Ali's 300-Day Pursuit of an AI Gateway: Quark Falls Short, Qianwen Steps into the Spotlight

![]() 11/20 2025

11/20 2025

![]() 520

520

Ali is on the verge of sparking a fresh wave of competition in the realm of the AI super gateway.

Recently, Ali officially rolled out the public beta version of its Qianwen App, directly challenging ChatGPT with the ambition of forging a future gateway for AI-driven lifestyles. This app represents an upgrade from the previous Tongyi App and Quark AI chat assistant, integrating Ali's cutting-edge Qwen 3-Max model from the Tongyi Lab.

Compared to Quark, which Ali once touted as its flagship AI offering, Qianwen carries less historical baggage. The shift from Quark's 'AI Super Frame' to the independent Qianwen App underscores Ali's reassessment of the AI gateway landscape. Search tools, it seems, struggle to align with strategic goals in the AI era, and a new gateway, unburdened by historical constraints, is better suited to the current competitive climate.

Over the years, Ali has made multiple attempts to establish a super gateway, but neither Taobao nor Alipay has truly evolved into a daily life gateway akin to WeChat, due to limitations in mindset or scenarios. Qianwen is now tasked with reclaiming the initiative in the AI era.

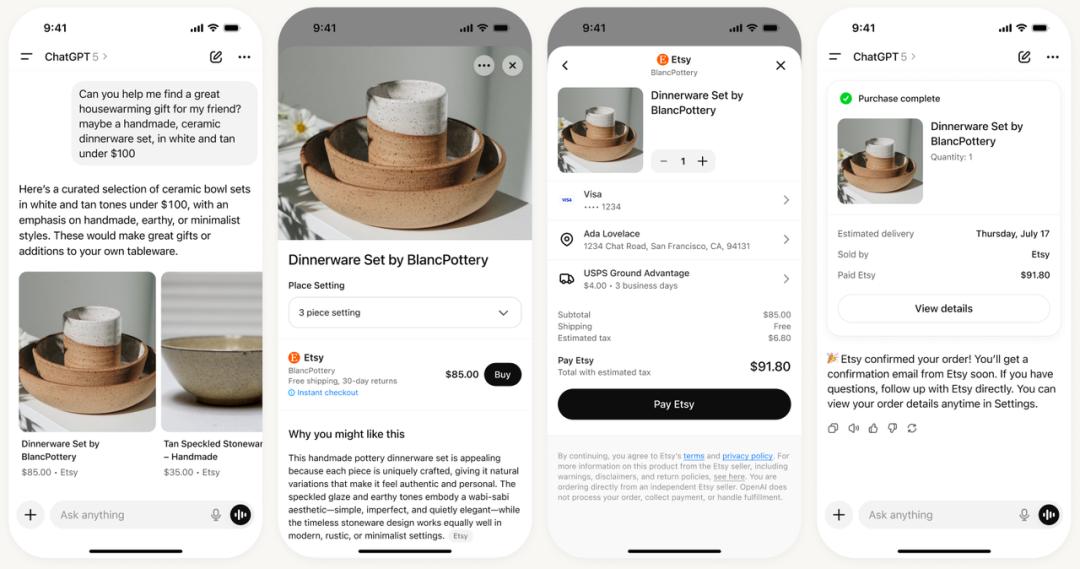

In contrast to industry peers, ChatGPT already supports instant checkout, enabling shopping within chat interfaces. Doubao has also begun incorporating Douyin product card links, redirecting consumer decision paths from search and content to AI dialogue.

Can Ali secure a foothold in the AI era's super gateway?

I. Urgent Strategic Pivot

Ali attributes its current focus on Qianwen to the maturity of model capabilities and the development of the Agent ecosystem, among other technological and ecological factors. However, from an external perspective, this appears more as an urgent, remedial shift.

Over the past two years, domestic AI products have entered a phase of rapid growth, while Ali's C-end gateway布局 (layout) has significantly lagged behind. According to a QuestMobile report, as of September this year, in terms of MAU rankings for AI-native apps, Doubao and Deepseek lead with 172 million and 144 million monthly active users, respectively. In contrast, Tongyi ranks 10th with only 3.05 million, a substantial gap.

Compared to the rapid user acquisition of products like Doubao, DeepSeek, and Yuanbao during the same period, Ali's AI products have a notably weak presence at the C-end. This stark contrast highlights the disparity between its high international profile in open-source models, which lead in technology, and its lack of a corresponding gateway presence.

During this critical window, Ali has consistently focused its resources on Quark.

In January of this year, Quark updated its slogan to 'The AI All-in-One Assistant for 200 Million People.' In March, Quark was upgraded to 'New Quark,' seen as Ali's flagship AI application.

The New Quark underwent a comprehensive upgrade into a borderless 'AI Super Frame,' integrating functions such as AI dialogue, deep thinking, deep search, deep research, and deep execution. At the time, Wu Jia, Vice President of Alibaba Group and CEO of Quark, stated that the new Quark completely abandons the traditional search box concept, with the 'AI Super Frame' approaching a personal super all-in-one assistant.

Ali claimed at the time that the latest achievements of the future Tongyi series models would be promptly integrated into Quark, continuously updating and optimizing its AI service functions.

However, just as the market widely believed Quark would shoulder the responsibility of Ali's AI flagship, the introduction of Qianwen revealed that Ali's C-end AI strategy is undergoing an urgent pivot.

This transformation is less a negation of existing strategies and more a reflection of Ali's senior leadership's response to the intensifying competition for the AI super gateway. In the C-end AI battlefield, the old model reliant on search boxes can no longer satisfy its ambition to rival ChatGPT.

Quark's core dilemma lies in its tool nature. Ali attempted to transform user perceptions from a traditional search tool to an AI assistant through innovation. However, regardless of how AI-driven its functions become, its underlying logic remains browser- and search-based, making it difficult for users to fully shed the perception of it as an information retrieval tool.

But Ali is clearly not satisfied with this. Future AI gateways must not only chat but also get things done. Therefore, Qianwen has chosen to directly rival ChatGPT. In the future, 'getting things done' will be a key focus for the Qianwen App.

In this context, Qianwen's pure, independent form makes it easier to cultivate user perceptions of it as a personal assistant or super intelligent agent. Ali clearly recognizes that to rapidly seize the first gateway for users in the AI era, a future-oriented, independent application without historical baggage is needed.

Over the next few months, Qianwen will gradually support intelligent agent functions, including shopping on Taobao. This is not merely a feature overlay but aims to directly position the AI assistant as a super executor connecting Ali's e-commerce, local services, and office services.

II. Betting on the Gateway Battle

This change stems from recognizing the immense value of independent gateways.

ChatGPT, which Qianwen is positioned against, exemplifies this trend. In October of this year, OpenAI announced the launch of instant checkout, allowing users to complete purchases without leaving the chat interface. OpenAI also stated that over one million Shopify merchants would join, including Glossier, Skims, Spanx, and Vuori.

More importantly, this is not simply about importing product links. Shopify's real-time data on prices, inventory, images, and styles will be directly integrated into ChatGPT's dialogue system.

Currently, ChatGPT has approximately 700 million weekly active users, generating around 75.6 million product-related dialogues per week. This equates to a supermarket receiving nearly 4 billion product inquiries annually. At this scale, achieving multi-billion-dollar GMV is only a matter of time.

Domestically, Doubao is also integrating e-commerce links to assist users in transaction decisions.

In early November of this year, many users noticed that when conversing with Doubao without selecting deep thinking, the replies began to include product links from Douyin Mall.

According to media reports, the initially integrated merchants are primarily high-quality stores with ratings above 4.8 within the Douyin e-commerce ecosystem, ensuring a certain foundation for recommended product quality. Currently, this feature covers multiple high-frequency consumption categories, including maternal and child products, beauty, and home furnishings.

A Doubao representative stated, 'Doubao has integrated some structured e-commerce information primarily to enhance the quality of its responses to related questions and improve user satisfaction.'

Undoubtedly, AI now possesses the capability to directly penetrate core user scenarios such as consumption decisions and lifestyle services. Such a super gateway capable of penetrating user perceptions and supporting broad lifestyle scenarios has long been an unfulfilled dream for Ali.

During the era of shelf e-commerce, Taobao used keyword searches as its gateway to meet user shopping needs. However, short videos and content e-commerce have diverted key stages of the decision-making process from Taobao. A significant portion of users no longer begin shopping by entering keywords but instead search for strategies on Xiaohongshu or browse videos on Douyin.

Regrettably, despite controlling China's largest e-commerce transaction scenarios over the past few years, Ali has consistently failed to create a super app capable of rivaling WeChat or Douyin, lacking a truly influential primary traffic gateway that captures user perceptions.

In 2014, Ali bet on Mobile Taobao as the gateway for the mobile internet era, but ultimately, Taobao's perception remained limited to shopping, struggling to support broad lifestyle scenarios. Subsequently, Tmall Genie attempted to seize the family scenario gateway through voice, but it proved to be a low-frequency family device ecosystem incapable of retaining high-value traffic.

Additionally, Ali repeatedly revamped Alipay to de-emphasize its tool nature and strengthen content and social attributes, while Taobao vigorously developed short videos—all in hopes of transitioning from purely tool-based products to digital lifestyle products and cultivating user habits of 'browsing Ali.'

However, all these cross-scenario gateway-level attempts ultimately yielded minimal results.

III. Greatest Strength, Greatest Burden

On its path to seizing the AI super gateway, Ali possesses undeniable resource advantages.

First is technological leadership. Qianwen is built on the latest open-source Qwen large model. In the field of general models, Qwen3-Max represents the most powerful foundational LLM in the current Tongyi model family, with parameter scales exceeding one trillion—approximately five times that of the previous general foundational model—narrowing the gap with leading North American general foundational models like GPT-4 (1.76 trillion) and Grok4.

Second is scenario advantage. Domestically, Ali controls high-frequency core scenarios such as shopping (Taotian), food delivery (Ele.me), navigation (Gaode), travel (Fliggy), office services (DingTalk), and payments (Alipay).

An Ali representative stated in a LatePost interview that Qianwen is currently undergoing joint development with Gaode, Taobao, Alipay, and Shangu, with rapid progress and anticipated major version updates soon.

However, these substantial scenario advantages also impose certain constraints.

The core of an AI super gateway lies in user trust in information. When AI intervenes in transactions, the greatest challenge is whether Ali can ensure decision neutrality.

Consumers choose AI shopping primarily for efficiency and trust. A study by Cognizant and the Oxford Economics Institute found that 75% of consumers feel frustrated with the shopping process, prompting them to use AI shopping, with 22% citing time savings as the primary reason for using platform shopping, while only 12% believe AI helps them find the best deals.

'People expect to ask questions of an AI engine and receive answers—and they don't want to pay for it. They simply want to use an AI engine they trust to provide honest, correct answers,' an AI industry insider noted.

As more purchases occur within AI chatbots, this means AI products will wield greater influence—deciding which products are displayed and how much commission or advertising fees are charged.

OpenAI lacks scenario advantages but also carries less historical baggage. OpenAI emphasizes that the product results displayed in its dialogues are 'naturally generated and unsponsored,' ranked solely based on relevance to users, and charges merchants only a 'small fee' for completed purchases.

Can Qianwen ensure that its generated decisions are free from interest bias and prejudice? This is an unavoidable conflict of interest in the AI era and a challenge Ali faces compared to OpenAI, which lacks historical baggage.

Of course, this is a common issue faced by all AI companies.