DJI Faces Increasing Competition

![]() 11/25 2025

11/25 2025

![]() 607

607

This year may not be the toughest one for DJI, but it's undoubtedly the year with the most new competitors.

On November 25th, at the DJI store located on the second floor of a Guangzhou shopping mall:

There weren't many customers, but occasionally, drone enthusiasts would stop by to try out the drones.

The store's overall layout had changed from before. The Osmo360 panoramic camera was now prominently displayed, and the ROMO sweeping robot was placed near the entrance.

Although the changes in the store were not drastic, 2025 has not been a smooth year for this tech giant. Despite holding over 13,000 patents and commanding a 70% share of the global consumer drone market, DJI has faced challenges.

Insta360 has sparked a price war in the panoramic camera market, and its core products have faced criticism for lacking significant innovation. Even the founder Wang Tao's statement, "True innovation solves problems that others cannot," has been mocked by netizens.

Indeed, a series of events highlight the precarious position DJI is in.

Image source: AI-generated

In the global consumer drone market, DJI already holds a 70% share, and its growth potential is becoming increasingly limited.

DJI is bound to expand into new areas, but it's encountering fierce competition in various fields.

With just one month left in 2025, DJI has invested in the consumer 3D printing company Intelligent Projects.

The anxiety behind this move is palpable.

01

Investment Dilemma

In November, two financing rounds in the 3D printing industry were linked to DJI.

First, Intelligent Projects completed a B-round financing worth several hundred million yuan, with DJI as the investor.

Second, rumors suggest that Bambu Lab, founded by a former DJI team member, is close to completing its latest financing round with Tencent as an investor, potentially reaching a valuation of $10 billion.

Image source: Intelligent Projects official website

Perhaps some of you have already noticed the issue: Why did DJI invest in a competitor instead of supporting a former colleague?

Not long ago, Tao Ye, the founder of Bambu Lab, posted a complaint on WeChat about his former employer, DJI.

He believes that DJI's investment in another 3D printing company and the inclusion of clauses targeting Bambu Lab are closely related to talent acquisition issues.

Firstly, the competition was initially only at the "exit end," meaning where DJI employees choose to go after leaving. But now, at the "entry end," DJI sometimes struggles to compete with Bambu Lab in recruitment.

Secondly, capital markets prefer to invest in entrepreneurs from leading companies like DJI, leading to a trend of DJI employees starting their own businesses.

Regarding talent planning, Wang Tao had already been proactive ten years ago: "We cannot let competitors find gaps to make money. Once they have money, they will compete with us for talent, which is the biggest trouble."

So, DJI's boss Wang Tao's investment in Intelligent Projects this time can be seen as a strategic move: gaining entry into the 3D printing market and curbing Bambu Lab, which competes with DJI for talent.

02

A Ticket to Entry

So, how important is the 3D printing industry to DJI?

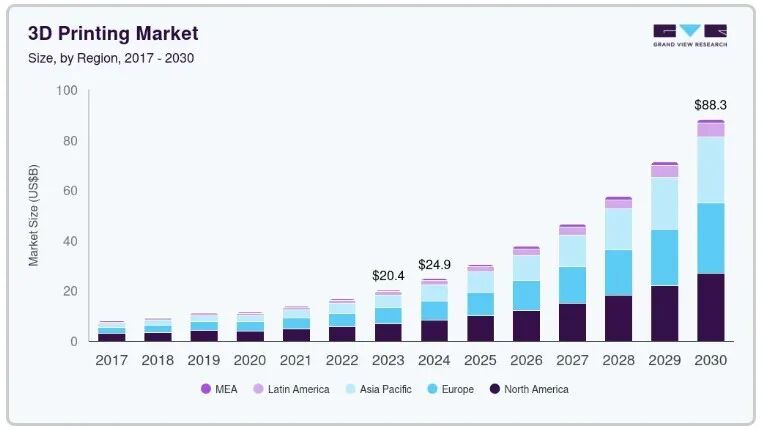

Currently, the global 3D printing market is growing at an annual rate of 20%.

According to a Grand View Research report, the global 3D printing market is expected to grow by over 220% and exceed $50 billion by 2028.

Image source: Grand View Research

Among the main players involved in this "social media feud," Bambu Lab and Intelligent Projects are both leaders in the 3D printing industry.

According to local Shenzhen media, the "Four Heavenly Kings" of Shenzhen—Creality, Bambu Lab, Anycubic, and Intelligent Projects—already control 90% of the global market share for entry-level 3D printers.

Founded in 2015, Intelligent Projects initially focused on STEM education kits before wisely betting on the 3D printing business.

Over the past three years, Intelligent Projects has achieved a compound annual growth rate of over 40%, with revenue reaching 1.6 billion yuan in 2024. It expects revenue to grow by 30% to 50% this year, potentially surpassing 2.5 billion yuan, and plans to exceed 5 billion yuan in annual revenue within the next three years.

However, compared to Intelligent Projects, Bambu Lab is an even bigger dark horse.

Its revenue reached 5.5 to 6 billion yuan in 2024, with net profit nearing 2 billion yuan and a net profit margin exceeding 30%. In the first quarter of this year, its revenue approached 2 billion yuan, and it continued to rank first in sales volume and revenue in the 3D printer category on Tmall and JD.com during Double 11.

Among the Four Heavenly Kings, there is a clear hierarchy, and Bambu Lab is undoubtedly leading the pack.

However, Wang Tao's choice of Intelligent Projects over Bambu Lab may have various considerations.

From another perspective, whether Bambu Lab is willing to accept DJI's involvement also depends on the founding team's wishes.

Regardless, this investment is equivalent to obtaining a ticket to entry.

03

New Competitors in the Low-Altitude Economy

Has DJI's drone business reached its peak? A horizontal and vertical analysis may yield completely different results.

As early as 2016, DJI's founder Wang Tao believed that the drone market was approaching saturation and that DJI's revenue would peak at 20 billion yuan.

This year, media estimates suggest that DJI's 2024 revenue exceeded 80 billion yuan, with the majority still coming from its drone business.

Currently, drones are mainly divided into consumer drones for the mass market and industrial drones for various industries.

DJI already commands over 70% of the global market share in consumer drones.

However, according to the China Research and Intelligence (CRI), the growth rate of China's consumer drone market size plummeted from 45% in 2020 to 18% in 2024.

The future is indeed uncertain.

In fact, the industrial drone market has greater prospects, and DJI also holds a significant share in this sector.

From January to September 2025, approximately 60,000 agricultural drones were subsidized nationwide, with 89.35% from DJI and 10.12% from XAG.

Image source: Frost & Sullivan

However, from a trend perspective, the future space for manned aircraft may be even larger.

According to the 2025 China Aviation Industry Conference, it is expected that China's low-altitude economy market size will reach 1.5 trillion yuan by 2025 and is expected to exceed 2 trillion yuan by 2030.

This largely depends on policies and the pace of opening up low-altitude airspace. In June, DJI also launched a civilian cargo drone.

However, in this sector, companies like EHang and XPENG AEROHT are also making significant efforts.

04

A Multiple-Choice Question or a Must-Answer Question?

For DJI, everyone is most familiar with its drones and the recently developed categories such as gimbals, action cameras, and gimbal cameras.

Essentially, these are all extensions based on DJI's stabilizer and imaging technologies from drones, and they have achieved remarkable success.

According to Jiuqian Consulting, as of the third quarter of 2025, DJI's revenue from action cameras accounted for a staggering 66% of the global market share, and the cumulative sales volume of the Pocket 3 gimbal camera has also surpassed 10 million units.

However, the market situation has become complex in recent years, especially with DJI's drone market share reaching its peak, increasing the urgency for DJI to expand into new areas.

The problem is that competitors think the same way.

DJI has entered Insta360's panoramic camera market with the launch of the Osmo360 panoramic camera. In response, Insta360 is also planning to enter DJI's drone market.

The two companies are engaged in a fierce rivalry in the panoramic camera market, with even market research data conflicting:

Jiuqian Consulting points out that in the third quarter of 2025, DJI held 43% of the global market share for panoramic cameras, while Insta360 held 49%.

Frost & Sullivan, on the other hand, presents a vastly different picture. In the same period, Insta360 commanded a 75% share of the global consumer panoramic camera market, while DJI held only 17.1%.

According to Tmall Double 11 data, Insta360 ranked first in the panoramic camera, action camera, and smartphone gimbal categories.

According to the latest financial report, Insta360's cumulative revenue for the first three quarters reached 6.611 billion yuan, a year-on-year increase of 67.18%. The entire market is still far smaller than DJI's drone revenue, which is nearly 100 billion yuan.

From another perspective, Insta360's current market value is over 97 billion yuan, which to some extent explains DJI's motivation to compete fiercely.

Similarly, DJI has also entered the sweeping robot market with its flagship ROMO brand.

However, the sweeping robot market is already highly competitive, making disruptive innovation extremely difficult.

DJI's competitors in this market are all giants with hundreds of billions of yuan in revenue.

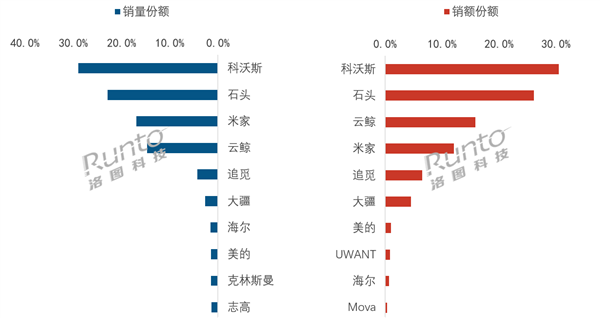

According to LoT Technology, in the third quarter of China's sweeping robot market, the top six online sales performers were Ecovacs, Roborock, Xiaomi, Yunji, Dreame, and DJI.

Image source: LoT Technology

For a company newly entering this field, this performance is not too bad.

In summary, DJI's strength lies in the drone market, but a host of technology companies, including Insta360, Dreame, Xiaomi, and Huawei, are all eyeing this space.

To find a second growth engine, DJI has ventured into panoramic cameras, sweeping robots, and 3D printing this year through self-development and investment, all of which will face fierce competition.

Strategically, adopting an offensive stance to defend may not be a multiple-choice question but a must-answer question.