Rivian Steers Out of the Red: US Emerging Auto Player Also Dives into AI and Robotics

![]() 11/10 2025

11/10 2025

![]() 481

481

Produced by Zhineng Technology

Rivian, the rising star in the US automotive industry, finally witnessed a turnaround in the third quarter of 2025. Its gross margin turned positive, and overall performance rebounded from the previous quarter's slump. While vehicle sales improved, the company is still grappling with significant losses.

Under immense pressure, Rivian has started to venture into AI and robotics. Through its newly established independent subsidiary, Mind Robotics, Rivian aims to emulate Tesla's strategy, seeking a path to survival in the post-new energy vehicle era by shifting from traditional manufacturing to cutting-edge AI technology.

01

Rivian Still Facing Financial Challenges

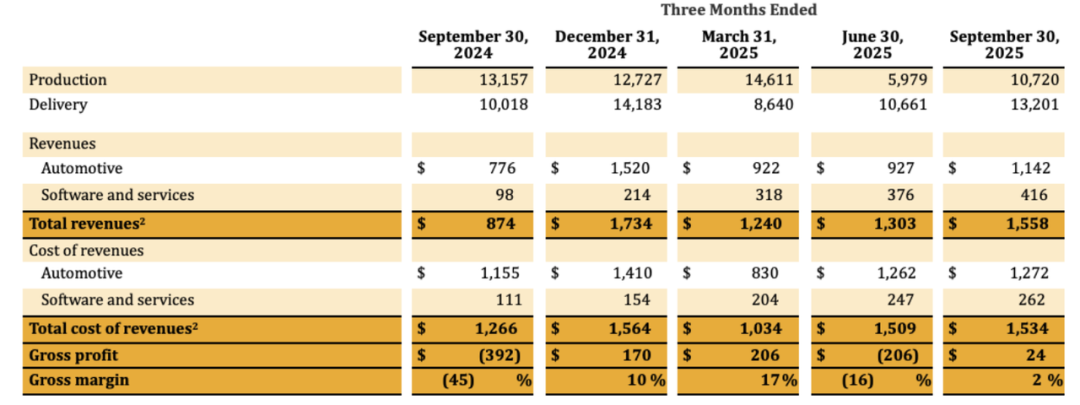

Rivian's third-quarter financial report offers a glimmer of hope. After several quarters of negative gross margins, the company achieved a positive margin of 1.5%. Although this figure may seem modest, it marks a significant milestone—the beginning of marginal improvements in Rivian's vehicle manufacturing losses.

Rivian is confronted with multiple headwinds:

◎ Following the Trump administration's entry into office, the weakening of new energy subsidies, tariff barriers driving up supply chain costs, and a sharp decline in carbon credit revenues have nearly pushed the company into a state of comprehensive financial distress.

◎ The "rush-to-buy" phenomenon before the phase-out of IRA subsidies led to a short-term surge in orders. Production increased by 24% quarter-on-quarter, significantly reducing unit manufacturing costs.

◎ Rivian's amortized cost per vehicle decreased by approximately $8,000, and variable costs per vehicle dropped by $10,000. This improvement brought the true gross margin on vehicle sales from -33.4% to -13.5%, the best level in the company's history.

In terms of revenue, Rivian exceeded expectations. Total revenue for the third quarter reached $1.56 billion, surpassing the market estimate of $1.49 billion. This includes:

◎ Vehicle sales contributed $1.14 billion, a 23% year-on-year increase.

◎ Services and software businesses continued to grow, reaching $416 million, primarily due to technology licensing revenue from a joint venture with Volkswagen.

◎ Despite increased R&D investment (especially for the R2 prototype and autonomous driving training systems), net losses improved sequentially to $790 million.

Due to fourth-quarter demand uncertainty, Rivian lowered its annual delivery guidance from 40,000 to 46,000 units to 41,500 to 43,500 units.

With the formal phase-out of IRA subsidies, the US electric vehicle market will face a short-term "vacuum period." Deliveries are expected to drop to around 10,000 units in the fourth quarter. Rivian maintains its goal of achieving a break-even gross margin for the full year and reiterates its adjusted EBITDA loss range of $2 billion to $2.25 billion. The company is still in a phase of high costs and capital consumption, and its financial health remains to be validated over time.

The R2 model is the center of market attention. Priced at $45,000, this mid-range model is expected to become Rivian's "scale breakthrough."

Officials estimate its bill of materials (BOM) cost to be only half of that of the R1 series. Production will initially take place at the existing Normal factory and later expand to a new plant in Georgia.

Rivian hopes to establish a product structure of "high-end R1 + scalable R2" to enhance capacity utilization and cash flow cycles. The real test will come after the R2's production launch in 2026. Until then, Rivian will need to maintain stable cash flow to navigate the investment and construction phase.

02

From Electric Vehicles to Intelligent Robotics: Rivian's "Second Act"

Despite not yet fully escaping the quagmire of losses, Rivian has chosen to embark on a radically different new path.

On the same day as the financial report release, the company announced the establishment of its independent subsidiary, Mind Robotics, focusing on "industrial AI and robotics systems." This move is perceived by the outside world as a bold transition from "vehicle manufacturing" to "intelligent manufacturing."

Mind Robotics aims to "redefine the operational methods of the real economy using industrial AI" and build a "robotics data flywheel" based on the data accumulated from Rivian's own manufacturing system.

While this may sound like a lofty Silicon Valley-inspired vision, it reveals Rivian's ambition in industrial intelligence—transforming its AI experience in the production system into marketable technological assets.

Rivian CEO RJ Scaringe stated during an investor conference call that AI is profoundly reshaping business operations, and in the physical manufacturing industry, its potential has only just begun to be unlocked. Rivian hopes to develop AI and robotics systems through Mind Robotics that can enhance manufacturing plant efficiency, achieving a leap from "factory automation" to "intelligent manufacturing."

Mind Robotics has secured a $115 million seed funding round led by venture capital firm Eclipse.

The firm's partner, Jiten Behl, previously served as a Rivian executive and is well-versed in the company's operational system. This is not Rivian's first foray into spinning off innovative businesses. In March of this year, Rivian independently established its micro-mobility division as a startup, Also Inc., and secured investments from Eclipse and Greenoaks Capital.

This "incubation spin-off" model, on the one hand, helps alleviate the financial pressure on the parent company, and on the other hand, enables innovative businesses to more flexibly attract external capital and collaborative resources.

Unlike traditional automotive factories, Rivian's production system has been deeply digitized from the outset, encompassing modules such as production automation, supply chain simulation, quality prediction, and equipment self-diagnosis.

The accumulation of this data provides a robust training foundation for its AI algorithms. If Mind Robotics can transform these capabilities into universal solutions, it could not only serve Rivian itself but also become a new revenue growth engine.

In fact, the automotive manufacturing industry is undergoing a transition from "hardware automation" to "intelligent collaboration," where AI-driven robotics possess learning and optimization capabilities.

While Rivian's Mind Robotics may still be in its infancy, its emergence underscores the company's realization of a critical issue—relying solely on vehicle manufacturing is insufficient to sustain long-term profitability. By mastering manufacturing intelligence, if Mind Robotics can develop replicable business models in production scheduling, supply chain collaboration, and even human-robot collaboration, Rivian could transform from a "new auto-making force" into a "manufacturing intelligence service provider."

Summary

Rivian's narrative is shifting from single-line vehicle manufacturing to robotics exploration. With the establishment of Mind Robotics, Rivian aims to create a second growth curve using AI and robotics technologies. This sector offers a long and promising path, allowing for gradual and sustainable development.