Monthly Car Production Tops 3.5 Million Units for the First Time; CAAM: November Exports Surpass 700,000 Units, Marking a New Milestone

![]() 12/12 2025

12/12 2025

![]() 500

500

On December 11, the China Association of Automobile Manufacturers (CAAM) officially released the automobile production and sales figures for November, revealing two historic achievements: monthly car production exceeded 3.5 million units for the first time, and exports of complete vehicles surpassed 700,000 units, also a first-time feat. These milestones underscore China's automobile market as the most vibrant in the world.

According to the CAAM's analysis, "In November, car production and sales maintained robust momentum. Enterprises capitalized on policy opportunities, with production and supply accelerating at a brisk pace. Building on a high base, both month-on-month and year-on-year production and sales increased. The passenger car market operated steadily, the commercial vehicle market continued to show improvement, new energy vehicles performed exceptionally well, and automobile exports grew rapidly."

By the end of November, car production and sales volumes had matched those of the entire year of 2023 and were approaching the full-year levels projected for 2024. CAAM data indicates that in November, car production and sales reached 3.532 million and 3.429 million units, respectively, with month-on-month increases of 5.1% and 3.2%, and year-on-year increases of 2.8% and 3.4%. Notably, production surpassed 3.5 million units for the first time, setting a new record.

In terms of cumulative data, from January to November this year, car production and sales reached 31.231 million and 31.127 million units, respectively, with year-on-year increases of 11.9% and 11.4%. However, compared to the first ten months, the growth rates for production and sales slowed down by 1.3% and 1%, respectively.

Examining the two major segments of the automobile industry—passenger cars and commercial vehicles—both experienced growth in November. Passenger car production and sales reached 3.144 million and 3.037 million units, respectively, with month-on-month increases of 5% and 2.6%, and year-on-year increases of 1.1% and 1.2%.

From January to November, passenger car production and sales reached 27.388 million and 27.256 million units, respectively, with year-on-year increases of 12% and 11.5%.

In contrast, commercial vehicles witnessed even more pronounced month-on-month growth. In November, commercial vehicle production and sales reached 388,000 and 392,000 units, respectively, with year-on-year increases of 18.6% and 24.4%. Nevertheless, the cumulative growth rate remained lower than that of passenger cars.

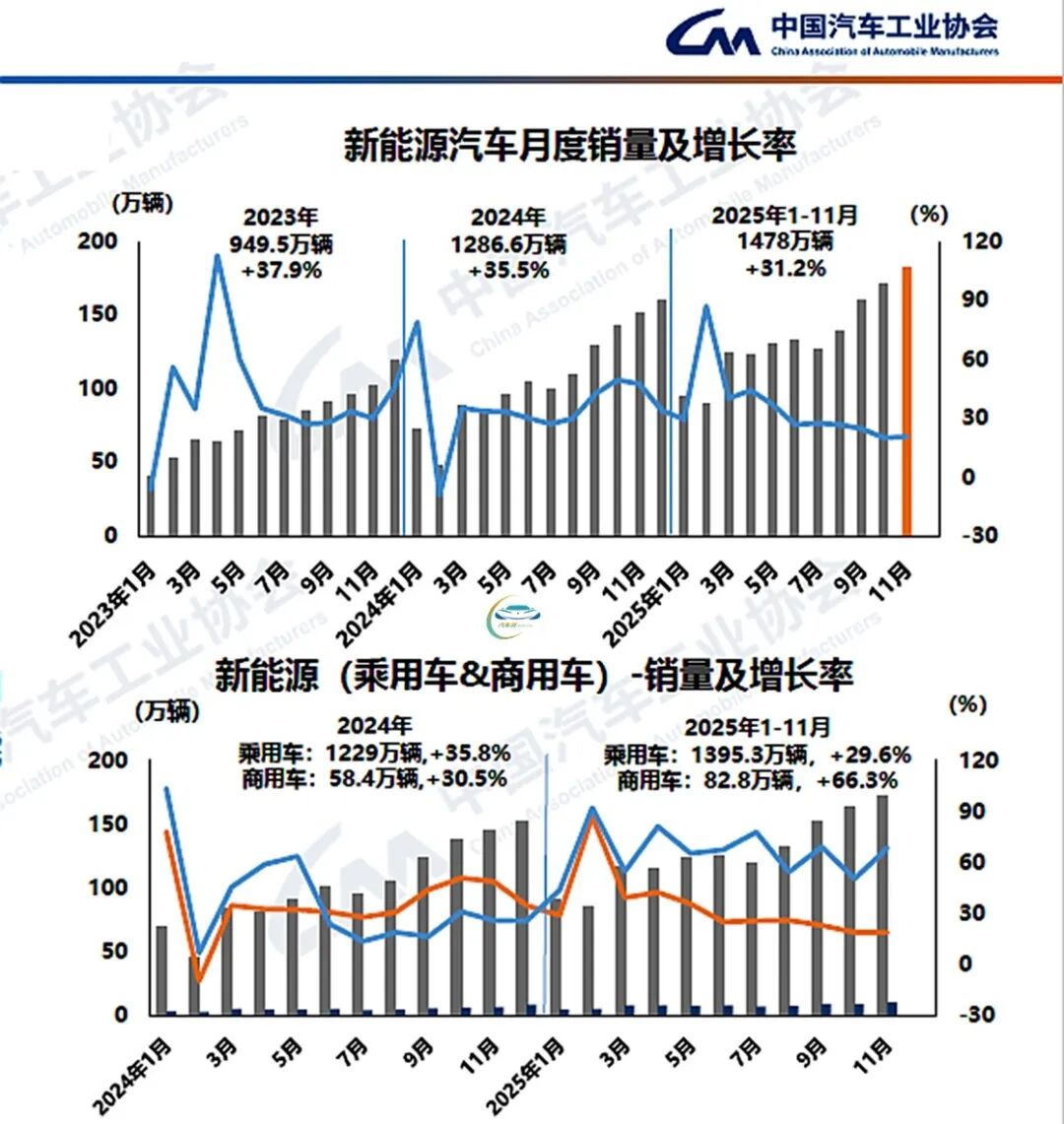

New energy vehicles (NEVs) continued to be the primary growth driver. CAAM data reveals that in November, NEV production and sales reached 1.88 million and 1.823 million units, respectively, with year-on-year increases of 20% and 20.6%. NEV sales accounted for 53.2% of the total.

From January to November, NEV production and sales reached 14.907 million and 14.78 million units, respectively, with year-on-year increases of 31.4% and 31.2%. NEV sales accounted for 47.5% of total new vehicle sales.

At first glance, it may seem that NEVs have not yet achieved a 50% market share. However, a closer examination of the data reveals that the key bottleneck hindering the overall growth of NEVs lies in the commercial vehicle segment. Compared to the overall figures, the market share of new energy passenger cars in domestic new vehicle sales reached 59% in November and 53.6% in the first eleven months. In contrast, the market shares of new energy commercial vehicles were 33.9% (November) and 25.7% (January-November), indicating that the overall NEV market share in domestic sales is being dragged down by the lower share of new energy commercial vehicles.

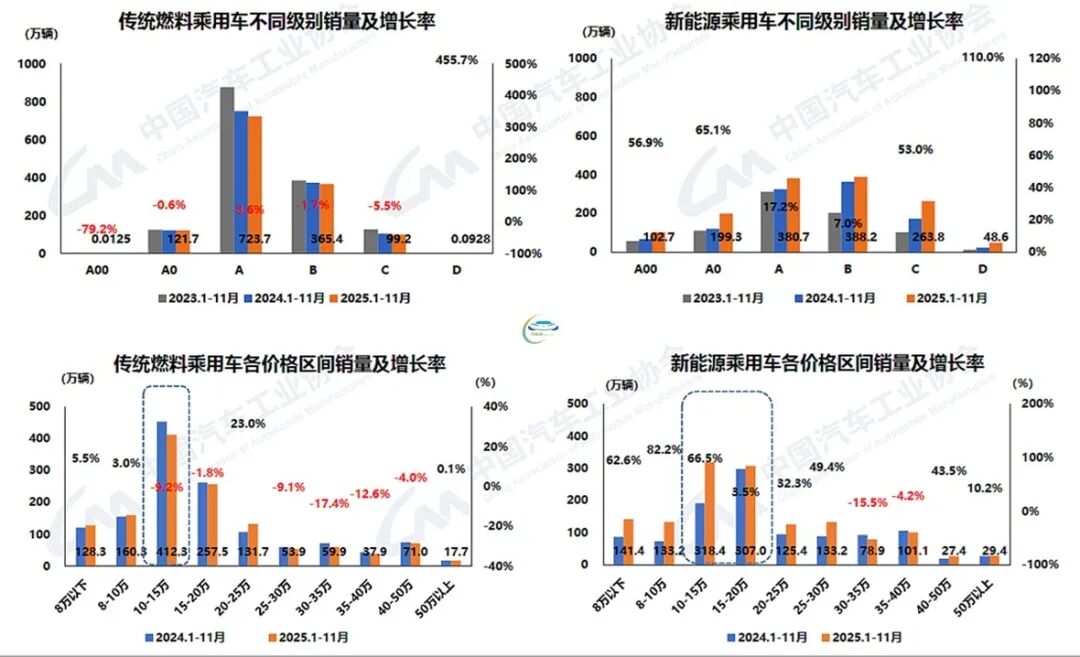

Nevertheless, the data underscores that the trend toward new energy vehicles is unstoppable, with traditional fuel vehicle sales continuing to decline. In November, domestic sales of traditional fuel vehicles reached 1.179 million units, down 1.5% month-on-month and 15.6% year-on-year. From January to November, domestic sales of traditional fuel vehicles totaled 12.318 million units, down 1.2% year-on-year.

In the first eleven months, traditional fuel passenger cars experienced a general decline across all segments, from A00 to C-class. The most significant drop was observed in A00-class traditional fuel vehicles, with a 79.2% decline. A-class vehicles, the mainstay, saw a 3.6% year-on-year decline. In contrast, new energy passenger cars witnessed across-the-board growth at all levels, with the largest increases in the A00 and A0 classes. The CAAM analysis attributes this growth to policy-driven momentum, with A-class and B-class new energy passenger cars being the main markets, showing year-on-year increases of 17.2% and 7%, respectively.

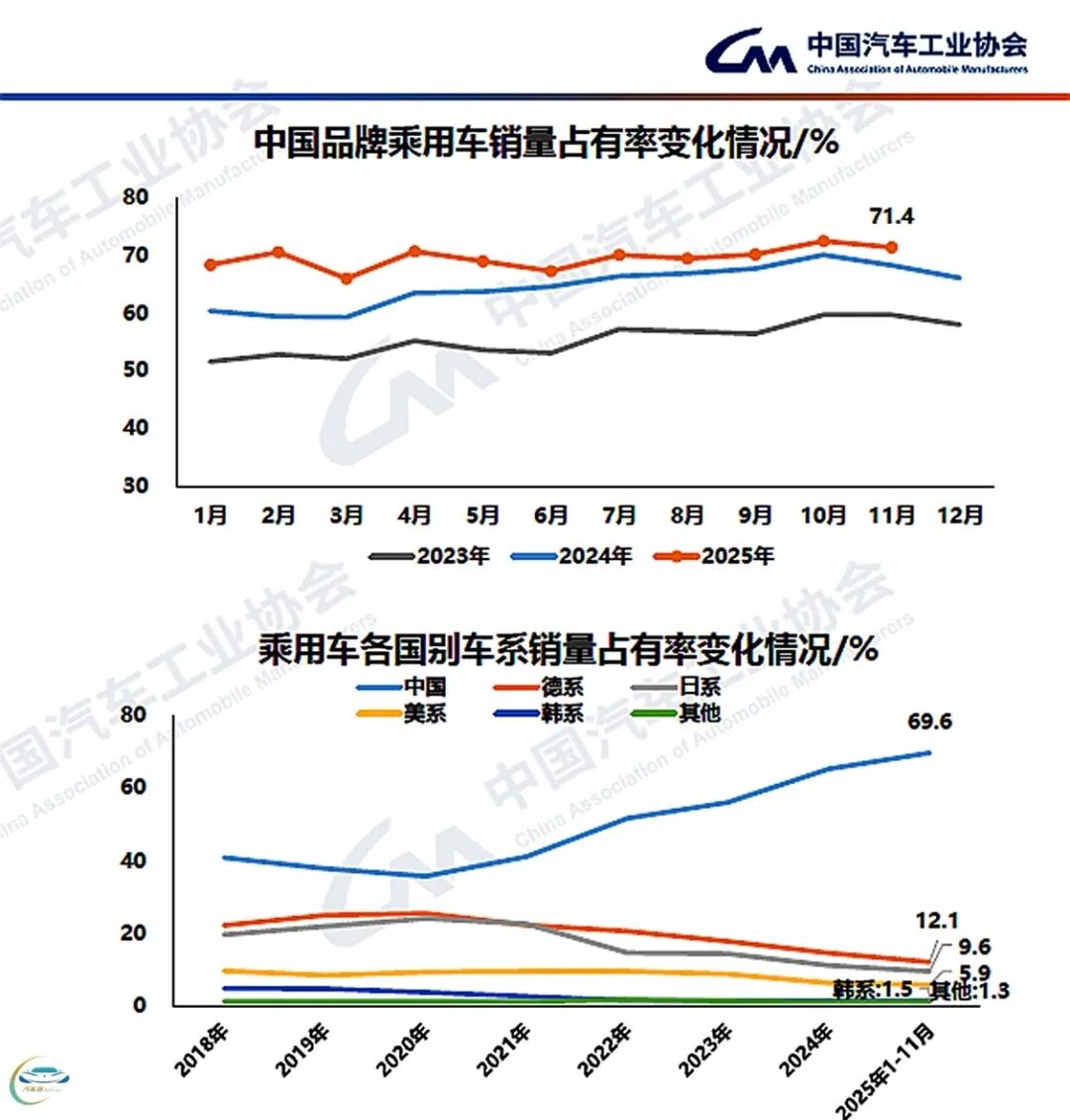

Alongside the surge in NEV sales, the market share of Chinese brand passenger cars also rose significantly. CAAM data indicates that in November, sales of Chinese brand passenger cars reached 2.169 million units, up 5.8% year-on-year, with a market share of 71.4%, up 3.1% year-on-year.

In the first eleven months, cumulative sales of Chinese brand passenger cars reached 18.978 million units, up 19.4% year-on-year, with a market share of 69.6%, up 4.6% year-on-year and 0.2% month-on-month.

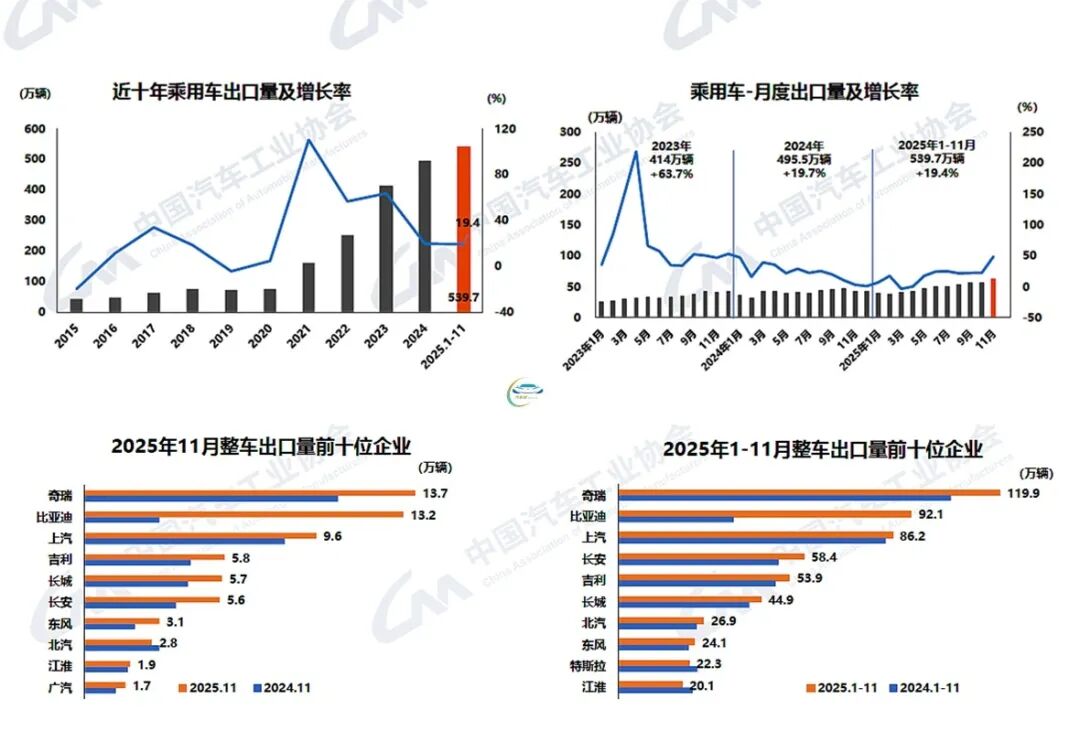

In the complete vehicle export sector, which achieved one of the two historic records, the intense competition among manufacturers is particularly evident. CAAM data shows that in November, automobile exports reached 728,000 units, up 9.3% month-on-month and 48.5% year-on-year, marking the first time exports exceeded 700,000 units in a single month. From January to November, automobile exports reached 6.343 million units, up 18.7% year-on-year.

A closer look at the export enterprise rankings reveals that BYD's complete vehicle exports reached 132,000 units in November, narrowing the gap with Chery, the leader, to just 5,000 units, while maintaining a "doubling" trend. However, Chery still leads in cumulative complete vehicle exports, with 1.199 million units, up 14.7% year-on-year, accounting for 18.9% of total exports. This "export marathon" is highly competitive.

At the time of the data release, the CAAM also mentioned trends for 2026: "Relevant meeting resolutions and policy documents have released positive signals, helping to boost development confidence, stabilize market expectations, and expand automobile consumption across the entire chain, laying a solid foundation for a strong start to the 15th Five-Year Plan period."