Can Baidu Be Saved by Embracing AI Storytelling?

![]() 11/20 2025

11/20 2025

![]() 430

430

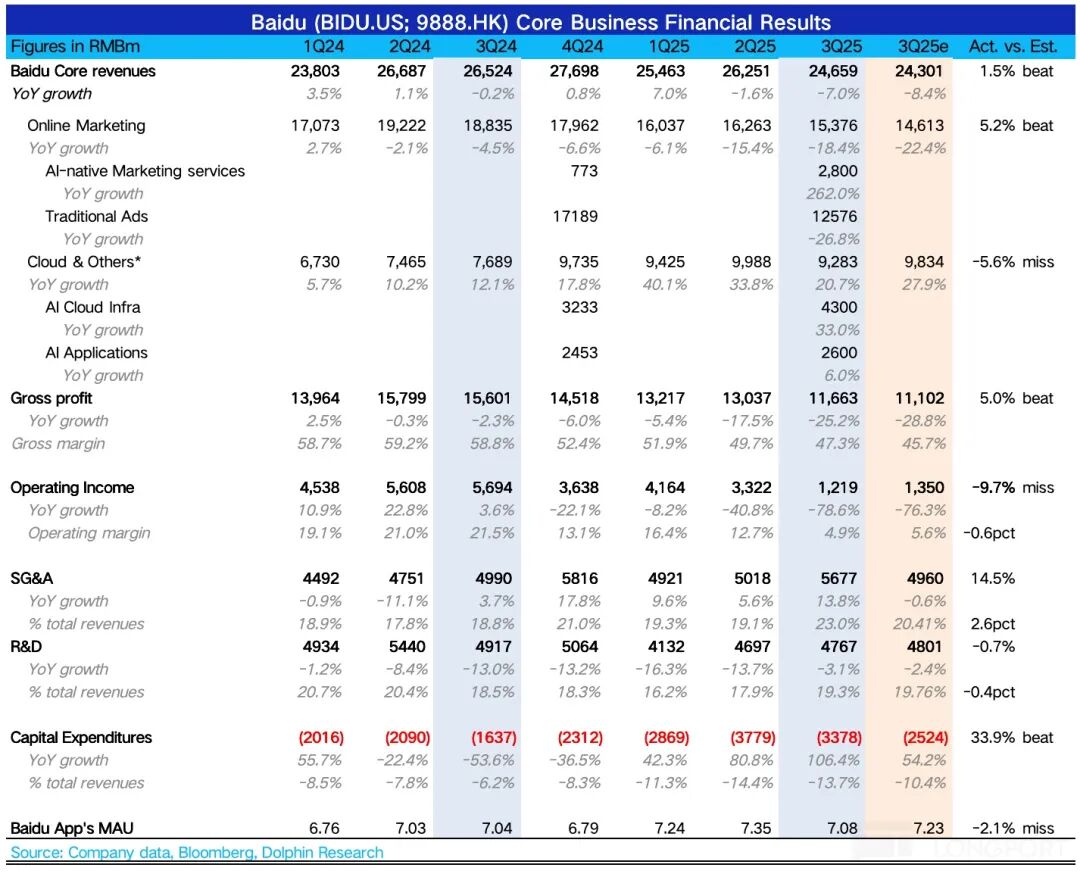

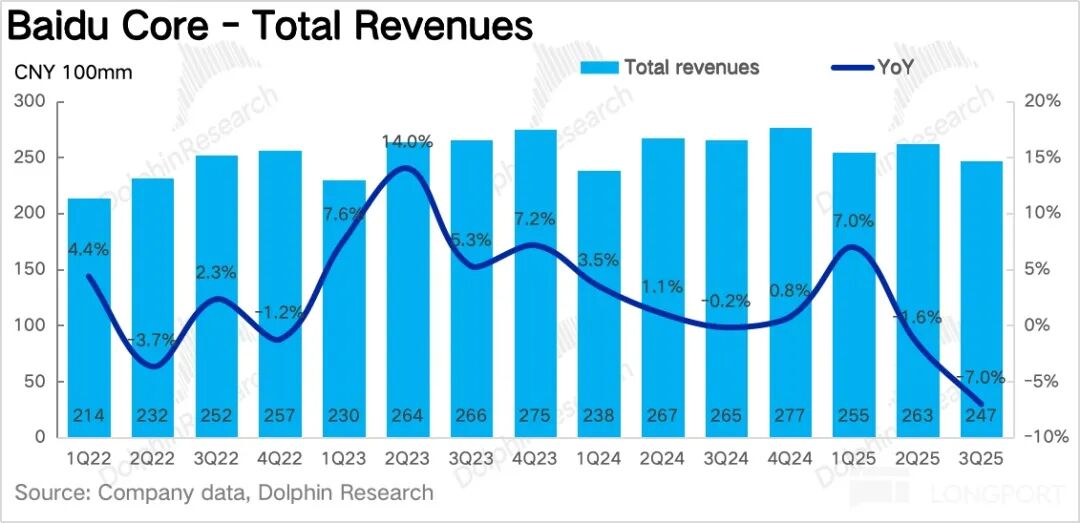

Baidu's Q3 results were released after the market closed on November 18, 2025, generally meeting expectations. Through detailed disclosure of AI revenue, the company demonstrated its urgent desire to shed its traditional label and fully embrace AI storytelling.

A closer look (focusing on Baidu Core):

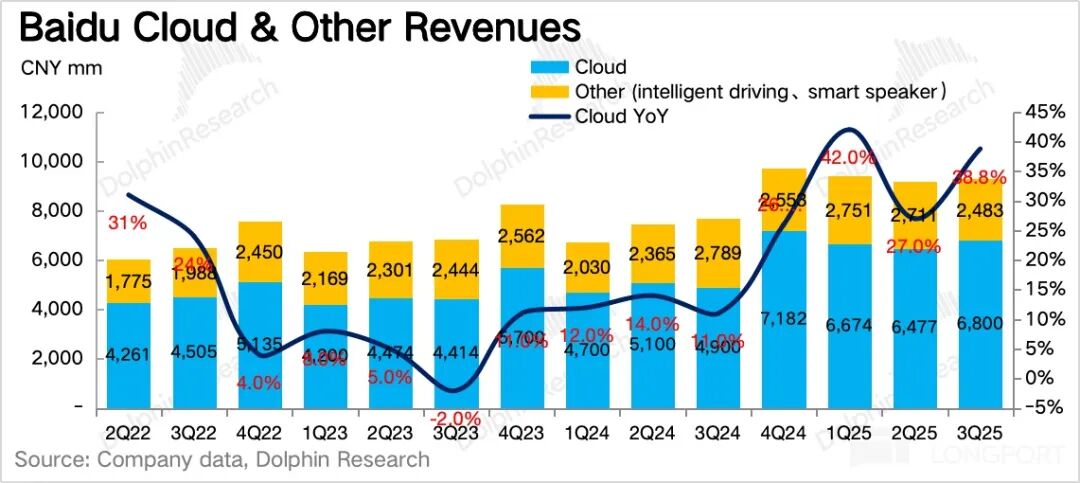

1. AI Revenue Contribution Reaches 40%: In Q3, revenue directly tied to AI approached 10 billion yuan, accounting for 40% of total revenue. This includes:

(1) AI cloud infrastructure (including large model APIs and computing power leasing) contributed half, with a 33% YoY increase. Given that AI revenue is now separately disclosed, this growth rate is not particularly impressive. Notably, computing power leasing saw a significant acceleration, growing 128% this quarter compared to 50% last quarter.

Dolphin Research believes this is driven by increased AI adoption across industries and transformation needs of SMEs, especially downstream application developers. It may also include demand from tech giants that previously relied on self-supplied computing power.

Management explained in the earnings call that if the latter is true, demand may shift back in the future. Without further industry penetration, this quarter's growth may be a one-time acceleration for Baidu.

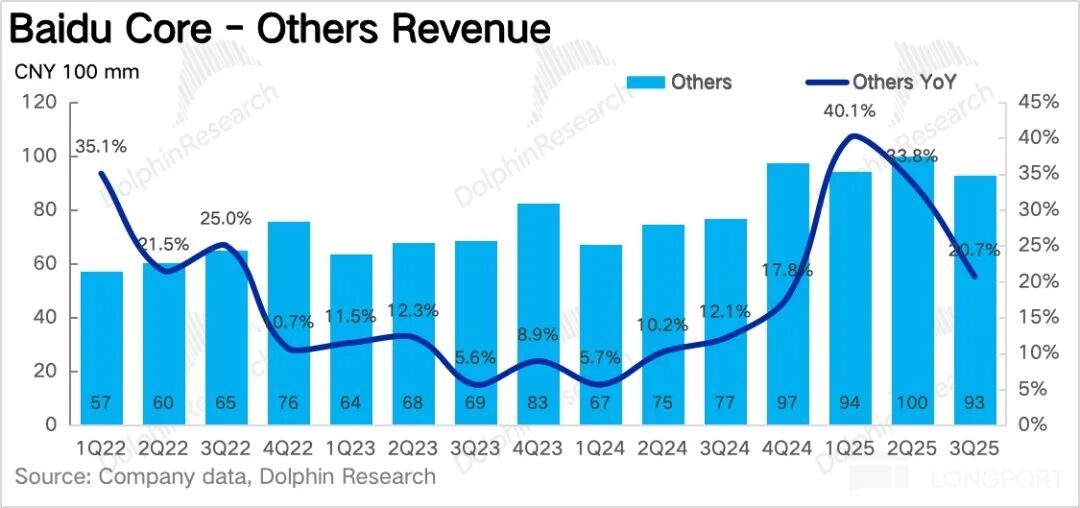

(2) AI applications generated 2.6 billion yuan in revenue, up 6% YoY, primarily from Baidu Wenku, Baidu Netdisk, and digital employees. Despite being AI+, growth was sluggish, likely dragged down by Baidu Netdisk (due to this quarter's promotional discounts) and other miscellaneous factors. Competition from Quark and WeChat Disk, which recently upgraded their features or services, cannot be ignored.

(3) AI-native marketing services, mainly Agent and digital humans, generated 2.8 billion yuan in revenue, up 262% YoY. This segment is clearly in its growth phase and holds greater application potential.

2. User Losses and Advertising Pressure Persist: Q3 overall marketing revenue declined 18% YoY, slightly better than guidance. Excluding AI revenue, traditional advertising fell 27% YoY. The company attributed this to AI-generated content, noting that 70% of mobile search results now contain AI-generated content, reaching a penetration plateau.

However, a nearly 30% decline suggests competitive pressures, including traffic migration to rival ecosystems (e.g., in-app search and native AI applications). For instance, Tencent's advertising revenue grew 21% YoY in Q3, driven by WeChat Search.

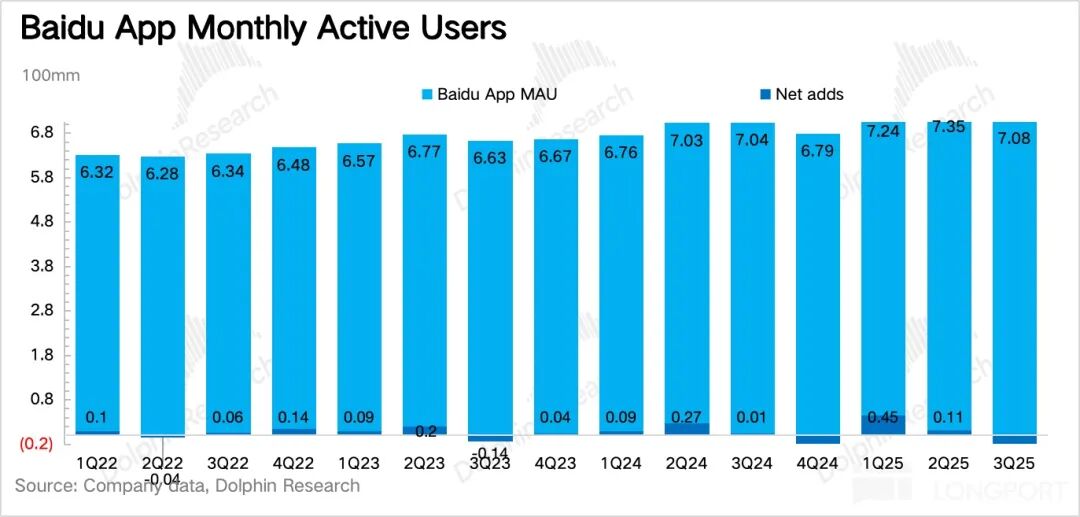

User metrics also raise concerns. Baidu Mobile's MAU declined by 27 million QoQ in Q3, an improvement over last year but indicating diminishing positive effects from AI-enhanced search experiences introduced earlier this year. This also suggests traffic migration.

3. Apollo Go Accelerates Internationally: Among other revenues, intelligent driving stood out. Apollo Go completed 3.1 million orders in Q3, up 212% YoY, accelerating from Q2. Beyond penetrating 22 mainland cities, Apollo Go expanded internationally this year to Hong Kong, Dubai, and Switzerland.

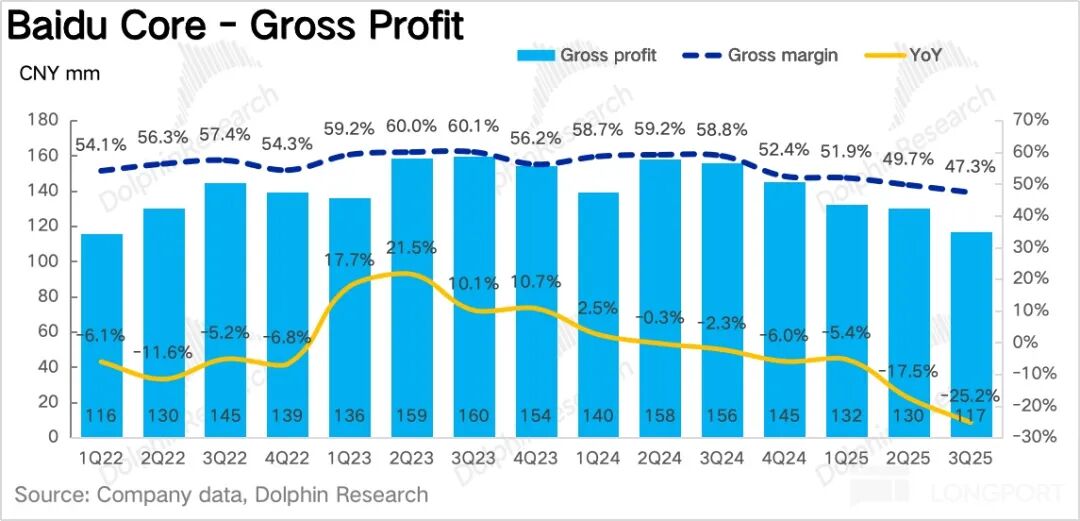

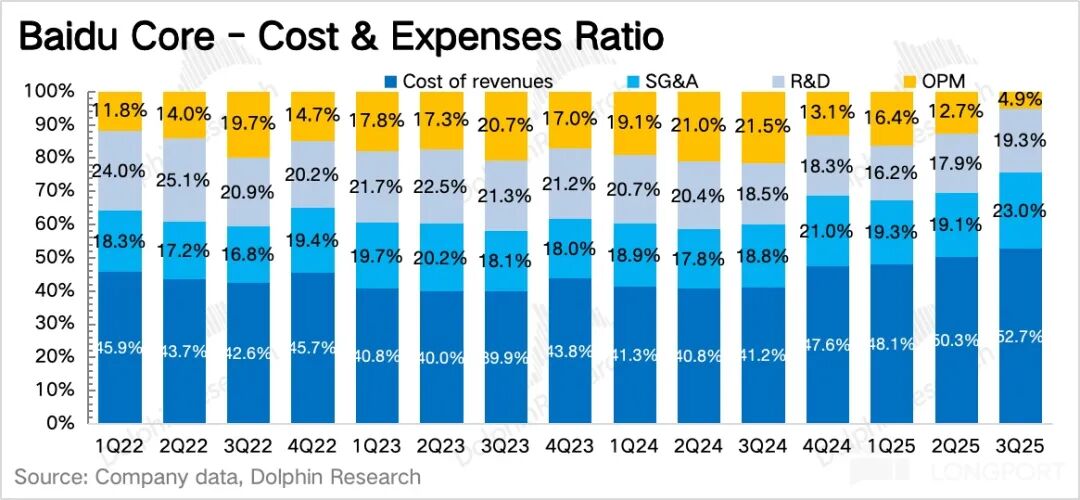

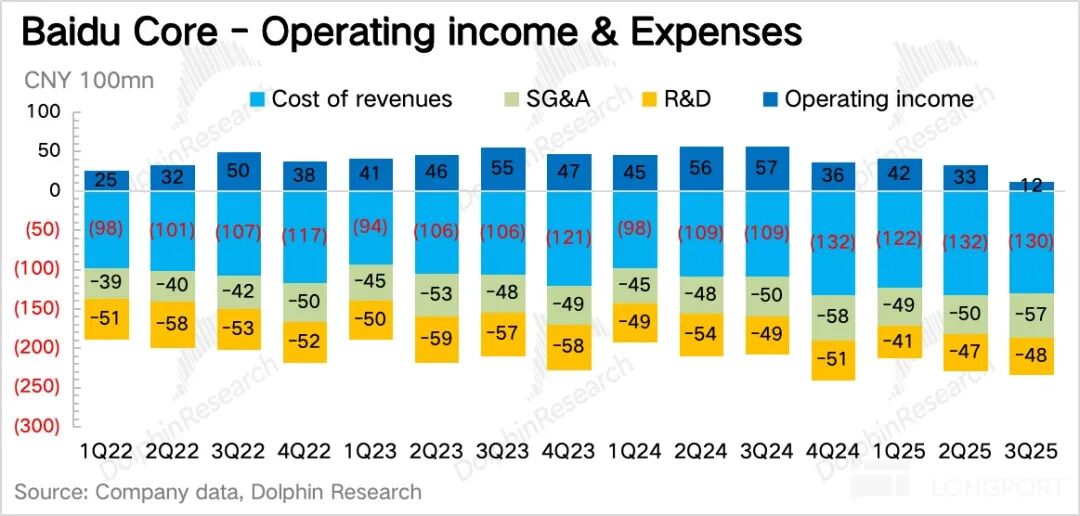

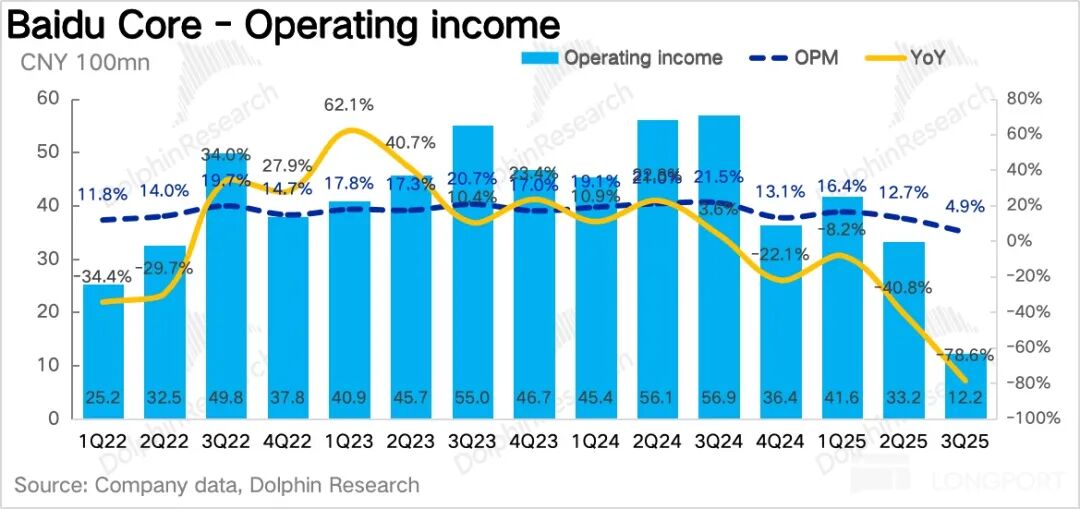

4. Core Profit Margin Pressure Eases: Baidu Core's operating profit (gross profit minus three operating expenses) fell to 1.2 billion yuan in Q3, with a profit margin of just 5%, well below normal levels. This is due to:

1) Business mix changes. AI revenue grew but at low margins, dragging down the overall level. 2) Q3 marketing expenses rose significantly, likely tied to cloud and AI application promotions, including sales team expansion and advertising costs.

Additionally, a one-time impairment charge of 16.2 billion yuan was recorded this quarter, primarily for legacy equipment. While this does not affect cash flow, it optimizes future costs, releasing pressure early.

5. Capital Expenditures Expand Slightly: Baidu's Capex remains significantly lower than peers, thanks to years of AI investment and in-house chip development, which reduces costs compared to external procurement. However, rising AI costs necessitated Capex expansion starting last quarter.

In Q3, Baidu's capital expenditures reached 3.4 billion yuan, up 106% YoY, aligning with the phase-out of legacy equipment. New server-related spending increased accordingly. Considering Baidu's Kunlunxin chip business, the Capex expansion likely relates to procurement of supporting facilities rather than external GPU purchases.

6. Enhanced Shareholder Returns on the Horizon? While the timing of advertising recovery remains uncertain, market expectations persist regarding Baidu's substantial cash allocation (Baidu Core's net cash stood at 103.5 billion yuan, or $14.8 billion, as of Q3-end).

Current returns are low. Q3 share buybacks were negligible and not disclosed in earnings. At the previous pace, a 2% shareholder return yield offered little support during the stock's decline.

During the earnings call, the company revealed ongoing discussions about a dividend plan and a "floor level" for buybacks to reduce seasonal fluctuations. If implemented, a robust return plan could boost short-term stock prices and provide support.

7. Detailed Financial Overview

Dolphin Research's View

Q3 results generally met expectations, with minor deviations potentially stemming from "less severe traditional advertising declines" or "stronger-than-expected AI marketing services." We lean toward the latter.

Regardless, Baidu is eager to pivot to AI storytelling, as traditional advertising remains uncertain. Google, its overseas counterpart, has largely shed its advertising label and accelerated toward becoming a full-stack AI leader.

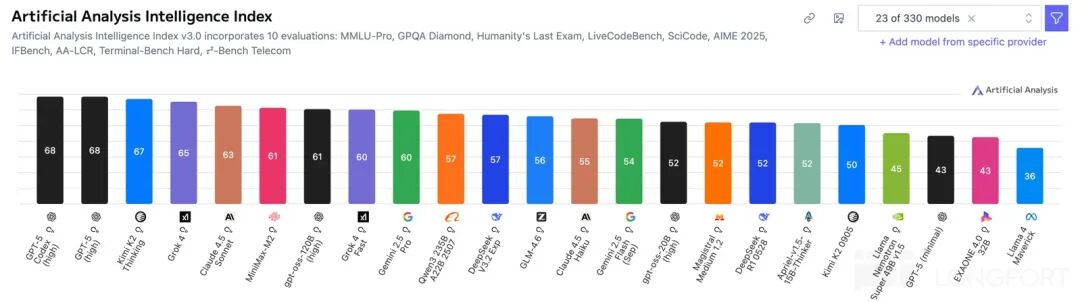

However, Google's AI transition has thus far delivered "net gains" without experiencing a sharp decline in its core business. Meanwhile, Google's Gemini ranks among the world's top large models, with the highly anticipated Gemini 3.0 on the horizon.

In contrast, Baidu faces challenges beyond advertising declines. Its AI competitiveness is diluted, as its edge over peers is less pronounced than Google's. For instance, while 90-point large models are rare, Chinese peers can compete fiercely in the 80-point range, eroding Baidu's first-mover advantage in ERNIE Bot. Among global large models, China's top performers in Q3 included Kimi, Qwen, and Deepseek.

Against this backdrop, Baidu's stock surged from $90 to $150 (a 60%+ gain in two months) amid chip sanctions and domestic substitution narratives, as China Mobile's orders boosted Kunlunxin and market enthusiasm for full-stack AI drove speculation.

Short-term gains appear overextended (AI valuations disconnected from actual performance). In our Q2 review ("Baidu's 'All-In' Bet: Can It Revive Growth?"), we outlined valuation ranges. With Q3 results generally inline, we make minimal adjustments to earnings expectations. Short-term sentiment will primarily affect valuation multiples and asset inclusion.

Considering plans to enhance shareholder returns, dual listing, and stock connect inclusion, a neutral-to-optimistic scenario could value Baidu as the sum of "net cash + core advertising + cloud," with "autonomous driving" as an upside option during bullish sentiment. Detailed analysis is available in the Longbridge App's [Dynamic - Research] section under the same article title.

Detailed Charts Follow

Baidu uniquely breaks down its financials into:

1. Baidu Core: Encompasses traditional advertising (search/information feed ads) and innovative businesses (intelligent cloud/DuerOS smart speakers/Apollo, etc.).

2. iQIYI Business: Memberships, advertising, and content licensing.

The two segments are clearly separated, and with iQIYI as an independently listed company providing detailed data, Dolphin Research dissects both. Due to approximately 1% (200-400 million yuan) in intersegment eliminations, our breakdown of Baidu Core may slightly differ from reported figures but does not affect trend analysis.

- END -

// Reprint Authorization

This article is original research by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is for general reference and data purposes only, intended for users of Dolphin Research and its affiliates. It does not consider individual investment objectives, product preferences, risk tolerance, financial status, or special needs. Investors must consult independent professional advisors before making investment decisions based on this report. Any investment decisions made using this report's content or information are at the user's own risk. Dolphin Research disclaims liability for any direct or indirect consequences arising from the use of this report's data. The information and data herein are based on publicly available sources and provided for reference only. Dolphin Research strives for but does not guarantee the reliability, accuracy, or completeness of this information.

The views and opinions expressed in this report do not constitute offers to sell or solicitations to buy securities in any jurisdiction, nor do they constitute recommendations, quotes, or endorsements of securities or related financial instruments. The information, tools, and data herein are not intended for distribution to jurisdictions where such distribution would contravene applicable laws or regulations or require Dolphin Research and/or its affiliates or subsidiaries to comply with registration or licensing requirements.

This report reflects the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliates.

This report is produced by Dolphin Research, with copyright reserved by Dolphin Research. No institution or individual may, without prior written consent from Dolphin Research, (i) reproduce, copy, duplicate, reprint, forward, or distribute in any form, or (ii) directly or indirectly redistribute or transfer to unauthorized persons. Dolphin Research reserves all related rights.