Pinduoduo Begins to 'Temper Its Own Growth Enthusiasm'

![]() 11/24 2025

11/24 2025

![]() 649

649

Reported by Cao Anxun, a trainee reporter from Sing Tao Daily, in Guangzhou.

Colin Huang's aspirations have once again come to the forefront at Pinduoduo.

On November 18, Pinduoduo, celebrating its 10th anniversary, held its third-quarter earnings call. As usual, founder Colin Huang was absent. Since stepping down as chairman in 2021 and stating his intention to "step aside and observe the path Pinduoduo will take in the next decade," he has maintained a low public profile.

However, Huang's understated demeanor and entrepreneurial ambitions remain deeply embedded in the company's ethos, carried forward by his successor, Pinduoduo Chairman Chen Lei.

Taking a 'Prudent' Step Back

On its 10th anniversary, Pinduoduo refrained from unveiling any grand new strategies. Instead, it focused on stability and long-term value, even taking the proactive step of "tempering its own growth enthusiasm."

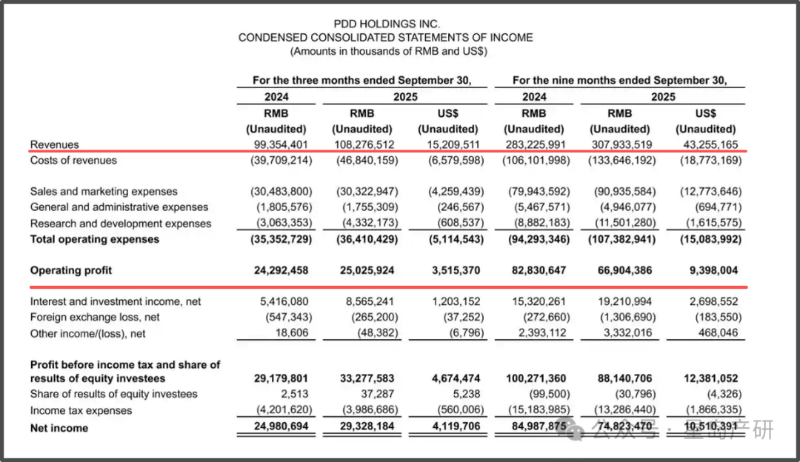

The third-quarter financial report revealed that Pinduoduo's total revenue reached 108.28 billion yuan, marking a year-on-year increase of approximately 9%. This continues the slowdown trend observed since 2024. Operating profit (non-GAAP) stood at 25.026 billion yuan, with a mere 3% year-on-year growth. Net profit attributable to the parent company was 29.328 billion yuan, up 17.4% year-on-year but down 4.63% sequentially.

▲Illustration: Pinduoduo Financial Report

Breaking down the revenue, Pinduoduo's online marketing services and other revenues amounted to 53.348 billion yuan, up 8.1% year-on-year, with the growth rate dipping into single digits for the first time. Transaction service revenues reached 54.929 billion yuan, up 9.89% year-on-year.

Pinduoduo's Co-CEO Zhao Jiajin also sounded a note of caution during the earnings call, stating, "Competition in the e-commerce industry, particularly around new business formats, continues to intensify. We will continue to invest substantial resources to support the platform ecosystem. Heavyweight merchant support initiatives, akin to our previous 'billions in relief' and 'hundreds of billions in support' programs, will persist in the long term. All these factors will impact the sustainable performance of our revenue and profit." He added, "We do not rule out the possibility of performance fluctuations in the coming quarters."

▲Illustration: Pinduoduo Stock Price

Following the release of the financial report, Pinduoduo's stock price was affected. On the announcement day, Pinduoduo closed at $119.58 per share, down 7.33%. As of the close on November 21 (Eastern Time), the stock price stood at $113.24 per share.

Regarding Pinduoduo's decision to "temper its own growth enthusiasm," industry insiders pointed out that, on one hand, it aims to lower market expectations for its performance and avoid significant stock price fluctuations caused by excessive optimism, thereby fostering a healthier market environment for the company's subsequent development. On the other hand, it may represent a strategic display of humility, demonstrating to investors the company management's clear understanding and cautious attitude towards the market by proactively acknowledging potential risks and challenges, such as intensified market competition and uncertainties in business expansion, thereby bolstering investor confidence in the company's long-term prospects.

The fundamental reason lies in Pinduoduo's willingness to sacrifice short-term gains for long-term, sustainable development.

Over the past decade, Pinduoduo has surged ahead with its strong "low-price shopping" positioning, overtaking Taobao and Tmall, and challenging JD.com, emerging as the largest dark horse in China's e-commerce industry. However, as competition intensifies, Pinduoduo recognizes that, rather than being ensnared in a vicious price war, it is wiser to invest resources in supply chains, logistics, and overseas markets, nurturing a new ecosystem for the next decade instead of being gradually drained in the existing competitive landscape.

▲A cargo ship laden with goods sets sail from the port. Image courtesy of Xinhua News Agency.

It is reported that Pinduoduo's "hundreds of billions in support" plan for merchants was proposed in April this year. Over the next three years, the company plans to invest over 100 billion yuan in resources such as funds and traffic to comprehensively build a multi-win commercial ecosystem for users, merchants, and the platform. This includes stimulating demand-side growth, reducing merchant operating burdens, and supporting merchant transformation and upgrading.

This represents Pinduoduo's most significant merchant support strategy since initiatives like the "billions in relief," "e-commerce expansion westward," and the "new-quality merchant support plan" in 2024, with an unprecedented level of capital investment.

An e-commerce expert told Sing Tao Daily that this is a pivotal strategy that will shape Pinduoduo's future decade. If successfully implemented, it will reshape Pinduoduo's platform ecosystem and cognitive positioning, enhancing its overall competitiveness in the e-commerce market. "Early issues on the Pinduoduo platform, such as inconsistent product quality and abuse of the 'refund-only' policy, made some brand merchants hesitant. Launching the hundreds of billions in support plan at this time can demonstrate to the market Pinduoduo's determination to build a high-quality e-commerce ecosystem."

'Building a Solid Foundation for the Long Term'

Reflecting on this year's e-commerce landscape, it has been even more vibrant compared to previous years. The three giants have engaged in a billion-dollar subsidy war, fiercely competing in the instant retail market, creating an almost overwhelming sense of survival anxiety across the industry.

In contrast, Pinduoduo has maintained an exceptionally low profile and even further "tempered its own growth enthusiasm," which is not unrelated to its relatively robust cash flow.

The third-quarter financial report showed that due to increased net profit and changes in working capital, Pinduoduo's net cash generated from operating activities surged to 45.661 billion yuan. As of September 30, 2025, Pinduoduo held 423.8 billion yuan in cash, cash equivalents, and short-term investments, up 27.8% year-on-year, boasting a stronger financial position than Alibaba, JD.com, Moutai, and Ctrip.

After emphasizing in August this year that "the most difficult period has passed," China Merchants Securities continued to point out in its research report that Pinduoduo's profit recovery trend in its domestic business and TEMU remains robust, thanks to the gradual fading of the base effect from new investments since the second half of last year, operating leverage, prudent cost control, and the continuous narrowing of TEMU's losses.

Standing at the 10th-anniversary milestone, Chen Lei stated that Pinduoduo will continue to focus on its core e-commerce business, firmly investing in the high-quality development of the platform and industries, moving towards the next decade of "Costco+Disney." This entails integrating the "ultimate cost-effectiveness" represented by Costco with the "entertainment experience" represented by Disney to create a shopping platform that is both cost-saving and enjoyable.

The vision of "Costco+Disney" was first publicly proposed by Colin Huang in 2018. In his depiction, Pinduoduo should be a community composed of users, merchants, administrators, platform service providers, and other participants, where all parties are interdependent and evolve together.

The reiteration of this vision by the current management team signifies that Pinduoduo's long-term business goals have not fundamentally changed, and the founder's thoughts and judgments continue to profoundly influence the direction of this industry giant.

▲Pinduoduo founder Colin Huang. Image courtesy of the Internet.

Colin Huang has never truly stepped away.

In his "farewell letter" in 2021, he stated that Pinduoduo itself is still very young and has a long and challenging journey ahead. However, to ensure its high-speed and high-quality development 10 years later, some explorations are now timely. As the founder, he hopes to "step aside and observe the path Pinduoduo will take in the next decade."

Having transitioned from "wild growth" to "meticulous cultivation," Pinduoduo has proactively stepped out of the narrative of high revenue growth. Whether investors will re-evaluate Pinduoduo at this new pace and where its ecological chess game will land next remain to be seen. The transformation journey of Pinduoduo and Colin Huang is far from over.