Who is Leading the Chinese AI Public Cloud Market?

![]() 08/20 2025

08/20 2025

![]() 624

624

Key Points:

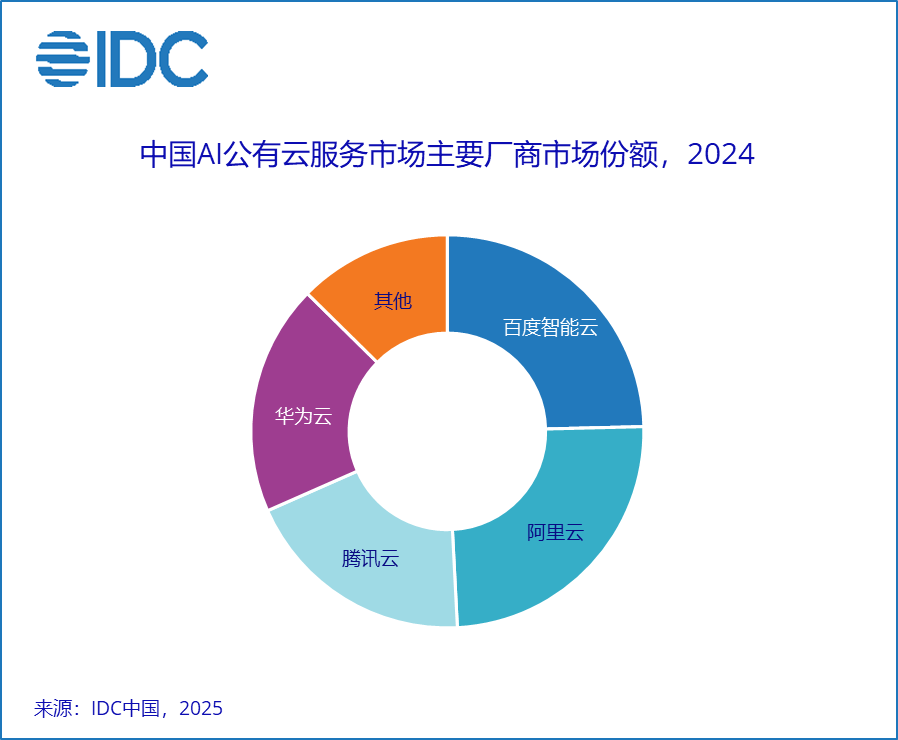

1. According to IDC's report, the Chinese AI public cloud services market surged by 55.3% year-on-year in 2024. Baidu Intelligent Cloud and Alibaba Cloud tied for the top spot in market share, emerging as the primary beneficiaries.

2. The AI cloud market's growth is fueled by three pivotal factors: the unlocking of technological dividends, the evolution of enterprise needs, and a robust cloud computing foundation. This market is not merely an extension but a comprehensive "relaunch" of the entire cloud computing industry.

3. Baidu Intelligent Cloud and Alibaba Cloud's leadership stems from their unique advantages: Baidu drives the cloud with AI, boasting sophisticated technical products and deep industrial integration, while Alibaba leverages its strong public cloud foundation and significant ecological influence to propel AI forward.

4. The transformation of the AI cloud services market by large models is just beginning and could potentially reshape China's public cloud market entirely. Future AI cloud competition will likely evolve into a "battle of the titans," with the industry's core narrative revolving around Baidu and Alibaba.

Author: Chang Yuan

Editor: Key Points Master

In 2024, China's AI public cloud market achieved a significant milestone. According to the latest IDC report, the market size of China's AI public cloud services reached RMB 19.59 billion, marking a 55.3% year-on-year growth.

In this thriving market, Baidu Intelligent Cloud and Alibaba Cloud tied for the top position in market share, becoming the primary beneficiaries. Notably, Baidu Intelligent Cloud has maintained its leading position in China's AI public cloud market for six consecutive years, totaling ten times at the top.

IDC data reveals that the market's rapid growth is primarily driven by two factors: the exponential expansion of generative AI applications and the substantial increase in demand for machine learning training and inference (train-infer). The former signifies a surge in enterprise application scenarios, while the latter reflects the demand for computing power and tools at the infrastructure and platform layers. In essence, AI public clouds have achieved true "enterprise-level implementation," propelling cloud vendors into a rapid growth trajectory.

The IDC report defines the AI public cloud services market as "AI capabilities deployed on public cloud services," where enterprises do not need to build their own servers to run AI but rather invoke AI capabilities provided by cloud vendors over the internet. This market encompasses five major submarkets: computer vision, intelligent speech, conversational AI, natural language processing, and machine learning platforms.

Specifically, in these submarkets, Baidu Intelligent Cloud and Alibaba Cloud have also performed impressively, ranking at the top in almost all categories:

The conversational AI market size was RMB 2.09 billion, with Alibaba Cloud and Baidu Intelligent Cloud ranking first and second, respectively.

The intelligent speech market size was RMB 1.88 billion, with Alibaba Cloud and Baidu Intelligent Cloud ranking first and second, respectively.

The natural language processing market size was RMB 2.22 billion, with Baidu Intelligent Cloud, Huawei Cloud, and Alibaba Cloud ranking first, second, and third, respectively.

The computer vision market size was RMB 8.1 billion, with Tencent Cloud and Baidu Intelligent Cloud ranking first and second, respectively.

The transformation of the AI cloud services market by large models is still in its nascent stages. Lu Yanxia, Director of IDC China's Artificial Intelligence Research, candidly stated, "Cloud vendors must have the courage and determination to comprehensively reshape cloud service products to help users establish a fully AI-enabled architecture."

The wave of generative AI is emerging as a turning point for AI public clouds. The tied leadership of Alibaba Cloud and Baidu Intelligent Cloud is a testament to this trend.

Overview of China's AI Public Cloud Services Market Share in 2024

01 The Logic Behind the Explosion of AI Cloud: Why Now?

The explosive growth of the AI cloud is not coincidental but the culmination of multiple forces.

From the perspective of the overall public cloud market, China's public cloud market grew by 17.7% in the second half of 2024, the highest growth rate in two years. The previous cloud computing boom was from 2014 to 2020; however, from 2021 to 2023, the mobile internet dividend peaked, and the cloud market growth rate declined. The turning point arrived in 2023, when the waves of AI and large models ignited renewed growth expectations across industries. Enterprises began integrating AI into their business processes, driving organizational restructuring and efficiency improvements. China's public cloud market also returned to a boom cycle, achieving double-digit growth.

Specifically for AI cloud, the timeline in the IDC report provides a clear context:

2015-2022: AI applications were primarily focused on traditional scenarios such as intelligent customer service, OCR recognition, industrial quality inspection, and intelligent security, featuring more "point-based implementations."

2023: Large models entered industrial applications, driving upgrades in semantic and speech applications like intelligent customer service and voice conversion.

2024-2025: AI capabilities on the cloud fully transitioned to generative AI, forming a "platform-based upgrade."

Second half of 2025: AI applications further evolved into Agent form, creating a smarter and more autonomous application ecosystem.

From a macro perspective, the growth of AI cloud benefits from three core factors:

First, the unlocking of technological dividends. Large models have become the cornerstone of the AI industry. The standardization of model size, inference capabilities, and application interfaces allows AI capabilities to be "supplied like water and electricity."

Second, the evolution of enterprise needs. From intelligent customer service to generative BI and industry-specific large models, more enterprises are seeking to quickly acquire AI capabilities on the cloud rather than building their own large models. AI cloud has emerged as the most cost-effective option.

Finally, a robust cloud computing foundation. Public clouds have laid a solid foundation at the IaaS and PaaS layers, and the explosion of AI cloud is akin to adding a layer of "intelligent operating system" to the existing cloud architecture.

Therefore, the AI cloud market is not merely an extension but a "relaunch" of the entire cloud computing industry. This explains the market size's 55.3% year-on-year growth in 2024, with the machine learning platform market even achieving 163.8% growth.

Despite significant investments from other players, it is Alibaba Cloud and Baidu Intelligent Cloud that are currently leading the AI public cloud. This is due to their differentiated advantages in strategic positioning, technical accumulation, and ecological layout.

Baidu Intelligent Cloud: Drives the Cloud with AI, Sophisticated Technical Products, Deep Industrial Integration

Starting with Baidu, as a "native player" in AI cloud, Baidu was the first Chinese vendor to propose the concept of "AI cloud," establishing "cloud + AI" as its core strategy in 2019 and advocating "integration of cloud and AI, deepening industrial implementation." Notably, at that time, cloud computing was still primarily focused on infrastructure as the core competitive point, and Baidu chose AI as its differentiating factor.

After years of deep cultivation, by the era of large models, Baidu Intelligent Cloud has accumulated strong product and technical capabilities along with deep industrial implementation experience.

In terms of product technology, Baidu Intelligent Cloud has built a comprehensive full-stack AI infrastructure encompassing computing power, models, data, and applications. At the computing power layer, Baidu has deployed a cluster comprising 30,000 Kunlun chips; at the computing power scheduling layer, the Baidu GPU cloud platform uniformly manages different underlying hardware; at the platform layer, the Qianfan large model platform provides enterprises with one-stop services for model invocation, development, deployment, and data intelligence.

This full-stack technology enables Baidu Intelligent Cloud to support enterprises' end-to-end needs from model training to business access. Simultaneously, it can cater to diverse needs and adapt to complex scenarios.

Baidu Intelligent Cloud operates on "two legs." While constructing infrastructure, it also utilizes its own application products to test and refine underlying capabilities. The latest example is the launch of the world's first batch of AI digital employees, which integrate Baidu's core large models, digital human technology, and industry knowledge, achieving "out-of-the-box use." Behind this lies a customer-centric approach: enterprises do not need to concern themselves with complex technical details but can obtain a professional, effective, and cost-effective solution by addressing their business pain points.

Specifically in industrial implementation, Baidu Intelligent Cloud's approach is clear: delve deep into industries to solve a core problem and enable AI to scale up across more industries.

Currently, Baidu Intelligent Cloud's implementation capabilities have been extensively validated across multiple industries. Public data indicates that Baidu Intelligent Cloud led in both the number and value of bids for large models in China in the first half of 2025. It has become the preferred AI cloud for 65% of central enterprises, 80% of systemically important banks, the top 10 new energy vehicle enterprises, and the largest number of key embodied intelligence enterprises.

For instance, recently at the 2025 World Humanoid Robot Games, the "Tiangong" robot, which won the championship in the 100-meter "Flying Man Battle," was supported by Baidu Intelligent Cloud.

In summary, Baidu Intelligent Cloud's competitiveness lies in "AI-driven cloud." It does not merely overlay AI on existing cloud businesses but reconstructs the cloud from an AI perspective.

Alibaba Cloud: Drives AI with the Cloud, Strong Public Cloud Foundation, Significant Ecological Influence

Next, let's turn to Alibaba. As the "ecological overlord" of cloud computing, Alibaba Cloud's advantage stems from its robust public cloud foundation and ecological influence.

Alibaba Cloud has consistently ranked first in China's public cloud market share, particularly at the IaaS layer, where it excels in large-scale computing and storage, providing a solid computing power guarantee for AI training and inference.

In the era of AI, Alibaba Cloud positions itself as a fundamental computing power provider, continuously increasing investments to solidify its cloud foundation and ecological advantages.

First, it continues to expand investments in cloud computing infrastructure, focusing on AI and large models. Alibaba CEO Wu Yongming previously announced that the company would invest RMB 380 billion over the next three years to build cloud and AI hardware infrastructure, surpassing the total investment over the past decade.

Second, it adheres to the open-source route for models, gaining momentum in the community and attracting developers and enterprises by ranking high in competitions with its open-source Tongyi Qianwen series of models. Currently, Alibaba Cloud's large model matrix spans multiple modalities such as language, speech, vision, and code.

Third, it invests in and acquires AI startups, binding them to Alibaba Cloud's AI infrastructure to consume training and inference computing power. Alibaba has invested in China's hottest AI unicorns, including Zhipu AI, MiniMax, Dark Side of the Moon, Zero One Everything, and Baichuan Intelligence, all of which train large models on Alibaba Cloud.

Alibaba Cloud's path can be summarized as "cloud-driven AI": it starts from the cloud's underlying advantages and uses AI as an upgrade and expansion.

Baidu and Alibaba have distinct paths. Baidu excels in AI technology and was the first to propose AI cloud, while Alibaba excels in cloud infrastructure and ecology. These differentiated advantages enable them to complement each other in different segments of the AI public cloud, ultimately forming a tied first-place market landscape. Currently, these two companies are among the few cloud vendors in China that have achieved profitability under non-GAAP accounting standards.

The IDC report clearly states that large models and generative AI will comprehensively reshape cloud service architectures. As AI applications gradually evolve towards Agent form, the core of competition in the future AI cloud market will no longer be computing power prices or model parameters but rather:

Whether it can provide an AI-native application architecture for the entire industry;

Whether it can establish a sustainable AI governance system;

Whether it can reconstruct the ecosystem to involve more developers and partners.

In these dimensions, Baidu and Alibaba are in the forefront.

For instance, at the ecological level, Baidu was the first company in the industry to propose the concept of "AI-native applications" and has increased investments in the developer ecosystem. By hosting the "ERNIE Cup" startup competition for several consecutive years, it has discovered outstanding entrepreneurs and attracted more to join Baidu's ecosystem. It is more likely to lead in constructing new application paradigms in the Agent era.

In 2024, the 55.3% growth rate of the AI public cloud market and the tied first-place ranking of Baidu and Alibaba marked a new phase of development for China's cloud computing.

After perusing the report, Key Points Master's immediate impression is that the large models' transformation of the AI cloud services market is in its nascent stages and has the potential to profoundly reshape China's public cloud market landscape. On one hand, the pricing model for large model products on the cloud is transitioning towards tokens; on the other, applications leveraging large models are significantly boosting the demand for infrastructure products like computing power. Undoubtedly, models and applications will be the linchpin of the AI era, offering the strongest assurance for the sustained growth of Baidu Intelligent Cloud and Alibaba Cloud in the future.

Currently, China's public cloud market can be encapsulated as "5+3," comprising five technology cloud providers (Alibaba Cloud, Huawei Cloud, Tencent Cloud, Baidu Intelligent Cloud, Volcano Engine) and three telecom operator clouds (China Telecom Cloud, China Mobile Cloud, China Unicom Cloud), collectively commanding a significant market share.

Cloud computing boasts a robust network effect. Observing overseas markets, the U.S. market is predominantly controlled by Amazon, Microsoft, Google, and Oracle. Conversely, China hosts over 15 cloud vendors, fostering a highly competitive environment marked by intense price wars and a scarcity of profitable players.

Future AI cloud competition is unlikely to be a "thriving spectacle" but will more likely morph into a "contest among titans." Baidu and Alibaba's leadership is not merely the fruit of technological and ecological accumulation but also signifies that in the years to come, the narrative of China's AI cloud market will revolve predominantly around these two giants.

In our opinion, the IDC report's conclusion can be succinctly stated: AI is transforming the cloud, and the cloud is, in turn, reshaping AI. Positioned at this crucial intersection are Baidu and Alibaba, who have made long-term investments and laid the deepest foundations.