Once Nexperia Faces Splitting, Who Will Be the Ultimate Loser?

![]() 11/10 2025

11/10 2025

![]() 590

590

Introduction | Lead

Against the backdrop of China's Ministry of Commerce gradually easing export controls on Nexperia China's semiconductors and exempting eligible exports, the semiconductor supply chain crisis that global automakers are grappling with is set to see some relief. On November 8, China consented to a delegation from the Dutch Ministry of Economic Affairs visiting China for consultations, urging the Netherlands to promptly propose substantive solutions and halt its interference in corporate affairs. The Nexperia incident is shrouded in uncertainties and could even profoundly reshape the future layout of the global automotive supply chain.

This article is produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Full text: 2,747 characters

Reading time: 4 minutes

The parties involved in the Nexperia incident are still at a standstill. As of now, the Dutch side has not taken any concrete steps to halt infringements on the legitimate rights and interests of Chinese enterprises or restore stability to the global semiconductor supply chain.

On November 2, Nexperia China Co., Ltd. issued a notice to its customers, formally confirming the unilateral decision by Nexperia Netherlands to cease wafer supplies to its packaging and testing plant in Dongguan (ATGD) starting from October 26, 2025. On November 6, a spokesperson for China's Ministry of Commerce commented, "With a responsible attitude towards the stability and security of the global semiconductor supply chain, China has swiftly approved relevant export license applications from Chinese exporters and exempted eligible exports, striving to facilitate the resumption of supplies by Nexperia (China) Co., Ltd." Two days later, the Ministry reiterated its stance, urging the Dutch side to move beyond empty rhetoric and promptly propose constructive solutions. It called on the Dutch to take substantive actions to swiftly and effectively restore stability to the global semiconductor supply chain from its roots and to cease using administrative measures to intervene in and disrupt internal corporate affairs, thereby promoting an early resolution to the Nexperia issue.

If this dispute is not promptly resolved, it will have a significant impact on the global automotive industry chain.

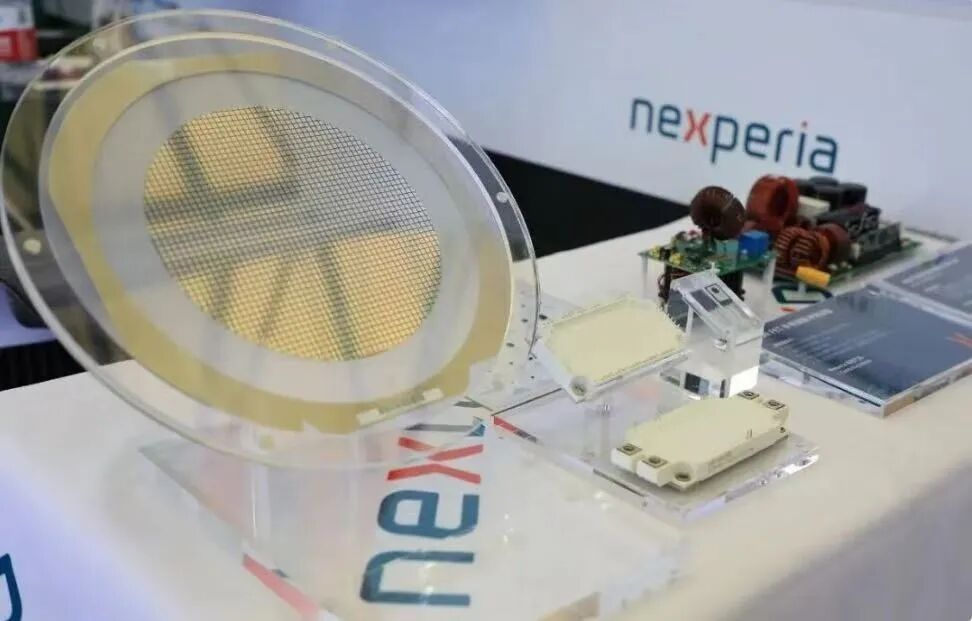

△ Nexperia Netherlands has halted wafer supplies to Nexperia's Dongguan plant.

Nexperia Netherlands claims that the suspension of wafer supplies is a "direct consequence of the local Chinese management's recent failure to comply with agreed contract payment terms." However, this statement was vehemently opposed and comprehensively refuted by Nexperia China. Nexperia China asserts that there has been no contract breach on its part. The claim by Nexperia Netherlands that the local Chinese management recently failed to adhere to agreed contract payment terms is not only entirely baseless but, on the contrary, Nexperia Netherlands currently owes the Dongguan packaging and testing plant as much as RMB 1 billion in outstanding payments.

The supply cut-off by the Netherlands headquarters has a substantial impact on Nexperia China. After all, Nexperia China's Dongguan plant solely undertakes packaging and testing functions, relying heavily on a steady supply of wafers from upstream manufacturers. In response, Nexperia China has remained composed and promptly provided solutions. In the short term, Nexperia China has built up sufficient inventory of finished products and work-in-progress to continuously meet the order demands of major customers until the end of the year and beyond. In the medium to long term, Nexperia China will seek new wafer suppliers and complete relevant verifications to continue fulfilling its role in supplying customers.

△ In the absence of upstream wafer supplies, Nexperia's Dongguan packaging and testing plant needs to find new wafer sources.

Who Will Blink First in the Nexperia Standoff?

From the current situation, both sides are engaged in a psychological battle, waiting to see who will crack first.

Currently, Nexperia Netherlands seems to be adopting a do-or-die approach. The Dongguan plant of Nexperia China accounts for 80% of Nexperia's global packaging and testing capacity. If the Dongguan plant cannot steadily supply major global customers, Nexperia Netherlands will inevitably breach contracts. In the short term, it is virtually impossible for Nexperia Netherlands to establish 80% of new packaging and testing capacity. However, once it breaches contracts, Nexperia will face exorbitant compensation, and the entire company will be on the brink of bankruptcy. This is a simple truth that Nexperia Netherlands must be well aware of. Nevertheless, the Dutch side has still made such a decision, perhaps determined to force Wingtech Technology to concede and hand over the global management rights of Nexperia.

△ Nexperia's Netherlands headquarters has not taken substantive action to restore stability to the global semiconductor supply chain.

For Nexperia China, it can hold out for now but may still face disadvantages in the long run. Although the Dongguan plant plays a crucial role in Nexperia's global supply chain, it is only a packaging and testing plant, the last link in the entire chip industry chain, with relatively low technological content. For Nexperia's Netherlands headquarters, establishing another chip packaging and testing plant overseas is not an insurmountable task, just requiring some time.

Moreover, neither the Nexperia Dongguan packaging and testing plant at the center of the storm, nor Nexperia China or Wingtech Technology, possesses the systematic in-vehicle chip R&D capabilities of Nexperia's Netherlands headquarters. Nexperia's chip R&D system is globally integrated, with core design platforms, patents, IP libraries, EDA tool licenses, and technology roadmap planning all controlled by the headquarters. Nexperia China primarily undertakes local deployment and application responsibilities, a stark contrast to starting from scratch.

Although in the future, if relations with the Netherlands headquarters completely deteriorate, Nexperia China will no longer receive chip patent licenses from Nexperia Netherlands. At that point, Nexperia China will need to start from scratch and redesign chips independently. However, Nexperia China's fate is not entirely in the hands of the Netherlands headquarters. Nexperia provides not high-computing-power, advanced-process chips but more reliable and mature in-vehicle chips, and China has already achieved technological autonomy in this field. Going forward, finding domestic wafer enterprises to supply Nexperia China or collaborating with other domestic in-vehicle chip companies will be viable paths for Nexperia China and its Dongguan plant. Nevertheless, once the situation evolves to this point, whether Nexperia's current major customers will recognize chips made from Nexperia China's new wafers remains questionable. Especially for overseas customers, whether they will still place orders with Nexperia China is highly uncertain.

△ Nexperia's core technologies, including R&D, remain in the hands of its Netherlands headquarters.

Automakers Need to Enhance Supply Chain 'Safety Lessons'

The dispute between Nexperia's Netherlands headquarters and its China packaging plant once again serves as a wake-up call for global automakers. Automobiles are industrial products composed of tens of thousands of components, and the absence of any single part can halt an automaker's production line. To better operate under the new global geopolitical landscape, major global automakers need to re-examine their supply chains:

Firstly, for critical components with limited alternatives, it is essential to increase inventory levels and establish strategic reserves. The biggest issue with in-vehicle chips has never been high technological barriers but rather the lengthy and stringent testing and certification process required for automotive-grade chips. If third-party chips are used rashly without completing certification and later prove unable to meet automotive-grade requirements, not only will significant costs be incurred for recalls, but the company's reputation will also be severely damaged.

△ Automakers need to establish strategic reserves related to chips.

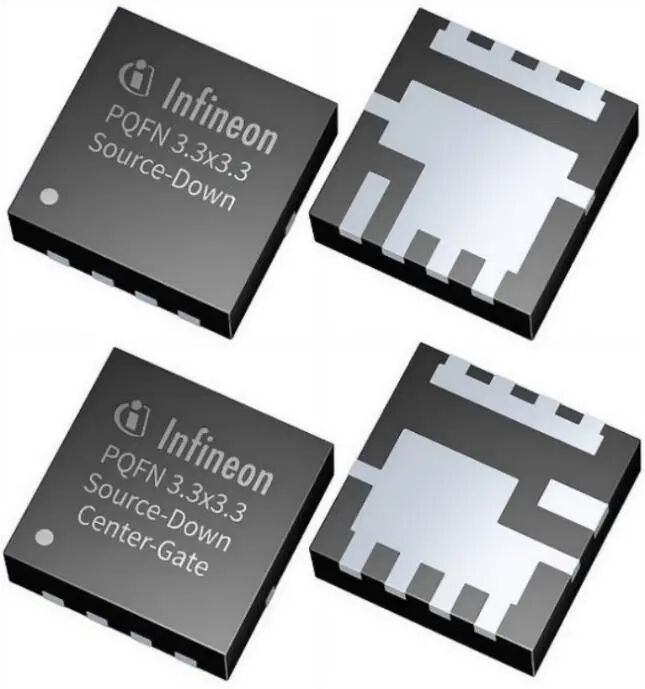

Secondly, during the initial product development phase, it is advisable to select at least two suppliers to reduce reliance on a single supplier. Taking Nexperia chips as an example, if automakers had simultaneously selected chips with similar technical parameters from other companies such as Infineon, ROHM, ON Semiconductor, Silan Micro, and China Resources Micro during the initial product development and subjected the products of both suppliers to all testing and certification processes throughout the vehicle development process, they could immediately switch suppliers in the event of a supply crisis at Nexperia. It is worth mentioning that this diversification applies not only to suppliers but also to production locations. This avoids the risk of multiple solutions facing sanctions simultaneously due to geopolitical conflicts.

△ Automakers should minimize reliance on a single supplier as early as the initial product development stage.

For Chinese domestic automakers, it is crucial to step out of their comfort zones and provide more opportunities to local chip companies. The Nexperia case serves as a reminder that the Chinese automotive industry must establish an autonomous and controllable supply chain to enhance its security and resilience.

Commentary

Can the rift between Nexperia's Netherlands headquarters and Nexperia China be mended? With China's Ministry of Commerce easing restrictions on Nexperia China's chip exports, the Dutch side and Nexperia Netherlands headquarters have still not taken substantive action, casting a shadow over the future of this dispute. Against the backdrop of global economic integration, if the Dutch side continues to adopt such a confrontational approach, it will have a significant short-term impact on the global automotive industry, potentially causing some factories of multinational automakers to halt production. This will result in a lose-lose situation, with no benefits for the rule-breakers. Nexperia Netherlands headquarters will bear global condemnation and may even lead to Nexperia's downfall. Simultaneously, this poses a huge test for the global automotive industry chain, prompting automakers to consider how to layout their strategies to avoid such unforeseen disasters.

(This article is an original work of Heyan Yueche and may not be reproduced without authorization.)