With an Average Daily Usage of 50 Trillion Tokens, Does Volcano Engine Earn More Than Just Through Casual GPU Sales?

![]() 12/19 2025

12/19 2025

![]() 590

590

Volcano Engine: Aspiring to Be the 'Catfish' in China's Public Cloud Market

Volcano Engine: Positioning Itself as the Cloud Provider Exclusively for the AI Era

From December 18th to 19th, the Volcano Winter Power Conference took place in Shanghai. During the event, Volcano Engine officially launched version 1.8 of its Doubao large model and upgraded its Doubao image creation model, Seedream, to version 4.5. These updates provided users with a richer set of creative tools and lower-barrier AI application deployment solutions.

However, the aspect that has garnered the most attention from the market is undoubtedly Volcano Engine's token usage.

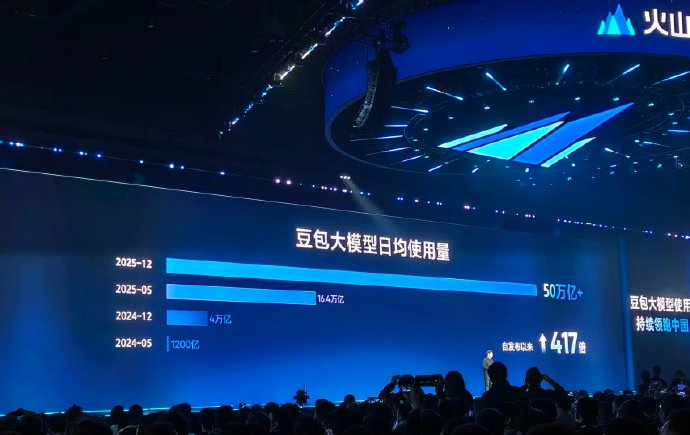

According to Tan Dai, the President of Volcano Engine, as of December this year, the average daily usage of the model has exceeded 50 trillion tokens, marking a more than tenfold increase year-on-year and a staggering 417-fold surge compared to its initial release.

The market views this as the strongest evidence of Volcano Engine's successful fulfillment of its promise as a cloud-native AI platform.

Yet, behind the awe for this achievement, new questions arise: How much tangible revenue can the exponentially growing token consumption contribute to Volcano Engine's financial performance? Can Volcano Engine, positioning itself as an AI-native cloud, leverage AI to overcome the labor-intensive challenges that have plagued the domestic SaaS industry?

01

Trillions of Tokens: What's the Real Monetary Value?

To understand Volcano Engine's ambitions, one must first delve into its 'origins.'

In the domestic cloud market, Volcano Engine stands out as an 'outlier.' Unlike Alibaba and Tencent, which carry the heavy legacy of 'traditional cloud' services, Volcano Engine has virtually no historical burdens. It was born at the twilight of the mobile internet era, just as the dawn of large models was emerging.

This 'late arrival' has become a strategic advantage. Without the need to maintain compatibility with outdated data center architectures, Volcano Engine has operated like a special forces unit in the AI era from the outset. It doesn't aim to be a traditional 'landlord' relying on selling storage and bandwidth; instead, it aspires to be the undisputed leader in MaaS (Model as a Service).

This is also the core logic that President Tan Dai has repeatedly emphasized at various events: Volcano Engine is a cloud built for AI, and its ultimate goal is to monetize model invocations and intelligent services.

Now, the market is embracing this vision. The 50 trillion average daily invocations are not just an astronomical figure that makes peers take notice; they represent Volcano Engine's first 'highway' paved in the AI cloud racing track. However, amidst the excitement, when the fireworks fade, rational investors and observers will inevitably crunch the numbers to assess the practical financial implications.

How much revenue can these 50 trillion tokens generate for Volcano Engine?

We can observe this almost frenzied expansion curve from several key data points disclosed by Volcano Engine this year. According to official releases and publicly available market data, the average daily token usage of Volcano Engine's Doubao large model has shown typical exponential growth:

December 2024: Average daily usage was only 4 trillion.

April 2025: It rapidly climbed to 12.7 trillion.

May 2025: It reached 16.4 trillion.

August 2025: It surpassed 25.9 trillion.

October 2025: It steadily grew to 30 trillion.

December 2025: Finally announced at the Power Conference that average daily usage has officially exceeded 50 trillion.

If we connect these data points and assume steady growth in consumption within the statistical interval, then throughout 2025, the total token consumption of the Doubao large model has exceeded 9,000 trillion, approaching 10,000 trillion.

However, this seemingly massive figure has not translated into substantial revenue, primarily because the unit price of tokens is simply too low.

To carve out a niche in the fiercely competitive cloud market, Volcano Engine has essentially adopted a 'suicidal' pricing strategy to sweep the market over the past year.

In May of the previous year, Volcano Engine ignited a price war in the industry by reducing the inference input price of its main Doubao model to 0.0008 yuan per thousand tokens, a decrease of over 99% from the then-industry price. Over the following year, it continued with a 'collapse-style' pricing logic.

This pricing strategy, which starts from scratch, has allowed Volcano Engine to attract a massive user base in a very short time. However, it also means facing an extremely harsh reality: Tokens have transformed from expensive 'luxury goods' into cheap 'commodities.'

So, how much revenue did the 10,000 trillion tokens in 2025 bring to Volcano Engine? Using the current official pricing on Volcano Engine's website as a benchmark, after calculating the prices for online inference, online inference with context caching, and batch inference, we arrive at an approximate price of 0.0009 yuan per thousand tokens.

At this unit price, the annual total invocation volume of '10,000 trillion' could theoretically support a revenue space of nearly 10 billion yuan for Volcano Engine.

However, these 9 billion yuan are by no means guaranteed cash in hand.

In the early stages of market promotion, to rapidly expand its footprint, the vast majority of tokens were essentially 'given away for free.' Under fierce price wars and ecosystem subsidies, the proportion of paid traffic that actually incurred fees was extremely low. If we boldly assume that paid tokens account for only 10% of the total, then Volcano Engine's actual MaaS revenue in 2025 would be around 900 million yuan.

This stands in stark contrast to its overall MaaS revenue, as Volcano Engine's total revenue in 2025 has already exceeded 20 billion yuan (approximately 24 to 25 billion).

This means that despite the impressive-sounding token invocation volumes in official statements, at this stage, the cornerstone of Volcano Engine's revenue remains IaaS, PaaS, and computing power leasing businesses, rather than pure AI invocations.

This 'top-heavy' data structure clearly indicates that while the ideal of an AI-native cloud is appealing, the reality of commercialization remains challenging.

Therefore, as 2026 approaches, Volcano Engine must confront a critical question: When tokens become as cheap and ubiquitous as electricity, how can it rapidly drive exponential growth in token consumption and leverage scale effects to make MaaS a true revenue pillar, as envisioned by Tan Dai for the market?

02

When Agent Meets Traditional Clients: Will Volcano Engine Need to Deploy Staff On-Site?

If selling tokens is akin to selling electricity, then Volcano Engine's push for Agents through platforms like Coze is like selling clients a ready-made 'automated factory.'

In Tan Dai's vision, the ideal path is extremely lightweight: Volcano Engine builds the foundation and tools, and clients simply develop business-appropriate Agents on the platform like building blocks. This essentially reshapes the delivery logic of SaaS, shifting from the past model of 'vendors feeding clients' to 'clients self-sufficient.'

However, in the domestic business landscape, this 'lightweight' approach often encounters significant challenges: How do you convince a client accustomed to 'paying for headcount' to instead pay for an intangible algorithmic logic?

The deepest pit the domestic SaaS industry has fallen into over the past decade is the vicious cycle of 'no payment without heavy human investment.' Due to the long-standing low willingness to pay for software in China, the few enterprise clients willing to open their wallets often adhere to a very simple logic: If I spend money, I need to see your people.

As a result, countless SaaS vendors that once touted standardization have ended up acting as 'renovation outsourcing teams.'

To secure a major deal, the vendor often has to dispatch a large delivery team, carrying laptops to the client's site, staying up late to modify code and adjust interfaces. This sense of security brought by a 'bustling scene' of personnel was once the psychological foundation for domestic SaaS deals.

This model is not only heavy but also extremely inefficient. Once a project-based approach is adopted, the software business, which should enjoy decreasing marginal costs, turns into a labor-intensive endeavor with constant marginal costs. As a 'latecomer,' Volcano Engine knows that if it follows other cloud vendors in engaging in this 'human delivery' race, it will not only struggle to overtake but also lose the 'AI-native' essence it prides itself on.

Therefore, Volcano Engine's strategy is a 'tool-based counterattack.' It offers not just large models but also a complete set of Agent development toolkits. The underlying message is: Stop asking us for hundreds of engineers; give you a sufficiently user-friendly tool, and your own staff can handle it.

But this is precisely where the contradiction lies. Clients accustomed to 'being fed' find it difficult to quickly adapt to this identity shift from 'buying solutions' to 'learning tools.' For most traditional enterprises, AI remains a black box. Although the threshold for Agent development has lowered, the gap between 'getting it to run' and 'integrating it into business operations' remains vast.

Moreover, as a new entrant, Agent's stability, logical closure, and understanding of complex business scenarios are still evolving from a 'work-in-progress' to a 'finished product.' Expecting a newly minted Agent to reach the level of SaaS software previously handcrafted by dozens of programmers and product managers is an extremely difficult task.

When clients discover that their self-developed Agents are still 'artificial idiots' after much effort, their natural reaction remains: Volcano Engine, can you send some knowledgeable personnel to help us optimize it?

This creates a massive paradox: The more Volcano Engine pushes for standardized, low-threshold Agents, the more it discovers that in the 'last mile' of actual implementation, a large number of professionals are still needed to bridge the gap between technology and business.

If Volcano Engine cannot achieve true 'human-like delivery' technologically or cultivate a vast ecosystem of third-party partners capable of sharing the physical workload, its touted AI-native cloud may find itself inevitably falling back into the labor-intensive trap of 'needing ten people to earn a hundred yuan' as it ventures deeper into the market.

At that point, supporting average daily invocations of 500 or 5,000 trillion may no longer rely solely on servers ticking away in the background but also on countless weary delivery engineers rushing around in the foreground. This scenario of 'new wine in old bottles' is probably not the final answer Tan Dai wants to present to the market.

Volcano Engine's ambition to be the cloud of the AI era is indeed a compelling vision. However, the transition from the 'trillion-token' frenzy to the cultivation of 'real profits' has just begun, and the tough battles lie ahead.

When technological myths meet business realities, Volcano Engine needs to prove not just the speed of its models but also its endurance in navigating the domestic business ecosystem.

- END-