"Elon Musk Finally Secures a Record-Breaking Compensation of $56 Billion, Driving Tesla to a Market Cap of $7 Trillion with Robotaxi!

![]() 06/14 2024

06/14 2024

![]() 591

591

On August 13, Beijing time, on the eve of Tesla's shareholder meeting, Elon Musk announced on his social media platform X that the previously court-invalidated compensation package of up to $56 billion (approximately 400 billion yuan) had been approved by shareholders in a large majority vote, signifying Musk's successful pursuit of compensation!

Ding, Elon Musk's compensation has arrived at $56 billion!

This is also the most lucrative compensation in human history to date. Of course, Musk had already paid over $10 billion in taxes for this astronomical compensation in 2022, making him the individual paying the most taxes in the United States that year.

It is worth mentioning that influenced by this news, Tesla's share price surged more than 6% before the market opened, coupled with a 3.88% increase in the previous trading day, Tesla's cumulative increase exceeded 10%, and the share price approached $190 again.

Tesla's share price surge may also have been influenced by a recent report on Tesla released by Ark Vest, a fund under Cathie Wood, a loyal investor known as "Woodie." In the report, Ark Vest believes that Tesla's share price will soar 12.5 times in five years, reaching $260 billion (market capitalization exceeding $7 trillion), and that Tesla's Robotaxi business will be launched within the next two years and will provide over 90% of Tesla's corporate value and earnings by 2029.

01

Seeking 25% Voting Rights After Successfully Securing Compensation

Currently, the court's previous ruling on Musk's astronomical compensation was invalid, and the victorious lawyers also demanded $5.6 billion in compensation from Tesla. Tesla responded that the lawsuit brought by the lawyers had hardly benefited Tesla and would not pay the compensation.

Now, the shareholder meeting has once again approved this astronomical compensation in a large majority.

For Musk, after receiving his rightful compensation, his next goal may be to acquire 25% voting rights in Tesla.

Previously, Musk had stated that due to his insufficient voting rights, he would not be able to obtain 25% voting rights and may develop AI and humanoid robots outside of Tesla. This is where Tesla's new growth points lie, supporting the two core expectations of Tesla's share price. Prior to this, it was revealed that Musk had allocated $500 million worth of NVIDIA chips from Tesla to xAI.

For Tesla shareholders, in the past few years, the company has not launched any high-volume models, leading to today's sales dilemma. One of the core reasons is that Musk has too many companies under his belt, and his attention is not focused much on Tesla.

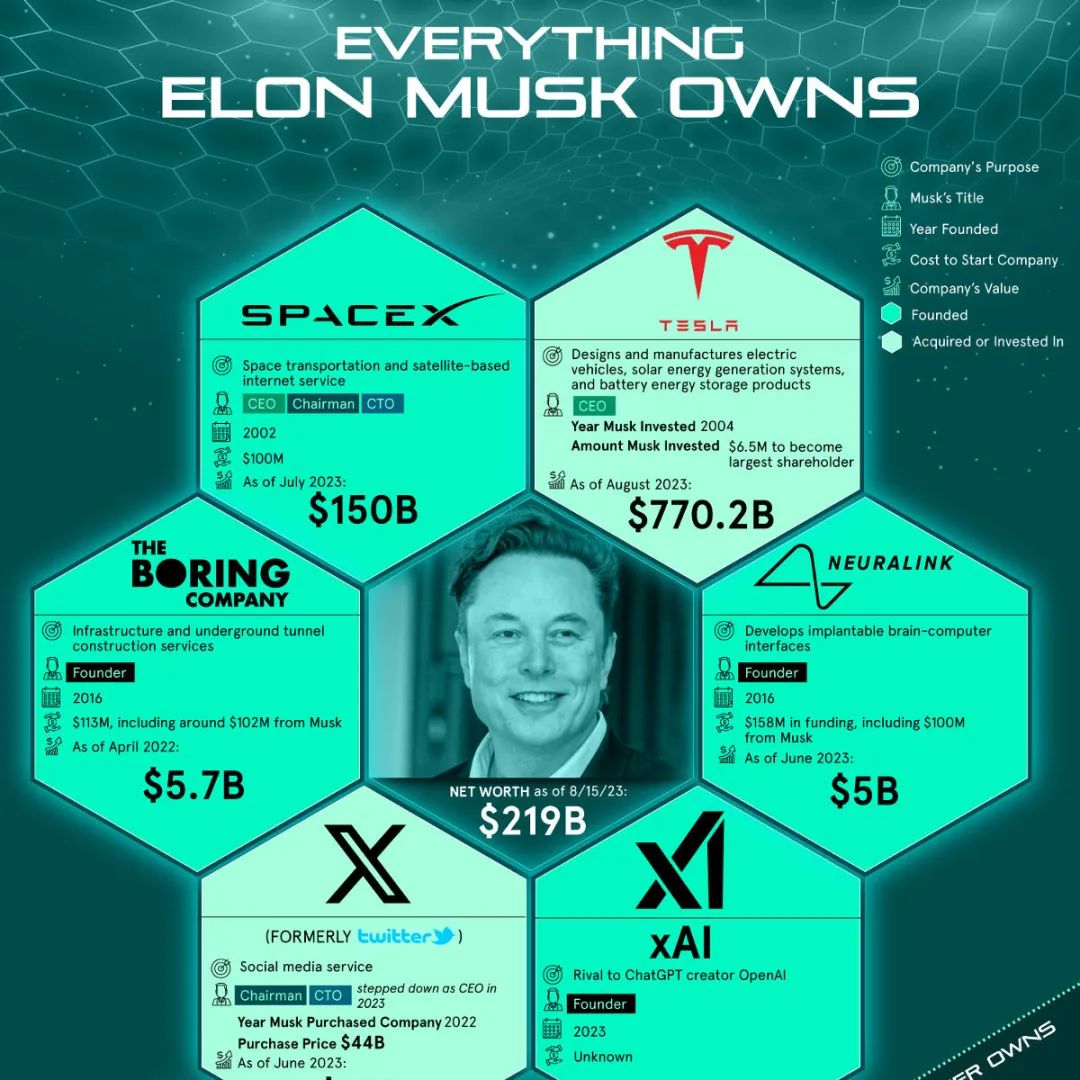

Elon Musk's Business Empire

Currently, Musk's companies such as SpaceX, Starlink, Neuralink, and xAI are highly sought after in the technology circle. SpaceX's fourth launch of Starship achieved unexpected success, Starlink adds thousands of new communication satellites every year, Neuralink has been approved for a second experiment, and xAI has just completed its first round of external financing of $6 billion.

In contrast, the difficulties faced by Tesla are obvious - the refreshed Model 3, which contributed one-third of sales in the Chinese market last year, no longer enjoys the glory of the older model, relying solely on the continuously discounted Model Y to support sales, while the US market has also shown signs of sluggish growth.

The core reason behind this is that Tesla's product update rhythm is too slow, and the updated products do not meet the needs of Chinese consumers well. With more options available in the market, Tesla's sales naturally decline.

Therefore, faced with Tesla's sales falling short of expectations and its continuously declining share price, Musk suddenly announced on X in late March that he would launch Robotaxi on August 8, which is another plan for Tesla to open up market imagination after the humanoid robot Optimus.

Musk may seize the opportunity of Robotaxi's launch to increase his voting rights in Tesla to 25%.

For Tesla shareholders, whether large or small, Musk is the totem and label of Tesla. Without Musk, Tesla is no different from General Motors or Ford, just another company selling electric vehicles. With Musk, Tesla is an AI company, and its share price has room for imagination.

02

Can Robotaxi Contribute 90% of Tesla's Profits?

Ark Vest's latest report on Tesla believes that Tesla will launch Robotaxi within two years. By 2029, Robotaxi will contribute 90% of Tesla's profits and corporate value, as Robotaxi's profit margin is significantly higher than that of the current electric vehicle business. By then, the electric vehicle business will only contribute 10% of Tesla's profits.

Tesla's share price will also surge 12.5 times in the next five years with the development of the Robotaxi business, reaching $2,600 per share. This means that Ark Vest believes that Tesla's market capitalization will reach $7 trillion.

Currently, two companies in the world have a market capitalization of over $3 trillion, namely Apple and Microsoft. By the way, Apple's share price has continued to surge and hit a record high, reaching a market capitalization of $3.3 trillion, thanks to the release of Apple Intelligence at WWDC 2024.

The power of AI has pushed Apple's share price to new highs. For Tesla, the application of AI is Robotaxi and Optimus, the humanoid robot. Compared to the humanoid robot, Musk is currently fully focused on Robotaxi, concentrating Tesla's personnel, organizational structure, and funds on this top-priority project.

Tesla's Robotaxi Rendered by INSIDE EV

The last such top-priority project was the mass production of Model 3.

Calculating the costs and benefits of Robotaxi in the US is straightforward.

Robotaxi primarily cuts labor costs, namely the costs of human drivers.

Once Tesla launches its Robotaxi service, it will significantly increase the service revenue of ride-hailing platforms as there will be no need to deduct commissions from drivers.

According to statistical data from Lyft, a US ride-hailing company, in Q1 2024, registered ride-hailing drivers on the Lyft platform, including tips, earned an average of $31.1 per hour. In addition to platform bonuses, after deducting costs, hourly income can still reach $24.25 (drivers' net profit reaches 77.97%).

If replaced with Robotaxi, working 12 hours a day can earn up to $291. Moreover, Robotaxi can operate 24 hours a day, doubling the income.

According to Lyft's financial report, gross margins have been between 40-45% in the past few quarters. Uber, another ride-hailing platform, had a gross margin of 39.1% in Q1 2024, which was considered a bombshell.

This is still under the premise that ride-hailing platforms need to pay drivers higher compensation. Once Robotaxi is realized, drivers' income will be completely attributed to the platform, meaning that the gross margin of ride-hailing platforms will further increase. It's worth noting that according to Lyft's data, drivers' net profit after deducting costs reaches 77.97%!

Once Robotaxi is realized, in addition to transporting people, it can also deliver food!

Uber has been doing just that. In 2023, Uber achieved revenue of $37.281 billion and a net profit of $1.887 billion.

Once Tesla launches Robotaxi, with Musk's appeal, the Robotaxi service provided will not need to spend a significant amount of money to accumulate customers like Uber and Lyft. It is estimated that at that time, bookings will be required!

This is why Ark Vest believes that Tesla's future market capitalization can reach $7 trillion."