Capitalizing on the Next Decade's 7 Trillion Yuan Service Retail Market Opportunity

![]() 07/13 2025

07/13 2025

![]() 629

629

International experience indicates that when a nation's GDP per capita surpasses USD 10,000, consumption shifts from mere material needs or status symbols to self-expression. Consequently, consumers gravitate from functional goods to higher-order needs such as emotional value, service experiences, and self-realization.

This transition heralds a 'Cambrian explosion' in the service retail sector.

Since 2019, China's GDP per capita has surpassed USD 10,000, fostering the rise of the service retail industry, which has garnered increasing attention from policymakers:

Starting in August 2023, the National Bureau of Statistics (NBS) began releasing monthly cumulative growth rates for service retail sales. These figures consistently outpace total retail sales growth, making service retail a key driver of economic expansion.

In August 2024, the State Council issued the 'Opinions on Promoting High-Quality Development of Service Consumption', further elevating the strategic importance of the service retail sector.

In June 2025, the People's Bank of China and five other departments jointly issued the 'Guiding Opinions on Financial Support for Boosting and Expanding Consumption', emphasizing support for service consumption and increasing credit support for key service retail sectors.

Data Source: National Bureau of Statistics

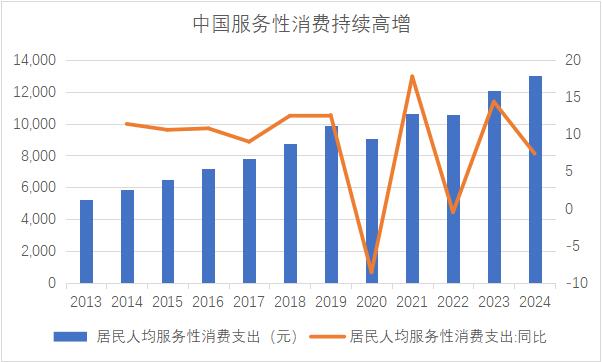

According to the NBS's broad definition, China's per capita service consumption expenditure reached RMB 13,000 in 2024. With a population of 1.4 billion, the corresponding service retail market space totals RMB 18 trillion, accounting for over 40% of total retail sales.

The China Institute for Reform and Development forecasts that by 2030, service consumption's share of total consumption expenditure will exceed 50%. Based on a conservative estimate of RMB 50 trillion in total retail sales, the service retail market will reach RMB 25 trillion in 2030, representing a compound annual growth rate exceeding 6%.

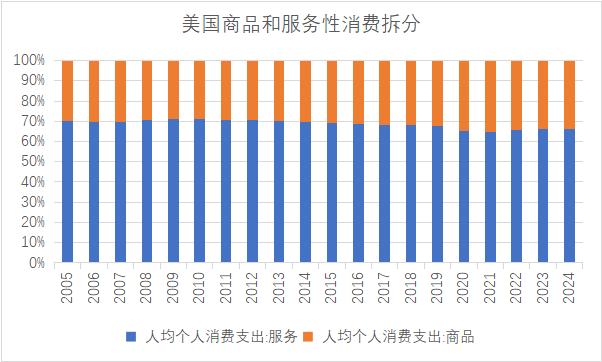

Longer-term, the U.S. benchmark shows that service consumption accounts for 70% of total consumption (compared to approximately 60% in Japan), suggesting China's service consumption has nearly double the long-term growth potential.

Data Source: Bureau of Economic Analysis

Within the vast service market, hospitality, catering, and healthcare services are relatively standardized. The true blue ocean lies in more personalized and vertical services. According to Meituan's estimates, these segments exceed 200, with a service retail market size of RMB 7 trillion in 2024, representing a 3-year compound annual growth rate of 8%. Of this, RMB 640 billion was transacted online, with a 3-year compound annual growth rate of 38%.

These data clearly indicate that service retail will be China's new domestic demand engine and the largest incremental domestic demand over the next decade. Personalized vertical markets within service retail hold greater growth potential, with online transformation offering the broadest blue ocean.

Amidst these changes, how can we navigate and capitalize on the service retail industry, poised to be China's biggest business opportunity in the next decade?

01 Challenges: Limited Scale, Online Transformation, and Standardization

Service consumption refers to the monetary value of services provided, encompassing retail sales in transportation, accommodation, catering, education, health, sports, and entertainment. Unlike commodity consumption, its value stems from the satisfaction gained from purchasing a service in a specific time and space.

Service retail markets exhibit distinct endowment characteristics and traits due to different stages of development:

In the U.S., it focuses on entertainment, sports, healthcare, wellness, transportation, and finance. In Japan, it emphasizes hobbies, anime, leisure, and elderly care. In China, during the transition to the 'fourth consumption era', the industry still has a strong 'practical attribute value', encompassing education, travel, household services, leisure, and entertainment.

Given these endowment characteristics, China's service retail industry presents immense potential but also prominent supply-demand contradictions:

As consumers, many have experienced inconsistent service quality, varying fitness coach competence, and gym closures soon after membership purchases.

Since service retail revolves around happiness and convenience, it places newer, higher demands on participants. Previous supply models and infrastructure can no longer adapt to structural changes:

Service consumption rises with aging, necessitating higher service quality. Elderly demand for services like healthcare, elderly care, household services, and leisure is strong. Overseas experience shows that for every 1% increase in the aging rate, service consumption rises by about 1.3%. China is aging, yet many service systems cater to the young.

With smaller families and the rise of solo economics, stickiness becomes crucial. China's average household size has dropped to 2.8 persons. For instance, a solo young adult may meet all daily consumption needs online, where word-of-mouth significantly influences purchasing decisions.

Generation Z drives consumption and new trends, yet their self-indulgent needs elude traditional businesses. Representing 17% of the population and 16% of income, Gen Z's perception of 'value' and 'cost-effectiveness' differs markedly, leading to contrasting consumption trends. New service categories like concerts, travel, tea drinks, outdoor sports, pop culture toys, and pets have surged, while others have stagnated. Businesses lament consumers' rapidly changing preferences.

Lower-tier and higher-tier markets are equally important. Beyond first-tier cities, China's vast consumer base in nearly 300 cities and 3,000 counties holds significant sway. Huachuang Securities estimates that non-first- and second-tier city consumption accounts for about 60% of the economy, with consumers upgrading through quality-to-price ratios, demanding higher business efficiency.

Traditional service economy traffic models rely on passive communication media like offline billboards, flyers, and word-of-mouth, mismatched with economic structure and consumer mindset changes. While physical retail relies on express logistics, service retail serves a three-kilometer radius, vastly different from physical retail.

Using outdated methods cannot uncover new world opportunities.

Businesses increasingly find digitizing and standardizing people and services harder than scaling shelves and products. For example, ensuring 7 million foot massage therapists accurately locate acupoints is tougher than standardizing 7 million goods.

However, challenges present huge business opportunities. Those who standardize well will expand faster, achieve higher efficiency, provide better experiences, and grow larger.

02 Breakthrough: Online Transformation as the Inevitable Path for Service Retail Evolution

Most Chinese service retail practitioners are small- to medium-sized merchants with inefficient retail models. Decentralized and fragmented operations hinder standardization, scale, and digitization.

China's service retail industry urgently needs new models with higher matching efficiency, scale effects, and fulfillment capabilities to evolve these inefficient businesses.

Within the trillion-yuan service retail market spanning over 200 industries, are there successful examples? Yes, but few. The most notable are tea and coffee, popularized by new consumption trends and takeout wars.

New consumers can buy Snow King's happy lemonade for just RMB 3 anytime, and Luckin Coffee's weekly RMB 9.9 coconut latte is a favorite among office workers. As a result, Honey Snow Ice City dominates the low-price milk tea market and replicated its model overseas, while Luckin Coffee rivals Starbucks China, potentially forcing a sale.

Why have domestic coffee and tea brands risen swiftly in service consumption? They achieved standardization and online transformation through chain operations.

Latest statistics show that tea drink chain rates exceed 50% due to financing and expansion. Leveraging scale, chain brands standardize products. Represented by Honey Snow and Gu Ming, enterprises contract orchards and tea gardens upstream, control distribution, and sell highly standardized products directly to consumers through a front-shop, back-factory model.

Luckin Coffee excels in digitization, with all orders placed via its app, takeout platforms, or WeChat mini-programs. This saves time in Starbucks stores and enables better understanding of consumer preferences and new store layouts through backend data.

The tea drink market exemplifies how leveraging platforms for online transformation will be the standard answer for most service retail formats.

Like fast food, coffee, and tea drinks are easy to chain due to semi-industrialization, consistent taste and pricing, and factory-like store management. With massive financing, they surpassed the critical point of diseconomies of scale through years of losses.

However, most businesses find chain operations harder. For instance, managing one hair salon or foot massage parlor is manageable, and a few good managers can handle ten, but scaling to hundreds or thousands distorts internal management due to non-standardized products and highly individualized service processes.

Yet, in China, these businesses can leverage highly digital mobile internet platforms for 'quasi-standardization' and overcoming 'diseconomies of scale'.

Standardization: Online tools from platforms like Meituan help service merchants provide intuitive, authentic service information. Aggregated reviews address trust issues through reputation mechanisms, reducing service mismatches. This improves service quality, regulates supply, and guides high-quality development.

Economies of Scale: In the highly fragmented catering industry, takeout penetration exceeds 20%, fostering scale effects through platform integration.

Compared to mature online industries like hotels and catering, other service categories are still in the early stages of online transformation, with home services and elderly care penetration not exceeding 5%.

Returning to basics, regardless of retail form, it must satisfy the consumer experience through 'more, faster, better, and cheaper'.

Meituan not only helps merchants achieve digitization, standardization, and scale but also leads the industry in transforming service retail's 'more, faster, better, and cheaper' aspects, making previously unfeasible business models viable.

Take Jingdezhen's porcelain industry. Ceramic products embodying high artistic craftsmanship are 'high-order emotional value' consumer goods, traditionally niche categories.

Located in Jingdezhen, Tao Gong Shu Yu Yan Kiln Pottery and Silver Jewelry has achieved remarkable growth in terms of 'quantity, speed, and quality' since partnering with Meituan in 2020. Since its debut on the platform in May last year, Yan Kiln's Taoxi Chuan store has amassed sales of RMB 2.2 million, consistently topping Jingdezhen's DIY sales chart. Currently, 90% of the store's revenue stems from Meituan. This year, the brand plans to open its third outlet in Jingdezhen and expand its franchise nationwide, transforming Yan Kiln into a nationally recognized chain brand.

Through its deep collaboration with Meituan, Yan Kiln has blazed a new trail in the 'culture + experience' sector. It leverages the platform to reach out to tourist groups in major cities like Beijing, Shanghai, Guangzhou, and Shenzhen, reimagining cultural tourism experiences through customized team-building and parent-child research activities. Additionally, Yan Kiln has pioneered the 'Cloud Kiln Worker' online education system, fostering a seamless transition from hobbyist engagement to professional training. The second Taoxi Chuan store has also integrated new elements such as handmade coffee, transcending the confines of traditional workshops and seamlessly blending culture with commerce through continuous cross-sector innovation.

In the service retail sector, Meituan's strategy of 'more, faster, better, and cheaper' is rapidly evolving and permeating every corner of the industry:

More: Offline service offerings are now accessible online, enabling consumers to fulfill their dining, entertainment, and shopping needs in one convenient location. This centralized approach also amplifies traffic, eliminating the need for merchants to invest heavily in multi-channel marketing.

Faster: Group buying and reservations cater to immediate consumer needs. Even during off-peak hours, AI customer service agents promptly address user inquiries.

Better: Breaking the traditional reliance on word-of-mouth, consider Tony, a hairstylist from Shenzhen's Tengye Styling. Since joining Meituan and Dianping's craftsman section in 2019, Tony has shared his work and accumulated reviews on the platform, attracting more customers through his 'digital business card' and boosting his monthly income to over RMB 50,000.

Cheaper: Reducing friction costs to benefit consumers. In-building stores enjoy rental costs that are half to a quarter of those of street-front outlets. Self-service stores, chess and card rooms, and KTVs, staffed minimally by cleaners, are proliferating rapidly.

Figure: Display of Meituan APP's primary menu

Throughout its development, Meituan has positioned itself as a 'little helper', collaborating with merchants to grow stronger through online transformation, with a focus on enhancing user experience and business efficiency.

Meituan's service retail division began in 2015 with the establishment of the Comprehensive On-site Business Department, which was officially renamed the Service Retail Business Department in March 2025 after a decade of growth. Centered around users finding information, transacting online, and fulfilling orders in-store, Meituan continuously refines its online products and tools, leveraging user experience and operational efficiency as dual engines to empower service retail merchants in their digital endeavors.

Over the past decade, Meituan has accumulated 470 million service retail users, 6.3 million merchants, spanning over 200 industries, and processed over 5 billion paid orders. In 2024, orders surged by 77% year-on-year, with user frequency increasing by 28%.

As an online 'little helper', Meituan has successfully guided numerous merchants past the hurdle of diseconomies of scale.

In just seven years, Tengye has opened nearly a thousand directly-operated stores in over 80 cities nationwide, employing over 20,000 hairdressers. From its roots in Guangzhou and Shenzhen to its national expansion, Tengye's rapid growth is attributed to its long-term strategy of 'streamlining operations'.

03 Conclusion: The will of the times is unstoppable

In China's trillion-yuan service retail market, where 'big water breeds big fish', only three enterprises have attained a scale of tens of billions.

This fundamental truth presents a dual perspective. On one hand, it highlights the primary contradiction of low scale, low online presence, and low standardization. On the other hand, it unveils immense potential opportunities. Those who can achieve scale expansion and online operations first will seize market opportunities and reap the next wave of growth dividends.

Tengye Hairdressing, Xiangdai 24-hour self-service billiards, Naiwan Massage... These pioneers in service retail who have embraced the digital age have already proven this.

With the advent of the AI era, the trend towards online service retail will accelerate further. Without data-driven decision-making, service retail providers will be at a disadvantage. The era of managing hundreds of stores based on experience and intuition is over. When your competitors are adjusting their strategies by the minute, while you meet only once a month or week, you risk falling behind.

The will of the times is unstoppable. The service retail industry, moving towards online, standardization, and scale, will inevitably become the largest contributor to domestic demand growth in China over the next decade.

This article is based on public information for information exchange purposes only and does not constitute investment advice.