Porsche CEO Ponders Past Failures, Weighs Localizing Electric Vehicle Production in China

![]() 12/22 2025

12/22 2025

![]() 412

412

Introduction

The East may not be the ultimate savior, but for luxury brands undergoing transformation, it undoubtedly offers an essential lesson.

"Looking back now, our product lineup from a few years ago lacked the necessary flexibility."

"We made a wrong call on the Macan model."

"Producing cars in the U.S. doesn't make financial sense for Porsche because the sales volumes for individual model series are too low."

Recently, Volkswagen Group CEO Oliver Blume, in a rare media interview, offered a candid reflection on Porsche's recent market performance and strategic positioning. He attributed the brand's current predicament mainly to its long-standing model of producing in Germany and exporting globally.

"Porsche is deeply committed to its German roots, but this very commitment has led us to where we are now. One hundred percent of our products are still shipped out of Europe, yet the Chinese luxury car market has seen a sharp contraction of over 80% in a short span. Meanwhile, the U.S. market is plagued by high tariff barriers. These two markets, which are Porsche's largest single markets, account for more than half of our global sales. This double whammy has put immense financial strain on us."

Perhaps the solution lies in the East.

Faced with these challenges, Blume made it clear that Porsche has no intention of pulling out of the Chinese market. In fact, he went a step further, suggesting the development of exclusive electric models tailored specifically for Chinese consumers. His remark, "The Volkswagen Group can facilitate localized production for this," was widely interpreted as a strong indication that Porsche is on the verge of accelerating the localization of its electric vehicle production in China.

Over the years, rumors about Porsche's plans to produce locally in China have surfaced repeatedly, only to fade away. However, this time, with the CEO himself setting the tone, the context has shifted dramatically. Perhaps it's no longer a case of China needing Porsche; rather, Porsche needs China more than ever.

01 Electrification Transition Hits a Snag

Although Blume claimed in the interview that "Porsche's electric mobility is a success," the objective market data and financial performance paint a starkly different picture of Porsche's electrification journey.

As early as November 2023, Porsche set ambitious targets: "Over half of new vehicles to be electrified by 2025 and over 80% fully electric by 2030." Yet, in 2024, electric vehicles accounted for a mere 27% of Porsche's deliveries.

This figure not only underscores limited consumer acceptance of Porsche's electric offerings but also highlights a significant lag in its transition pace.

Chronologically, Porsche wasn't late to the electrification game. The 2019 launch of the all-electric Taycan was seen as a landmark moment in the electrification transition of traditional luxury brands, with Porsche seemingly ahead of its traditional rivals. However, its actual large-scale delivery faced noticeable delays.

The imbalance in return on investment is even more concerning. After pouring substantial resources into R&D and production costs to drive electrification, Porsche's fully electric models have failed to deliver the expected returns. Sales have declined, and profit margins are lower compared to those of internal combustion engine models.

In August of this year, Porsche announced a restructuring of its high-performance battery subsidiary Cellforce, abandoning plans for in-house battery production. In September, it officially announced a slowdown in its electrification pace, with plans to introduce more internal combustion engine and plug-in hybrid models. This series of strategic retreats is tantamount to admitting that its electrification route has hit a dead end.

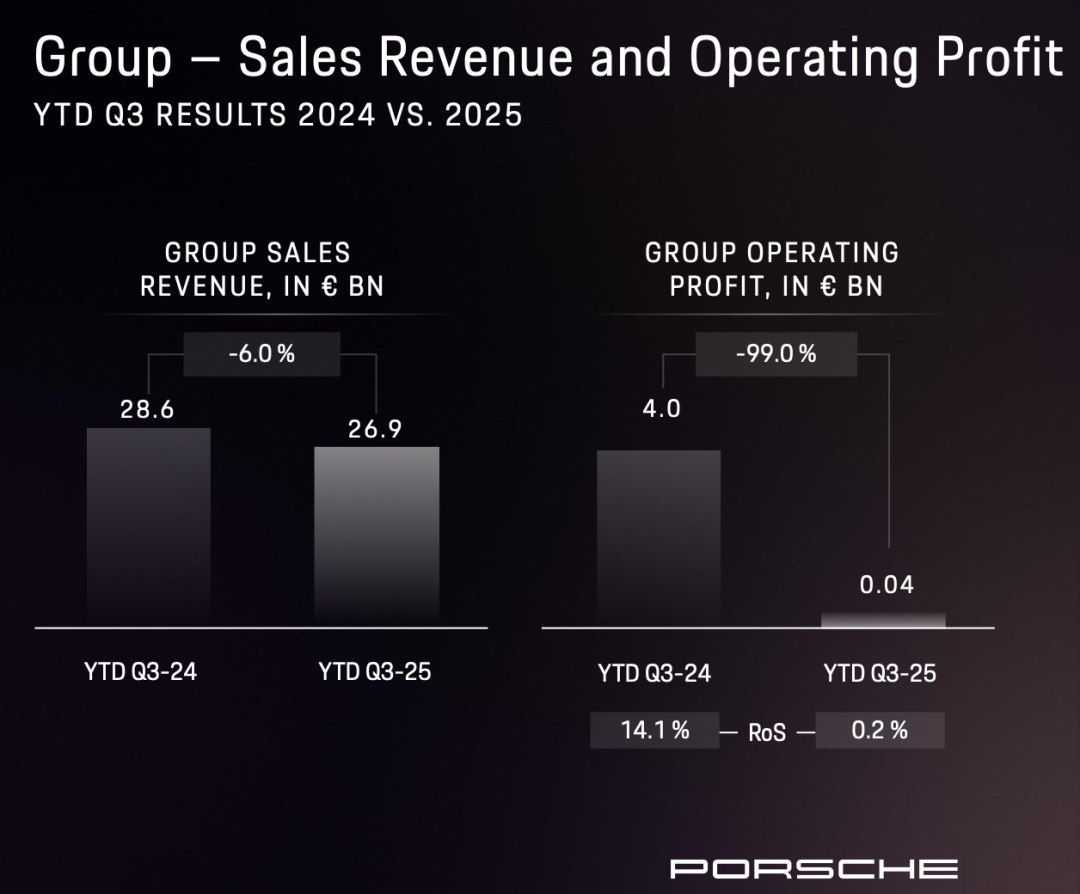

This dead end has directly dragged down Porsche's financial performance. In the first three quarters of 2024 alone, Porsche incurred €2.7 billion in special expenses due to restructuring. A €966 million loss in the third quarter resulted in a sales profit of just €40 million for the first three quarters, a staggering 99% plunge from €4.035 billion in the same period last year. This "cliff-like" decline has forced Porsche to re-evaluate the pace and direction of its electrification strategy.

Beyond subjective factors, Porsche's electrification transition faces more fundamental structural challenges: the ultra-luxury fully electric vehicle market has yet to truly take off.

Globally, Porsche's predicament is not unique. Recently, Maserati slashed prices significantly in China, with some models starting below ¥300,000, in an attempt to stay relevant through price cuts. In stark contrast, China's emerging luxury electric brand ZEEKR achieved a milestone by producing 10,000 units of its first model in just over 200 days, demonstrating a vastly different product rhythm and market responsiveness in the new energy era.

In the electrification wave, the brand premium, performance aura, and craftsmanship narratives that traditional luxury brands rely on are being deconstructed by electric vehicles' new technological architectures, intelligent experiences, and ecological values. Consumer perceptions of electric luxury are being reshaped, and traditional luxury brands like Porsche appear to be struggling to keep up.

Porsche's electrification dilemma stems from both its own strategic and execution missteps and reflects the collective anxiety of traditional luxury automakers at a crossroads in the new era. The glory of the internal combustion engine era is fading, while the path ahead in electrification remains shrouded in uncertainty. This sports car manufacturer, proud of its racing heritage, faces its most complex strategic choice yet—and the key to breaking through may not lie in Germany but in the East.

02 Chinese Market Becomes Crucial

"China's innovation speed and product diversity are astonishing, and competitive strategies are evolving rapidly. We must admit that many local products closely align with Chinese customers' needs," stated Alexander Pollich, CEO of Porsche China. His words not only objectively describe the Chinese automotive market but also show a clear awareness of Porsche's own situation.

More notably, Volkswagen Group CEO Oliver Blume explicitly stated in a recent interview: "Porsche will not withdraw from the Chinese market. Not only will it stay in the world's largest automotive market, but it will also consider launching exclusive models for Chinese buyers—an electric sports car." He specifically added: "Theoretically, the Volkswagen Group can facilitate localized production for this." This statement is widely interpreted as a significant signal that Porsche may, for the first time, localize electric vehicle production in China.

The option of "local production in China" is not new to Blume and his team. Porsche's parent company, Volkswagen Group, has deep roots in China, with a mature production system and supply chain network. In recent years, Volkswagen has accelerated its positioning in intelligent electric technology through equity stakes in XPENG and partnerships with Horizon Robotics, providing a solid foundation for Porsche's potential localization.

Rumors of Porsche's localized production in China have circulated for years but remained just that—rumors. Today, the context has shifted. Once, China needed Porsche to fill the gap in the luxury car market; now, Porsche needs China to rescue its electrification transition.

Behind this shift lies the harsh reality in Porsche's two core markets. In the first three quarters of 2025, although North America became Porsche's largest global market with 64,446 deliveries, high tariffs due to all models being produced in Germany severely eroded profit margins. The situation is even more dire in its former largest single market, China: new vehicle deliveries in the first three quarters totaled only 32,000 units, a 26% year-on-year plunge.

Although Porsche has taken measures such as increasing internal combustion engine and hybrid model supplies, looking ahead to 2026, the brand has no strong plans for new internal combustion engine models. This means that without substantive breakthroughs in electrification, Porsche will face sustained market pressure.

This pressure stems not only from product line limitations but also from the constraints of a globalized production positioning.

Regarding localized production in the U.S., Porsche appears highly cautious. Blume stated bluntly: "Producing in the U.S. is not cost-effective for Porsche because sales volumes for individual model series are too low." While Audi has a production base in the U.S., "making economically viable decisions hinges on substantial financial support from the U.S. government, which has not materialized so far."

More hope is pinned on China. Beyond Blume's statement, Porsche has launched its "Win Back China" strategy, recently inaugurating its first comprehensive R&D center outside Germany in Shanghai, focusing on developing exclusive solutions for the Chinese market. Next year, the all-electric Cayenne, featuring a new intelligent navigation and infotainment system solution, will debut as a flagship product for Porsche's Chinese market push.

Porsche is not the only ultra-luxury brand changing its strategy. Lexus, which long insisted on "never localizing production," finally announced in 2024 that it would establish production lines in China.

From "China needs Porsche" to "Porsche needs China." This is not merely a response to market pressure but a strategic choice to integrate into the world's most dynamic electric ecosystem.

The localization of brands like Lexus validates this trend. For Porsche, performance in the Chinese market will significantly influence its ability to continue its legacy in the new era. The East may not be the ultimate savior, but for luxury brands undergoing transformation, it undoubtedly offers an essential lesson.

Editor-in-Chief: Cui Liwen Editor: He Zengrong

THE END