China Ping An and Others Aim to Fortify Positions with AI

![]() 07/13 2025

07/13 2025

![]() 394

394

While AI is not the primary battleground for the insurance industry, publicly traded insurance companies are intensifying their investments in AI. This strategic approach is akin to the "Red Queen Effect," where constant effort is required just to stay in place.

By Original New Entropy, AI New Technology Team

By Original New Entropy, AI New Technology Team

As the insurance industry braces for heightened competition, insurers are establishing multi-faceted competitive barriers to "defend their turf," with AI emerging as an unspoken choice.

On July 3, the China Academy of Information and Communications Technology announced the first batch of exemplary cases for software innovation applications under the "Open Source Large Model+" initiative in 2025. Among them, 14 intelligent products from Ping An Property & Casualty Insurance, Ping An Life Insurance, Ping An Good Doctor, and other Ping An Group subsidiaries stood out. These products passed the evaluation for the quality and efficiency of open-source large model integration and application capabilities and were selected as the first batch of showcase cases. This official recognition underscores the remarkable achievements of China Ping An in the AI domain. In fact, China Ping An's recent actions have frequently highlighted "artificial intelligence." In its 2024 annual report alone, "AI" appeared over 20 times, and "artificial intelligence" was mentioned ten times.  In the fiercely competitive market, leading enterprises often display remarkable consistency in their strategic layouts, a natural outcome of commercial competition and market forces. Like China Ping An, China People's Insurance, China Life Insurance, China Pacific Insurance, and New China Life Insurance, the four other listed insurance companies, also noted in their annual reports and performance presentations that AI technology has evolved from an auxiliary tool to a strategic core. The industry holds an extremely optimistic outlook on this AI competition spearheaded by listed insurance companies. UBS previously stated in a research report that, under the best-case scenario, generative AI could reduce labor costs in the securities and insurance industries by 40% by 2030, lifting the valuation of securities firms/insurance companies by 38%/26% in 2030. Market expectations have also been reflected in the secondary market. Choice data reveals that from April 1 to July 8 this year, the insurance sector rose by 13.48%, significantly outperforming the A-share's three major indexes over the same period. However, despite the frenzy of various funds in the secondary market, the "tipping point" for giants is still far off. After all, the real battleground has never been AI. As the industry enters a zero-sum game phase, the core of competition shifts to the redistribution of existing resources. The strategic focus of giants has shifted from expansion to defense, and at this juncture, "defending territory" may be a pragmatic winning strategy. The significant investment in AI at this time could become one of the biggest boosts for insurance giants to successfully fortify their positions.

In the fiercely competitive market, leading enterprises often display remarkable consistency in their strategic layouts, a natural outcome of commercial competition and market forces. Like China Ping An, China People's Insurance, China Life Insurance, China Pacific Insurance, and New China Life Insurance, the four other listed insurance companies, also noted in their annual reports and performance presentations that AI technology has evolved from an auxiliary tool to a strategic core. The industry holds an extremely optimistic outlook on this AI competition spearheaded by listed insurance companies. UBS previously stated in a research report that, under the best-case scenario, generative AI could reduce labor costs in the securities and insurance industries by 40% by 2030, lifting the valuation of securities firms/insurance companies by 38%/26% in 2030. Market expectations have also been reflected in the secondary market. Choice data reveals that from April 1 to July 8 this year, the insurance sector rose by 13.48%, significantly outperforming the A-share's three major indexes over the same period. However, despite the frenzy of various funds in the secondary market, the "tipping point" for giants is still far off. After all, the real battleground has never been AI. As the industry enters a zero-sum game phase, the core of competition shifts to the redistribution of existing resources. The strategic focus of giants has shifted from expansion to defense, and at this juncture, "defending territory" may be a pragmatic winning strategy. The significant investment in AI at this time could become one of the biggest boosts for insurance giants to successfully fortify their positions.

Listed Insurance Companies Launch AI Competition AI's potential to redefine growth logic is now a consensus among almost all insurance companies. According to iResearch estimates, the total technology investment in the insurance industry will surpass 67 billion yuan in 2025, with the frontier technology research and development sector performing prominently, expanding at a compound annual growth rate of 22.5%. According to the "14th Five-Year Plan for Insurance Technology" issued by the China Insurance Association at the end of 2021, the cumulative investment in information technology in the insurance industry was 35.1 billion yuan in 2020, accounting for 0.63% of operating revenue. In other words, in four years, the entire insurance industry's investment in the technology sector has nearly doubled.

Specifically, insurance companies have tacitly chosen the currently "hot" AI. Among them, the five major listed insurance companies have acted swiftly and vigorously. For example, PICC's "six unified" intelligent base construction (computing power base, technical route, data base, intelligent base, security base, and independent and controllable solution), Ping An's "953" technology matrix, China Pacific Insurance's "AI+" strategy, and the seamless integration of China Life's digital intelligence technology and operational services. Among the five major listed insurance companies, Ping An China's actions and achievements in AI are currently in a "leading" position. In the opening speech of Ping An China's 2024 annual report, Chairman Ma Mingzhe emphatically stated, "Comprehensive digitization is the primary task for the start of 2025!" At the performance presentation meeting, Ma Mingzhe further revealed that artificial intelligence has been fully implemented across all aspects of Ping An's main business. Leading enterprises have a keen insight into market changes. As early as 2013, in his New Year's speech, Ma Mingzhe proclaimed the slogan of "Technology Leading Comprehensive Finance." Since then, Ping An China has stated that it will invest 1% of its annual revenue in technology research and development. Regarding the timing of targeting AI, Executive Director Guo Xiaotao said that Ping An Group has been investing in technology and AI for over 15 years. As for the amount spent on AI thus far, Ping An China has not disclosed specific figures. It only revealed in 2020 that it had invested a total of 100 billion yuan in technology over the past decade and would invest another 100 billion yuan in the next five years.

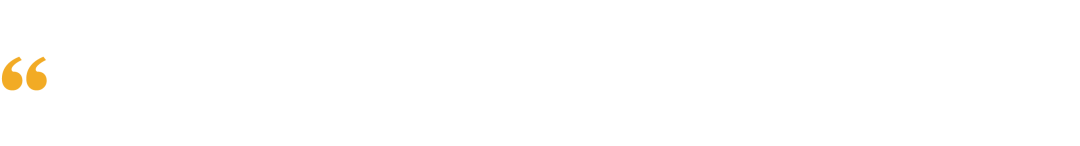

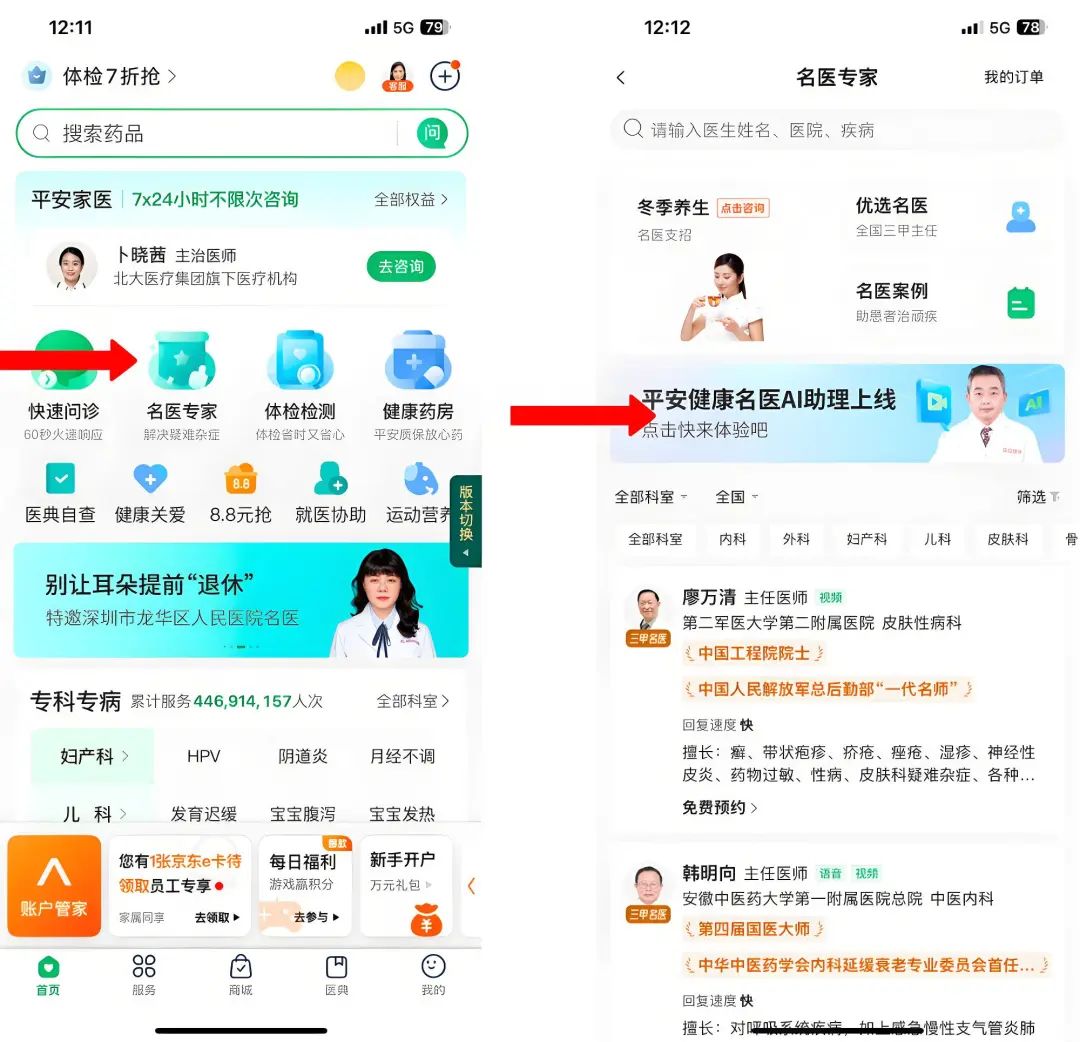

In terms of specific achievements, Ping An China's AI application scenarios are primarily divided into financial insurance, healthcare, and others. In the field of financial insurance, it is mainly used in sales, underwriting, claims, and customer service; in healthcare, it can be specifically utilized in Ping An Chip Doctor, An Director, AI-assisted diagnosis and treatment system, and AI health manager; in addition to the above two fields, it is also used in Ping An Bank's AI-assisted coding, etc.

AI's potential to redefine growth logic is now a consensus among almost all insurance companies. According to iResearch estimates, the total technology investment in the insurance industry will surpass 67 billion yuan in 2025, with the frontier technology research and development sector performing prominently, expanding at a compound annual growth rate of 22.5%. According to the "14th Five-Year Plan for Insurance Technology" issued by the China Insurance Association at the end of 2021, the cumulative investment in information technology in the insurance industry was 35.1 billion yuan in 2020, accounting for 0.63% of operating revenue. In other words, in four years, the entire insurance industry's investment in the technology sector has nearly doubled.

Specifically, insurance companies have tacitly chosen the currently "hot" AI. Among them, the five major listed insurance companies have acted swiftly and vigorously. For example, PICC's "six unified" intelligent base construction (computing power base, technical route, data base, intelligent base, security base, and independent and controllable solution), Ping An's "953" technology matrix, China Pacific Insurance's "AI+" strategy, and the seamless integration of China Life's digital intelligence technology and operational services. Among the five major listed insurance companies, Ping An China's actions and achievements in AI are currently in a "leading" position. In the opening speech of Ping An China's 2024 annual report, Chairman Ma Mingzhe emphatically stated, "Comprehensive digitization is the primary task for the start of 2025!" At the performance presentation meeting, Ma Mingzhe further revealed that artificial intelligence has been fully implemented across all aspects of Ping An's main business. Leading enterprises have a keen insight into market changes. As early as 2013, in his New Year's speech, Ma Mingzhe proclaimed the slogan of "Technology Leading Comprehensive Finance." Since then, Ping An China has stated that it will invest 1% of its annual revenue in technology research and development. Regarding the timing of targeting AI, Executive Director Guo Xiaotao said that Ping An Group has been investing in technology and AI for over 15 years. As for the amount spent on AI thus far, Ping An China has not disclosed specific figures. It only revealed in 2020 that it had invested a total of 100 billion yuan in technology over the past decade and would invest another 100 billion yuan in the next five years.

In terms of specific achievements, Ping An China's AI application scenarios are primarily divided into financial insurance, healthcare, and others. In the field of financial insurance, it is mainly used in sales, underwriting, claims, and customer service; in healthcare, it can be specifically utilized in Ping An Chip Doctor, An Director, AI-assisted diagnosis and treatment system, and AI health manager; in addition to the above two fields, it is also used in Ping An Bank's AI-assisted coding, etc.  ▲Image/Ping An Good Doctor

▲Image/Ping An Good Doctor

To a certain extent, Ping An China's AI layout has played a crucial role in cost reduction and efficiency enhancement. Sheng Ruisheng, Secretary of the Board of Directors and Brand Director of Ping An China, stated last year that AI technology not only drove the sales of products worth hundreds of billions but also saved 10 billion yuan in annualized costs through 2.2 billion AI services and process reengineering. In comparison, other listed insurance companies have not placed as much emphasis on AI as Ping An China, whether in terms of funds, manpower, depth of application, or strategic height. They are mostly in the "pilot first, steady progress" phase. In February of this year, Wei Jiaohua of CPIC Technology revealed that currently, at China Pacific Insurance, the implementation scenarios of large models are concentrated in employee offices, R&D testing, health insurance claims, auto insurance claims services, audit operations, etc., and are still in the pilot stage. China People's Insurance and New China Life Insurance are similar to China Pacific Insurance. According to a report by Securities Daily in July last year, China People's Insurance has established its own artificial intelligence algorithm team, delved into large model technology research and development, and piloted applications in scenarios such as agent empowerment and intelligent customer service. New China Life Insurance's AI applications are also in the pilot phase. However, at the annual report press conference, Qin Hongbo, Vice President of New China Life Insurance, stated that the next step is to comprehensively promote the implementation of large models in agent empowerment, customer experience enhancement, and internal office work. For example, in terms of agent empowerment, the company will launch its intelligent marketing assistant and intelligent coaching AI tools as soon as possible; in terms of customer experience upgrades, it will introduce intelligent customer service entities, and in terms of internal office work, it will introduce a series of AI assistants.  China Life Insurance is no different. According to China Life Insurance's 2024 annual report, its AI large model is applied in various business scenarios such as intelligent underwriting, agent training, and office collaboration. Judging from the path, according to a survey by Caijing in November last year, at present, the domestic insurance industry is still in the initial stage of scenario implementation, from knowledge assistants, intelligent offices, underwriting and claims assistants, intelligent question answering, and other fields, from inside to outside, from B-end to C-end applications, is the current common path for the implementation of large models in the insurance industry. At the implementation level, Caijing further pointed out that the efficiency of large models used internally within enterprises to improve operational efficiency and empower agents and partners has already shown initial results, assisting insurance companies in improving efficiency and accuracy in product design, marketing, customer service, claims processing, and other links, thereby enhancing the benefits of the entire value chain; on the C-end, it is still primarily focused on the basic level of customer service interaction, and direct services still need to evaluate and solve large model security issues to meet the controllability and compliance requirements of generated content; at the technical level, the insurance industry is focusing on training large models specifically for the industry. In other words, although currently listed insurance companies have prioritized "AI," their applications are still primarily marginal and auxiliary functions and have not yet deeply empowered core insurance businesses (such as actuarial pricing, risk management, product innovation, etc.).

China Life Insurance is no different. According to China Life Insurance's 2024 annual report, its AI large model is applied in various business scenarios such as intelligent underwriting, agent training, and office collaboration. Judging from the path, according to a survey by Caijing in November last year, at present, the domestic insurance industry is still in the initial stage of scenario implementation, from knowledge assistants, intelligent offices, underwriting and claims assistants, intelligent question answering, and other fields, from inside to outside, from B-end to C-end applications, is the current common path for the implementation of large models in the insurance industry. At the implementation level, Caijing further pointed out that the efficiency of large models used internally within enterprises to improve operational efficiency and empower agents and partners has already shown initial results, assisting insurance companies in improving efficiency and accuracy in product design, marketing, customer service, claims processing, and other links, thereby enhancing the benefits of the entire value chain; on the C-end, it is still primarily focused on the basic level of customer service interaction, and direct services still need to evaluate and solve large model security issues to meet the controllability and compliance requirements of generated content; at the technical level, the insurance industry is focusing on training large models specifically for the industry. In other words, although currently listed insurance companies have prioritized "AI," their applications are still primarily marginal and auxiliary functions and have not yet deeply empowered core insurance businesses (such as actuarial pricing, risk management, product innovation, etc.).

The AI "Aspirations" of China Ping An and Others

Behind the intense AI layouts being undertaken by listed insurance companies lie their own considerations. On the one hand, it is policy-driven. The "14th Five-Year Development Plan for Insurance Technology" issued by the China Insurance Business Association at the end of 2021 pointed out that the future development of insurance technology will focus on the five major trends of online, service-oriented, refined, platform-based, and intelligent development. On the other hand, it is out of the need to defend their positions. In the first half of this year, some subtle changes have occurred among listed insurance companies. China Life Insurance and China Ping An announced in February this year that they would no longer disclose monthly premium data. The first-quarter premiums are crucial for insurance companies to make a good start, which to a certain extent lays the foundation for the annual premium scale. For example, from 2020 to 2024, the proportion of China Life Insurance's first-quarter premium scale to the annual premium scale was approximately 50%. Based on this, the market can estimate the approximate data for the entire year. It is widely speculated in the industry that the two insurance companies chose not to disclose it due to growth rates lower than expected. The data of leading companies has always been a barometer for the entire industry. According to data from the National Financial Regulatory Administration, in the first three months of 2025, the insurance industry achieved original insurance premium income of 2.17 trillion yuan, a year-on-year increase of 0.93% on a comparable basis, which is a significant slowdown compared to the 5.1% growth rate in the same period last year.  ▲Image/National Financial Regulatory Administration

▲Image/National Financial Regulatory Administration

Apart from efficiency, some insurance companies also believe that AI is an engine for value creation. Ping An China stated that the company's investment in technology is not aimed at creating a certain number of unicorns. The core direction is to empower the main business, which will bring tremendous contributions to profits. For Ping An China, which is financially robust and has a clear direction, Goldman Sachs has given an extremely optimistic forecast: AI technology is expected to drive an average annual revenue growth of 2.5% for Ping An over the next decade. In other words, although AI in the insurance field is influenced by factors such as technology maturity, cost investment, and data quality, and is still far from realizing its full potential, both the industry and institutions are brimming with imagination for it.

The Real Battlefield Has Never Been AI

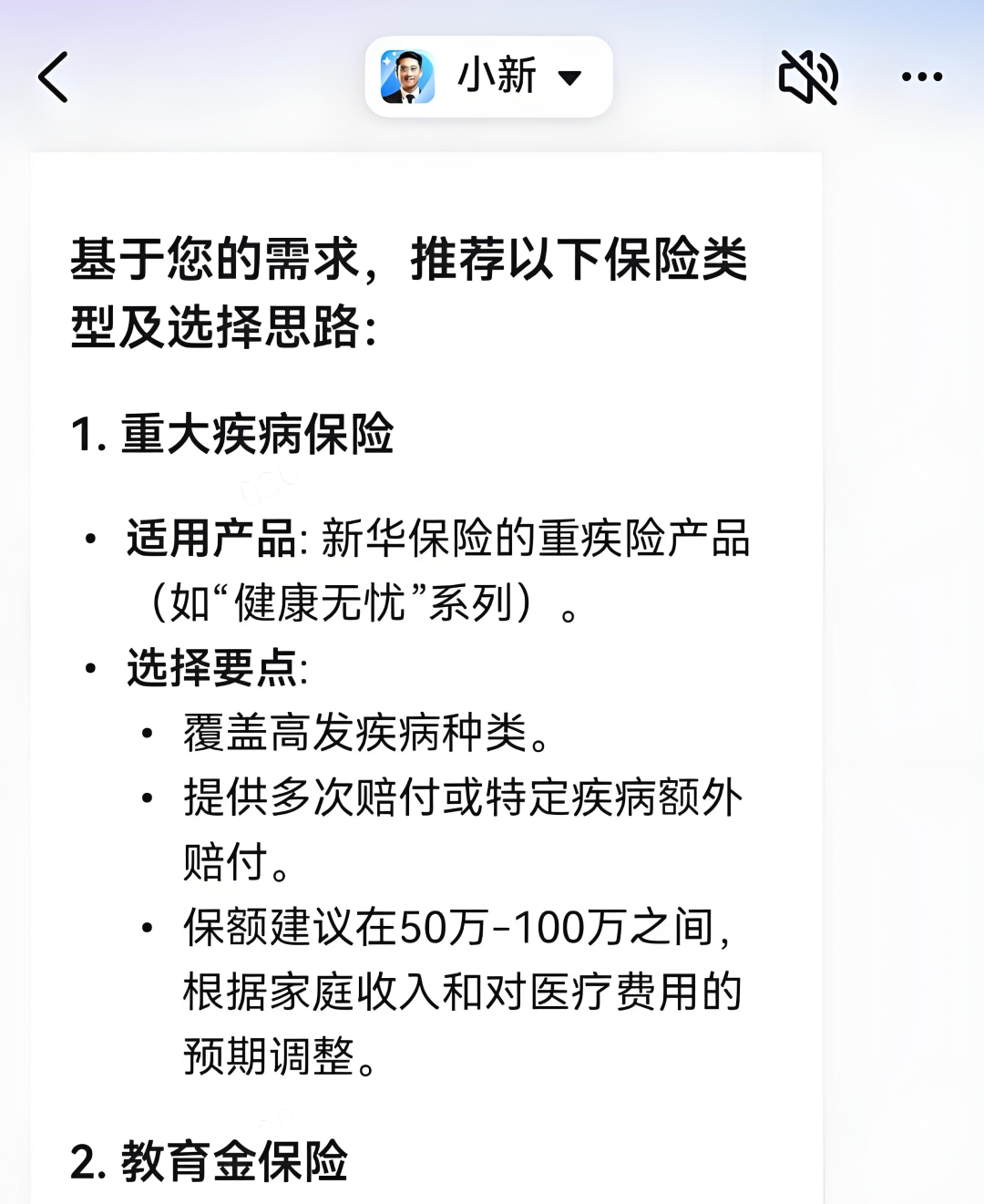

However, the challenges confronting listed insurance companies are "systemic," and AI alone cannot address all aspects. From the perspective of the entire industry, including leading insurance firms, at the operational level, they typically grapple with phenomena such as sluggish premium growth (primarily in life insurance) and fluctuating net profits. Under the new accounting standards, the impact of stock market volatility on insurance companies' net profits has intensified. Pursuant to these standards, the majority of equity assets are classified as trading assets (i.e., FVTPL), and fluctuations in their fair value directly impact net profits. Thanks to the market rally in September 2024, the five major insurance companies witnessed a surge in net profits. However, in the first quarter of 2025, when equity investments became more challenging, the year-on-year changes in the net profits of these five companies were -26.40%, 43.36%, -18.13%, 19.02%, and 39.52%, respectively. Specifically, Ping An China incurred a fair value change loss of -21.802 billion yuan in the first quarter, compared to a gain of 34.487 billion yuan in the same period of 2024, resulting in a difference of 56.289 billion yuan. Meanwhile, China Pacific Insurance recorded a fair value change gain of 1.655 billion yuan in the first quarter, down from 15.104 billion yuan in the same period of 2024, marking a difference of 13.449 billion yuan. These changes have a direct bearing on the performance of insurance companies' net profits.  ▲Image/Ping An China

▲Image/Ping An China

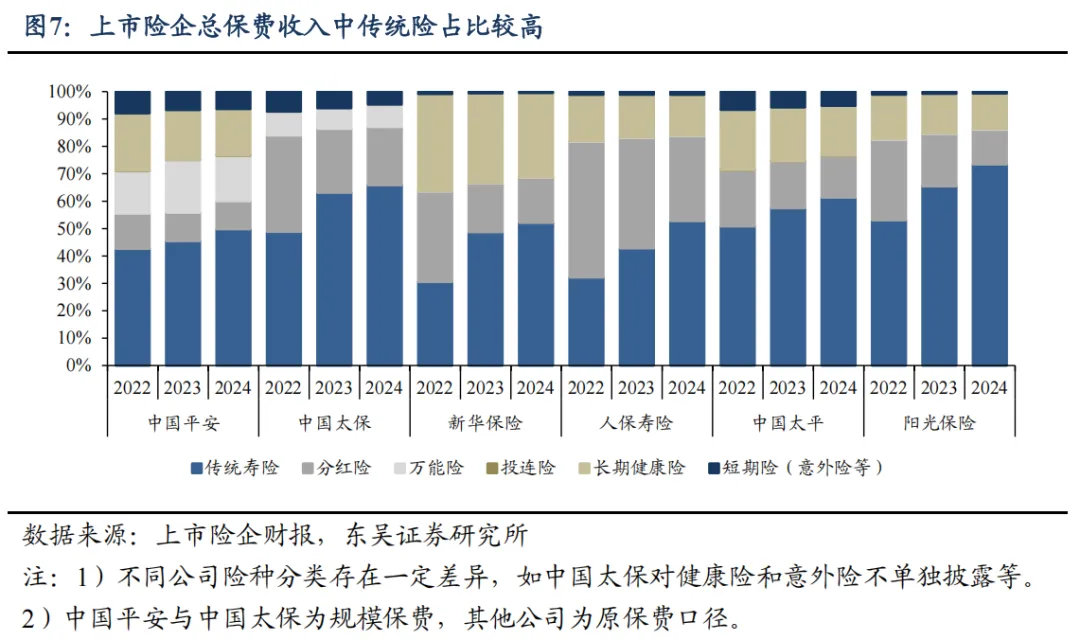

It can be argued that the new accounting standards have imposed stricter requirements on the asset-liability management of insurance companies. Especially against the backdrop of fluctuating interest rates and heightened market uncertainty, asset allocation capabilities are intimately linked to the profit stability and risk control levels of insurance companies. After all, for insurance companies, if investment income fails to cover the cost of liabilities, it will result in an interest spread loss. Furthermore, although the era of evaluating companies solely by premiums is no longer prevalent, premium income remains one of the foundations and core indicators for the operations of insurance companies. According to an analysis by Soochow Securities, since 2023, traditional savings insurance, represented by increasing life insurance, has consistently been the primary product in the life insurance market. In 2024, traditional insurance accounted for 59.2% of the total premiums of listed insurance companies, an increase of 5.4 percentage points year-on-year. The top five product forms of listed insurance companies' premium income reveal that traditional increasing life insurance occupies multiple positions.  ▲Image/Soochow Securities

▲Image/Soochow Securities

Nonetheless, the industry believes that the scale of life insurance premiums, as the market's mainstay, will continue to face pressure in 2025. Moreover, there is a widespread market belief that the pre-determined interest rates of insurance products may undergo a wave of adjustments. Currently, the upper limit for the pre-determined interest rate of ordinary life insurance products is 2.5%, while the research value for the pre-determined interest rate announced in April stands at 2.13%. According to regulatory guidelines, when the maximum pre-determined interest rate of ordinary life insurance products sold by insurance companies exceeds the research value by 25 basis points or more for two consecutive quarters, the maximum pre-determined interest rate for new products must be promptly reduced. The latest research report by Founder Securities indicates that the China Insurance Association may convene the quarterly meeting of the Expert Advisory Panel on the Evaluation Interest Rate of Life Insurance Liability Reserves for the second quarter of 2025 in July. The estimated pre-determined interest rate for the second quarter could be 1.96%, a decrease of 17 basis points from the previous quarter. The pre-determined interest rate for the third quarter of life insurance may decrease by 50 basis points. According to 21 Finance Circle, the upper limit for the pre-determined interest rate of ordinary life insurance may drop from 2.5% to 2.0%, that of participating insurance from 2.0% to 1.5%, and that of universal insurance from 1.5% to 1.0%, with the transition expected to be completed by the end of August at the earliest. The reduction in insurance interest rates will lower the liability costs of insurance companies, thereby mitigating interest rate spread risk. If the pre-determined interest rate for insurance is lowered in the third quarter, it implies that life insurance, which was already less appealing, will become even less favorable with customers. In fact, many listed insurance companies have previously stated their intention to shift their future product orientation towards floating-income products, exemplified by participating insurance. As reported by Securities Daily, as of April 9, among the 185 newly filed life insurance products in the insurance industry since 2025, 71 are participating insurance products, accounting for 38%, an increase of 10 percentage points compared to the entire year of 2024. However, while the concept is straightforward, execution proves challenging. Participating insurance products are inherently complex and demand high levels of quality and professionalism from insurance agents. Even for leading insurance companies, this transformation poses significant hurdles. Furthermore, with many insurance companies currently focusing on participating insurance, differentiating themselves has become paramount. In summary, amidst intensifying competition within the insurance industry, companies that can stand their ground often identify the breakthrough points for the next round of growth first. AI has the potential to become a invaluable assistant for listed insurance companies in safeguarding their positions. With continued defensive investments in the later stages, these investments will eventually culminate in a structural advantage that is difficult to replicate.

Sources: Alpha Factory Financier, "2025, Individual Insurance in Crisis"; iResearch, "iResearch Data || Technology Investment in China's Insurance Industry"; 21 Finance Circle, "Insurance Pre-determined Interest Rates Approach 1.5%, but the Market is No Longer 'Hype-Stopping Sales'"; 21st Century Business Herald, "From Auxiliary Tool to Strategic Engine: Listed Insurance Companies Initiate AI Upgrade War"; Caijing Mayflower, "Insurance Large Model Innovation: Countdown to Full Automation | Special Report by Caijing" - END -