Before retirement, Buffett sells Apple shares and buys Google, what is the intention of the Oracle of Omaha's last battle?

![]() 11/20 2025

11/20 2025

![]() 414

414

As we all know, the Oracle of Omaha, Warren Buffett, is a legendary figure in the world investment circle. With his remarkable track record in the capital market, every move Buffett makes draws significant attention. However, Buffett recently announced his impending retirement. Just as he is about to step down, news emerged that Buffett has sold Apple shares and bought Google shares. What does the Oracle's last battle really signify?

I. Buffett Sells Apple Shares and Buys Google Before Retirement

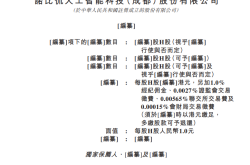

According to a report by Cailian Press, Berkshire Hathaway, led by the 'Oracle of Omaha' Warren Buffett, released its 13F report for the third quarter.

As previously speculated by the outside world, Buffett indeed sold a substantial amount of Apple shares in the third quarter. However, at the same time, Buffett also acquired a significant number of shares in Alphabet, the parent company of Google.

It is worth mentioning that Buffett, now 95 years old, will step down as CEO of Berkshire at the end of the year, with his long-time deputy, Greg Abel, taking over. Therefore, this 13F report is also Buffett's last detailed disclosure of his stock portfolio before concluding his 60-year tenure as CEO.

The report shows that as of the end of the third quarter, Berkshire held a total of 41 stocks, with a total market value of holdings at $267 billion, up from $258 billion in the previous quarter, representing a 3.4% increase. Berkshire increased its holdings in six stocks and reduced its holdings in five stocks during the quarter. It also initiated a new position in 17.84 million shares of Google and liquidated its shares in D.R. Horton, one of the four major real estate developers in the United States. In this tech-driven bull market for U.S. stocks, Berkshire Hathaway has been a net seller of stocks for 12 consecutive quarters.

Apple remains its largest holding, with a market value of approximately $60.66 billion. However, Berkshire's Apple holdings have decreased from 280 million shares to 238.2 million shares this quarter. It has now sold nearly three-quarters of the 905 million shares it once held.

Apart from reducing its Apple holdings, another notable move by Berkshire in its tech sector investments was initiating a new position in 17.84 million shares of Alphabet, the parent company of Google, making it its tenth-largest stock holding.

II. What is the Intention Behind the Oracle's Last Battle?

Recently, Buffett made a remarkable market move just before his retirement, selling Apple shares and buying Google shares. What is the deeper meaning behind this?

Firstly, from the perspective of Apple's own development, the reduction in holdings seems reasonable. Apple is undoubtedly one of the most successful consumer tech companies in the past decade, with its strong brand moat, stable cash flow, and vast user ecosystem making it a 'bond-like asset' in the eyes of value investors. However, in recent years, Apple's pace of product innovation has significantly slowed down, with iPhone iterations becoming more conservative. New hardware like Vision Pro has yet to achieve scale effects, and its layout (layout) in the AI field appears relatively lagging. To be honest, as a tech enthusiast, I have been quite disappointed with Apple in recent years. It has failed to launch truly revolutionary innovative products and often relies on its past successes to move forward. This is truly disappointing for a company whose DNA is innovation.

At the same time, its market value has repeatedly hit new highs, with its valuation level long surpassing the traditional safety margin of value investing. For Buffett, whose core credo is 'safety margin,' reducing holdings at high levels is not bearish but a return to rationality. When a company's stock price far exceeds its intrinsic value growth potential, even the highest-quality assets deserve re-evaluation. Therefore, this reduction in Apple holdings precisely reflects Buffett's increasingly cautious investment attitude in his later years, rather than a sudden change in style.

Secondly, this move seems more like the work of Buffett's successor. Although this move is seen by the outside world as Buffett's last major market decision, it seems to bear the imprint of his successor. According to Buffett's previous investment style, tech stocks have never been his core target. Buffett has always emphasized investing in companies with stable cash flows, strong moats, and sustainable competitive advantages. The tech industry, characterized by rapid technological updates and fierce competition, poses relatively higher risks and does not align with his consistent investment principles. However, in recent years, other investment managers within Berkshire have shown a strong interest in tech stocks.

As a global leader in the tech sector, Google possesses strong technological capabilities and a wide-ranging business layout (layout). It holds a leading position in search engines, cloud computing, artificial intelligence, and other fields, with tremendous development potential. Choosing Google is likely a strategic move by other investment managers at Berkshire. This also reflects the gradual diversification of investment philosophies within Berkshire. With the evolution of times and market changes, a single investment style may struggle to adapt to the complex and ever-changing market environment. Buffett may have also recognized this point and, through this move, injected new elements into Berkshire's investment strategy, paving the way for the company's future development. At the same time, this is also a transitional arrangement, allowing the market to gradually adapt to changes in Berkshire's investment style and preparing for the investment decisions of Buffett's successor after taking over the company.

Thirdly, diversification in the post-Buffett era is inevitable. For Berkshire, it is about to enter the post-Buffett era. At such a critical juncture, choosing a more diversified investment strategy rather than rigidly adhering to Buffett's previous style is undoubtedly the right choice. Buffett's investment philosophy and style have brought tremendous success to Berkshire over the past few decades. However, with changes in the global economic landscape and the deepening of the technological revolution, the market environment has undergone tremendous changes.

Traditional investment areas, such as consumer goods and finance, while still possessing certain investment value, offer relatively limited growth potential. In contrast, emerging areas like technology and new energy hold tremendous development opportunities. Diversified investment can help Berkshire spread risks and reduce dependence on a single industry or company. By venturing into different fields, the company can achieve asset preservation and appreciation across different market cycles. For example, when the consumer industry is in a downturn, the tech industry may be on the rise. Diversified investment allows the company to hedge risks across different industries. Furthermore, diversified investment enables Berkshire to better grasp the development trends of emerging industries and proactively layout (layout) in potentially promising areas in the future, laying a solid foundation for the company's long-term development. Therefore, at this juncture of Buffett's impending retirement, Berkshire's choice of a diversified investment strategy is an inevitable response to the trends of the times.

Fourthly, the systematic reshaping of Berkshire's investment style is what deserves the most attention. Once Buffett completely leaves Berkshire, the investment company's style is highly likely to undergo significant changes. This change does not negate Buffett's investment philosophy but rather represents innovation and adjustment based on inheriting its core values while adapting to the new market environment and the company's development needs. Buffett's investment style is renowned for its stability and long-term holding of high-quality assets. This style has established a strong brand image for Berkshire over the past few decades and earned the trust of investors.

However, with the continuous evolution of the market, new investment opportunities and challenges emerge endlessly. The future Berkshire may place greater emphasis on investments in the tech sector and increase its layout (layout) in enterprises engaged in the research, development, and application of emerging technologies. At the same time, investment decisions may become more flexible, with a greater focus on seizing short-term market opportunities. This stylistic shift does not mean that Berkshire will abandon the principles of value investing but rather incorporate more innovative elements and flexibility while adhering to the principles of value investing. This change is actually something we should look forward to even more. The market should not deify 'Buffett's style' as an unchangeable golden rule but rather recognize its essence as a spirit of rationality, discipline, and long-termism. As long as this essence is preserved, changes in form are precisely a manifestation of vitality.

After all, the Oracle of Omaha is getting old and will eventually become a legendary figure. However, when Buffett is no longer at the helm of Berkshire, whether the company can truly possess a vitality that transcends individuals and achieve enduring success may be the most crucial question that needs to be answered.