China's Humanoid Robot Industry Booms with Order Surge: Foreign Media Forecasts Global Leadership

![]() 07/31 2025

07/31 2025

![]() 551

551

By 2025, China's humanoid robot industry is poised to reach an unprecedented turning point. Leading enterprises have secured numerous substantial orders, signaling the readiness of their technological products for large-scale deployment. Furthermore, China's competitive edge in the global industrial chain, spanning from core components to scenario adaptation, continues to expand. However, amidst this surge in popularity, the industry also grapples with challenges such as high costs, scenario implementation, and commercial closed-loop.

Today, artificial intelligence has emerged as the "new frontier" in the competition among major powers. After traversing the realms of perceptive AI and generative AI, the era of agent AI and physical AI (embodied intelligence) is now upon us. Humanoid robots stand as the paramount carriers of embodied intelligence. Currently, China holds a leading position in the humanoid robot industry, and its ability to further expand these advantages in the coming years will be pivotal in steering the era of intelligence.

Multiple humanoid robot enterprises have successively experienced an "explosion of orders."

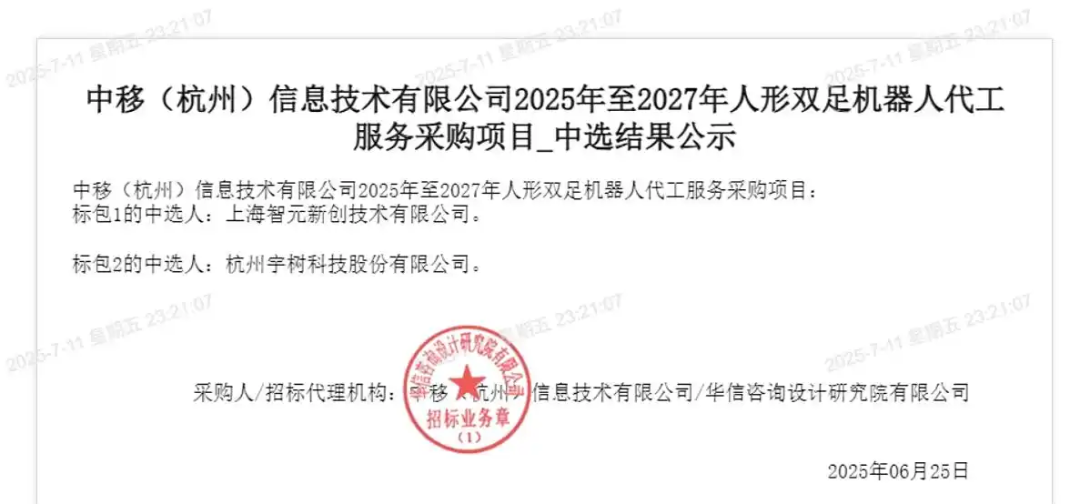

On July 11, China Mobile Procurement and Bidding Network announced that Zhiyuan Robotics and Unitree Robotics had successfully won the bidding for China Mobile (Hangzhou) Information Technology Co., Ltd.'s humanoid bipedal robot OEM service procurement project, with a total budget of 124.05 million yuan (tax included). The procurement was divided into two bid packages:

Bid Package 1: Full-size humanoid bipedal robots, budgeted at 78 million yuan (tax included), won by Zhiyuan Robotics

Bid Package 2: Small-size humanoid bipedal robots, computing backpacks, and dexterous five-fingered hands, budgeted at 46.05 million yuan (tax included), won by Unitree Robotics

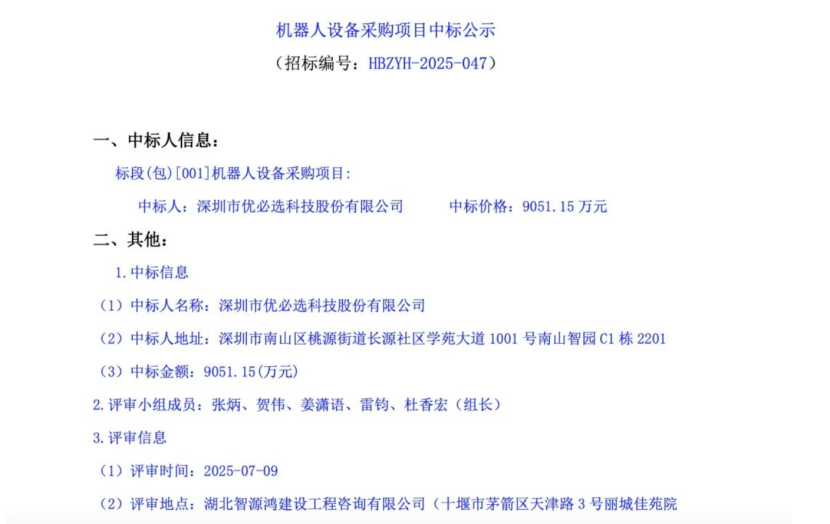

Shortly thereafter, the "Announcement of Successful Bidding for Robot Equipment Procurement Project" released by the China Bidding and Tendering Public Service Platform revealed that UBTech Robotics had won the bidding for Miyee (Shanghai) Automobile Technology Co., Ltd.'s robot equipment procurement project, with a project amount of 90.5115 million yuan. Unlike Zhiyuan and Unitree, UBTech Robotics secured an order of nearly 100 million yuan exclusively this time – currently, the largest procurement order for a single company in the global humanoid robot industry based on publicly available information, setting a new record for a single humanoid robot order.

Notably, these orders carry clear delivery timelines, indicating that 'mass production' is the paramount issue for humanoid robot enterprises this year. Besides these landmark 'large orders,' multiple enterprises have announced the initiation of batch deliveries within 2025, primarily aiming for thousands of units.

At its performance conference in April this year, UBTech Robotics stated that the company's goal for the year is to produce about 1,000 humanoid robots, all of which will enter real customer scenarios to gather more data. In July, it announced that its TianGongXingzhe robot for scientific research and education had received hundreds of orders, with an expected delivery of over 300 units this year. In an interview with the Science and Technology Innovation Board Daily in March this year, Zhiyuan Robotics said that the company plans to maintain robot shipments in the thousands this year. Zhongqing Robotics revealed that it will conduct small-scale landings of 1,000 units this year and expects greater demand next year. The relevant person in charge of Leju Robotics also said that in the first quarter of this year, Leju Robotics' orders increased by 200%, and the expected annual delivery volume will reach the thousands of units level. Currently, it is essentially 'one unit online, one unit delivered.'

Mass 'production' represents a leap from technological breakthrough to commercial realization.

As products enter the mass production stage, the challenges extend beyond the product engineering capabilities and production line construction progress of humanoid robot enterprises. They also include higher demands for the stable supply of core components, consistency control of the entire machine, after-sales service systems, and delivery and operation and maintenance capabilities. Enterprises must swiftly transition from 'laboratory models' to 'industrial products' and overcome numerous hurdles in design, manufacturing, testing, supply chain, and scenario deployment to truly achieve a leap from technological breakthrough to commercial realization.

"We don't lack orders, we lack delivery capabilities. Mass production is indeed challenging," a robot industry professional bluntly stated.

One challenge stems from technology. Even the leading humanoid robot enterprises globally still confront numerous technological bottlenecks. According to 'LatePost Auto' news in early July, Tesla has suspended production of its humanoid robot Optimus. Previously, Musk promised to produce 5,000 Optimus units this year, but now it seems this goal may not be met. It is reported that the primary reason for the suspension is unresolved hardware issues, including overheating of joint motors, insufficient load capacity of dexterous hands, and inadequate battery life.

Worse still, during mass production, adjustments to technical solutions necessitate adjustments to the supply chain. For instance, to resolve the aforementioned issues, Tesla needs to replace parts or even suppliers. According to foreign media reports, to address the problem of insufficient load capacity of dexterous hands alone, Tesla is simultaneously testing different technical solutions from at least three suppliers to explore alternative designs. Even if some suppliers are not replaced, additional investment is required to collaborate with Tesla in refining parts.

Another challenge originates from costs. The current overall cost of a humanoid robot remains as high as 300,000 to 500,000 yuan. The prices of core components such as high-performance reducers, servo motors, and force control sensors are still high and dominated by a small number of enterprises, limiting bargaining power. Enterprises must continuously invest in research and development, production line construction, and operation and maintenance system establishment, leading to massive initial capital investment. Against the backdrop of an immature business model and limited rigid demand scenarios, customers' willingness to pay and actual deployment numbers struggle to cover enterprises' marginal costs, resulting in extremely limited profit margins. Furthermore, as current robots have not yet achieved standardized and modular design, orders often come with highly customized needs, further escalating delivery costs.

Moreover, it is worth emphasizing that 2025 is the 'year of large-scale mass production' for humanoid robots and, from another perspective, the 'year of scenario verification.' The humanoid robots produced in mass quantities will be the first to be deployed in scenarios such as manufacturing, education, and household services. For instance, an informed source revealed that the aforementioned UBTech Robotics' winning bid was for industrial humanoid robots. Currently, UBTech Robotics' Walker S series has entered multiple automobile factories for practical training. In October 2024, UBTech Robotics announced that its Walker S1 entered BYD's factory for practical training, collaborating with L4-level unmanned logistics vehicles, unmanned forklifts, industrial mobile robots, and intelligent manufacturing management systems. Additionally, workshops of automakers such as FAW-Volkswagen, Geely, BAIC BJEV, and Lynk & Co. have also seen the presence of UBTech Robotics.

Applications and scenarios are the 'soil' for the evolution of humanoid robots – large robot models require vast amounts of training data to enhance success rates and efficiency, promote applications, and gather data from actual work scenarios, ultimately forming a virtuous cycle from research and development to application.

China's humanoid robot industry continues to broaden its leading advantages.

The explosion of orders and large-scale mass production can be seen as evidence of China's humanoid robot industry entering an accelerated development stage. Earlier this year, the Beijing Municipal Development and Reform Commission released the "Beijing Embodied Intelligence Technological Innovation and Industrial Cultivation Action Plan (2025-2027)," stating that by 2027, it will cultivate no less than 50 core enterprises in the upstream and downstream of the embodied intelligence robot industry chain, form no less than 50 mass-produced products, and achieve no less than 100 large-scale applications in the three major scenarios of scientific research and education, industrial commerce, and personalized services. The total scale of mass production will take the lead in exceeding 10,000 units, fostering a hundred-billion-yuan industrial cluster.

Historically, China has been a global leader in embodied intelligent hardware such as robots. In terms of ownership, according to the "World Robotics 2024 Report" released by the International Federation of Robotics (IFR), China is currently the largest global market for industrial robots. In 2023, China's ownership of industrial robots was approximately 1.8 million units, making it the first and only country in the world with such a large ownership of industrial robots. In terms of core components, while China still lags behind Japan and Germany in the three core components of robots (servo motors, reducers, controllers), the localization rate of the supply chain is significantly increasing. Simultaneously, the gap between domestic control systems and foreign products is gradually narrowing, with some domestic manufacturers independently developing their control systems. In terms of costs, data from semiconductor consulting firm SemiAnalysis shows that the manufacturing cost of producing a mechanical arm of the same specification in the United States will be 2.2 times that of China.

On this foundation, China has the capability and necessity to continue expanding its leading advantages and spearhead the development of the future embodied intelligence industry. Tian Feng, co-director of the Computational Law and AI Ethics Research Center at Shanghai Jiao Tong University, pointed out that the robot track holds immense development potential and a low penetration rate. If the domestic industrial chain matures, it may recreate a global industrial chain pattern akin to that of new energy vehicles. However, the current usage scenarios of humanoid robots are still in the early stages of exploration, and a dominant product similar to the iPhone has yet to emerge. Tian Feng predicts that during the '15th Five-Year Plan' period, the industry will enter the finals stage, with enterprises gradually converging and the Matthew Effect emerging.

Recently, Wall Street investment bank Morgan Stanley also released a report predicting that humanoid robots will be 'widely adopted' in China in the second half of this year. It further predicts that China will increasingly dominate the field of humanoid robots in the future, gradually widening the gap with other countries such as the United States.

Morgan Stanley stated that by 2050, China may have 302.3 million humanoid robots in use, while the United States will only have 77.7 million. "It is evident that China's support for 'embodied artificial intelligence' may be significantly greater than that of any other country, driving continuous innovation and capital formation."

Postscript

Currently, humanoid robots are attracting significant attention from the outside world. GGII predicts that the global market size of humanoid robots will reach 15 billion US dollars by 2030. The International Federation of Robotics predicts that from 2021 to 2030, the compound annual growth rate of the global humanoid robot market size will reach as high as 71%.

Standing at the critical juncture of industrial leapfrogging, humanoid robots not only carry the new expectations of China's intelligent manufacturing but also represent a strategic high ground in the new round of scientific and technological competition. Mass production orders are merely the starting point. What truly determines how far the industry can advance is its ability to build a stable technological system, a universal application ecosystem, and a sustainable business model. The next three to five years will be a crucial window period for humanoid robots to transition from 'prototyping' to 'infrastructure.' If China can seize the first-mover advantage in the development of embodied intelligence and continue to make strides in dimensions such as software and hardware integration, industrial collaboration, and global expansion, it may achieve a fundamental leap from technological catch-up to leadership in the era of physical AI.

Reference Materials:

Morgan Stanley predicts that China will experience a surge in the adoption of humanoid robots in the latter half of this year. Cailian Press reports that "The First Stock of Humanoid Robots" has secured a massive order worth nearly 100 million yuan. According to Securities Times, Guangdong is establishing an AI and Robotics Industry Alliance, with multiple humanoid robot enterprises experiencing an explosion of orders. The integration of industrial chains and technological breakthroughs are entering an accelerated phase. Zhiyuan, responding to the news of a 124 million yuan order for humanoid robots from Unitree, stated that there is no pressure regarding delivery. IT Home announced that UBTech Robotics, known as "The First Stock of Humanoid Robots," has won an order of nearly 100 million yuan, raising questions about whether mass production is a key bottleneck for the industry. ECNS reports that humanoid robot companies have successively secured large orders, accelerating cost reduction within the industry chain. However, ECNS Intelligence notes that intelligence remains a hurdle for Tesla's humanoid robot, and the suspension of Optimus production may impact Chinese enterprises. Sina Finance explores why it is said that in the era of embodied intelligence, China will have the opportunity to stand out globally. IoT Think Tank echoes Morgan Stanley's prediction, stating that China will unleash a humanoid robot boom in the second half of the year, with the industry's advantages gradually expanding in the future, as reported by Cailian Press.