Can Baidu "Reinvent" Itself Post "Introspection"?

![]() 07/28 2025

07/28 2025

![]() 638

638

Baidu is on a quest for transformation.

On July 26, at the 2025 World Artificial Intelligence Conference (WAIC) held in Shanghai, Baidu Huibo Xing unveiled its next-generation digital human technology, NOVA. Announcing that this technology, modeled after Luo Yonghao's digital persona, has been platformized and is set to officially launch in October this year.

Image source: Baidu

As NOVA gradually opens up to more merchants and influencers, ordinary users will also acquire professional live streaming capabilities comparable to top-tier anchors, signifying the dawn of mass-production for replicating the prowess of "super-head anchors".

Today, the AI battlefield is no longer confined to a simple competition of technology and computing power; it is diving deep into the waters of "reconstructing business underlying logic", with AI applications booming in the B-end market.

Unlike most of Baidu's toC AI products, Baidu Huibo Xing's digital human live streaming platform is a quintessential B-end application.

Currently, the Huibo Xing NOVA technology has entered the invitation testing phase and has been applied in advance to top influencers and merchants across over a dozen industries, including education, health, and 3C. The head of Baidu Huibo Xing revealed that upon the platform's October launch, it will provide a "zero-code" operation interface, enabling merchants to complete digital human customization and live streaming room setup through drag-and-drop tools, reducing costs by over 80% compared to traditional MCN agencies.

In addition to the newly released Huibo Xing NOVA technology, at the recent Baidu AI Day open house, Baidu also unveiled a video generation model named "MuseSteamer", primarily targeting B-end users. Notably, this product was self-developed by Baidu's business team based on a marketing scenario to meet customer needs.

Image source: Baidu

Unlike most market solutions that require post-dubbing, MuseSteamer can simultaneously generate images, sound effects, and character lines, achieving seamless synchronization between sound and image, significantly enhancing the completeness and artistic expression of video works. It is the world's first video model capable of integrated Chinese audio and video generation.

Chen Yifan, head of Baidu's mobile ecosystem business system, said that the launch of the Qingduo platform last year aimed to help Baidu's advertisers and agents quickly produce high-quality advertisements, but subsequently, many new demands emerged; for example, whether short dramas, animations, or science fiction scenarios could be utilized to create video advertisements, or whether some scenes could be further extended.

Amidst the growing demand for various content scenarios, Baidu created MuseSteamer with a team of only 50 people in about three months. Currently, the MuseSteamer Turbo version has been launched on Baidu's AI video creation platform, Huixiang Platform.

It can be said that MuseSteamer was "compelled" by demand. From the release of MuseSteamer to NOVA, Baidu's AI products are diving deeper into the application layer, particularly in B-end commercial scenarios.

Shen Dou, Executive Vice President of Baidu Group and President of Baidu Intelligent Cloud Business Group, believes that AI applications are first booming in the B-end market, and behind the massive emergence of "enterprise-level" AI applications lies a breakthrough in product service forms and a significant boost in capabilities. Now, these applications have permeated every aspect of enterprises' "research, production, supply, marketing, and service" and have become pivotal factors for enterprises to enhance their competitiveness.

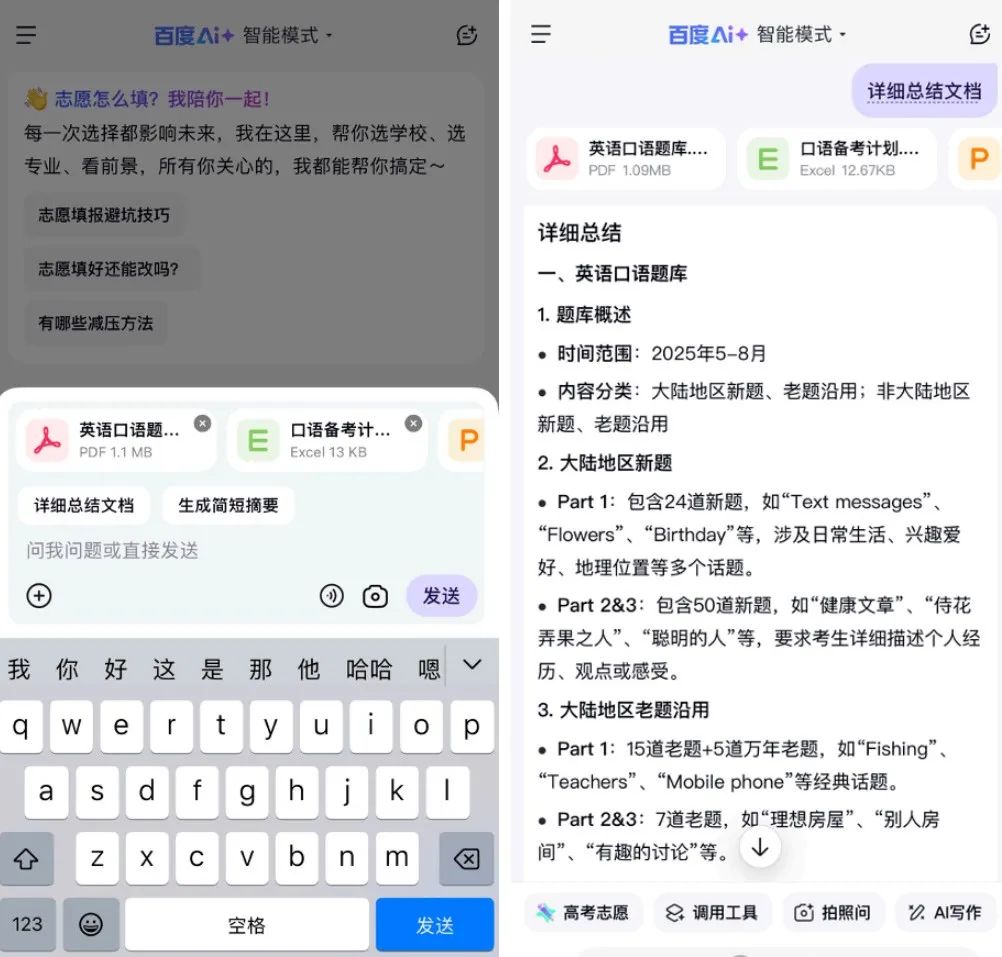

On the same day as the release of MuseSteamer, Baidu Search also underwent its most significant redesign in nearly a decade, transforming from the search box, search results page, to the search ecosystem.

Among them, the most intuitive change is the "enlargement" of the Baidu search box. The new "Smart Box" of Baidu Search can accommodate more content than the original search box, not only fitting long texts of over a thousand words but also allowing file uploads, whether documents, spreadsheets, or images, which can all serve as the basis for search, broadening the dimensions of search.

Image source: Screenshot from Baidu APP

Moreover, practical tools such as AI writing and AI drawing have been integrated into the Smart Box, allowing users to access them at any time while searching, achieving a seamless transition from information acquisition to content creation.

From being the first to deploy AI in China and releasing the Wenxin Yiyan large model to the current significant redesign of Baidu Search, Baidu's changes encompass both "proactive attacks" and "passive defenses".

In recent years, with the rise of new content communities such as Douyin and Xiaohongshu, as well as the emergence of various AI Chatbot products, the market share and user base of traditional search engines have faced the challenge of being diverted; in particular, AI Chatbots pose the first threat to traditional search engines. Baidu, which relies on online marketing businesses such as search advertising as its primary revenue source, must adapt to user needs and the development of the AI era to make changes.

During the Q1 2025 earnings call, Luo Rong, President of Baidu Mobile Ecosystem Business Group, bluntly stated, "If we don't proactively innovate our search business, we will inevitably face challenges sooner or later."

In the view of Zhao Shiqi, General Manager of Baidu Search, one must not view it with the product definition of the original search engine anymore. "We have been saying internally that we need to forget the old search form."

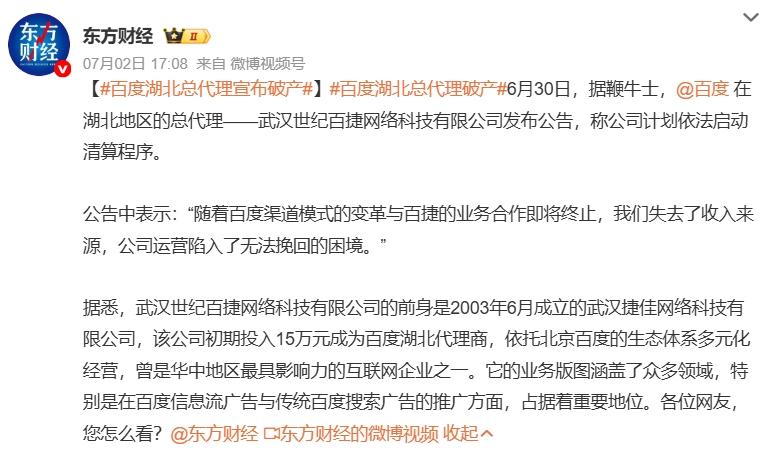

However, Baidu Search in the form of AI has also directly impacted third-party advertising service providers across the nation, and Baidu's traditional agency model also needs to be optimized and iterated like the redesign of traditional search engines.

According to media reports, Baidu will make significant adjustments to the agency model in some regions in the third quarter of 2025: starting from July 1 this year, the exclusive agency mechanism in six cities, including Jinan, Chongqing, Wuhan, Fuzhou, Xiamen, and Quanzhou, will be abolished, and a service provider operation model will be adopted instead. In other words, after the adjustment, customers can choose to sign cooperation contracts with Baidu's direct sales branches or local service providers.

The day before this policy was implemented, Wuhan Shiji Baijie Network Technology Co., Ltd., the general agent of Baidu in Hubei for 22 years, issued an announcement stating that all employee salaries would be paid up to June 30, and the company would initiate the liquidation process in accordance with the law. The announcement stated, "With the transformation of Baidu's channel model and the imminent termination of our business cooperation with Baijie, we have lost our source of income, and the company's operations have fallen into an irretrievable dilemma."

Image source: Screenshot from Weibo

According to "Qujie Shangye", this agent obtained the general agency qualification of Baidu in Hubei in 2003 and officially entered the field of internet marketing; in 2005, it was awarded the "Special Contribution Award" by Baidu, and in 2006, Li Yanhong personally inspected Shiji Baijie and gave high praise to its team's strength. It is rumored that its annual sales volume once reached 2 billion yuan, with profits reaching 300 million yuan, and it was also named the "Star of the Year" for Baidu's PPC ranking.

However, with the transformation of Baidu's channel model, the "monopoly" of Shiji Baijie's regional general agency disappeared, and now it can only exit with regret. The collapse of Baidu's general agent in Hubei and the adjustment of the regional agency model seem to mark the end of an era.

According to data from Aurora Mobile and QuestMobile, in the first quarter of this year, Douyin's average daily search volume reached 5.3 billion times, accounting for 70% of the mobile search share, WeChat's average daily search volume exceeded 1 billion times, and Xiaohongshu's average daily search volume was 600 million times, with an annual growth rate exceeding 100%; while Baidu App's average daily search volume has dropped to 300 million times, accounting for about 30% of the market share, no longer retaining its former position as the search " overlord ".

At the same time, the "gold content" of Baidu's advertising and agents has also been diluted. "The primary service of agents is to optimize search terms and bidding to maximize advertising efficiency," explained Xiao Liang (pseudonym), an information stream advertising practitioner. "Some agents also provide advertising page production services because some small and medium-sized advertisers may not have the resources to maintain a design and marketing team; after the upgrading of AI technology, these small and medium-sized businesses are the first to benefit, as the entire process from planning, content, design, to delivery can be completed using AI tools."

From preliminary market insight to mid-term advertising material preparation, strategy formulation and delivery, to post-period lead reception, Baidu's AIGC can empower the entire marketing process.

It is not only the product form of search engines that has been altered by AI, but also the advertising business itself.

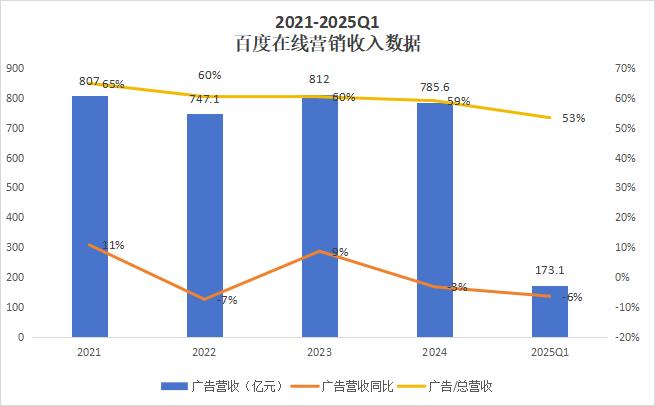

Over the past four years, after achieving an 11% year-on-year increase in 2021, Baidu's advertising business (online marketing) has continued to slow down, and there has even been a year-on-year decline; the proportion of online marketing in total revenue has also declined from 65% to 53% in the first quarter of this year.

Data source: Baidu Financial Report

Xiao Liang (pseudonym), an information stream advertising practitioner, said that as the forms of advertising diversify, including short videos, images, and text, advertisers' requirements for advertising are also becoming higher. "They have higher requirements for delivery efficiency and conversion rates. Display advertising is more about brand promotion, and some small and medium-sized advertisers are not at the stage of brand building; they mostly hope that the advertisement can lead to consumer conversions once delivered, so they will not choose Baidu advertising, which focuses on brand display."

In the era of AI, "de-advertising" is a characteristic of AI search; for AI to have fewer "hallucinations", the quality of training data must be higher, which requires search engines to include less marketing and advertising content.

Baidu recently launched a new AI search product, TizzyAI, which emphasizes being "ad-free"; it not only improves the product from the perspective of data quality but also enhances the user experience. "Since I got used to Chatbot, my acceptance of traditional search engine ads has been very low," said a deep AI product user. "Ad-free products that can also meet my more precise needs and save the steps of secondary and tertiary links are the ones users will choose in the era of AI."

Under this trend, Baidu's advertising business, which is the primary source of revenue, is bound to face further impacts; Baidu is also aware of this, and changes have already taken place.

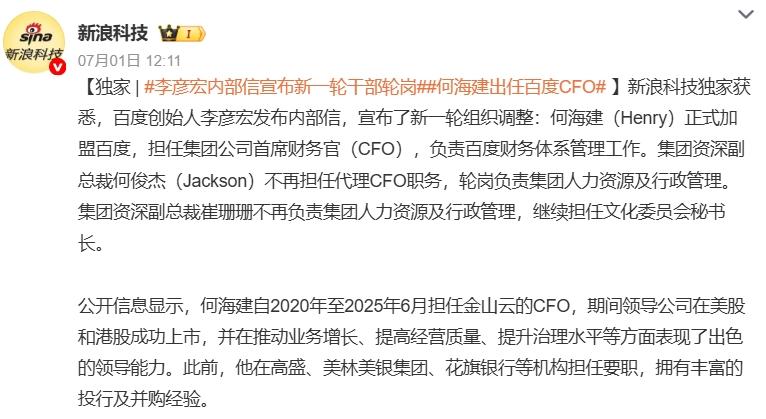

To do new things requires new people. Recently, Li Yanhong replaced Baidu's CFO. On July 1, Li Yanhong issued an internal letter announcing a new round of organizational adjustments. In this round of executive rotations this year, He Haijian, the former CFO of Kingsoft Cloud, officially joined Baidu as the Group CFO, and He Junjie (Jackson) ceased to serve as the Acting CFO of Baidu Group, rotating to be responsible for human resources and administrative management of Baidu Group.

This CFO, who was not promoted from within Baidu but was parachuted in from Kingsoft Cloud, is perceived by the outside world as meeting the strategic needs of Baidu's transformation. Li Yanhong also emphasized in the internal letter that this "old-for-new" alternation is aimed at "stimulating organizational innovation and vitality".

Image source: Screenshot from Weibo

The development of Baidu's AI business requires substantial capital investment and complex financial planning. Bo Wenxi, Vice Chairman of the China Enterprise Capital Alliance, believes that Baidu is attempting to find new revenue growth points and optimize financial resource allocation by adjusting its management layer to cope with market competition and enhance profitability.

It is worth mentioning that the frequency of executive changes at Baidu in recent years has been significantly higher than in the past, with adjustments to core executives almost every year.

Recently, media reported that Baidu Vice President Shang Guobin and the head of Baidu Maps are about to resign, and the Baidu Maps business they previously coordinated has been transferred to the Intelligent Driving Group (IDG); meanwhile, Xie Tian, General Manager of Baidu's industry search and intelligent agent business, will be transferred to IDG to head the Maps Business Unit.

Li Yanhong himself also reflected on Baidu's long-standing criticism of "being early but late to the party", describing Baidu as "unfocused".

This "unfocused" state may also be glimpsed from Baidu's attempts to enter the "car manufacturing" sector. Baidu once wavered between "car manufacturing" and being a "supplier"; even when cooperating with Geely on the Jiyue project, resources in intelligent driving were not exclusively inclined, and in the end, Baidu failed to achieve the success of Xiaomi or Huawei in the electric vehicle sector. On the other hand, in the firmly path-determined Luobo Kuaipao, better results were achieved.

"Not every game can be played and won by Baidu, hence we must discern what paths to pursue and what to avoid." This encapsulates Li Yanhong's philosophy of "seeking truth and being pragmatic."

Image source: Canned Stock Photo

To address the current state of being "unfocused," Li Yanhong mandated in the second-quarter OKR the establishment of a centralized AI capability hub. This hub could manifest as a model, a tool, or an intelligent agent, designed to enable uniform access and governance across different departments, ultimately minimizing redundant investments.

Li Yanhong aims to rejuvenate internal confidence, stating, "While Baidu faces numerous challenges, and there are areas where we have fallen short, I remain hopeful that everyone maintains their faith."

Regarding the AI-driven revamp of products, Baidu has successfully restructured its first batch of over a dozen applications, encompassing search, Ruliu, maps, cloud storage, and document libraries. "Focusing" marks the initial step in this transformation, and there is still substantial work ahead for Baidu, which has undergone an "AI makeover," to navigate intense industry shifts and revenue pressures.