Alibaba AI Develops a 'C' Focus

![]() 11/24 2025

11/24 2025

![]() 552

552

Source | Bohu Finance (bohuFN)

Alibaba, which has been slow in the AI To C space, has now played its 'ace card.'

On November 17, Alibaba officially launched the public beta version of its 'Qianwen' APP. Positioned as 'chatty and capable,' it will cover various life scenarios including office work, maps, health, and shopping. Among these, the upcoming shopping agent has drawn the most attention from the outside world.

According to Bloomberg, the 'Qianwen' project is led by Alibaba Chairman and CEO Wu Yongming, who has assembled over 100 engineers for several months of secret development. The goal is to fully compete with ChatGPT, become a future AI life portal, and expand globally.

Interestingly, Alibaba's flagship AI application, Kuake, just launched its conversation assistant feature less than a month ago, and now the 'Qianwen' APP has made a grand debut. A few days later, Ant Group also released its full-modal general AI assistant, 'Lingguang.'

Alibaba has clearly pressed the accelerator in the AI To C race. The battle for the super entrance in the AI era has fully commenced, but acceleration does not equal victory. Whether Alibaba can catch up from behind depends on how many strong cards it holds.

01 AI To C: Slow to Start

Many users have noticed that Alibaba has heavily promoted 'Qianwen' on Bilibili, mirroring the high-profile launches of Doubao and Kimi in the past.

Considering the previous media hype about 'Alibaba's cafeteria roast duck selling out, suspectedly due to AI engineers being brought in from Guangdong,' it seems Alibaba is seriously determined to make a big push into the AI To C market.

Over the past two years, although Alibaba has clearly defined its core strategy as 'All in AI,' its AI layout (layout) has mainly focused on the B-end market, providing model APIs, customized solutions, and other services to enterprise clients through Alibaba Cloud.

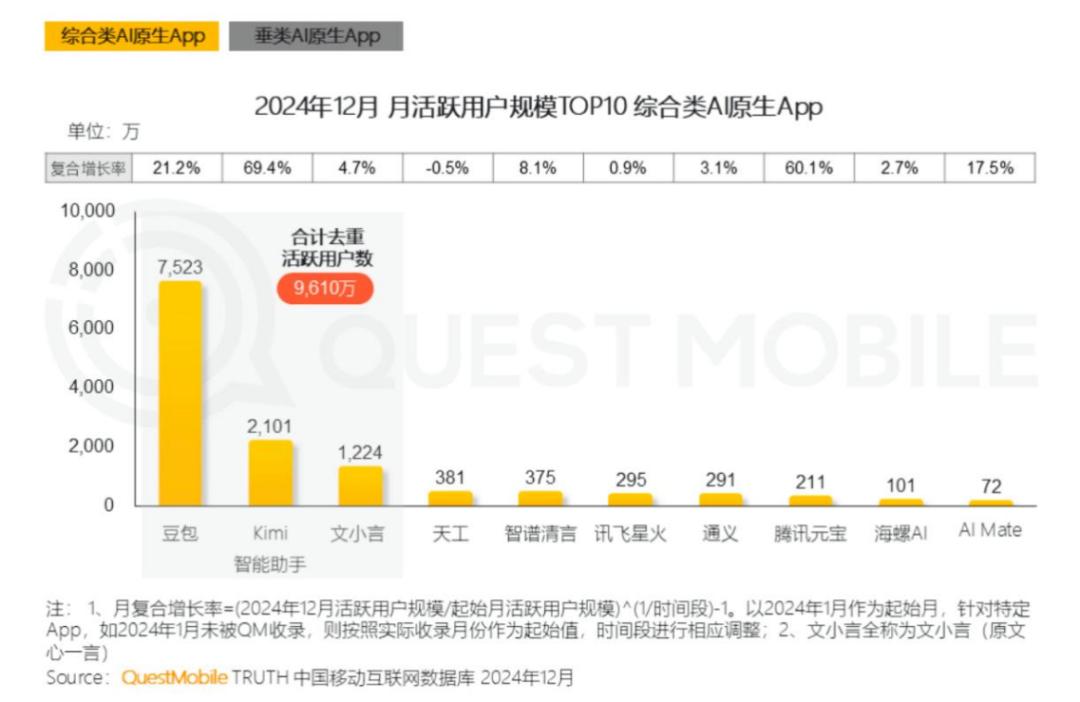

In comparison, Alibaba's AI presence in the C-end market has been relatively subdued. According to QuestMobile data, as of December 2024, the top three AI native apps in terms of monthly active users were Doubao, Kimi, and Wenxiaoyan. Among them, Doubao had 75.23 million users, while 'Tongyi' had less than 3 million monthly active users.

However, Alibaba's 'Tongyi' actually launched earlier than Doubao and Kimi. Why has its presence in the C-end market remained weak? The answer lies more in Alibaba's corporate DNA.

Firstly, Alibaba has a strong To B gene. Taking its e-commerce business as an example, although it targets C-end consumers, its business logic is to first serve B-end merchants and then have those merchants serve C-end clients.

In terms of AI strategy, Alibaba initially packaged the Tongyi APP with its large models into To B services. Therefore, before 'Tongyi' was upgraded to 'Qianwen,' it had already undergone thorough testing within Alibaba's commercial ecosystem, integrating deeply with applications like Alibaba Cloud, DingTalk, and Taobao, and iterating repeatedly in real-world scenarios such as e-commerce, marketing, and office work.

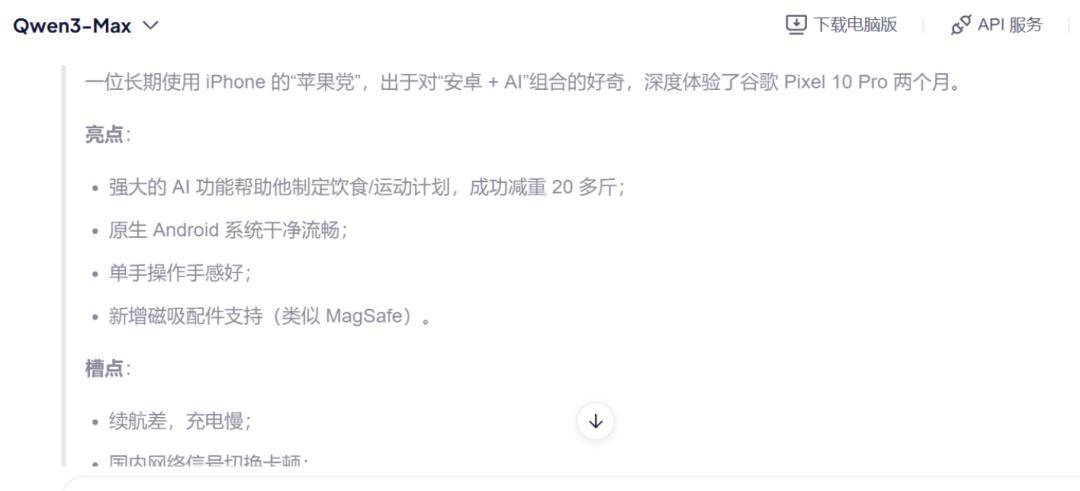

From a practical standpoint, Alibaba's iteration logic from B to C has proven effective. We conducted multiple rounds of Q&A tests with 'Qianwen' and found it performed steadily in simple Q&A scenarios but excelled in video, image, and tool-based tasks.

For example, in the PPT function, users only need to input theme keywords, and 'Qianwen' can automatically build a logical framework, fill in relevant content, and generate a complete and usable PPT. Its short video understanding function is also outstanding; 'Qianwen' can not only efficiently extract core viewpoints but also extend relevant backgrounds and comb, sort out, organize, arrange, streamline (sort out) logical contexts, greatly enhancing information acquisition efficiency.

Secondly, for Alibaba, AI To B can quickly generate visible returns. In the second quarter of 2025, Alibaba Cloud's revenue surged by 26% year-on-year to 33.398 billion yuan, marking a three-year high in growth rate. Its adjusted profit was 2.954 billion yuan, up 26% year-on-year.

In the AI To C market, major platforms have yet to explore mature business models. In contrast, AI To B can not only quickly drive performance and profits, boosting the company's market value, but also empower other applications within Alibaba's ecosystem.

This year, the Tongyi large model was applied on a large scale for the first time during Tmall's 'Double 11,' significantly improving product translation for overseas markets, business data analysis, and customer service efficiency. Through Dianxiaomi, it saved merchants approximately 20 million yuan daily during the promotion period.

However, Alibaba's stronger AI To B business has somewhat overshadowed the urgency of AI To C, causing scattered AI segments to 'fight their own battles' and struggle to form a cohesive force. Clearly, Alibaba now wants to reverse this 'heavy B, light C' situation.

02 Accelerating the Shift: What Is Alibaba Anxious About?

Last year, Alibaba's AI strategy began to gradually shift. The Tongyi application was officially separated from Alibaba Cloud and placed on par with Kuake in terms of organizational structure, signaling Alibaba's push into AI To C.

This year, Kuake has become Alibaba's vanguard in the AI To C space. In March, Kuake upgraded from a traditional search box to an 'AI super box,' aiming to become an intelligent assistant with powerful general capabilities. In October, Kuake launched the 'C Plan,' officially introducing its conversation assistant feature, making it the first AI product in China to deeply integrate search capabilities with conversational experiences.

In November, Alibaba once again made a big move by introducing the truly AI-native application 'Qianwen.' By launching two heavyweight products in the AI To C market within a short period, what is Alibaba anxious about?

Firstly, the timing is right. According to LatePost, the Qianwen team pointed out that Alibaba's AI path started with cloud and foundational models before returning to the C-end, with model capabilities being the most crucial.

Currently, Qwen3–Max has become one of the world's most popular and high-performing open-source large models. The Agent ecosystem has also reached a state where it can be widely called upon by models to solve more problems. Everything is in place, and Alibaba only needs to seize the opportunity.

Secondly, Alibaba's overall strategy is becoming more cohesive and focused. In the first half of this year, Alibaba integrated applications like Taobao Flash Sale, Ele.me, Fliggy, and Gaode into a unified ecosystem, creating a super traffic entrance and achieving impressive results: as of August this year, Taobao Flash Sale's monthly active users reached 300 million, a 300% increase from four months prior.

Having tasted the benefits of concentrated efforts, Alibaba may be applying the same approach in the AI field. By consolidating its previously scattered AI capabilities, such as the large language model 'Tongyi Qianwen' and the video model 'Tongyi Wanxiang,' into 'Qianwen,' Alibaba naturally amplifies its strength.

Of course, besides these 'worth doing' reasons, Alibaba also has more 'must do' reasons.

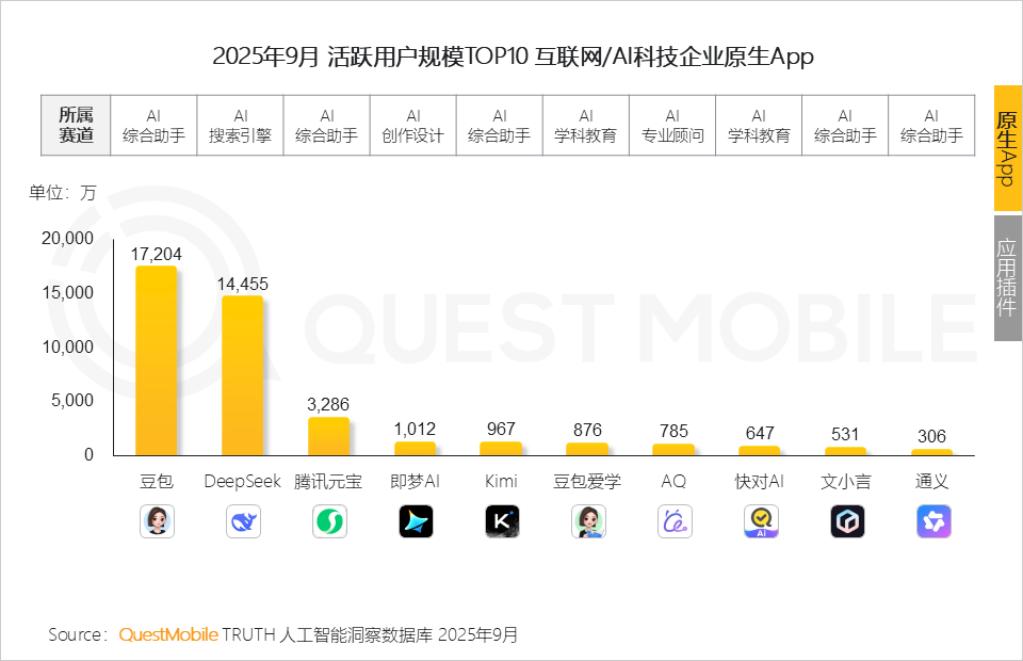

One reason is the threat from competitors. Although the domestic AI To C market has not yet formed a stable pattern (landscape), Doubao and Deepseek have maintained leading positions.

As time passes, user awareness of top products will gradually solidify. If Alibaba continues to wait and see (wait and see), the difficulty of changing this pattern (landscape) in the future will only increase. From December last year to September this year, the monthly active users of the 'Tongyi' APP have remained largely unchanged, while Doubao's monthly active users have surged from 75.23 million to 172 million.

More importantly, Doubao has started to drive sales through its AI assistant by embedding product links from Douyin Mall in its intelligent replies, essentially bringing the 'fire' to Alibaba's e-commerce stronghold.

Another reason is that Alibaba does not want to rely solely on Kuake. In fact, after Alibaba launched 'Qianwen,' many users wondered why Alibaba would upgrade Kuake's intelligent assistant and then introduce a new native application.

From Alibaba's perspective, since it has decided to take on the challenge, pursuing both approaches is more prudent. Currently, there are no mature examples of products that combine 'search engine + intelligent assistant,' and it remains uncertain whether users will embrace such a composite form.

Moreover, as a tool-based product, Kuake fundamentally differs from a general AI assistant like 'Qianwen' in terms of user perception. By creating a purer and more powerful AI entrance, Alibaba can better unify its influence in the C-end market.

03 The Commercialization Path of Super AI

Since the 'Hundred Models War,' the competitive dimensions in the large model industry have continued to evolve. However, whether focusing on niche vertical fields or achieving stronger 'hands-on' capabilities through intelligent agents, commercialization remains a common challenge for all players.

Besides traditional business models like paid subscriptions and enterprise customization services, ChatGPT has also announced collaborations with e-commerce platforms Shopify and Etsy to explore sales commissions through product recommendations. This is a new commercialization path that domestic AI intelligent assistants like Doubao, Kimi, and Wenxiaoyan are also following.

However, for artificial intelligence, which is a 'money pit,' this level of commercial revenue is likely insufficient. In February this year, Alibaba announced plans to invest over 380 billion yuan in cloud and AI infrastructure over the next three years, surpassing the total investment of the past decade.

Nevertheless, the Qianwen team stated that they are not currently considering charging fees. Regarding the commercialization issue that all AI assistants cannot avoid, Alibaba has its own answer.

After introducing 'Qianwen,' Alibaba plans to gradually add intelligent agent functions to it. Among them, the shopping agent may be the first to launch, supporting users in shopping on Taobao and Tmall platforms using natural language. Currently, when users perform image recognition searches on 'Qianwen,' it can accurately identify corresponding items and provide product links.

Next, 'Qianwen' will expand into various life scenarios such as maps, food delivery, ticket booking, office work, learning, shopping, and health. As Alibaba puts it, 'Qianwen' is 'not just for chatting but also for getting things done.'

This is also why 'Qianwen' is not in a hurry to charge fees. Even for ChatGPT, only 5% of its users are paid subscribers. Alibaba prefers to first establish a user base and then charge for AI services within Alibaba's rich ecosystem, achieving a commercial closed-loop.

Compared to other competitors, Alibaba has accumulated abundant scenario resources and traffic foundations in e-commerce, local life, and travel. When AI capabilities are deeply integrated with Alibaba's ecosystem, they may create entirely new user experiences, allowing AI to truly transition from the screen to the physical world.

Therefore, 'Qianwen' is not just an important exploration for Alibaba in the C-end market but also a crucial carrier for Alibaba's full-stack AI system. Through 'Qianwen,' Alibaba can connect its ecological resources with the 'food, clothing, housing, transportation, entertainment' needs of hundreds of millions of users.

In this process, user demands will not only call upon the services of one or two agents but also involve a series of capabilities across different scenarios. Breaking down the invisible 'walls' between scenarios is also Alibaba's unique advantage over other players.

The Qianwen team has stated that domestic AI applications are still in their early stages and have not truly evolved to solve many practical problems. Therefore, 'Qianwen's entry is not too late.

As large models iterate at an increasingly rapid pace, the advantage of technological leadership will be further compressed. The future competition will not only be about technical capabilities but also about systemic capabilities.

'Qianwen' aims to be not just the 'brain' of the future world but also a pair of 'hands' that can get things done. Integrating the value created by AI into real life and creating tangible usage value is the ultimate destination of value in the AI era.

The cover image and accompanying pictures of the article are owned by their respective copyright holders.

If the copyright holders believe that their works are not suitable for public browsing or should not be used free of charge, please contact us promptly, and our platform will make corrections immediately.