The year-end melee of L2 intelligent driving: no absolute winner

![]() 11/25 2025

11/25 2025

![]() 418

418

Starting from November 2025, automotive safety will undergo accelerated changes.

This is not just about the new national battery standards to be implemented in 2026, which are already known and widely discussed, nor is it limited to the enhanced management of OTA updates starting from the first half of 2025. From numerous details and collective voices, it is not difficult to see that new conclusions have been drawn on the subsequent development of power batteries before this Guangzhou Auto Show. Additionally, besides regulatory requirements, actions by companies like Xiaomi are driving the formation of a new round of competitive rules in the industry.

On the one hand, on November 18, the China Industrial Association of Power Sources issued a notice stating that power battery companies should use the average cost disclosed by the association as an important reference for their quotations and avoid breaking the cost red line by engaging in low-price dumping.

On the other hand, at the 2025 Guangzhou Auto Show, with Xiaomi's release of the HAD Enhanced Edition assisted driving system, the landscape of L2-level intelligent driving assistance in the automotive industry has basically taken shape, and the trend of automakers developing their own technologies has largely ended. This also includes the dissolution of Dazhuo and the downfall of Haomo Tech.

In short, the new landscape of the automotive market in 2026 has been determined. For any automaker, relying solely on boldness and a fast start will no longer support sales expansion.

The trend of intelligent driving assistance comes to an end before L3

The trend of L2-level intelligent driving assistance has now visibly reached its end.

The reason is that the differences between technological routes are becoming smaller. Although there are still battles in marketing over end-to-end, VLA, and world models, they are essentially converging, with more being a matter of permutation and combination.

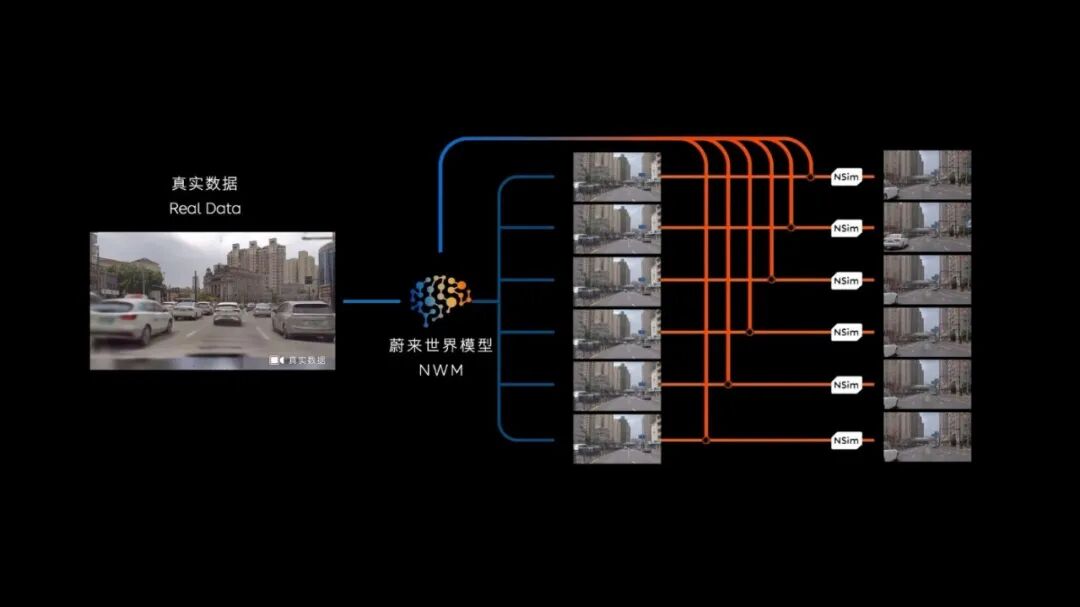

At this auto show, Xiaomi's release of the HAD Enhanced Edition has publicly disclosed its choice of technological path in interview information. The upcoming 1.11 version will be a product of end-to-end + reinforcement learning + world models. Xiaomi's Chen Long stated that he believes the L in VLA, the large language model, is the ultimate choice for the future.

In simple terms, Xiaomi's HAD Enhanced Edition currently follows an end-to-end model, continuously undergoing reinforcement training in data generated by world models. It rewards correct behaviors and penalizes incorrect ones, ultimately seeking to foster AI's proactive consciousness and ability to learn.

At the same time, a key feature is that Xiaomi is rebuilding an entire data system instead of training with publicly available internet data. This logic is also understandable, as Elon Musk shares the same mindset and has made similar statements. Hence, Musk developed his own AI, advanced the 10,000-card center, and directly spurred the rapid birth of Grok.

It is evident that Xiaomi is now attempting to break through the inherent (fixed) perception that many have of it as merely aesthetically pleasing through more corporate actions. For instance, it has recently released various technical patents. With the current iteration of the HAD Enhanced Edition, it will optimize behaviors such as taking wrong paths and swerving after activating intelligent driving assistance, further enhancing safety efficiency.

In short, you can view its latest OTA update as optimizing previous HAD deficiencies based on the maturity of end-to-end technology. Subsequently, with more applications of VLA and world models, it will form technological advantages. Additionally, unlike Huawei's choice, Xiaomi believes that VLA and world models can coexist without conflict, while Huawei has chosen the WEWA (World Model) architecture as its future technological mainline.

Xiaomi's logic for choosing VLA is not difficult to understand. This technology can not only be applied to intelligent driving assistance and autonomous driving but also to smart homes, embodied robots, and other areas, ultimately significantly improving efficiency and reducing costs.

Looking at current automakers, technological routes have basically reached a consensus.

Li Auto primarily promotes VLA, with many high-value data trained on world models for feedback; XPENG optimized its technological path shortly after introducing VLA in the first half of 2025, aiming to minimize translation in the intermediate L link (link), essentially deeply shifting towards world models.

NIO has always primarily promoted world models, but its technological route, whether cloud-dominated or vehicle-dominated, will only be verified in subsequent OTA updates. Besides several leading new forces, emerging players like Momenta and Horizon Robotics continue to delve into end-to-end technology in the short term and have previously announced subsequent world model plans.

In short, the good news is that with the initial maturity of end-to-end models and the subsequent choice of world models as a crucial part of simulation, consumers' assisted driving safety will significantly improve. Before the arrival of L3, it is difficult to clearly judge whose technological application is superior. Therefore, this directly leads to the end of the L2-level intelligent driving trend and the disappearance of many previous unicorn companies.

Strict supervision of battery safety directly curbs a new round of price wars

In short, from the perspective of the latest assisted driving technology updates, whether promoting world models, VLA, or delving into end-to-end technology, all have achieved excellent technological application performances.

Vehicles will safely overtake slower vehicles as much as possible, with a significant decrease in drivers' urban takeover rates and willingness to take over, and a notable reduction in the system's probability of taking wrong paths. With Huawei's announcement before the Guangzhou Auto Show that ADS Pro will receive urban NCA updates, Huawei's latest in-cabin LiDAR version of assisted driving will enable models priced around 150,000 yuan to have urban navigation capabilities.

Thus, the so-called L2-level intelligent driving assistance trend period has largely ended. Because the market is limited, if companies cannot secure enough orders, they will have to terminate. So far, NIO, XPENG, and Li Auto have all embraced self-research; Geely has embraced self-research; BYD has embraced Momenta and self-research; Changan has embraced Huawei and self-research; Great Wall has embraced Yuanrong Qixing; Chery has simultaneously embraced Horizon Robotics and Momenta; and numerous joint venture giants like BMW, Mercedes-Benz, Toyota, General Motors, and Nissan have also selected Momenta.

Therefore, besides the aforementioned mainstream brands, most other automakers will have limited installation volumes. Consequently, companies like Haomo Tech, Dazhuo, and Zero Beam, internally incubated by Great Wall Motors, Chery Automobile, and SAIC Motor, respectively, are likely to hit pause buttons easily.

Besides intelligent driving assistance, power batteries are also becoming a new point of change.

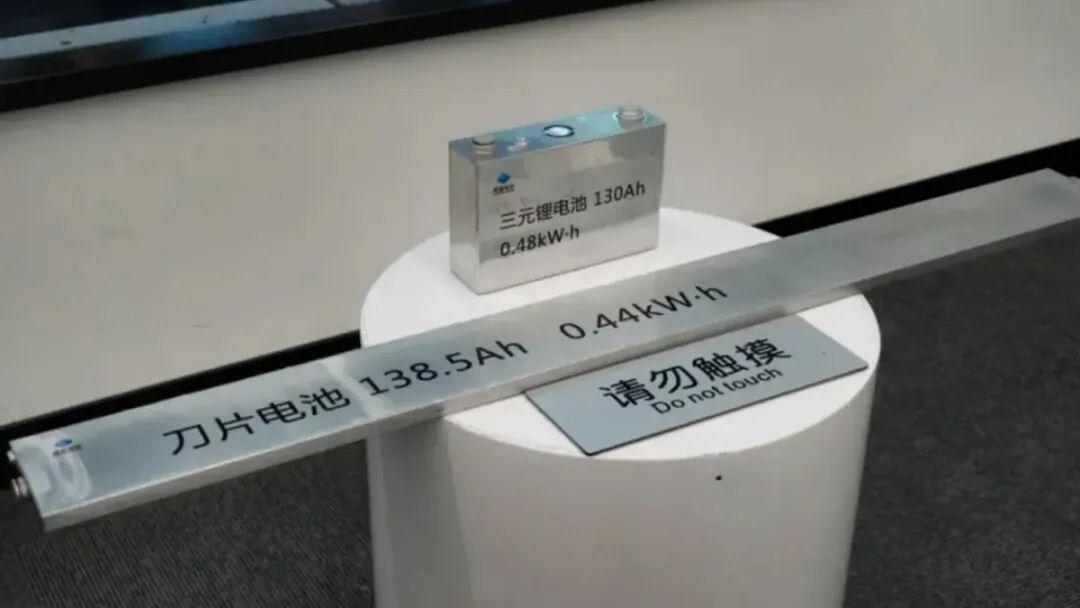

The power battery industry is currently highly differentiated, with recent concentrate (concentrated) occurrences of three issues: which is safer, ternary lithium or lithium iron phosphate batteries; low-price sales of power batteries; and high-end power batteries being snapped up.

These aspects are now being significantly strengthened in terms of supervision. Regarding which is safer, ternary lithium or lithium iron phosphate batteries, a conclusion was reached during the auto show, with multiple automakers stating in group interviews that both have their advantages and disadvantages and can be safe. Views in related salons suggested that neither is perfect nor absolutely safe, and China must pursue both routes simultaneously. What truly determines safety is system engineering, including thermal insulation, flue, structure, arc prevention, and BMS, rather than just the material itself.

Besides, controlling low-price dumping of power batteries has become a new issue.

It started with vehicle technology consistency checks in the middle of the year, followed by the association's notice before the auto show, and will be followed by control over the reasonableness of power battery quotations. Many related plans have actually been drafted by multiple departments since 2023 and are now entering the implementation phase.

Regulation of prices will also positively guide subsequent price wars and price reduction trends.

Regarding the topic of battery snapping, currently, CATL's high-nickel batteries are in short supply. The main reason is that with the success of high-end models priced over 300,000 yuan launched by various automakers in the latter half of 2025, the supply-demand relationship has shifted.

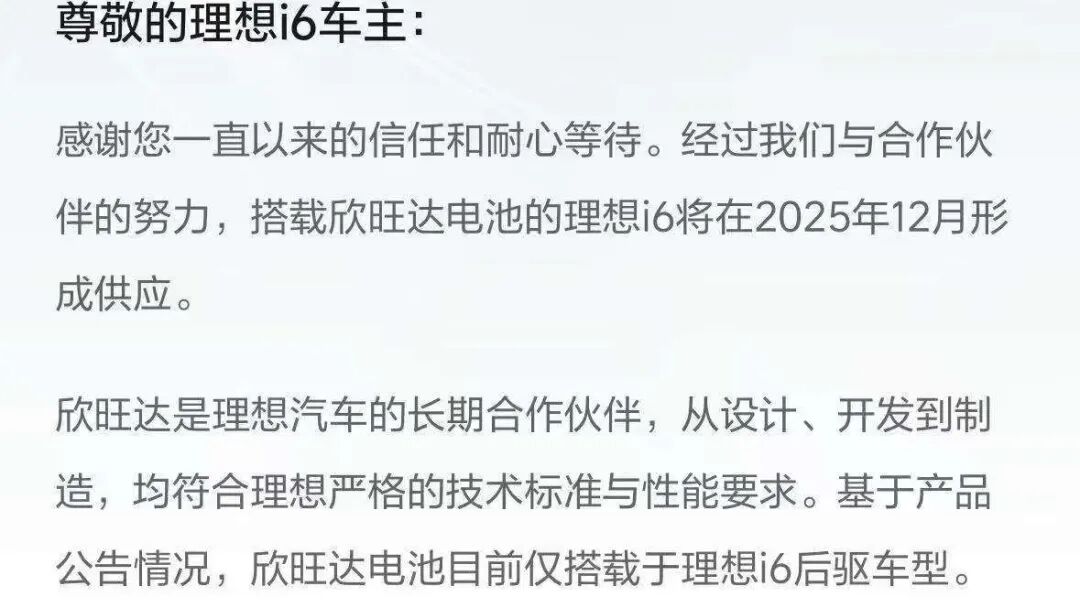

Of course, this phenomenon is somewhat accidental but reflects another trend. Many new car sales have formed a head aggregation effect, leading to increasingly noticeable waiting periods for delivery after orders are placed. For instance, Li Auto recently announced that it would increase the supply of Sunwoda batteries in December to reduce waiting periods, sparking much discussion.

Overall, this is a positive development for the comprehensive growth of the supply chain, favoring the growth of more power battery suppliers. However, the premise is that Li Auto can complete the adaptive changes in users' original perceptions.

In conclusion

From the aforementioned series of transformations, it is not difficult to see that a new landscape has emerged.

If good assisted driving technologies, especially urban assisted driving systems, cannot be implemented in 2026, companies will face a situation of being gradually eroded. Regarding power batteries, with dual control over prices and technology, there is an expected relief in the downward trend of car prices.

The remaining landscape is clear: everything is not as simple as the new national standards on the surface; automakers need to master an entire round of new technological applications.

In other words, the mode of piling up components may gradually lose its effectiveness by 2026.