutions. These job-hopping bankers joined the battle with the client lists of Goldman Sachs and Morgan Stanley.

Chinese investment banks compete for pricing power with 'Chinese-style valuation,' and Chinese funds from mainland China directly stir up the trading logic of Hong Kong stocks.

Since the beginning of this year, southbound funds have swept up HK$730 billion, and the proportion of transactions has jumped from 34.6% last year to 43.9%, meaning that mainland funds have mastered nearly half of the trading discourse power in Hong Kong stocks.

The continuous expansion of interconnection targets, the expansion of the scope of ETF targets for Shanghai-Shenzhen-Hong Kong Stock Connect, and the continuation of preferential tax policies have jointly sent the system dividend of Hong Kong stocks to continuously attract source water. Since the beginning of this year, the Hang Seng Index has crushed major global stock indices with a 22% increase.

As southbound funds contribute over HK$700 billion in increments annually, insurance fund allocation exceeds 51%, and large internet + AI + new consumption + innovative drug listed companies constitute the frontline of Hong Kong stocks, a historic transformation has begun. Ideally, Hong Kong's financial market will break away from the European and American pricing system and become the main battlefield for global pricing of RMB assets.

Chinese assets + Chinese stories + Chinese pricing + Chinese capital, a financial battle positioned in Hong Kong, the scales have already begun to tilt.

Revitalization

In 1866, the earliest securities trading activities in Hong Kong began to emerge. It was not until many years later, when British businessman Paul Chatter founded the Hong Kong Stockbrokers' Association in 1891, that the birth of Hong Kong's first stock exchange was marked.

For the next century, Hong Kong's financial market became an appendage of foreign capital financing and the British colonial economy. The Gold and Silver Securities Exchange, the Kowloon Stock Exchange, the 'Hong Kong Club,' and the 'Far East Club' stood tall together. In 1986, the Stock Exchange of Hong Kong Limited officially opened, and the four exchanges completed their merger.

By March 2000, the Stock Exchange of Hong Kong Limited, the Futures Exchange of Hong Kong, and the Central Clearing and Settlement System merged to form Hong Kong Exchanges and Clearing Limited (HKEX), which was later listed on the Stock Exchange of Hong Kong, becoming one of the world's first listed exchanges.

After 25 years of development, the market value of mainland Chinese enterprises currently accounts for 81% of the total market value of Hong Kong stocks, and Hong Kong stocks have become a must-visit 'shelf' for international investors to buy Chinese assets.

After a century of storms, Hong Kong's status as a financial center has encountered many challenges, including the pandemic, political turmoil, international economic and trade instability, and its own institutional defects, which have all caused doubts about Hong Kong's future from the outside world. But every time, Hong Kong has reached new heights.

With multiple advantages, Hong Kong's financial market will obviously not evolve into an awkward situation like Singapore. Currently, Singapore's financial market is experiencing a rapid decline in financing capacity and trading volume. Whether it is stock and bond trading or commodity trading, Singapore cannot match Hong Kong.

In 2025, a massive capital exodus occurred in the Singapore stock market, with 11 enterprises collectively delisting within four months. HSBC and Standard Chartered moved their Asia-Pacific headquarters back to Victoria Harbor, and Singapore's long-cultivated myth of a 'financial safe haven' is rapidly fading.

Supported by the motherland and facing the global stage, the Hong Kong stock market has consistently been a beacon of reform:

By dismantling the listing barriers for 'dual-class shares' and embracing Chinese concept stocks, it has opened its doors wider.

The introduction of Chapter 18A enabled unprofitable biotechnology firms to list, while Chapter 18C in 2023 bolstered financing for 'specialized technology' enterprises.

In 2024, the SPAC (Special Purpose Acquisition Company) listing mechanism was instituted, diversifying listing avenues and positioning Hong Kong as a hub for new economy financing and investment.

Mechanistically, the Shanghai-Shenzhen-Hong Kong Stock Connect was established, and the Bond Connect and Swap Connect were continually refined, injecting sustained vitality into the Hong Kong stock market.

According to the latest reforms, enterprises from the Guangdong-Hong Kong-Macao Greater Bay Area listed in Hong Kong will now be permitted to list in Shenzhen as per policy guidelines, heralding the potential emergence of new 'H+A' listed companies.

Amidst international upheavals, Hong Kong plays an irreplaceable bridging role and attracts elite talent. With the convergence of the right time, place, and people, Hong Kong is dispelling the myth of 'financial ruin' and surpassing Singapore's financial legend. It is foreseeable that this Oriental Pearl will undoubtedly shine brightly once more, but this time, its prosperity will transcend that of decades past.