AI Feedback: Elevating Tencent, Revitalizing Baidu

![]() 08/28 2025

08/28 2025

![]() 546

546

Source | Benyuan Finance

Author | Ye Xing

Artificial intelligence is spearheading a new wave of technological revolution. As the traffic dividend of the traditional internet wanes, AI is integrating into internet giants at an unprecedented pace, emerging as a fresh growth engine. Investors and entrepreneurs are flocking in, convinced that the "Next Big Thing" resides in AI.

Leading companies that have been amassing strength to participate in the AI technology arms race have also begun emphasizing AI's significance in their financial reports, frequently highlighting that "AI drives business growth".

Has AI truly commenced its transition from the exploration and investment phase to the "harvest stage"? Tencent's revenue and net profit both achieved double-digit growth. In its latest financial report, AI was mentioned 16 times. Baidu's new AI business revenue surpassed 10 billion yuan, and its intelligent cloud business revenue increased by 27% year-on-year. Perhaps these achievements already provide the answer.

01

Baidu Ushers in a New Era

As pioneers in AI, Tencent established the YouTu Lab in 2012, and Baidu set up the Deep Learning Lab in 2013. Both companies' explorations in AI are relatively advanced, albeit with slightly different strategic paths.

Baidu was the first Chinese company to proclaim "All in AI". Driven by the pressure of declining advertising revenue and the company's strategic transformation, its comprehensive embrace of AI appears more thorough and radical.

In 2024, the annual growth rate of China's AI platform-related traffic exceeded 30%, while traditional SEO channels declined by 10%-20% year-on-year. As the king of search in China, Baidu's impact was not as significant as anticipated.

The second-quarter financial report for 2025 reveals that Baidu Group's total revenue was 32.7 billion yuan, a year-on-year decrease of 4%, which is broadly in line with market estimates of 32.74 billion yuan; net profit attributable to Baidu Core was 7.32 billion yuan, an increase of 33% year-on-year. (Under Non-GAAP, Baidu's net profit attributable to shareholders was 4.795 billion yuan, a year-on-year decrease of 35%, compared to 7.396 billion yuan in the same period last year.)

The standout highlight in the financial report is that "new AI business revenue exceeded 10 billion yuan for the first time", with a year-on-year increase of 34%, accounting for 30.6% of total revenue. This revenue primarily stems from Baidu Cloud and intelligent driving.

Baidu insists on full-stack self-research in AI. Under the leadership of Shen Dou, breakthroughs in the Wenxin large model, Qianfan platform, and Kunlun chip on the hardware side have propelled Baidu's intelligent cloud business revenue to increase by 27% year-on-year to 6.5 billion yuan, representing approximately 24.8% of core revenue. According to IDC's "China AI Public Cloud Service Market Share, 2024" report, Baidu Intelligent Cloud has ranked first for six consecutive years; in the latest IDC report released on August 20, Baidu Intelligent Cloud topped the large model platform market; it covers more than 65% of central enterprises, securing B-end market dividends for Baidu.

Regarding Baidu's "Luobo Kuaipao" (Apollo Go), the number of global ride-hailing services exceeded 2.2 million in Q2, a year-on-year increase of 148%. Robin Li revealed that in Wuhan, Luobo Kuaipao has achieved break-even. This year, the pace of Luobo Kuaipao's overseas expansion has significantly accelerated, from Asia and the Middle East to Europe, with 1,000 unmanned vehicles deployed on a large scale in Dubai, and collaborations with global travel giants Uber and Lyft. As of June this year, Luobo Kuaipao's global footprint has spanned 16 cities.

Search remains the fundamental entry point of the internet and Baidu's most notable business, which is now comprehensively transitioning towards AI. Recently, Baidu Search underwent its most significant revision in a decade, with the Baidu search box enlarging and evolving into an "intelligent box".

In July, the proportion of AI-generated content in mobile search result pages rapidly increased from 35% in April to 64%; on the Baidu APP, rich media content was presented at the top of over 60% of search result pages. Furthermore, the usage rate of digital human technology continues to climb. In the second quarter, digital human-related business revenue surged by 55% month-on-month to approximately 500 million yuan.

Structured, intelligent, and multimodal AI answers are gradually replacing traditional hyperlink searches. This transformation also poses new challenges. As the proportion of AI in search increases, the profit margins of traditional pay-per-click advertising continue to come under pressure. As the core business and cash cow of Baidu's online marketing segment, revenue in the second quarter was 16.2 billion yuan, a year-on-year decrease of 15%, with the decline rate intensifying.

He Haijian, Baidu's new CFO, stated during the conference call that over the past few quarters, Baidu has increased its investment in AI, but as the commercialization of AI search is still in its nascent stages and has not yet scaled up, Baidu's revenue and profit margins are anticipated to face considerable pressure in the short term, with the third quarter being particularly challenging.

Goldman Sachs analysts pressed the management team, asking, "What will the commercialization path of AI search look like, and what will the profit margin be approximately?"

The management team revealed a crucial piece of information: in the past, keywords in AI search could not be monetized, but now they can be slowly monetized, significantly expanding Baidu's advertising inventory. Additionally, AI answers are more specific and relevant, enhancing the user experience, which makes users more willing to pay. Moreover, AI can better comprehend user needs in search conversations, thereby connecting users with service providers in industries such as healthcare, tourism, and education, transitioning the traditional CPC advertising model (cost-per-click) to a CPS model (cost-per-sale).

It's worth noting that in the second quarter, Baidu's subsidiary iQIYI's revenue was 6.6 billion yuan, a year-on-year decline of 11%. Excluding iQIYI, Baidu's core business revenue was 26.25 billion yuan, a year-on-year decrease of 2%. Concurrently, operating costs increased by 21% year-on-year, and R&D expenditure decreased by 14% year-on-year.

Amidst the rises and falls, Baidu's core business operating profit margin in the second quarter declined from 21% in the same period last year to 13%. As of June 30, 2025, cash flow was negative 4.7 billion yuan, indicating real pressure.

Change often brings pain. Traditional search business agents like Wuhan Shiji Baijie and Kaichuang Group have successively exited the historical stage, serving as a typical example.

Baidu possesses full-chain technological capabilities, with AI applications, AI large models, AI frameworks, and AI computing power thriving, covering the complete closed loop of AI industrialization. Baidu's founder, Robin Li, stated that within this quarter, Baidu accelerated the AI transformation of search and the globalization of Luobo Kuaipao. How much commercial potential the newly revitalized Baidu can unleash, we will wait and see.

02

Tencent Tastes the Rewards of AI

Compared to Baidu's mixed blessings, Tencent's financial report paints a picture of quiet prosperity.

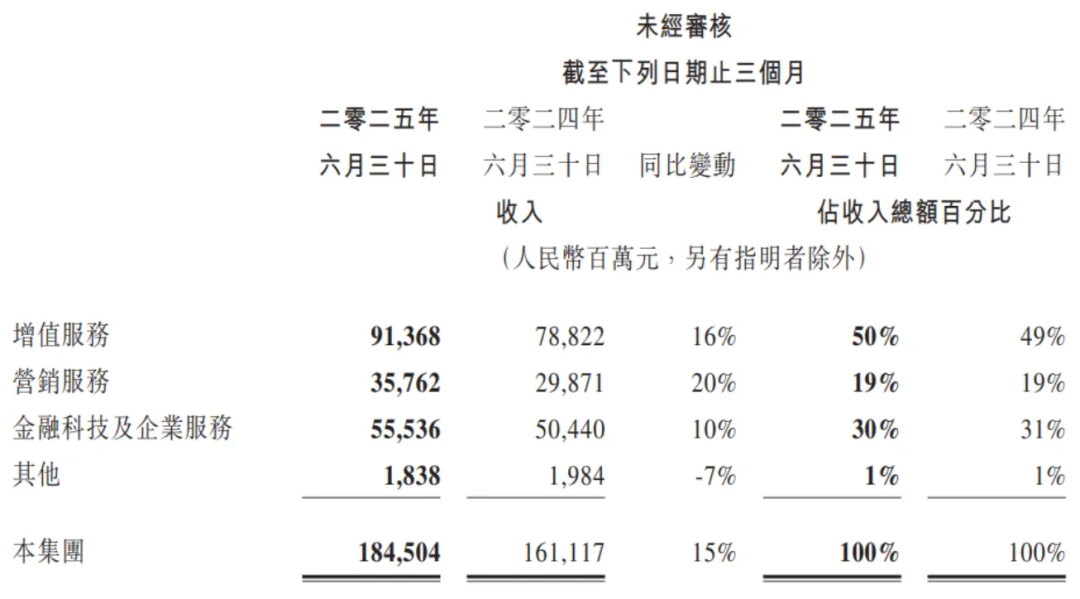

It earned 184.5 billion yuan in the quarter, a year-on-year increase of 15%; operating profit (Non-IFRS) reached 69.25 billion yuan, a year-on-year increase of 18%. Despite its large size, it has maintained a relatively high-speed steady expansion, and its profitability has basically returned to the level around 2021.

The gross profit margin is even more impressive, with a year-on-year increase of 22% to 105 billion yuan; the gross profit margin directly reached 57%, nearly approaching the profitability level of global top technology giants.

The three core businesses of value-added services, marketing services, financial technology, and enterprise services all achieved double-digit sustainable growth and exceeded market expectations. Although Tencent did not disclose specific data on its AI business in its financial report, it mentioned AI 16 times in the report.

Unlike Baidu and Alibaba, which focus more on underlying technology output, Tencent's AI strategy centers more on scenario-based applications, emphasizing the seamless integration of AI capabilities into its vast social and content ecosystem.

For instance, Tencent's marketing service business revenue in the second quarter increased by 20% to 35.76 billion yuan, a record high. This marks the 11th consecutive quarter that Tencent's business has achieved double-digit growth. Tencent's advertising "cost per impression" and "impression rate" both increased. In the financial report, Tencent clearly attributed this rapid growth to "AI-driven advertising platform improvements" and the vitality of the WeChat transaction ecosystem.

Tencent utilizes AI to upgrade the advertising basic model, assisting in ad creation, placement, recommendation, and effect analysis, thereby increasing ad click-through and conversion rates, facilitating more closed-loop transactions, and amplifying advertisers' investment and return on Video Numbers, Mini Programs, and WeChat Search.

In Tencent's ToB business segment, revenue from Tencent's financial technology and enterprise services business was 55.5 billion yuan, a year-on-year increase of 10%. Among them, the growth rate of enterprise service revenue has accelerated compared to previous quarters, also benefiting from the increasing demand for AI-related services from enterprise customers, specifically reflected in the growth of GPU leasing, API token usage, and merchant technical service fees.

Ma Huateng also stated, "We are committed to promoting the usage of AI native application Yuanbao by enabling more application scenarios within WeChat, upgrading the capabilities of our Hunyuan basic model, and bringing further AI benefits to users and enterprises."

Tencent's self-developed fast-thinking model Hunyuan TurboS and deep-thinking model Hunyuan T1 continue to be upgraded, while the core achievements of the Hunyuan 3D large model series are intensively landing, continuously infusing intelligent genes into the business.

Tencent Yuanbao, which was the "first to access DeepSeek", emerged as a "dark horse" among AI-native mobile applications in 2025, bridging WeChat Reading, Qidian Reading, QQ Music, Tencent Maps, etc., and deeply integrating into core scenarios such as WeChat and QQ. Tencent's investment in Yuanbao is also evident. According to AppGrowing data, in the second quarter, Tencent Yuanbao's App advertising investment amounted to over 1 billion yuan in both June and July.

However, sustained growth cannot rely solely on blind investment in traffic. At the performance report meeting, Tencent President Martin Lau mentioned that in the future, they do not plan to simply acquire new users by spending money on market investment but instead aim to "deeply integrate Yuanbao with our existing platforms" and appropriately increase product marketing efforts.

As for the gaming segment that had been "resting on its laurels", it has been on an upward trajectory since being "scolded" by Ma Huateng in 2024: revenue in the second quarter reached 59.2 billion yuan, a year-on-year increase of 22.06%.

Both domestic and international markets flourished. Tencent's game revenue in the domestic market in the second quarter reached 40.4 billion yuan, a year-on-year increase of 17%; international game revenue was 18.8 billion yuan, a year-on-year surge of 35%. Among them, evergreen games performed best, with "Honor of Kings" (launched 10 years ago) and "Game for Peace" (launched 8 years ago) being named. According to third-party data, in the first half of this year, "Honor of Kings" generated nearly 1.2 billion yuan in monthly revenue. The new game "Delta Force" also performed well, with its daily active user base exceeding 20 million in July, ranking third in domestic game revenue and growing into a new blockbuster capable of supporting revenue. Games are naturally suited for AI implementation. In "Honor of Kings", the AI hosting function addresses the pain point of teammates accidentally going offline and sacrificing the gaming experience. The AI voice assistant "Lingbao" serves as a gaming partner and can engage in real-time dialogue with players. "Game for Peace" has introduced a reliable AI teammate "Hua Aotian" who never goes offline, never betrays, and remembers player information, and has also connected the digital spokesperson "Jilli" to DeepSeek. The incorporation of AI enhances the freshness, user stickiness, and experience richness of the game. Simultaneously, scenario applications like AI programming significantly reduce game production costs and time, lightening development work and aiding in improving industrialization capabilities. Tencent mentioned at the financial report meeting that evergreen games such as "Honor of Kings" and "Game for Peace" are evolving towards a platform and increasing the application of AI.

Baidu is gathering strength, Tencent is surging ahead, and the focus on AI in the financial reports of major companies is intensifying. The continuous empowerment of AI is also reshaping the performance of major companies. Robin Li and Ma Huateng each have their own commitments. Entry into the field may be early or late, but future performance competitions depend solely on strength. This not only impacts the commercial success or failure of a company but also the position of China's artificial intelligence industry in global competition. Come on, Chinese giants.

end